Ask the 1.4 million homeowners still underwater

December marks the 10-year anniversary of the Great Recession, and the onset of all the losses it brought: jobs, wages, homes, credit scores, and so much more.

December marks the 10-year anniversary of the Great Recession, and the onset of all the losses it brought: jobs, wages, homes, credit scores, and so much more.

At the center of the recession, and the financial crisis that rocked markets in 2008, was the housing bubble.

Now, by many measures, housing has healed. Home prices have surpassed their bubble-era peaks in many, though not all, metro areas. The homeownership rate seems to have hit bottom and has climbed two quarters in a row. And foreclosures, by one measure, fell to the lowest ever in the third quarter.

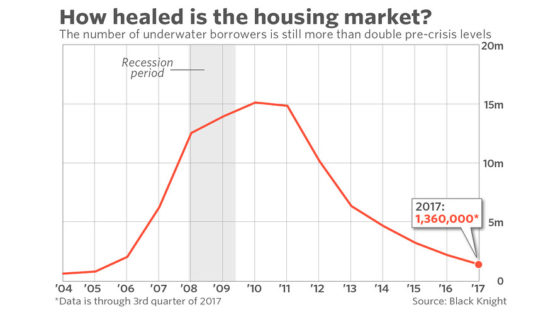

But this chart tells a different story.

The number of homeowners who are underwater on their mortgage – meaning they owe a lender more than their home is worth – is still more than double what was normal in the years before the bubble.

The number of homeowners who are underwater on their mortgage – meaning they owe a lender more than their home is worth – is still more than double what was normal in the years before the bubble.

That number, 1.36 million, comes from Black Knight BKI, -0.67% , the real estate data provider able to provide MarketWatch the longest time series of this borrower data.

It may seem jarring that more than a million homeowners still haven’t climbed above water so many years after the bubble burst, even in a housing market supposedly starved for inventory. And yet that measurement doesn’t even account for the homeowners who have some equity, but not enough to make financial sense to sell their properties.

Read: The financial and housing market rescue left many Americans behind

Earlier this year, Attom Data estimated there were millions such homeowners.

As Attom said at the time, those homeowners are stuck in limbo. They represent “laden” inventory, bogging down the market and snarling the normal patterns of exchange of homes between owners.

For owners they also represent lost equity, deferred or dashed plans, and lack of mobility – all worth remembering as the stock market hits fresh highs and assets that didn’t even exist when the housing bubble popped grip headlines.

Even as policymakers assess the handling of the crisis in order to prepare for the next one, these 1.36 million homeowners are a reminder that the last one isn’t over yet.

Read: Why aren’t there enough houses to buy?

Written by Andrea Riquier and published by Market Watch ~ December 14, 2017.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml