For years, I’ve lectured chapter and verse about the wonderfulness of Roth IRAs, and they may soon be more wonderful than ever. The quickest way to get a relatively large sum into a Roth IRA so you can start taking advantage of the wonderfulness is to convert a traditional IRA with a hefty account balance into a Roth account. Here’s the updated scoop on the conversion strategy, taking into account the possibility of tax reform.

For years, I’ve lectured chapter and verse about the wonderfulness of Roth IRAs, and they may soon be more wonderful than ever. The quickest way to get a relatively large sum into a Roth IRA so you can start taking advantage of the wonderfulness is to convert a traditional IRA with a hefty account balance into a Roth account. Here’s the updated scoop on the conversion strategy, taking into account the possibility of tax reform.

Roth conversion basics

A Roth conversion is treated as a taxable distribution from your traditional IRA, because you’re deemed to receive a payout from the traditional account with the money then going into the new Roth account. So doing a conversion this year will trigger a bigger federal income tax bill for this year (and maybe a bigger state income tax bill too). But if you wait until next year, the federal income tax hit could lower. Or not, depending on your exact situation.

Tax reform effect

If a GOP tax reform plan becomes law and takes effect next year, the federal income-tax rates for most folks might be the lowest you’ll see for the rest of your life. If so, the tax cost of doing a Roth conversion could also be the lowest you’ll see.

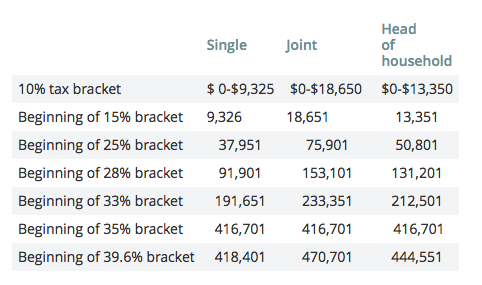

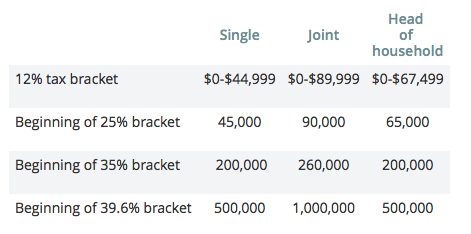

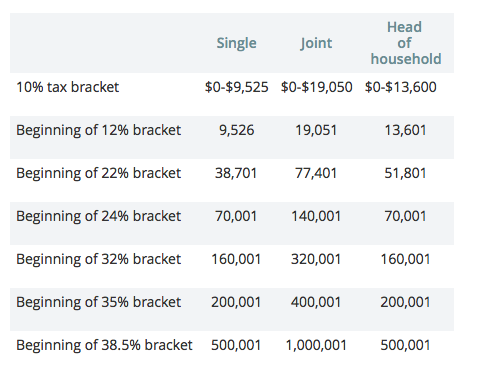

Here are the tax rates and brackets for 2017 and the currently proposed rates and brackets in the House and Senate tax reform bills.

Table: 2017 rates and brackets

Table: 2018 rates and brackets under the House bill

Table: 2018 rates and brackets under the House bill

For 2018 and beyond, the House GOP bill would reduce the number of individual tax rates from the current seven to four: 12%, 25%, 35%, and 39.6%. The last rate is the same as the highest rate under current law. The proposed rate brackets are as follows, based on taxable income (gross income minus allowable write-offs).

With these tax rates and brackets, the vast majority of people would be in a lower marginal rate bracket next year. However, some folks who are currently in the 33% bracket would find themselves in the 35% bracket next year.

With these tax rates and brackets, the vast majority of people would be in a lower marginal rate bracket next year. However, some folks who are currently in the 33% bracket would find themselves in the 35% bracket next year.

Table: 2018 rates and brackets under the Senate bill

For 2018 through 2025, the Senate GOP bill would keep seven tax brackets, but five would be at lower rates. In 2026, the current-law rates and brackets would return. The temporary rate brackets under the Senate bill would be as follows.

As with the House bill, these tax rates and brackets would put the vast majority into a lower marginal rate bracket next year. However, some people who are currently in the 33% bracket would be in the 35% bracket next year.

As with the House bill, these tax rates and brackets would put the vast majority into a lower marginal rate bracket next year. However, some people who are currently in the 33% bracket would be in the 35% bracket next year.

Here’s the point: If you have high income and want to convert a traditional IRA with a substantial balance into a Roth account, the extra taxable income triggered by the conversion would probably be taxed at rates ranging from 28% to 39.6% under the 2017 federal income-tax rate scheme. But if tax reform is enacted, the extra income triggered by a conversion might be taxed at rates ranging from “only” 24% to “only” 38.5%. I don’t think we will see rates any lower than what is being proposed in the foreseeable future. On the other hand, many upper-middle income folks would not pay much more and might pay even less if they convert this year instead of next year due to the lower threshold for the 35% rate under the GOP tax reform bills. Whether you do a conversion this year or next, you would avoid the potential for higher future rates on all the post-conversion income that will be earned in your new Roth account. That’s because qualified Roth withdrawals taken after age 59½ are totally federal-income-tax-free. And believe me, there is potential for higher rates in the future despite the tax reform efforts that are under way right now.

To be clear, the best candidates for the Roth conversion strategy are people who believe that their tax rates during retirement will be the same or higher than the tax rate they would pay on the extra income triggered by the conversion. So you have to decide what you believe.

The Bottom Line

A relative low tax cost for converting either this year or next year + the chance to avoid higher tax rates in future years on income that will accumulate in your Roth account = the perfect scenario for the Roth conversion strategy. But you don’t have to do a conversion right now. You can wait and see if a GOP tax reform bill becomes reality, which might be around Christmas, and then either pull the trigger this year or next year depending on what the legislation says and your specific situation. Finally, please take my advice and consult a good tax pro before converting a traditional IRA with a significant balance. You want to be sure you understand exactly what you’re getting into tax-wise.

Written by Bill Bischoff and published by Market Watch ~ December 10, 2017.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml