October 28, 2012 ~ We have recently been told by people, who are new to the idea of precious metals as a part of their ‘survival’ or ‘prepper’ kits, that this site is too difficult to find any information on it. We have been told that they don’t understand this web-site, and what its purpose is. “Why should I buy gold?” is among the questions most often asked. “How will it help me in troubled times?” “Why are of these news articles and headlines on the front page?“

October 28, 2012 ~ We have recently been told by people, who are new to the idea of precious metals as a part of their ‘survival’ or ‘prepper’ kits, that this site is too difficult to find any information on it. We have been told that they don’t understand this web-site, and what its purpose is. “Why should I buy gold?” is among the questions most often asked. “How will it help me in troubled times?” “Why are of these news articles and headlines on the front page?“

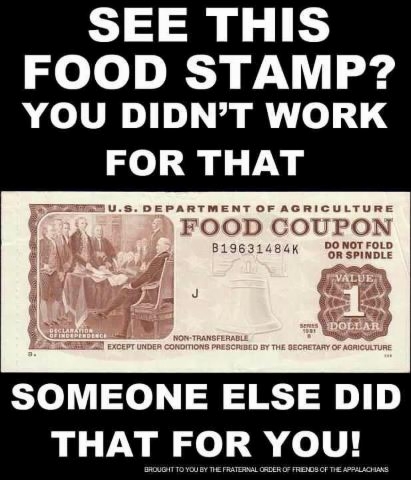

Well dear readers, it’s fairly simple my friends – if you are not aware of what is going around you in the world, and the TRUE economic picture in this country with massive job losses and larger numbers of people living below the poverty line, and the fact that YOUR taxes are being picked from YOUR pocket to feed, cloths, educate and house people who are just too damned lazy to do something about it – then you will NEVER understand why you should own gold and silver.

Wake-up – look around you and stop trying to look at the world through your hi-tech “smart phones” and become aware of the BIG picture. If you are unable or unwilling to scroll down the front page of this web-site and see the category headings, “Why Gold?”, The Gold Bullion Vault, The Silver Bullion Vault, etc., – then maybe you just aren’t as smart as some people seem to think that you are.

Finally, to those of you who can’t figure out why there are no prices posted at this site; there are many gold, silver and platinum products available throughout the world – but this isn’t a one-shop fits all. Each client deserves to know the truth, receive fair and honest treatment, and assistance in the development of their holding-portfolio. There are plenty of places that you can go to on line and do your shopping. We believe that you should understand the reasons for the problem first, then we will gladly assist you with the solution – the RIGHT solution for your family’s needs and goals.

Kettle Moraine Ltd. has proven to be highly competitive in the marketplace throughout the years and will continue to be so.

If what you are about to read doesn’t answer the questions for you – then you will never get it. (Ed.)

Continue reading →

Americans, living in what is called the richest nation on earth, seem always to be short of money. Wives are working in unprecedented numbers, husbands hope for overtime hours to earn more, or take part-time jobs evenings and weekends, children look for odd jobs for spending money, the family debt climbs higher, and psychologists say one of the biggest causes of family quarrels and breakups is “arguments over money.” Much of this trouble can be traced to our present “debt-money” system.

Americans, living in what is called the richest nation on earth, seem always to be short of money. Wives are working in unprecedented numbers, husbands hope for overtime hours to earn more, or take part-time jobs evenings and weekends, children look for odd jobs for spending money, the family debt climbs higher, and psychologists say one of the biggest causes of family quarrels and breakups is “arguments over money.” Much of this trouble can be traced to our present “debt-money” system. I remember a German farmer expressing as much in a few words as the whole subject requires; “money is money, and paper is paper.”

I remember a German farmer expressing as much in a few words as the whole subject requires; “money is money, and paper is paper.”