During the 40 months after Alan Greenspan’s infamous “irrational exuberance” speech in December 1996, the NASDAQ 100 index rose from 830 to 4585 or by 450%. But the perma-bulls said not to worry: This time is different—-it’s a new age of technology miracles that will change the laws of finance forever.

During the 40 months after Alan Greenspan’s infamous “irrational exuberance” speech in December 1996, the NASDAQ 100 index rose from 830 to 4585 or by 450%. But the perma-bulls said not to worry: This time is different—-it’s a new age of technology miracles that will change the laws of finance forever.

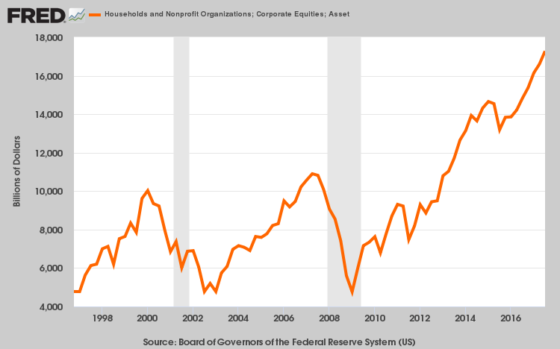

It wasn’t. The market cracked in April 2000 and did not stop plunging until the NASDAQ 100 index hit 815 in early October 2002. During those heart-stopping 30 months of free-fall, all the gains of the tech boom were wiped out in an 84% collapse of the index. Overall, the market value of household equities sank from $10.0 trillion to $4.8 trillion—-a wipeout from which millions of baby boom households have never recovered.

Likewise, the second Greenspan housing and credit boom generated a similar round trip of bubble inflation and collapse. During the 57 months after the October 2002 bottom, the Russell 2000 (RUT) climbed the proverbial wall-of-worry—-rising from 340 to 850 or by 2.5X.

And this time was also held to be different because, purportedly, the art of central banking had been perfected in what Bernanke was pleased to call the “Great Moderation”. Taking the cue, Wall Street dubbed it the Goldilocks Economy—-meaning a macroeconomic environment so stable, productive and balanced that it would never again be vulnerable to a recessionary contraction and the resulting plunge in corporate profits and stock prices.

Wrong again!

During the 20 months from the July 2007 peak to the March 2009 bottom, the RUT gave it all back. And we mean every bit of it—-as the index bottomed 60% lower at 340. This time the value of household equities plunged by $6 trillion, and still millions more baby-boomers were carried out of the casino on their shields never to return.

Now has come the greatest central bank fueled bubble ever. During nine years of radical monetary experimentation under ZIRP and QE, the value of equities owned by US households exploded still higher—-this time by $12.5 trillion. Yet this eruption, like the prior two, was not a reflection of main street growth and prosperity, but Wall Street speculation fostered by massive central bank liquidity and price-keeping operations.

Nevertheless, this time is, actually, very different. This time the central banks are out of dry powder and belatedly recognize that they have stranded themselves on or near the zero bound where they are saddled with massively bloated balance sheets.

So an epochal pivot has begun—-led by the Fed’s committement to shrink its balance sheet at a $600 billion annual rate beginning next October. This pivot to QT (quantitative tightening) is something new under the sun and was necessitated by the radical money printing spree of the past three decades.

So an epochal pivot has begun—-led by the Fed’s committement to shrink its balance sheet at a $600 billion annual rate beginning next October. This pivot to QT (quantitative tightening) is something new under the sun and was necessitated by the radical money printing spree of the past three decades.

What this momentous pivot really means, of course, is ill understood in the day-trading and robo-machine driven casinos at today’s nosebleed valuations. Yet what is coming down the pike is nothing less than a drastic, permanent downward reset of financial asset prices that will rattle the rafters in the casino.

This time is also very different because there will be no instant financial market reflation by the central banks. And that means, in turn, that there will be no fourth great bubble, either. Here’s why.

~ PART 1 ~

In the first instance, the market is not merely complacent; it is insouciant—–indulging in an eye-wide-shut orgy of recklessness that truly has no parallel, not even the mania of 1927-1929.

That’s implicit in Wall Street’s dismissal during 2017 of two fundamental policy messages that emerged from Washington officialdom. These signals strike at the very heart of the current stock market mania and scream-out “rising yields ahead” to a casino that has “priced-in” ultra-low interest rates as far as the eye can see.

To wit, the Fed is now on automatic pilot—set to drain cash from the canyons of Wall Street at a $600 billion annual rate by Q4. At the same time, the political goulash known as Trumpian government has thrown fiscal caution entirely to the winds, and has essentially now enacted the most asinine fiscal borrowing spree known to history.

As we have recently pointed out, ground zero of the impending bond market conflagration is FY 2019, which incepts exactly 276 days from now during the same window of time (Q4) as the Fed hits full stride on its bond dump-a-thon. Yet on top of CBO’s most recent but now obsolete FY 2019 deficit deficit projection of $700 billion, the Trumpian GOP is adding $200 billion for defense, disasters, border control, ObamaCare insurance bailouts and other domestic boodle; and on top of that, now comes its vaunted front-loaded tax cut, which will rip $280 billion out of Uncle Sam’s revenue collections in the same year.

Then, throw in $100 billion extra for interest on the higher debt and off-budget borrowing (e.g. $80 billion for student loans). What you get is Uncle Sam fixing to sell $1.28 trillion of debt—equal to 6.2% of projected GDP—at the same time the Fed is dumping another $600 billion of existing treasury and GSE paper.

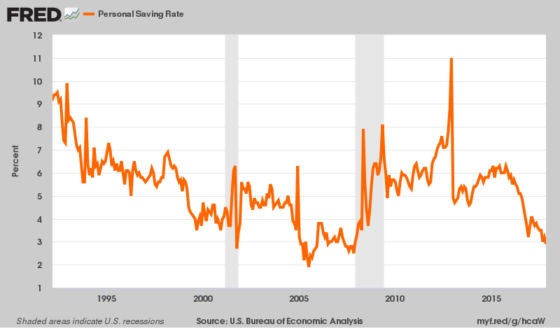

Folks, they most assuredly did not repeal the laws of supply and demand. Indeed, as we stumble toward this FY 2019 public sector debt tsunami, the household savings rate has plummeted to virtually a pre-crisis low at 2.9% of disposable personal income. Accordingly, we have every reason to believe that consumers will use their temporary tax cut windfall to pay-down their own debt, not accumulate the bills and bonds Uncle Sam will be dumping on the market.

So where else is the financing supposed to come from if the Fed and households are out of the picture? Surely, not the corporate sector, which is being induced by $262 billion of FY 2019 tax cuts (the 21% rate plus “bonus” depreciation) to undertake an orgy of CapEx.

So where else is the financing supposed to come from if the Fed and households are out of the picture? Surely, not the corporate sector, which is being induced by $262 billion of FY 2019 tax cuts (the 21% rate plus “bonus” depreciation) to undertake an orgy of CapEx.

To be sure, we rather suspect that whatever investment orgy happens with this $262 billion gift from Uncle Sam, it is likely to occur via stock buybacks and M&A deals in the canyons of Wall Street, not on plant and shop floors on main street. But regardless, slurping-up paper from the incipient tsunami of new treasury debt is likely to be the last place it goes.

The only other category left is foreign buyers—private investors and central banks alike—but that source of “demand” for Uncle Sam’s emissions is fixing to dry-up, as well. And that will be especially true for private European and Japanese investors—who have poured into the dollar bond markets in search of yield and to escape their own yield-free local currency alternatives.

The fact is, this off-shore rescue brigade of the last few years depended upon radical central bank easing in their home markets, which drove these investors and speculators into the dollar markets in search for yield; and, crucially, it also required a yield differential in favor of dollar securities sufficiently wide to cover the carry cost including the inherent FX hedging expense.

Alas, those artificial props are falling by the wayside. The ECB will be out of the bond-buying business by the fall of 2018, the PPBOC is now desperately trying to drain liquidity from its own booming credit Ponzi and even the bank of Japan is slowing down it purchase rate—perhaps because its balance sheet is already approaching absurdity at 100% of GDP.

In all, what was a $1.3 trillion central bank bond purchase rate earlier this year will fade to nearly zero in 2019; and then it will become a large cash drain as central banks shrink their balance sheets in the context of hyper-bloated global financial markets.

Stated differently, what is “priced-in” to the world’s risk asset markets is central bank footings of $22 trillion—–not the $6 trillion level prior to the financial crisis or the $17-18 trillion level now being targeted for the end of the QT/normalization campaign.

What is worse, however, is that on top of this epochal central bank pivot to QT (quantitative tightening), there also comes the abrupt change of the corporate tax regime now enacted into law. That is, the switch from a worldwide income to a territorial income based levy will throw a giant monkey wrench into the works—causing dollar funding costs in FX and swap markets to soar as the trapped cache of un-repatriated earnings of US corporations are brought home.

On the one hand, the resulting reflow of some $2.8 trillion of off-shore dollars does not exactly count as a new source of financing for the domestic US treasury market. Uncle Sam intends to take an average 13.5% level from any repatriated funds, and that $130 billion in FY 2018-2019 (and $339 billion over the decade) is already built into the net cost of the tax bill.

Moreover, the untaxed portion of these allegedly “trapped” off-shore funds were not exactly stuffed into a corporate shoe-box. More often than not these assets functioned as collateral for dollar borrowings in the domestic US markets—with Apple (APPL) being the obvious poster boy case.

Yes, APPL has $275 billion of cash-like assets parked abroad in Ireland and other tax havens, but even as it floated on a sea of cash, Apple has also borrowed $115 billion to fund domestic investments—-mainly investments on Wall Street in the form of stock buybacks.

So after-tax reflows of corporate cash are likely to finance the unwinding of previous tax law arbitrages like Apple’s or be applied to funding current financial engineering maneuvers including stock repurchases and M&A deals.

In short, the mandatory one-time repatriation tax grab of $339 billion over the next decade by Uncle Sam will likely cascade in many complex directions, but the first use will almost certainly not be to buy US government debt at today’s 2.43% yield on the 10-year benchmark issue.

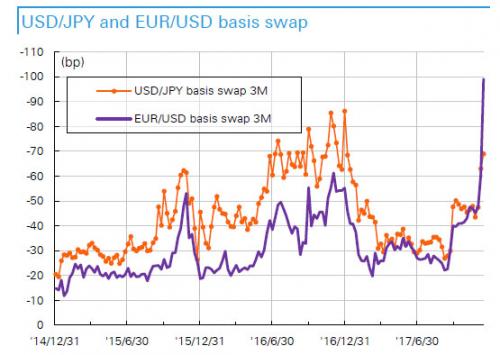

But what is certain is that the mandatory repatriation tax just passed by Congress will reinforce the global off-shore dollar shortage that is inherent in the Fed’s normalization and QT campaign. That means hedging costs will rise and the currency-adjusted returns on foreign-investor owned US treasury paper will fall—and could actually disappear entirely if the basis swap becomes increasingly negative.

For instance, the Japanese financial institutions tend to use 3-month FX forwards when they invest in hedged foreign bonds. Annualized hedge costs have recently risen to 2.33%, which means that yen-based investors in 10-year US Treasuries at today’s yield of 2.43% would end up with virtually no return.

In short, this time is truly different because the impending, spectacular late-cycle collision of US fiscal and monetary policies is sure to rock the $100 billion global bond market with severe, cascading ripples of downward pricing adjustments (i.e. higher yields and wider spreads). Yet the entire price structure of the equity market incorporates the previous era of drastically repressed yields.

In short, this time is truly different because the impending, spectacular late-cycle collision of US fiscal and monetary policies is sure to rock the $100 billion global bond market with severe, cascading ripples of downward pricing adjustments (i.e. higher yields and wider spreads). Yet the entire price structure of the equity market incorporates the previous era of drastically repressed yields.

In our judgment, a large share of the $15 trillion of US stock buybacks and M&A deals over the last decade would not have happened—save for the ultra-low after-tax cost of debt. For instance, mega-M&A deals by investment grade companies always look accretive to earnings because they have been 85% cash/debt financed at a weighted average after-tax cost of under 2.0%.

Likewise, the scramble for yield has funded a massive revival of the junk loan and bond markets—with combined outstandings now pushing $4 trillion or more than double the 2007 level. On the margin, virtually every dollar of that $2 trillion gain went into the liquidation of corporate equities via LBO’s and leveraged recaps.

In a word, a huge chunk of the over-valuation in today’s stock markets reflects the cheap debt fueled financial engineering “bid” for stocks that will be literally monkey-hammered by the central bank pivot to QT—compounded by the fiscal insanity of the Trump-GOP debt binge.

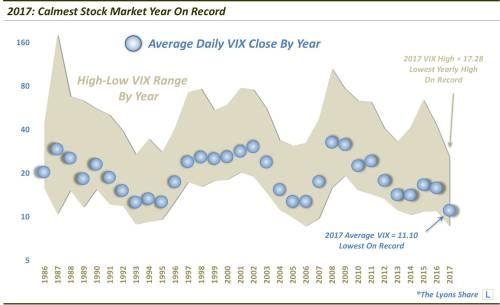

In that context, the insouciant complacency in today’s casino is all the more remarkable—and dangerous. The VIX index average during 2017 came in at 11.1. That is the lowest reading ever — by more than one and a half points — since the VIX inception in 1986. By way of comparison, the daily average for all years since then was over 20.

Likewise, the maximum level reached by the VIX in 2017 was 17.3. That’s the lowest maximum level attained in any year since inception—-and 60% lower than average.

And that’s what ultimately makes this time so very different.

And that’s what ultimately makes this time so very different.

Valuation levels have never been higher relative to income and forward prospects. Central banks have never been on the precipice of a multi-trillion cash extraction and pivot to QT. And nine years of central bank fostered bubble inflation and fake recovery have never rendered the casino so complacent.

In all, we’d say Wall Street is calling the sheep to the final slaughter. At the moment, in fact, the bleating is so loud that the gamblers are seriously debating whether the 50X gain in bitcoin in just 22 months is sustainable. But that’s surely derangement at Tulip Mania scale, as we will further consider in a few moments.

~ PART 2 ~

The most dangerous place on the planet financially is now the Wall Street casino. In the months ahead, it will become ground zero of the greatest monetary/fiscal collision in recorded history.

For the first time ever both the Fed and the US treasury will be dumping massive amounts of public debt on the bond market—upwards of $1.8 trillion between them in FY 2019 alone—and at a time which is exceedingly late in the business cycle. That double whammy of government debt supply will generate a thundering “yield shock” which, in turn, will pull the props out from under equity and other risk asset markets—-all of which have “priced-in” ultra low debt costs as far as the eye can see.

The anomalous and implicitly lethal character of this prospective clash can not be stressed enough. Ordinarily, soaring fiscal deficits occur early in the cycle. That is, during the plunge unto recession, when revenue collections drop and outlays for unemployment benefits and other welfare benefits spike; and also during the first 15-30 months of recovery, when Keynesian economists and spendthrift politicians join hands to goose the recovery—-not understanding that capitalist markets have their own regenerative powers once the excesses of bad credit, malinvestment and over-investment in inventory and labor which triggered the recession have been purged.

By contrast, the Federal deficit is now soaring at the tail end (month #102) of an aging business expansion. And the cause is not the exogenous effects of so-called automatic fiscal stabilizers associated with a macroeconomic downturn, but deliberate Washington policy decisions made by the Trumpian GOP.

During FY 2019, for example, these discretionary plunges into deficit finance include slashing revenue by $280 billion, while pumping up an already bloated baseline spending level of $4.375 trillion by another $200 billion for defense, disasters, border control, ObamaCare bailouts and domestic pork barrel of every shape and form.

These 11th hour fiscal maneuvers, in fact, are so asinine that the numbers have to be literally seen to be believed. To wit, an already weak-growth crippled revenue baseline will be cut to just $3.4 trillion, while the GOP spenders goose outlays toward the $4.6 trillion mark.

That’s right. Nine years into a business cycle expansion, the King of Debt and his unhinged GOP majority on Capitol Hill have already decided upon (an nearly implemented) the fiscal measures that will result in borrowing 26 cents on every dollar of FY 2019 spending. JM Keynes himself would be grinning with self-satisfaction.

Moreover, this foolhardy attempt to re-prime-the-pump nearly a decade after the Great Recession officially ended means that monetary policy is on its back foot like never before.

What we mean is that both Bernanke and Yellen were scared to death of the tidal waves of speculation that their money printing policies of QE and ZIRP had fostered in the financial markets. So once the heat of crisis had clearly passed and the market had recovered its pre-crisis highs in early 2013, they nevertheless deferred, dithered and procrastinated endlessly on normalization of interest rates and the Fed’s elephantine balance sheet.

So what we have now is a central bank desperately trying to recapture lost time via its “automatic pilot” commitment to systematic and sustained balance sheet shrinkage at fixed monthly dollar amounts. This unprecedented “quantitative tightening” or QT campaign has already commenced at $1o billion of bond sales per month (euphemistically described as “portfolio run-off” by the Eccles Building) during the current quarter and will escalate automatically until it reaches $50 billion per month ($600 billion annualized) next October .

Needless to say, that’s the very opposite of the “accommodative” Fed posture and substantial debt monetization which ordinarily accompanies an early-cycle ballooning of Uncle Sam’s borrowing requirements. And the present motivation of our Keynesian monetary central planners is even more at variance with the normal cycle.

To wit, they plan to stick with QT come hell or high water because they are in the monetary equivalent of a musket reloading mode. Failing to understand that the main street economy essentially recovered on its own after the 2008-2009 purge of the Greenspanian excesses (and that’s its capacity to rebound remains undiminished), the Fed is desperate to clear balance sheet headroom and regain interest rate cutting leverage so that it will have the wherewithal to “stimulate” the US economy out of the next recession.

Needless to say, this kind of paint-by-the-numbers Keynesianism is walking the whole system right into a perfect storm. When the GOP-Trumpian borrowing bomb hits the bond market next October we will already be in month #111 of the current expansion cycle and as the borrowing after-burners kick-in during the course of the year, FY 2019 will close out in month #123.

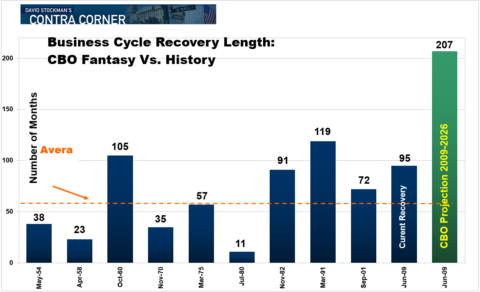

Here’s the thing. The US economy has never been there before. Never in the recorded history of the republic has a business expansion lasted 123 months. During the post-1950 period shown below, the average expansion has been only 61 months and the two longest ones have their own disabilities.

The 105 month expansion during the 1960s was fueled by LBJ’s misbegotten “guns and butter” policies and ended in the dismal stagflation of the 1970s. And the 119 month expansion of the 1990s reflected the Greenspan fostered household borrowing binge and tech bubbles that fed straight into the crises of 2008-2009.

Yet the Trumpian-GOP has not only presumed to pump-up the fiscal deficit to 6.2% of GDP just as the US economy enters the terra incognito range of the business cycle (FY 2019); it has actually declared its virtual abolition. Ironically, in fact, on December 31, 2025 nearly all of the individual income cuts expire—-meaning that in FY 2026 huge tax increases will smack the household sector at a $200 billion run-rate!

But not to worry. The GOP’s present-day fiscal geniuses insist that the current business expansion, which will then be 207 months old, will end up no worse for the wear. The public debt will then total $33 trillion or 130% of GDP—even as the US economy gets monkey-hammered by huge tax increase.

Alas, no harm, no foul. The business expansion is presumed to crank forward through FY 2027 or month #219.

Needless to say, the whole thing degenerates into a sheer fiscal and economic fairy-tale when you examine the data and projections. But that hasn’t deterred the GOP’s fiscal dreamers.

Needless to say, the whole thing degenerates into a sheer fiscal and economic fairy-tale when you examine the data and projections. But that hasn’t deterred the GOP’s fiscal dreamers.

Not only have they implicitly embraced an out-of-this-word 219 month business cycle expansion, but they have also insisted it will unfold at an average nominal GDP growth rate that has not been remotely evident at any time during the 21st century.

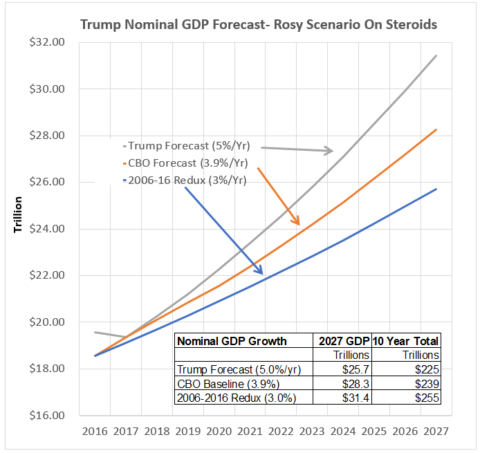

As shown in the chart below, the 10-year CBO forecast of nominal GDP (yellow line) is already quite optimistic relative to where GDP would print under the actual growth rate of the last ten-years (blue line). In fact, the CBO forecast generates $16 trillion of extra GDP and nearly $3 trillion more Federal revenue than would a replay of the last 10-years—and notwithstanding the massive fiscal and monetary stimulus during that period.

Still, the GOP/Trump forecast (grey line) assumes a full percentage point of higher GDP growth on top of CBO and no intervening recession and resulting GDP relapse.

Accordingly, the GOP assumes $30 trillion of extra GDP over the coming decade or nearly 23% more than would be generated by the actual growth rate (blue line) of the last decade; and consequently, $6 trillion of extra revenue.

That’s right. An already geriatric business cycle is going t0 rear-up on its hind legs and take off into a new phase of growth in the face of an epochal pivot of monetary policy to QT and a public debt burden relative to GDP that is approaching a Greek-style end game.

(Note: Figures in the box are inverted. First line should be 2006-2012 redux and third line should be Trump forecast.)

(Note: Figures in the box are inverted. First line should be 2006-2012 redux and third line should be Trump forecast.)

Stated differently, fiscal policy has descended into the hands of political mad-men at the very time that monetary policy is inexorably slouching toward normalization. Under those circumstances there is simply no way of avoiding the “yield shock” postulated above, and the cascading “reset” of financial asset prices that it will trigger across the length and breadth of the financial system.

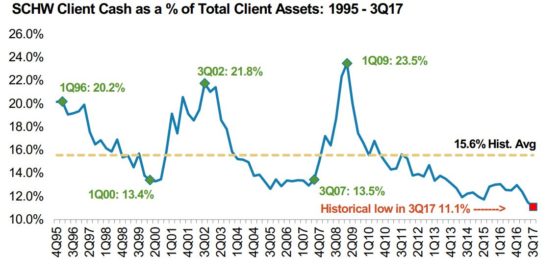

As usual, however, the homegamers are the last to get the word. The unaccountable final spasm of the stock market in 2017 will undoubtedly come to be seen as the last call of the sheep to the slaughter. And owing to the speculative mania that has been fostered by the Fed and its fellow-traveling central banks, it now appears that the homegamers are all-in for the third time since 1987.

Indeed, Schwab’s retail clients have never, ever had lower cash allocations than at the present time—not even during the run-up to the dotcom bust or the great financial crisis.

But this time these predominately baby-boom investors are out of time and on the cusp of retirement—if not already living on one of the Donald’s golf resorts. When the crash comes they will have no opportunity to recover—-nor will Washington have the wherewithal to stimulate another phony facsimile of the same.

The GOP-Trumpian gang has already blown their wad on fiscal policy and the Fed is stranded high and dry still close the zero-bound and still saddled with an elephantine balance sheet.

That is, what is fundamentally different about the greatest financial bubble yet is that there is no possibility of a quick policy-induced reflation after the coming crash. This time the cycle will be L-shaped—– with financial asset prices languishing on the post-crash bottom for years to come.

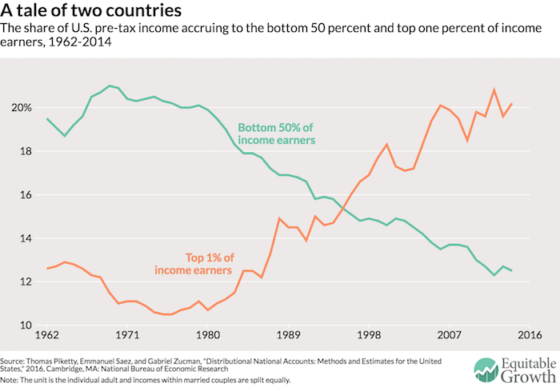

And that is a truly combustible condition. That is, 65% of the retirement population already lives essentially hand-to-month on social security, Medicare and other government welfare benefits (food stamps and SSI, principally). But after the third financial bubble of this century crashes, tens of millions more will be driven close to that condition as their 401Ks again evaporate.

That’s why the fiscal game being played by the Donald and his GOP confederates is so profoundly destructive. Now is the last time to address the entitlement monster, but they have decided to throw fiscal caution to the winds and borrow upwards of $1.6 trillion (with interest) to enable US corporations to fund a new round of stock buybacks, dividend increases and feckless, unproductive M&A deals.

Then again, what the GOP has not forgotten is the care and feeding of its donor class. That mission is being accomplished handsomely as it fills up the deep end of the Swamp with pointless, massive defense spending increases and satisfies K-Street with a grotesquely irresponsible tax bill that was surely of the lobbies, by the PACs and for the money.

Then again, what the GOP has not forgotten is the care and feeding of its donor class. That mission is being accomplished handsomely as it fills up the deep end of the Swamp with pointless, massive defense spending increases and satisfies K-Street with a grotesquely irresponsible tax bill that was surely of the lobbies, by the PACs and for the money.

At the end of the day, however, the laws of free markets and sound finance will out. The coming crash of the greatest bubble ever will prove that in spades.

Written by David Stockman and published by Contra Corner ~ December 28th and 29th, 2017.

Written by David Stockman and published by Contra Corner ~ December 28th and 29th, 2017.

Author, David Stockman

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml