U.S. homes have regained value since the Great Recession, but many households have not

Photo: Market Watch, Everett Collection

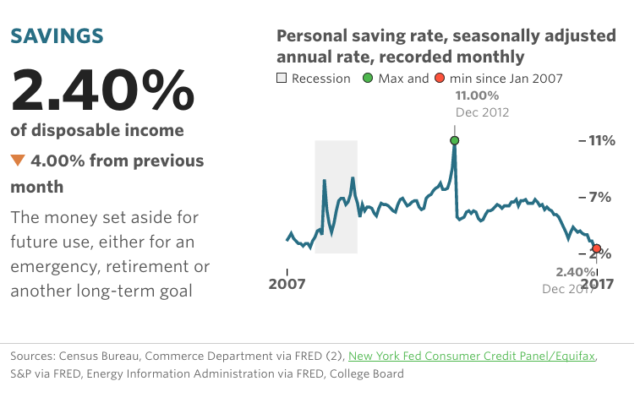

Millions of Americans are living on the edge.

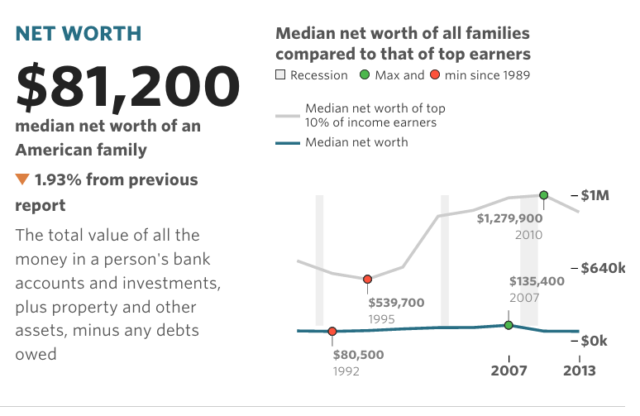

One in five households has zero or negative wealth, according to a report released this week by the Institute for Policy Studies, a progressive think tank based in Washington, D.C. What’s more, an even greater share of African-American (30%) and Latino (27%) households are “underwater” financially. The combined impact of $1 trillion in credit-card debt, $1.4 trillion in student loan debt, and stagnant wages are taking a toll.

U.S. homes have regained value since the Great Recession, but many households have not. “Millions of American families struggle with zero or negative wealth, meaning they owe more than they own,” the report found. “This means that they have nothing to fall back on if an unexpected expense comes up like a broken down car or illness.” And inequality could get worse through new tax cuts for the wealthy.

President Trump’s tax proposals won’t give America’s middle class the reprieve they need to grow their wealth and recover from the financial crash, said Josh Hoxie, who heads up the Project on Opportunity and Taxation at the Institute for Policy Studies. A recent analysis by the Joint Committee on Taxation concluded that taxes would decline for all income groups, with the biggest percentage-point decline for millionaires.

After-tax income would rise by nearly 7% for households earning over $1 million per year, compared to less than 2% for those earning between $50,001 and $1 million, as MarketWatch recently reported. And less than 1% for those earning less than $50,000, according to Ernie Tedeschi, an economist at Evercore IS investment banking advisory firm who worked in the Treasury Department under President Obama.

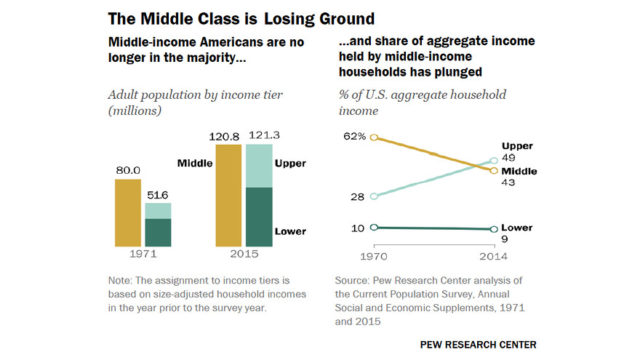

Looking at private income, such as earnings and dividends, and government benefits like Social Security, the income of families near the top increased roughly 90% from 1963 to 2016, while the income of families at the bottom rose less than 10%, according to a separate report released last month by the Urban Institute, a nonprofit policy group based in Washington, D.C., while most other groups have been left behind.

Looking at private income, such as earnings and dividends, and government benefits like Social Security, the income of families near the top increased roughly 90% from 1963 to 2016, while the income of families at the bottom rose less than 10%, according to a separate report released last month by the Urban Institute, a nonprofit policy group based in Washington, D.C., while most other groups have been left behind.

And that gap between rich and poor is only going to get worse, Hoxie said. The wealthiest 25 individuals in the U.S., including Microsoft co-founder Bill Gates, Amazon CEO Jeff Bezos and Facebook CEO Mark Zuckerberg, own $1 trillion in combined assets. These 25 — a group equivalent to the active roster of a major league baseball team — hold more wealth than the bottom 56% of the U.S. population.

The State of the American Wallet

Data portraits of how the average American family is faring financially.

Written by Quentin Fottrell and published by Market Watch ~ December 29, 2017.

Written by Quentin Fottrell and published by Market Watch ~ December 29, 2017.

Life, Liberty & All That Jazz is aired at 1:00 p.m. (Eastern Time) for TWO-HOURS, each Monday through Friday on The Micro Effect.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

1-623-327-1778

Email: gold@kettlemorainepreciousmetals.com

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml