Households currently have high exposure to the equity market

Uncertainty over trade policy may be the primary driver of the U.S. stock market at the moment, but the real policy risk facing equities could be coming from the Federal Reserve, with the potential downside a lot more pronounced than investors are currently anticipating.

Uncertainty over trade policy may be the primary driver of the U.S. stock market at the moment, but the real policy risk facing equities could be coming from the Federal Reserve, with the potential downside a lot more pronounced than investors are currently anticipating.

Last week, Fed Chairman Jerome Powell said the economic outlook had strengthened, but he painted a mixed picture about what policy might look like going forward. The U.S. central bank raised interest rates but indicated it would only do a total of three rate hikes in 2018, which some saw as a dovish signal given that a number of investors had expected four this year. However, the Fed pushed up its expected rate path in 2019 and 2020.

Barry Bannister, head of institutional equity strategy at Stifel, said it was a concern that the Fed’s view for 2019 and 2020 had grown more hawkish, which raised the risk of the central bank making a policy mistake.

“What matters for investors is that any decline is likely to be unusually rapid and occur as a result of P/E compression, resulting from policy risks not weak GDP,” he wrote in a research report. “Investors need a bit more acrophobia, as our best model points to a bear market and lost decade for stocks.”

Bannister argued the new Fed, under Powell, “wishes to fade the ‘Fed put,’” or the idea that the central bank would step in to prop up falling equity prices. “The cost may be a 16% P/E drop,” he wrote, referring to price-to-earnings, a popular measure of equity valuation.

The Fed is expected to regularly raise rates over the coming years, and some investors think it may hasten its pace of increases to rates in the event that inflation returns to the market in a more pronounced fashion.

“Maybe it is not that the Fed has actually made an error, perhaps it is fear the Fed may make an error,” Stifel wrote (emphasis in original). “The late-2010s echo the late-1990s as ‘bookends’ for global imbalances. Unlike the yield curve inversion in [the first half of the 2000s] in anticipation of 2% inflation that led to an S&P 500 peak, investors may simply worry that the same outcome is possible in this cycle, causing equities to decline.”

A bear market is typically defined as a 20% drop from a market peak. Currently, the S&P 500 SPX, +1.38% is about 9.3% below a record high hit earlier this year, while the Dow Jones Industrial Average DJIA, +1.07% is down 10.4% and the Nasdaq Composite Index COMP, +1.64% is down 9%. Both the Dow and the S&P 500 are in correction territory, meaning they’ve dropped 10% from a peak and haven’t recovered; the Dow’s correction was one of its fastest such drops from a record in history.

Last week, major equity indexes suffered their biggest one-week drop in about two years, pressured in large part by uncertainty over trade policy. That kind of outsize volatility has continued into this week, though fluctuations in large-capitalization technology shares have been the biggest contributor to the swings.

These moves have come at a time when investors are heavily exposed to the equity market. TD Ameritrade recently reported that its retail clients ended 2017 with record levels of market exposure, while cash balances for Charles Schwab clients were at record lows in December, according to Morgan Stanley. Meanwhile, the AAII stock allocation index is above 70%, near its highest level since 2000.

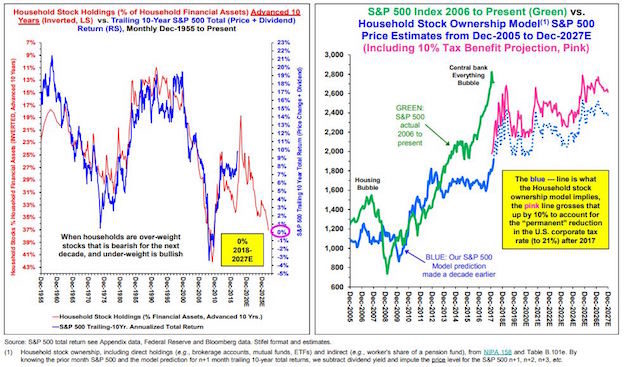

All of these stats sound ominous warnings for Bannister, who wrote that there was an inverse correlation between household stock ownership and the total return of the S&P 500 over the coming 10 years. An inverse correlation means that as stock ownership rises, S&P 500 returns fall, and vice versa.

The high level of ownership “points to a 0% total return” between 2017 and 2028, he wrote, adding, “After the central bank bubble of recent years the model now points to a rapid 20% drop ahead.”

Written by Ryan Vlastelica and published by Market Watch ~ March 29, 2018.

Written by Ryan Vlastelica and published by Market Watch ~ March 29, 2018.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml