A comprehensive look at Bitcoin and why blockchain technology can be so disruptive to the status quo

In the beginning of 2017, you could buy 1 Bitcoin for around $700-$900. Throughout the summer, Bitcoins price started to soar and seemed to reach new highs on almost a daily basis. In the fall of 2017, Bitcoin continued its impressive run, doubling in price in a 30 day period while breaking through the much anticipated $10,000 USD mark. On December 7th, Bitcoin went parabolic and breached $19,000 USD before settling in the $15,000 – $17,000 range. Even long-term Bitcoin enthusiasts were shocked at this price movement. With these spectacular new highs, more people are discovering Bitcoin and it’s becoming increasingly difficult for media pundits to write Bitcoin off as some cypherpunk fad or anomaly. Make no mistake, for better or for worse, Bitcoin has arrived in a big way and it has officially put the financial world on notice.

In the beginning of 2017, you could buy 1 Bitcoin for around $700-$900. Throughout the summer, Bitcoins price started to soar and seemed to reach new highs on almost a daily basis. In the fall of 2017, Bitcoin continued its impressive run, doubling in price in a 30 day period while breaking through the much anticipated $10,000 USD mark. On December 7th, Bitcoin went parabolic and breached $19,000 USD before settling in the $15,000 – $17,000 range. Even long-term Bitcoin enthusiasts were shocked at this price movement. With these spectacular new highs, more people are discovering Bitcoin and it’s becoming increasingly difficult for media pundits to write Bitcoin off as some cypherpunk fad or anomaly. Make no mistake, for better or for worse, Bitcoin has arrived in a big way and it has officially put the financial world on notice.

FUD (fear, uncertainty, and doubt – or deception)

Speculation from prominent establishment people like Jamie Dimon, CEO of JPMorgan Chase, to more anti-establishment people like Peter Shiff, long time gold-bug are calling Bitcoin a scam and a Ponzi Scheme. It’s important to keep in mind that some of these critics make a living off of competing currencies and have a vested interest in the failure of Bitcoin. Their hyperbole reminds me of something the head of the horse and buggy industry might have said at the turn of the last century– warning people about the dangers of the Model T Ford.

C. Ponzi

Are we to believe what Jamie Dimon tells us about Bitcoin? I doubt it. For example, while Dimon strongly condemned Bitcoin, (and even went so far to say that if anyone in his company touched it, they’d be fired) it was later learned JPMorgan was buying up Bitcoin futures overseas. So why is JPMorgan buying Bitcoin futures if their CEO thinks it’s a scam? Dimon’s well-timed (and well-publicized) comments coincided with the Chinese government banning crypto exchanges. Subsequently, there was a significant drop in the crypto market. Was Dimon part of a coordinated effort to talk down the crypto markets? By doing so, was he creating a more favorable entry point for his bank, or was he buying Bitcoin futures to manipulate the price at a later date? Either way, his actions were very telling.

The truth is that Bitcoin represents an existential threat to the banking industry and even the monetary system itself. This may be why the mainstream news has reported the death of Bitcoin countless times over the years. It’s their attempt to scare people away and crush sentiment. Fortunately, the media lacks the credibility to influence public opinion they once had. As we can see, Bitcoin is still alive and well and bigger than ever. If you only listen to the mainstream news, you’re missing the big picture on Bitcoin. Here are some of the legitimate concerns that critics have about Bitcoin and some counter-arguments to consider.

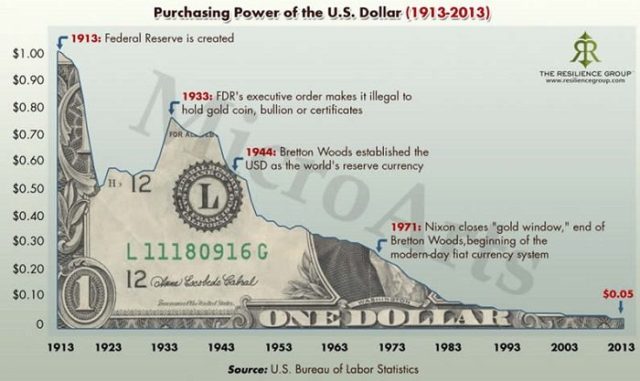

Bitcoin Has No Intrinsic Value

One of the arguments that critics make about Bitcoin is that it cannot be used as a money or a store of wealth because it has no intrinsic value. While this is technically true, the same could be said for the dollar and every other fiat currency. The Dollar may be the world reserve currency and backed by the US Government, but ever since we went off the gold standard in 1971, the US dollar has nothing tangible backing it, it only has the perception of value we collectively assign it. It’s just a piece of paper or digital entry in an account. The value of any currency is very subjective.

Throughout history, many unconventional things have been used as currency. We’ve used beads, shells, pelts, salt, food, spices, gold, silver and the list goes on. These were all things that society put a value on, and not so much for their intrinsic value, but because most of these items were useful in their time and could be used for barter. Then we went to bank notes and paper currencies for convenience and consistency. Since then, we haven’t really had a currency with intrinsic value, just paper. Not only does the Federal Reserve Note have no intrinsic value, it’s based on debt. History has shown us that all paper currencies eventually fail. Is it really that much of a stretch of the imagination to think that in this technological day and age, a secure, finite digital crypto-currency can’t hold value? Bitcoin is a peer to peer decentralized payment network that allows anyone, anywhere in the world to transfer money without using a financial institution. This is one of Bitcoin’s functional value or utility.

Source: The Market Oracle

Bitcoin is a finite currency with only 21 million ever allowed to come into existence. This makes Bitcoin scarce and deflationary by design. Fiat currencies can be inflated until they lose most of their purchasing power (as we’ve seen in the last 100 years). The reason housing costs have increased 47,000% in England (and many other developed countries) in the last century is not because lumber, concrete, and raw materials or even labor costs increased by 47,000%. It’s primarily due to inflation (and other reasons like population growth and govt. intervention). Housing is a basic human need and its costs affect almost everyone, but it’s not just housing, inflation affects almost everything we use. It wouldn’t be so bad if the average wage kept that same pace, but it hasn’t. As the population grows we need to expand the money supply but not like this. This is what happens when the money supply is expanded and distributed disproportionately. Inflation is a pernicious hidden tax and a form of wealth redistribution that only benefits a small segment of society and hurts the average saver. Trillions of dollars have been created in the last decade alone, diluting our currencies and driving up the costs of goods and services. By design, Bitcoin is a finite currency and can’t be inflated like fiat currencies, which is another functional value Bitcoin possesses. This one design alone makes Bitcoin very attractive to many investors.

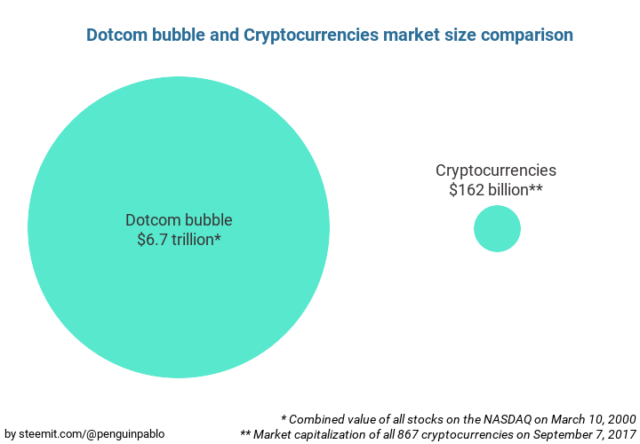

Source: Penguinpablo As of 12.07.2017 the BTC market cap is $271 billion – the cryptocurrency combined market cap is $418 billion

Bitcoin is a Bubble

Critics also say that Bitcoin is in a bubble and gone too high too quick. This very well may be true. Bitcoin has had a meteoric rise in 2017 and is up well over 2000% this year alone. However, bubbles usually coincide with a significant segment of the public’s involvement. It’s difficult to make this case with Bitcoin. Nine out of ten people on the street don’t even know what Bitcoin is, and out of the ones that do, nine out of ten of them are not even invested in it. With that said, as we saw in the early days of the internet, the Dotcom’s got way ahead of themselves and most were not worth anywhere near the valuations they were priced at. We could experience something similar in the cryptocurrency markets. Most of the cryptocurrency altcoins raised money on their whitepaper alone and don’t even have a working model yet. These are highly speculative investments and most of them will never be successful. The thing about bubbles is that they are rarely if ever detected in real time, so we’ll just have to wait and see if that’s the case.

Source: Coinbase

Bitcoin is Over-Priced

Is Bitcoin currently overpriced? That’s very possible. Bitcoin was trading between $700-$900 earlier this year and has reached over $19,000. That’s an enormous increase by any standard. It seems like Bitcoin may be overbought on the news of Bitcoin futures and chasing it after this recent run up because of FOMO (fear of missing out) may not be wise. However, recent pullbacks have been short-lived and we’ve seemed to have reached another level of awareness and valuation of Bitcoin. Even so, it feels like it’s overpriced right now and it’s best to proceed with caution. We’ve also seen huge price drops in Bitcoin after events like the MT Gox implosion. That could happen again today. All it would take would be for one of the major exchanges to get hacked or legislation unfavorable to Bitcoin be passed, etc. I think we’ll see more significant pullbacks but they could end up being incredible buying opportunities when we look back in 5 or 10 years from now.

Bitcoin Will Usher in a Cashless Society

Another argument made by critics is that Bitcoin is Trojan Horse designed to get people used to digital currency and usher in a cashless society so all transactions can be monitored and or scrutinized. This may be true, but for all intents and purposes, we’re almost a cashless society already. It is estimated that in the U.S. only 14.3%-15.5% of all transactions are still done in cash. In other country’s these figures are even lower. People have been using credit and debit cards for decades and have moved away from cash long before Bitcoin was introduced. The way I see it, Bitcoin is more of a threat to the other forms of digital payments than it is to cash. Visa, Mastercard, Discover, American Express, Pay Pay and Western Union, etc. all seem ripe for disruption, not cash payments. Wouldn’t it be better to have an alternative like Bitcoin instead of our only other digital choice be corporate payment systems who have full control of our credit and are constantly collecting our information?

Bitcoin Will Be Outlawed

For those who think that Bitcoin will be made illegal, I have three words for you — The Black Market. The black market has existed since time immemorial and will never go away. Anything governments make illegal go directly to the black market and then appreciate in value. Making things illegal never stops the activity. All you need to do is look at the war on drugs. It’s almost as easy for someone to buy a bag of marijuana (or drug of their choice) as it is to buy a pack of gum. Besides, any government who makes Bitcoin illegal will be missing out on a huge technological and taxable trend. The cryptocurrency genie is out of the bottle and making it illegal won’t put it back in.

A more likely scenario would be for governments to try and control it and put a punitive tax on any capital gains made from Bitcoin when converting them back into U.S. Dollars. Maybe even something more Draconian. However, because Bitcoin IS a currency, what would happen if instead of converting back to dollars, you had the ability to directly purchase all of your goods and services with it? That’s where we are heading. There are also altcoins like Monero, Zcash, or Cloak which will allow people to transact in total anonymity, and platforms like Salt Lending that will underwrite loans against cryptocurrencies. By borrowing against your cryptos, you won’t have to convert them into dollars, avoiding or deferring any short or long-term capital gains taxes. I want to be clear, I do not recommend illegally trying to avoid taxes on capital gains, and don’t be surprised if the IRS comes up with a new law for this loophole.

You Can’t Physically Hold Bitcoin

This is actually not entirely true. Bitcoin is technically a digital entry on a ledger, but you can remove your private key and store it offline in a paper wallet which then acts like a paper currency or a bearer bond. As long as you have the private key you can redeem your Bitcoin from anywhere in the world that has an internet connection. The criteria of having to touch your money to be able to buy things went out the window a long time ago. I don’t need to touch my electricity to turn on the lights. Most people buy things every day without ever physically touching their money through their credit and debit cards. You cant touch your wealth in a bank either, its just digits similar to Bitcoin. It’s only when you convert those digits into physical assets can you actually touch something. And the concept is not lost on me, I get the fact that real wealth is usually a tangible asset, but we’re living in a new and unusual age of digital assets now. If and when cryptocurrencies are fully implemented in our society, you’ll never even notice a difference between using credit cards or crypto cards.

Bitcoin is Only For Criminals

Bitcoin is Only For Criminals

Jim Rickards and others tell us that Bitcoin is only used by criminals. Where is the evidence to back up this claim? The duplicitous Jamie Dimon says the same from his glass house. Dimon goes on to say that Bitcoin is for drug dealers who want to launder money. In June of 2017, a subsidiary of JPMorgan Chase was sanctioned for guess what? Money laundering. JPMorgan, HSBC Bank, Commonwealth Bank and many others are the ones helping the criminals that are laundering the really big money, but you won’t hear about that from Rickards or Dimon. It’s true there’s been criminal activity related to Bitcoin which was demonstrated by the Silk Road website, (or as some would call it, free trade among consenting sovereign adults) but it’s very short-sighted to brand all Bitcoin users criminals. That’s like saying that because we only find US Dollars at every drug busts that everyone with a US Dollar is a criminal. Any type of currency in a free society will always be open to criminal activity and unless we totally abolish criminal activity, that will always be the case. Those who are stereotyping Bitcoin users as criminals are taking a page straight out of the same playbook that people used to falsely label Ron Paul voters as domestic terrorists. It’s not criminal to want a new form of money that performs in a way that’s in the peoples best interest and not central banks.

What Exactly Is Bitcoin and What Makes it So Special?

Bitcoin is an open source digital cryptocurrency created in 2009 by the mysterious Satoshi Nakamoto. Many speculate Nakamoto isn’t even a real person but a pseudonym used for a collective group of computer experts. Speculation runs the gamut from the NSA actually created Bitcoin to early computer savant, Alan Greenspan. Catherine Austin Fitts is someone whose opinion I respect a lot. She makes an interesting case on how cryptocurrencies are a government psyop designed to allow the market to fully develop the technology by running up the price. This remains to be seen though. The truth is, nobody really knows who is behind Bitcoin. The Bitcoin whitepaper can be read here. Simply put, Bitcoin is a decentralized electronic peer to peer payment system which uses blockchain technology to keep a public ledger allowing anyone to verify the transactions. Here are some of the other aspects that make Bitcoin a truly revolutionary concept.

1) Transparency — Bitcoin is open source software and transactions can be verified by anyone. Bitcoins cannot be spent twice or counterfeited. Bitcoin uses mathematical equations and does not rely on trust between the parties exchanging them.

2) Decentralized — There is no Bitcoin CEO or Bitcoin central offices. Bitcoin exists on thousands of servers around the world and is totally decentralized. There is no central point of attack. The only way Bitcoin could be stopped is if the internet was to go down, and even then, they could be recovered once services were restored.

3) Bitcoin is Scarce — Unlike just about every other fiat currency, Bitcoin cannot be diluted by the creation of endless Bitcoins. With only 21 million Bitcoins ever allowed to come into existence, Bitcoin is a finite currency.

4) Bitcoin is Not Debt Based — Unlike just about every other fiat currency, Bitcoin is not created from debt. There are no arbitrary interest payments due to a central authority when Bitcoins are mined.

5) Bitcoin is a Global Currency — Bitcoin is not owned by a central bank, government or monarch and does not to belong to any nation. Bitcoin allows anyone anywhere in the world to transact without the need for a bank or middleman.

6) Bitcoin is Antifragile — What is Antifragile? Antifragile is a term coined by economist and author, Nasim Taleb, which basically means, a property of systems that increase in capability, resilience, or robustness as a result of stressors, shocks, volatility, noise, mistakes, faults, attacks, or failures. It seems the more Bitcoin is attacked the stronger it gets.

7) Bitcoin Has No Counterparty Risk (provided it’s stored offline in a hard or paper wallet!) Bitcoin is free and clear from any counterparty risk, but only if it’s stored offline in cold storage or a paper wallet. With Bitcoin, you own it free and clear of any third party claims. The same cannot be said for your bank deposits. In fact, most people are not aware that, thanks to the Dodd-Frank banking reform bill, technically, and more importantly, legally, depositors no longer own their bank deposits and are now subject to bail-ins. A bail-in is when the bank uses depositors money to stabilize the system during times of crisis instead of turning to the government for a bail-out. Bail-ins are law and have already been done outside the US, just look at The Cypress Bank.

8) Bitcoin has the ability to truly revolutionize the current monetary system and change the world as we know it – Perhaps one of the most overlooked aspects of Bitcoin is just how disruptive the technology really is. In addition to the banking system, block-chain technology has the ability to disrupt entire industries. Most people do not put much thought into how our monetary system actually works. We’re not taught about it in school and it’s obfuscated using fancy legal jargon and political doublespeak – which is not by accident. Henry Ford once said, “It is well enough that people of the nation do not understand our banking system, for if they did, I believe there would be a revolution before tomorrow morning”.

To fully appreciate the implications of this technology and its application in modern banking, it’s best to learn about the rapacious nature of our present monetary system. For those who are not familiar with its origin, check out the book called “The Creature From Jekyll Island,” by G. Edward Griffin, or if you don’t like reading, you can watch the documentary below made by James Corbett of the Corbett Report. There’s simply too much on this topic to cover in this article without getting sidetracked.

Bitcoin Can Be Risky — Caveat Emptor

Bitcoin has many positive aspects, but it also has its own set of challenges to consider. We are still in the early days of cryptocurrencies which some liken to the wild west. Bitcoin is largely unregulated which is good and bad. Investing in Bitcoin is not like buying a publicly traded stock on E-trade and there are many things to consider before jumping into this volatile market.

Bitcoin has forked off several times and it’s difficult to know which version of Bitcoin will ultimately prevail. There are three versions right now: Original Bitcoin, Bitcoin Cash, and Bitcoin Gold? The only way to be sure is to buy all three.

Bitcoin also has scaling issues, slow transaction times, and transaction cost issues that still need to be addressed.

Storing your Bitcoins comes with its own challenges too. If you leave your Bitcoin in online exchanges and not in a hard wallet or paper wallet, they remain vulnerable to any number of circumstances that can part you from your wealth.

Bitcoin is very volatile and subject to huge price swings. It’s not uncommon to see $2000+ day swings in the Bitcoin market. Bitcoin has had major corrections and depending on your entry point, this could make a significant difference on your ROI.

If you send your Bitcoin to the wrong address you will lose it forever.

There is little room for error when investing in Bitcoin and even small mistakes can prove to be quite costly. It’s probably not wise to invest in Bitcoin for the short term either unless you are a seasoned trader with a high appetite for risk. You should only invest money you are willing to lose.

Other Factors

There are other factors to consider before investing in Bitcoin:

* The threat of government regulation and legislation could hurt the price of Bitcoin in the short term or even prevent people in some countries from accessing their wealth.

* The Bitcoin community is at odds with each other. Too many forks can change the number of Bitcoins in circulation which can hurt the original model.

* The innovation in this space is moving so rapidly that it’s quite possible that another cryptocurrency could replace Bitcoin one day, or at the very least, steal Bitcoins market-share. Litecoin is another crypto-currency that is 4x faster than Bitcoin with lower transaction fees. Most crypto experts view Bitcoin as digital gold and Litecoin as digital silver. Litecoins price is up almost 5000% this year. Even though Bitcoin has the largest network, it’s not immune to competition.

* At an environmental level, Bitcoin’s mining networks electricity use is an issue that will need to be addressed too. It’s estimated that the electricity used to mine Bitcoin this year exceeded the annual usage of 159 countries. People in colder regions are actually using Bitcoin mining as a source of heat.

* Despite its relatively short track record, the difficult barrier to entry, and all of the other issues still surrounding Bitcoin, it’s currently trading at $16,800 USD at the time of publishing this article. That’s over 13 times the price of an ounce of gold. They call Bitcoin digital gold and it’s performing the way gold was meant to, but on steroids. Bitcoin has come a long way in a short period of time and it still has a long way to go. Bitcoin needs a lot more infrastructure built before it can be adopted by the masses. With that said, every disruptive technology has to start somewhere and it’s always doubted early on until it cannot be.

Final Thoughts

Less than a decade ago we went through a global financial crisis that threatened the world economy and it was never really resolved, just papered over. Some experts say that the next crisis is inevitable and this time the government won’t be able to fix it. Governments around the world will continue to inflate their currencies while reducing their citizen’s purchasing power just to keep the game going, that’s pretty much a given. We need to ask ourselves; where is the greatest risk? Where is the most effective place to store and possibly even grow our wealth? There are now banks that have changed their business model to negative interest rates, which means you’ll have to pay them to hold your money. Some of the largest banks in the world are technically insolvent, and in a globalized economy, they’re all interconnected to some degree or another. There is a massive global derivative bubble out there waiting to be unwound. How safe is your bank if and when there is another crisis? Will your bank use a bail-in with your hard earned savings during the next crisis? With Bitcoin, you are your own bank and in full possession of your wealth.

At its most fundamental level, money represents our time and energy. Money also allows us more freedom. The more money a person has, the more options in life they’re afforded. Why should we let others who may or may not have our best interest in mind have so much control over such a precious asset? How long should we participate in a monetary system that devalues our time, energy and self-worth? Is Bitcoin the answer to all of our problems? I doubt it, but it’s a starting point. The truth is there are still a lot of unknowns about Bitcoin. What we do know is the current system is corrupt and was never designed to serve humanity. It was designed to benefit a few at the top of the pyramid while systematically fleecing the rest of us. Maybe it’s time to try something new.

I think people are waking up, and the phenomenon we’re seeing in Bitcoin may be the very early stages of a long-term run on fiat currencies, or another way to look at it would be, the old monetary system is starting to be repudiated because there’s a new one and it’s better. Of course, this is only speculation, but if true, buckle up, because Bitcoins just getting started.

Written by Marc Zorn for Vision Launch ~ December 11, 2017.

~ Author ~

Marc Zorn is the founder of Vision Launch Development Group. Vision Launch was created to inspire, empower, and promote social entrepreneurs – and be a vehicle for positive change in the world. Marc is strong proponent of individual freedom, freedom of speech, economic empowerment, open source and decentralized peer to peer solutions.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml