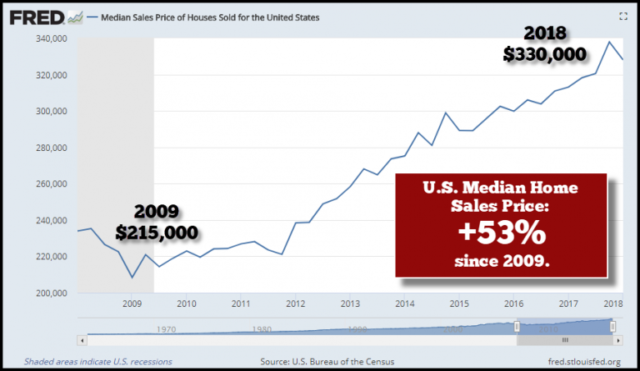

Most Americans don’t know, but the housing market is heading toward another epic bubble. However, the bubble forming today is much different than the subprime housing meltdown in 2007. Back in 2007, there was an oversupply of homes, whereas today there is a shortage. With more buyers than sellers bidding up prices, the U.S. median home price value hit a new record high of $338,000 at the end of 2017.

Most Americans don’t know, but the housing market is heading toward another epic bubble. However, the bubble forming today is much different than the subprime housing meltdown in 2007. Back in 2007, there was an oversupply of homes, whereas today there is a shortage. With more buyers than sellers bidding up prices, the U.S. median home price value hit a new record high of $338,000 at the end of 2017.

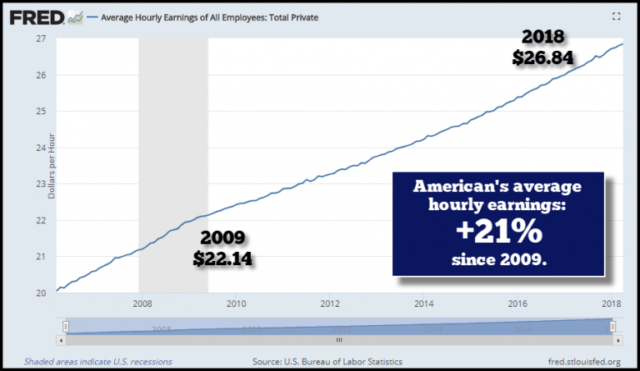

Unfortunately, wages have not kept up with rising home values. For example, the average hourly earnings have only increased 21% since 2009. However, the U.S. median home price $330,000 in Q1 2018 is 53% higher…

Now, to make up for the shortage of homes in the high-demand cities across the countries, the new-home building boom is once again on the rise. The U.S. housing starts in March are up to 1.3 million from the low of 478,000 at the bottom of the 2009 recession. Now, even though current housing starts are more than double what they were at the lows in 2009, they are nearly 50% less than the peak of 2.3 million in 2006.

Now, to make up for the shortage of homes in the high-demand cities across the countries, the new-home building boom is once again on the rise. The U.S. housing starts in March are up to 1.3 million from the low of 478,000 at the bottom of the 2009 recession. Now, even though current housing starts are more than double what they were at the lows in 2009, they are nearly 50% less than the peak of 2.3 million in 2006.

However, there is a much different dynamic today as the cost to build a new home is much higher than it was in 2006. At the peak in 2006, the U.S. median new home price was $262,000 versus the $337,000 in Q1 2018. Moreover, the U.S. median new home price is 60% higher than the low in 2009:

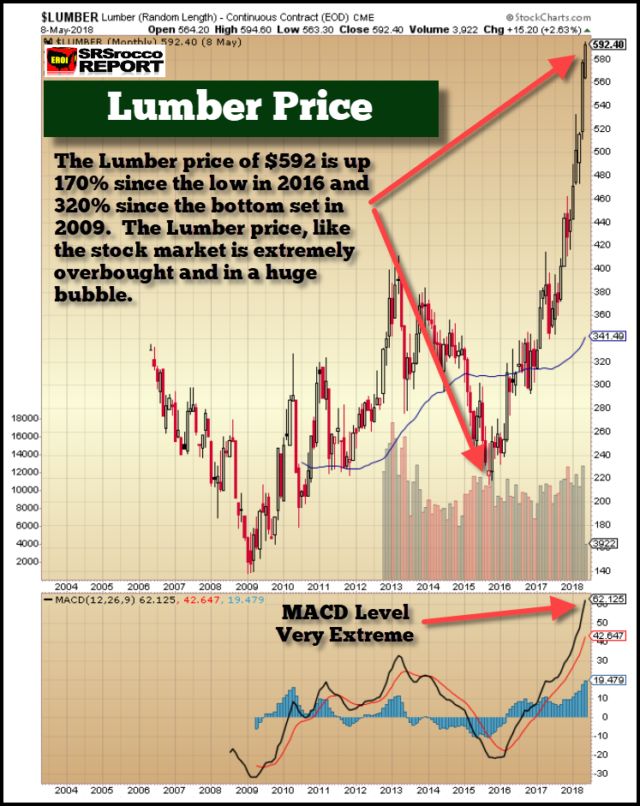

Even though the average wages of an American increased 21% since 2009, the median new home price is 60% higher. Part of the reason for the higher new home price is demand but also is the higher cost. For example, the lumber price shut up 170% since the beginning of 2016. When the U.S. median new home price reached a high of $262,000 in 2006, the price of lumber was $330. Today, the lumber price isn’t quite double, but at $592, it’s pretty darn close:

Even though the average wages of an American increased 21% since 2009, the median new home price is 60% higher. Part of the reason for the higher new home price is demand but also is the higher cost. For example, the lumber price shut up 170% since the beginning of 2016. When the U.S. median new home price reached a high of $262,000 in 2006, the price of lumber was $330. Today, the lumber price isn’t quite double, but at $592, it’s pretty darn close:

You will also notice that the lumber price fell in mid-2014 to a low of $220 at the beginning of 2016. The falling lumber price was party due to the falling oil price. One of the significant costs for cutting and transporting lumber is energy. As the oil price fell in half by 2016, it impacted the price of lumber. However, the lumber price has increased a great deal more in percentage terms than the oil price and seems to be in a bubble or huge top formation.

You will also notice that the lumber price fell in mid-2014 to a low of $220 at the beginning of 2016. The falling lumber price was party due to the falling oil price. One of the significant costs for cutting and transporting lumber is energy. As the oil price fell in half by 2016, it impacted the price of lumber. However, the lumber price has increased a great deal more in percentage terms than the oil price and seems to be in a bubble or huge top formation.

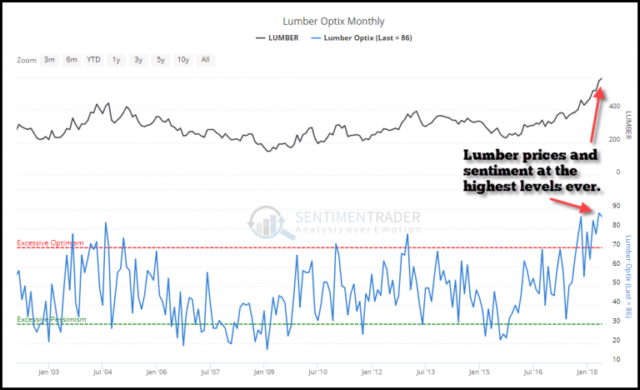

We can see this by the record positive lumber sentiment. I have recently subscribed to Sentiment Trader and have found their service as a great tool to show changes in market trends. If we look at the lumber sentiment of 86, it has never been higher. Any reading above 70 is overly optimistic, and anything under 30 is excessively pessimistic:

While the lumber price can move higher, we can plainly see that bubbles are forming everywhere. According to Dr. Housing Bubble, Total Value of U.S. Homes is $31.8 trillion- Los Angeles homes now valued at $2.7 trillion, the value of the U.K. economy.

While the lumber price can move higher, we can plainly see that bubbles are forming everywhere. According to Dr. Housing Bubble, Total Value of U.S. Homes is $31.8 trillion- Los Angeles homes now valued at $2.7 trillion, the value of the U.K. economy.

Housing values in the U.S. have reached a new peak. In total, U.S. homes are valued around $31.8 trillion according to Zillow. That is 1.5 times the GDP of the U.S. and close to three times the GDP of China. Crap shacks in Los Angeles are now worth $2.7 trillion, which is more than the United Kingdom’s GDP. What is very telling is that real estate values across the country in virtually every large metro area are near peak values. In places like San Francisco, they are in a new stratosphere. The allure of real estate is now fully engulfing the nation and flipping rates are at decade highs. People want to get a piece of the action. You also have many ex-pats now taking their money abroad and retiring in more affordable countries where they can stretch those Taco Tuesday dollars while money from China is flowing the other way and boosting prices in some areas dramatically.

Not only are Americans bidding up housing prices, so are foreigners. Money is sloshing around the world searching for the biggest gains. Unfortunately, the oil that drives the U.S. and the global economy is getting into serious trouble. While I didn’t think the oil price would shoot up as high as it has recently, it may move up even higher before the stock market rolls over. Regardless, the U.S. economy is living on borrowed time as it’s Shale Oil Industry continues to add more debt to produce uneconomic oil.

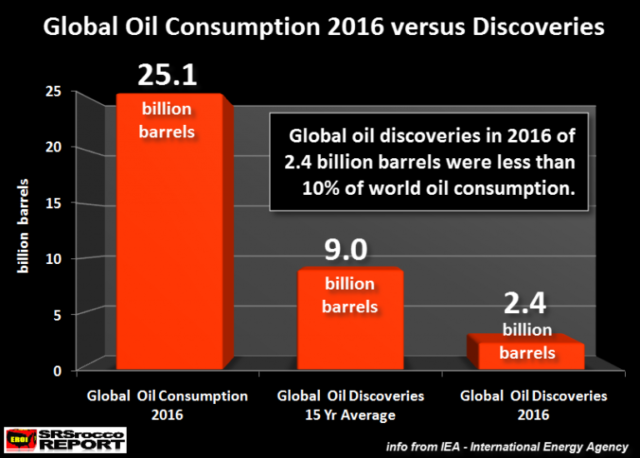

Furthermore, the world is burning one heck of a lot more oil than it is discovering. For example, in 2016 the world found 2.4 billion barrels of conventional oil, but consumed more than ten times that amount at 25 billion barrels:

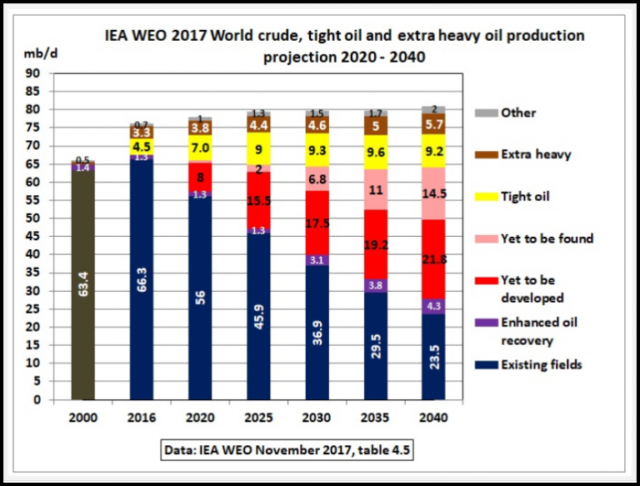

Now, we are making up the difference with unconventional shale (tight oil), tar sands and heavy oil:

Now, we are making up the difference with unconventional shale (tight oil), tar sands and heavy oil:

Regrettably, unconventional oil sources need higher oil prices. As I mentioned in my previous article, How Wall Street Enabled the Fracking ‘Revolution’ That’s Losing Billions:

Regrettably, unconventional oil sources need higher oil prices. As I mentioned in my previous article, How Wall Street Enabled the Fracking ‘Revolution’ That’s Losing Billions:

The U.S. shale oil industry hailed as a “revolution” has burned through a quarter trillion dollars more than it has brought in over the last decade. It has been a money-losing endeavor of epic proportions.

A large percentage of U.S. oil supply was from the huge increase in shale oil production. However, most of that shale oil production wasn’t economical. Thus the companies were forced to tap into investor funds to increase production. Not only are shale oil companies borrowing more money to grow or at least sustain production, but many are also paying higher interest expense to service their debt.

In looking at the fundamentals, I see the U.S. shale oil industry beginning to disintegrate within the next 1-3 years. And by 2025, U.S. oil production will be considerably less than it is today. With the collapse of the U.S. domestic oil industry, it will significantly impact the overall economy and Dollar.

For these reasons, I see a 3 Stage Collapse of the U.S. Housing Market. The 1st stage of the housing collapse will occur when the broader markets experience a 25-50% sell-off. At this point, the U.S. median home price will fall 40% to $200,000. As U.S. oil production continues to decline, we will enter the second stage as the U.S. median home price drops 60% to $120,000.

RELATED: 32¢ on the Dollar and Getting Screwed Faaaaaast!

The 3rd stage of the U.S. Housing Collapse will occur likely by 2030 (or possibly sooner) as domestic oil production falls to 50-75%. As Americans and citizens of the world understand that oil production will continue to decline, the value of stocks, bonds, and real estate will also continue to fall. Which is why I see the U.S. median home price to $40,000 in the 3rd stage of the collapse.

Of course, my timing could be off by a few years, but not decades. Either way, the notion that real estate values will always rise in the future will be DEAD for GOOD as the market is impacted negatively due to falling oil production.

Written by Steve St. Angelo for SRSrocco ~ May 10, 2018.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml