Are we the Reincarnation of Rome?

“If you wanted to understand a politician you mustn’t pay too much attention to his speeches, but find out who were his paymasters. A politician couldn’t rise in public life, in France Rome any more than in America, unless he had the backing of big money, and it was in times of crisis like this that he paid his debts.

The great corporation which employed you lied to you, and lied to the whole country – from top to bottom it was nothing but one gigantic lie.” ~ Upton Sinclair

More than 2,000 years before America’s bailouts and entitlement programs, the ancient Romans experimented with similar schemes. The Roman government rescued failing institutions, canceled personal debts, and spent huge sums on welfare programs. The result wasn’t pretty.

Roman politicians picked winners and losers, generally favoring the politically well connected — a practice that’s central to the welfare state of modern times, too. As numerous writers have noted, these expensive rob-Peter-to-pay-Paul efforts were major factors in bankrupting Roman society. They inevitably led to even more destructive interventions. Rome wasn’t built in a day, as the old saying goes — and it took a while to tear it down as well. Eventually, when the republic faded into an imperial autocracy, the emperors attempted to control the entire economy.

Debt forgiveness in ancient Rome was a contentious issue that was enacted multiple times. One of the earliest Roman populist reformers, the tribune Licinius Stolo, passed a bill that was essentially a moratorium on debt around 367 BC, a time of economic uncertainty. The legislation enabled debtors to subtract the interest paid from the principal owed if the remainder was paid off within a three-year window. By 352 BC, the financial situation in Rome was still bleak, and the state treasury paid many defaulted private debts owed to the unfortunate lenders. It was assumed that the debtors would eventually repay the state, but if you think they did, then you probably think Greece is a good credit risk today.

In 357 BC, the maximum permissible interest rate on loans was roughly 8 percent. Ten years later, this was considered insufficient, so Roman administrators lowered the cap to 4 percent. By 342, the successive reductions apparently failed to mollify the debtors or satisfactorily ease economic tensions, so interest on loans was abolished altogether. To no one’s surprise, creditors began to refuse to loan money. The law banning interest became completely ignored in time.

By 133 BC, the up-and-coming politician Tiberius Gracchus decided that Licinius’s measures were not enough. Tiberius passed a bill granting free tracts of state-owned farmland to the poor. Additionally, the government funded the erection of their new homes and the purchase of their farming tools. It’s been estimated that 75,000 families received free land because of this legislation. This was a government program that provided complimentary land, housing, and even a small business, all likely charged to the taxpayers or plundered from newly conquered nations. However, as soon as it was permissible, many settlers thanklessly sold their farms and returned to the city. Tiberius didn’t live to see these beneficiaries reject Roman generosity, because a group of senators murdered him in 133 BC, but his younger brother Gaius Gracchus took up his populist mantle and furthered his reforms.

Gaius, incidentally, also passed Rome’s first subsidized food program, which provided discounted grain to many citizens. Initially, Romans dedicated to the ideal of self-reliance were shocked at the concept of mandated welfare, but before long, tens of thousands were receiving subsidized food, and not just the needy. Any Roman citizen who stood in the grain lines was entitled to assistance. One rich consul named Piso, who opposed the grain dole, was spotted waiting for the discounted food. He stated that if his wealth was going to be redistributed, then he intended on getting his share of grain.

By the third century AD, the food program had been amended multiple times. Discounted grain was replaced with entirely free grain, and at its peak, a third of Rome took advantage of the program. It became a hereditary privilege, passed down from parent to child. Other foodstuffs, including olive oil, pork, and salt, were regularly incorporated into the dole. The program ballooned until it was the second-largest expenditure in the imperial budget, behind the military.It failed to serve as a temporary safety net; like many government programs, it became perpetual assistance for a permanent constituency who felt entitled to its benefits.

In 88 BC, Rome was reeling from the Social War, a debilitating conflict with its former allies in the Italian peninsula. One victorious commander was a man named Sulla, who that year became consul (the top political position in the days of the republic) and later ruled as a dictator. To ease the economic catastrophe, Sulla canceled portions of citizens’ private debt, perhaps up to 10 percent, leaving lenders in a difficult position. He also revived and enforced a maximum interest rate on loans, likely similar to the law of 357 BC. The crisis continually worsened, and to address the situation in 86 BC, a measure was passed that reduced private debts by another 75 percent under the consulships of Cinna and Marius.

Less than two decades after Sulla, Catiline, the infamous populist radical and foe of Cicero, campaigned for the consulship on a platform of total debt forgiveness. Somehow, he was defeated, likely with bankers and Romans who actually repaid their debts opposing his candidacy. His life ended shortly thereafter in a failed coup attempt.

In 60 BC, the rising patrician Julius Caesar was elected consul, and he continued the policies of many of his populist predecessors with a few innovations of his own. Once again, Rome was in the midst of a crisis. In this period, private contractors called tax farmers collected taxes owed to the state. These tax collectors would bid on tax-farming contracts and were permitted to keep any surplus over the contract price as payment. In 59 BC, the tax-farmer industry was on the brink of collapse. Caesar forgave as much as one-third of their debt to the state. The bailout of the tax-farming market must have greatly affected Roman budgets and perhaps even taxpayers, but the catalyst for the relief measure was that Caesar and his crony Crassus had heavily invested in the struggling sector.

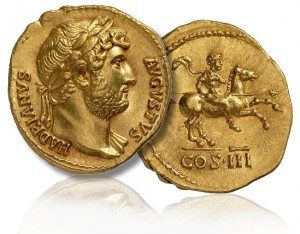

In 33 AD, half a century after the collapse of the republic, Emperor Tiberius faced a panic in the banking industry. He responded by providing a massive bailout of interest-free loans to bankers in an attempt to stabilize the market. Over 80 years later, Emperor Hadrian unilaterally forgave 225 million denarii in back taxes for many Romans, fostering resentment among others who had painstakingly paid their tax burdens in full.

Emperor Trajan conquered Dacia (modern Romania) early in the second century AD, flooding state coffers with booty. With this treasure trove, he funded a social program, the alimenta, which competed with private banking institutions by providing low-interest loans to landowners while the interest benefited underprivileged children. Trajan’s successors continued this program until the devaluation of the denarius, the Roman currency, rendered the alimenta defunct.

By 301 AD, while Emperor Diocletian was restructuring the government, the military, and the economy, he issued the famous Edict of Maximum Prices. Rome had become a totalitarian state that blamed many of its economic woes on supposed greedy profiteers. The edict defined the maximum prices and wages for goods and services. Failure to obey was punishable by death. Again, to no one’s surprise, many vendors refused to sell their goods at the set prices, and within a few years, Romans were ignoring the edict.

Enormous entitlement programs also became the norm in old Rome. At its height, the largest state expenditure was an army of 300,000–600,000 legionaries. The soldiers realized their role and necessity in Roman politics, and consequently their demands increased. They required exorbitant retirement packages in the form of free tracts of farmland or large bonuses of gold equal to more than a decade’s worth of their salary. They also expected enormous and periodic bonuses in order to prevent uprisings.

The Roman experience teaches important lessons. As the 20th-century economist Howard Kershner put it, “When a self-governing people confer upon their government the power to take from some and give to others, the process will not stop until the last bone of the last taxpayer is picked bare.”

Putting one’s livelihood in the hands of vote-buying politicians compromises not just one’s personal independence, but the financial integrity of society as well. The welfare state, once begun, is difficult to reverse and never ends well. Rome fell to invaders in 476 AD, but who the real barbarians were is an open question.

The Roman people who supported the welfare state and the politicians who administered it so weakened society that the Western Roman Empire fell like a ripe plum that year. Maybe the real barbarians were those Romans who had effectively committed a slow-motion financial suicide.

Written by Lawrence W. Reed and Marc Hyden for the Foundation for Economic Education ~ August 17, 2015

* Lawrence W. Reed is president of the Foundation for Economic Education

* Marc Hyden is a conservative political activist and an amateur Roman historian.

Emperor Hadrian

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml