Fiat Currency has always proved to be a Scam

We all run after money, but most of us do not even attempt to understand the way it’s generated. We can’t be blamed much, since it’s been made complex, on purpose, so as to keep commoners ignorant about it – who are, otherwise, quite able to change this evil system. The fundamental question we need to ask ourselves is if we know the difference between Money and Currency. If we don’t, then we are totally out of sync with what’s happening out there. It’s extremely common to think that both are the same. The currency (from the word Current) has no value but is a medium of exchange that enables us to buy things of value. The money, on the other hand, has an intrinsic value.

We all run after money, but most of us do not even attempt to understand the way it’s generated. We can’t be blamed much, since it’s been made complex, on purpose, so as to keep commoners ignorant about it – who are, otherwise, quite able to change this evil system. The fundamental question we need to ask ourselves is if we know the difference between Money and Currency. If we don’t, then we are totally out of sync with what’s happening out there. It’s extremely common to think that both are the same. The currency (from the word Current) has no value but is a medium of exchange that enables us to buy things of value. The money, on the other hand, has an intrinsic value.

Winston Churchill has said that farther back you can look, the farther forward you are likely to see. In the olden days, we used to have a barter trade but its complete reliance on the ‘coincidence of wants’ made it unworkable with the advent of time. In 407 B.C, the government of Athens used Gold as money. When their requirements went up, due to the war expenses, they added copper into their Gold coins to churn out more, and thereby debased their currency. This means 1000 coins of tax payment were made into 2000 coins simply by adding 50% copper into it. Now, the government was spending more than what it had in its treasury. This is called Deficit-spending, which happens to this day.

Eventually, when the paper money was introduced, it represented an equal amount of gold in the government vault. This meant that you could go into the bank with a $100 bill and redeem it for a $100 Gold coin. The currency bills were just medium of exchange. However, when the governance costs shot up, in order to fulfill unrealistic promises made during elections -more importantly, wars, they began printing money more than the gold they had, i.e. they had actually created receipts of gold more than the Gold they had. Now they had a currency which was not backed up by Gold. The US began sending these dollars out to all the countries but when many countries realized that these are mere papers, they asked for Gold in exchange for these dollars. The US did some gold repatriation but since it did not have enough gold, it came up with, what is known as ‘The Nixon Shock’ in 1971. The Nixon Shock, inter alia other economic measures, was a unilateral decision to cancel direct convertibility of the US dollar into Gold. By 1973, it was all about free floating fiat currencies. This was history repeating itself probably more than the hundredth time, as is the nature of such a system. A fiat currency is plainly an order of any authority that the papers they print in their printing press are to be accepted as a legal tender. Now all the world currencies are fiat currencies and are backed up by nothing. They are simply being printed out of thin air.

Eventually, when the paper money was introduced, it represented an equal amount of gold in the government vault. This meant that you could go into the bank with a $100 bill and redeem it for a $100 Gold coin. The currency bills were just medium of exchange. However, when the governance costs shot up, in order to fulfill unrealistic promises made during elections -more importantly, wars, they began printing money more than the gold they had, i.e. they had actually created receipts of gold more than the Gold they had. Now they had a currency which was not backed up by Gold. The US began sending these dollars out to all the countries but when many countries realized that these are mere papers, they asked for Gold in exchange for these dollars. The US did some gold repatriation but since it did not have enough gold, it came up with, what is known as ‘The Nixon Shock’ in 1971. The Nixon Shock, inter alia other economic measures, was a unilateral decision to cancel direct convertibility of the US dollar into Gold. By 1973, it was all about free floating fiat currencies. This was history repeating itself probably more than the hundredth time, as is the nature of such a system. A fiat currency is plainly an order of any authority that the papers they print in their printing press are to be accepted as a legal tender. Now all the world currencies are fiat currencies and are backed up by nothing. They are simply being printed out of thin air.

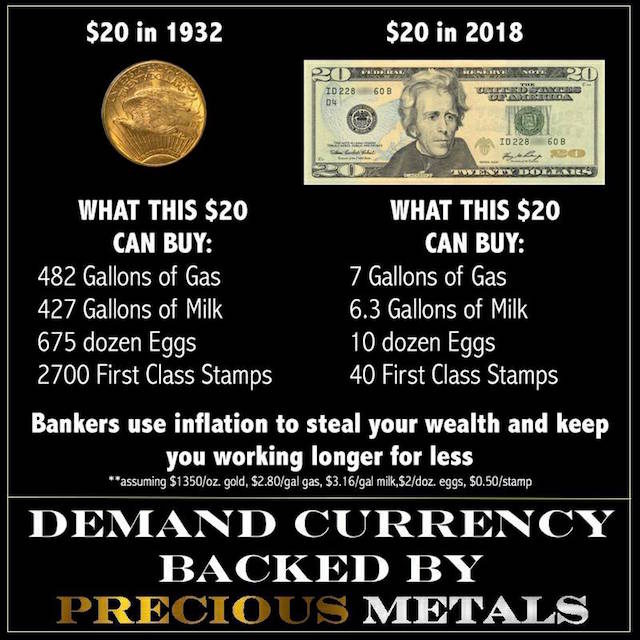

Now when our governments do deficit spending, which they always do, by the way- they simply turn the switch of their printing machine on and pump in new currencies- a process called Quantitative Easing (QE). When you have more currency in circulation with the same assets, the assets/services get pricey. This is Inflation. In inflation, everything becomes valuable except currency. This shows us that the government’s ability to debase the currency by either adding copper in old days or by printing new notes to cover for their extra-spending is the root of the problem. Throughout history, whenever people lost confidence in these papers, they have rushed back to the Gold and Silver, and these two precious metals have revalued themselves. It has happened umpteen times since the advent of monetary history. And it’s due to happen again in this decade, as strongly claimed by a famed monetary historian Mike Maloney. Whenever that happens, there’s a massive wealth transfer, since wealth can never be destroyed. We have to take a call now as to if we want to be on the receiving side or the losing side of this impending wealth transfer. Those who rush back to Gold now will see tremendous profits. Those who rely on currency deposits in the banks are bound to lose.

“The suspicions that the system is rigged in favor of the largest banks and their elites, so they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid.” ~ Neil Barofsky

The deficit spending is to raise a debt which is to be repaid by citizenry along with interest. So, this system is based on debt and interest, which is why it is bound to come crashing down, each time this cycle is repeated. This shows that the only way to stop governments from indulging in this practice is to do away with the paper currency and have the coins of gold as money. What’s wrong in that? That money can also be digitally managed as we do with the fiat currency. This is because it cannot be artificially printed at their whims and desires that they do not do it. At the max, the paper currency can be used if there’s a universally accepted financial institution that can make sure that the currency printed is totally backed by the gold in reserves, otherwise Gold currency is the only bankable option. Coincidentally, Islam favors the same equitable and fair system that has an anti-bubble mechanism installed in it. No ‘Great depressions’ and no ‘Economic Meltdowns/Recessions’.

The deficit spending is to raise a debt which is to be repaid by citizenry along with interest. So, this system is based on debt and interest, which is why it is bound to come crashing down, each time this cycle is repeated. This shows that the only way to stop governments from indulging in this practice is to do away with the paper currency and have the coins of gold as money. What’s wrong in that? That money can also be digitally managed as we do with the fiat currency. This is because it cannot be artificially printed at their whims and desires that they do not do it. At the max, the paper currency can be used if there’s a universally accepted financial institution that can make sure that the currency printed is totally backed by the gold in reserves, otherwise Gold currency is the only bankable option. Coincidentally, Islam favors the same equitable and fair system that has an anti-bubble mechanism installed in it. No ‘Great depressions’ and no ‘Economic Meltdowns/Recessions’.

Written by Dr. Mehboob Makhdoomi for Greater Kashmir ~ November 3, 2018.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml