The eye-opening debt increase is driven by $9.1 trillion in mortgages

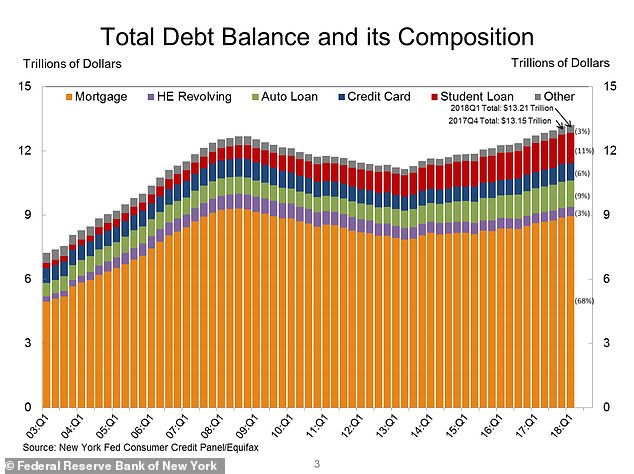

American household debt hit another record high, rising to $13.5 trillion in the last quarter, driven by $9.1 trillion in mortgages. The total is now $837 billion higher than its previous peak in 2008, just as the last recession took hold.

American household debt hit another record high, rising to $13.5 trillion in the last quarter, driven by $9.1 trillion in mortgages. The total is now $837 billion higher than its previous peak in 2008, just as the last recession took hold.

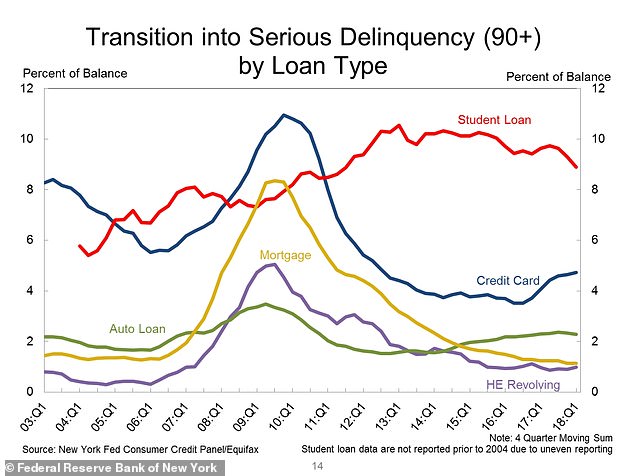

Along with an unusual jump in student-loan delinquencies, the debt load could provide another signal that the U.S. economic expansion is flagging.

Serious delinquency, of 90 or more days, rose by half-a-percent in the third quarter, the Federal Reserve Bank of New York reported on Friday, propelling the biggest jump in the overall U.S. delinquency rate in seven years.

It was a reversal after a period of improvement for student debt, which totaled $1.4 trillion. Serious-delinquency flows have been growing on auto debt since 2012 and on credit card debt since last year, raising red flags for some economists.

The world’s largest economy has grown well above its potential in 2018 on the back of strong consumer spending and the lowest unemployment rate since the 1960s. If growth continues for another year it will be the longest U.S. expansion ever.

While borrowers are far more creditworthy and lenders are more stringent than in the run-up to the last downturn, the upward creep in serious delinquencies in automobile, credit card and now student debt could unsettle policymakers at the Fed and elsewhere.

The record-setting household debt total of $13.5 trillion is $837 billion higher than it was prior to the 2008 recession

The recent increase in serious student loan delinquencies is the biggest jump in seven years

The $219 billion rise in total debt in the quarter ended September 30 was the biggest jump since 2016.

While borrowers are far more creditworthy and lenders are more stringent than in the run-up to the last downturn, the upward creep in serious delinquencies in automobile, credit card and now student debt could unsettle policymakers at the Fed and elsewhere.

Some 4.7 percent of outstanding debt was in some stage of delinquency in the third quarter, up from 4.5 percent previously. This was ‘primarily due to a large increase in the flow into delinquency for student loan balances,’ the New York Fed said in its report.

If the jump in student delinquencies persists, it could raise questions about the ability of income-based repayment programs to ease debt burdens on lower-income borrowers. Unlike auto and credit card lenders, student lenders have not loosened standards in recent years.

Separate data from the New York Fed showed that borrowers aged 30 to 39 years and those 50 and older drove the jump in flows to serious delinquencies, a measure economists use to gauge market stress and likelihood of defaults.

Written by Michael Nam for The Daily Mail ~ November 16, 2018.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml