My grandson had quite a day at school. He had learned that the economy had been suffering from things called Panics, capital P, during the 19th century and had another big one in the early 20th century. He had been told that responsible, public-spirited men like J. P. Morgan had organized a central bank to prevent those Panics. He and other bankers finally got the government to go along with their idea and pass it into law in late 1913. And wouldn’t you know it — we’ve had no more Panics since then.

My grandson had quite a day at school. He had learned that the economy had been suffering from things called Panics, capital P, during the 19th century and had another big one in the early 20th century. He had been told that responsible, public-spirited men like J. P. Morgan had organized a central bank to prevent those Panics. He and other bankers finally got the government to go along with their idea and pass it into law in late 1913. And wouldn’t you know it — we’ve had no more Panics since then.

He looked doubtful, though. He didn’t understand what a central bank did, exactly. And wasn’t the Depression and the recent Financial Crisis kind of like a Panic, only called a different name? And if those calamities were like Panics, then why didn’t the federal reserve prevent them?

His teacher said that this country and most countries of the western world were on a gold standard during the days of Panics. Economists and other people decided that the real culprit behind the turmoil was the gold we used as money. So we got rid of gold for the stuff we use today . . . which doesn’t come out of the ground . . . which comes from the government but is regulated by the people in charge of the federal reserve, which is not really part of the government, though they’re close friends.

“Ok,” he said, “so we have gold causing us and other countries all those Panics and we got rid of it. But we didn’t get rid of it.” He said his teacher told the class about the vault at the Federal Reserve Bank of New York, which houses gold for other countries. The vault is 80 feet below street level and 50 feet below sea level. He found that astounding. The vault is protected by armed guards, CCTV, and electronic surveillance. And the guards are trained marksmen.

Then his teacher pulled out his tablet and read this to the class, which my grandson read to me from his smartphone:

There are no doors into the gold vault. Entry is through a narrow ten-foot passageway cut in a delicately balanced, nine-feet-tall, 90-ton steel cylinder that revolves vertically in a 140-ton, steel-and-concrete frame. The vault is opened and closed by rotating the cylinder 90 degrees. An airtight and watertight seal is achieved by lowering the slightly tapered cylinder three-eighths of an inch into the frame, which is similar to pushing a cork down into a bottle. The cylinder is secured in place when two levers insert large bolts, four recessed in each side of the frame, into the cylinder. By unlocking a series of time and combination locks, Bank personnel can open the vault the next business day. The locks are under “multiple control” no one individual has all the combinations necessary to open the vault.

He found this even more astounding.“Why?” he wanted to know, “Why all the protection for something that’s worthless?Why even keep it around, except maybe for rings and other jewelry?”

As I started to answer he interrupted me.

“Gold, Mr. Bond.”

“That bank stores the gold of other countries. Fort Knox vaults the gold Americans once had. And it’s a piece of work, too.”

He told me the depository was on an army base, and the building that housed the vault was made of North Carolina granite. When the government ordered Americans to turn in their gold coins they melted it down into bars and shipped them by rail to the depository under heavy guard.

“But it’s not just gold stored there,” he said. The place is so secure the government stored the Declaration of Independence and the Constitution there during World War II — the original documents. It also held four exemplified copies of the Magna Carta, which had been on display during the 1939 World’s Fair in New York.

“And get this,” he added, again reading from his smartphone:

During World War II and into the Cold War, until the invention of different types of synthetic painkillers, a supply of processed morphine and opium was kept in the Depository as a hedge against the US being isolated from the sources of raw opium.

“What’s going on?” he wanted to know.“Drugs are bad, gold is bad, right? They’re against the law. But we protect them like our very lives depended on them.”

“You want an answer.”

“Yeah. Why didn’t government just dump the gold into the ocean or drop it down a volcano?

“For that matter, why did the government order people to turn it in? If they didn’t want people using it for money, why not just say it was no longer legal.

“I checked the Constitution during study hall. It says no state shall coin money. It also says no state shall make anything but gold or silver coins a tender in the payment of debts. Since the federal government is prohibited from doing anything not explicitly authorized by the Constitution, that would mean private mints would coin money. Right?”

I told him I couldn’t answer his questions on the constitution, other than to say it’s become a dead letter, meaning that men in power have used tortured arguments to interpret it to suit their purposes or have ignored it altogether in the name of “national security.”

I told him when “national security” is used to justify any government action we’re either at or headed for a dictatorship. He agreed. Then I attempted to fill in some other blanks he left.

Explaining why we went from gold to fiat paper money

A central bank, I explained, is a bank only to its member banks, not to people like you or me. It holds its members’ deposits as reserves on which the commercial banks can issue loans.

At the time of the Fed’s creation in 1913 gold and to some extent silver were still legal money in the United States. Holders of gold or silver coins could walk into stores and buy things with them, or deposit them in banks. In some cases they could get banks to exchange notes for coins, though that became uncommon after 1917 when commercial banks began shipping their gold off to regional federal reserve banks where they were added to the banks’s reserves.

People, thereby, lost the use of gold coins and became acclimated to paper. They were confident, though, that if they really wanted the gold the paper money promised to pay, they could get it.

That confidence crashed and burned in 1933 when FDR ordered Americans to turn in their gold coins — or else. They were given assurances of the necessity of the heist — which has also been called a “gold recall,” as if the gold itself were defective. It was a national emergency, and Americans knew the government took away their rights in a national emergency.

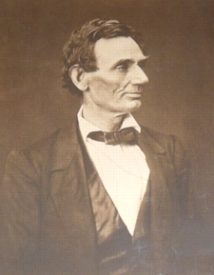

Many of them recalled the social environment of World War I where people could get arrested for reading the Bill of Rights publicly. And during the American Civil War Lincoln suspended habeas corpus and ordered the arrest and imprisonment of anyone challenging his policies. Even the Constitutional Convention amounts to a violation of rights inasmuch as the delegates created a new government rather than revise the charter of the existing one, as they were empowered to do. I suppose they would have said ‘national security’ required the ditching of the old government.

Many of them recalled the social environment of World War I where people could get arrested for reading the Bill of Rights publicly. And during the American Civil War Lincoln suspended habeas corpus and ordered the arrest and imprisonment of anyone challenging his policies. Even the Constitutional Convention amounts to a violation of rights inasmuch as the delegates created a new government rather than revise the charter of the existing one, as they were empowered to do. I suppose they would have said ‘national security’ required the ditching of the old government.

When Roosevelt delivered his first inaugural address he referred to the depression as an emergency comparable to war, thus setting up his listeners for some drastic measures. Later, when he ordered people to turn in their gold, he told them not to worry. The paper they would be using was good stuff, guaranteed. Gold was preventing a recovery — somehow — even though the classical gold standard had been ditched almost two decades earlier. If that doesn’t make sense rest assured monetary issues were complicated, and only the best and brightest could untangle them. And Roosevelt had those kind advising him. Besides, one of the best and brightest had said the gold standard was a barbarous relic, and it was obvious prices were too low, and the only way to bring them up was to manufacture more money. But how are you going to do that with a scarce commodity like gold?

When Roosevelt delivered his first inaugural address he referred to the depression as an emergency comparable to war, thus setting up his listeners for some drastic measures. Later, when he ordered people to turn in their gold, he told them not to worry. The paper they would be using was good stuff, guaranteed. Gold was preventing a recovery — somehow — even though the classical gold standard had been ditched almost two decades earlier. If that doesn’t make sense rest assured monetary issues were complicated, and only the best and brightest could untangle them. And Roosevelt had those kind advising him. Besides, one of the best and brightest had said the gold standard was a barbarous relic, and it was obvious prices were too low, and the only way to bring them up was to manufacture more money. But how are you going to do that with a scarce commodity like gold?

“In a sense, though not the right one, gold did cause the Panics you mentioned.” I said banks had been engaging in fractional reserve lending, where they would promise to redeem in gold coin all the banknotes and deposits for which they were liable. But they expanded the banknotes and deposits beyond the amount of gold they had, a form of embezzlement, though bankers and their friends don’t see it that way. Banks were creating multiple receipts to the same weight of gold, and those receipts circulated as money. In that way they were inflating the money supply. They got away with it until depositors got nervous about the bank’s ability to pay out in gold or until some other bank attempted to clear payments and discovered the inflating bank couldn’t do it.

The public’s discovery of an over-inflating bank led to distrust of other banks, and soon there was chaos known as a Panic. Bankers and most economists see nothing wrong with expanding credit beyond the money in the vault. They consider it a sound practice that only becomes unethical and disruptive when the banks expand too much.

Instead of ceasing the practice of fractional-reserve lending they directed their wrath on gold. If they didn’t have to redeem their notes in gold they could inflate to a much greater degree. Get rid of gold, establish an institution that can provide funds during an emergency — in other words, a central bank — and the chaos would end.

Only it didn’t. Gold acts as a brake on inflation, and without it the monetary unit we call the dollar starts to proliferate and lose value. With economists focused on prices instead of the money supply they missed the inflation of the 1920s. They said inflation was a rise in prices, and there was very little of that in the 1920s, except on the stock market. When the Crash hit it came as a big shock — though not to Ludwig von Mises, an economist of the Austrian school.

Only it didn’t. Gold acts as a brake on inflation, and without it the monetary unit we call the dollar starts to proliferate and lose value. With economists focused on prices instead of the money supply they missed the inflation of the 1920s. They said inflation was a rise in prices, and there was very little of that in the 1920s, except on the stock market. When the Crash hit it came as a big shock — though not to Ludwig von Mises, an economist of the Austrian school.

Did they see their mistake and rethink their theories? No. Once again they seethed over gold’s role as true money. President Roosevelt seized it from the public, but the Depression continued long after that event.

Why the government protects gold to such an extent is a mystery to me. Gold has always been a highly valued commodity, even now when it’s not used as a general medium of exchange. So it would make sense for the government to safe-keep it. But that only pushes the question back further. Why is it such a highly valued commodity?

Not every government has kept it. Gordon Brown, Britain’s Chancellor of the Exchequer, sold roughly half of the UK’s gold reserves between 1999-2002.

“We should be free to decide what to use for money,” I told him. “I would prefer something the supply of which can’t be increased easily, such as gold. And banking should be subject to the laws of the market, instead of granted privileges protecting it from the market.”

He asked me to tell him again the name of the economist who predicted the Crash. I was pleased to do so.

Written by George Smith for 24h Gold ~ January 18, 2017