The following is mixed from two different columns, one from renowned economic commentator, Peter Schiff, and the other from the editor of the Kettle Moraine family of publications, including Morgana Precious Metals.

Numismatics Are Fool’s Gold

Numismatics Are Fool’s Gold

Last month, I addressed the hype around gold confiscation, and debunked the myth that collectible or numismatic coins would offer effective protection. But there is another sales pitch that many dealers will use while trying to “up sell” you to numismatics. They may argue that on investment merits alone, numismatics are a better bet. While this may be a more rational line of thinking than the typical confiscation con, it is bad advice for investors hoping to protect their assets in an economic slump.

Think Like A Pro, Not A Schmo

I have long urged investors to keep 5-10% of their portfolios in physical precious metals, and add even more exposure when appropriate through (mining stocks). This advice, far outside of the Wall Street mainstream, stems from my view of the kind of crisis we are approaching.

Countless big names are all protecting themselves from a global monetary breakdown by buying gold.

But are they doing it with numismatics? Among the big players, the answer is universally, “NO!”

Numismatics Are Like Stamps, Not Stocks

The reason a numismatic coin can sell for double, triple, or even many multiples of the value of the metal it contains is that a collector values the rarity and/or beauty of the coin. As an investment, it is on par with a stamp or a baseball card. Some people do make money flipping these items, but it is usually an experienced broker who can buy at a steep discount and sell at a large markup – either to a collector who takes pleasure in owning the item but does not expect to profit from it, or to a naive investor who thinks he can make money selling it on to a collector (or a greater fool).

If you are buying numismatic coins, chances are you’re making a fast-talking salesman very rich at your expense…

Lies, Damned Lies, and Statistics

This salesman might have a chart showing the performance of “rare/collectible/numismatic coins” against “regular/bullion coins.” Of course, the chart shows the numismatics performing much better. But these graphs inevitably track particular rare coins, which are cherry-picked with the benefit of hindsight. For every one rare coin that outperforms, there could be ten that severely under-perform. Only afterward would you know which coin you should have bought.

In addition, these comparisons typically measure times of relative affluence, when coin collectors are flush. The chart is likely to reverse during a recession, not to mention the inflationary depression we are likely to experience. When times are tough, coin collectors are just as broke as everyone else.

Finally, the comparisons often omit the dealer’s high markups and markdowns that would more than wipe out the alleged profits for retail investors. (NOTE: The average mark-up on numismatic, so called ‚’rare’ common-date gold pieces, is 40% above their cost, which unto itself, has little or nothing to do with it’s ‘melt’ or bullion value. ~ Ed

Bullion Gold is Money

Bullion Gold is Money

By contrast, bullion gold is more than an investment. It something you own so you can trade locally for the stuff you need – food, clothes, a roof over your head – even if the other guy isn’t a coin enthusiast. In other words, it is money. One of the characteristics that makes gold money is its uniformity – meaning each coin is the same as every other coin of the same weight. Diamonds, which are not uniform because they vary in clarity, color, etc., are not money. Numismatic coins, which vary in rarity, condition, date of

issue, etc., are also not money.

Bullion gold coins will always have value to your fellow Americans, while paper dollars have less and less. As the dollar declines, the “price” of gold will continue to rise, reflecting the stable purchasing power of the yellow metal. What’s more, in a volatile environment, bullion gold will carry a premium for being reliable and widely accepted money – just as the US dollar does now.

Saint-Gaudens-Double-Eagle

The Worst Time for Numismatics is Now

If we enter into depression conditions, numismatics may actually drop in value while the gold price rises.

As I mentioned above, numismatic coins depend on the demand of collectors. Collectors are folks with plenty of discretionary income. When inflation is eating away savings and the economy is contracting, who are these mystery millionaires that are going to buy your stash of St. Gaudens Double Eagles?

Chances are any collectors will also be liquidating their collections as they lose their jobs and their investments go south.

Sure, the coins’ gold content will provide a ‘floor’ to their value that stamps and baseball cards don’t have, but the gold value is typically only a fraction of the retail price of a numismatic coin. If you pay twice the bullion value to buy a ‘rare coin’ (which probably isn’t ‘rare’ at all).

NOTE: Although bullion could double in value and you still might not be able to sell your numismatic or ‘rare’ coin for a profit. If you buy a regular bullion coin, the gold price only has to rise the amount of the markup above spot before you profit. ~ Ed.

In short… the idea of numismatic coins as investments should be put to rest, once and for all.

Don’t Buy Fool’s Gold

Don’t Buy Fool’s Gold

Gold is a commodity. Bullion coins are pre-measured units of this commodity, stamped with a design as a quick signal of authenticity. Gold is also history’s most reliable form of money, which makes it a good commodity to own when the world’s paper money system is in upheaval. But just like buying an Armani suit is not an investment in wool, numismatics are not an investment in gold. The only people who should be buying numismatics are those who appreciate the coins for their aesthetic value and take pleasure in owning them, not those hoping to preserve their wealth.

Gold still has a long bull market ahead of it. It’s not too late for Americans to dump their dollar for a real store of value (or convert their current position in over-priced ‘numismatic’ gold-coins, into bullion products. ~ Ed). The key is to find a trustworthy dealer with fair markups – and avoid dealers with teaser prices on the bullion coins you want and aggressive pitches for numismatics you should avoid.

For further insight into this topic, please read the following, Beware: The Ide(ea)s of “Rare Coin” Dealers

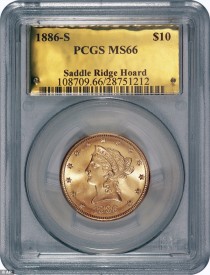

If you are currently holding a supply of certified (PCGS or NGC type) graded US $20, $10, $5, or other ‘rare’ coins, it might be of benefit to have us do complete a no obligation ‘cost vs. benefit’ analysis of your collection, to determine if you would benefit at this time to a conversion to bullion type coins. We recently performed such a service for one of our clients, and increased his holdings by over eight ounces net of gold. It was like handing him over $11,000 – and he has already seen the benefit – at a time when the generic, common date “rarities” have continued to decline in value – all while gold has been going up.

If you are currently holding a supply of certified (PCGS or NGC type) graded US $20, $10, $5, or other ‘rare’ coins, it might be of benefit to have us do complete a no obligation ‘cost vs. benefit’ analysis of your collection, to determine if you would benefit at this time to a conversion to bullion type coins. We recently performed such a service for one of our clients, and increased his holdings by over eight ounces net of gold. It was like handing him over $11,000 – and he has already seen the benefit – at a time when the generic, common date “rarities” have continued to decline in value – all while gold has been going up.

In the fore-referenced, Beware: The Ide(ea)s of “Rare Coin” Dealers, there is another story of one of our clients who also benefited greatly by doing a similar conversion. At the time he did his exchange – gold was trading in the $500.00 per ounce range. He has done extremely well with his transaction.

Don’t you owe it to yourself to look into the facts of your collection, and see how much stronger YOUR position might be?

Call me now at 602-799-8214. We expect a strong response to this sensible offer, so leave a message, and I’ll get back to you. Or, send me an email at:

[Got physical… close at hand?]

Let’s do something about that…

Protecting Your Wealth is heard at 3:00 p.m. (Eastern Time), each Tuesday and Thursday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Protecting Your Wealth is heard at 3:00 p.m. (Eastern Time), each Tuesday and Thursday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

1 – 623 – 327 – 1778

gold@kettlemorainepreciousmetals.com