Many American voters have come around to the idea that the loans are an unsustainable burden

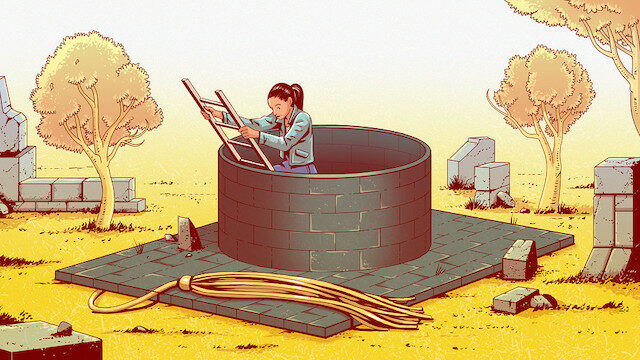

Illustration by Glenn Harvey

Student-debt cancellation, once viewed as a niche political issue, has now, with loans topping a staggering $1.5 trillion, made it onto the platforms of major presidential candidates.

Since at least the Great Recession a decade ago, borrowers, activists and others have been building a case that erasing debt acquired during students college years is a matter of economic justice. More recently, researchers have found that canceling some or all of the nation’s outstanding student debt has the potential to boost gross domestic product, narrow the widening racial wealth gap and liberate millions of Americans from a financial albatross that previous generations never had to contend with.

Sens. Elizabeth Warren and Bernie Sanders, both vying for the Democratic nomination for president, are proposing to wipe away some or all of the country’s burdensome debt as a key part of their campaigns. They plan to pay for it — and accompanying proposals to make public college tuition-free — by raising taxes on the wealthy. Warren estimates her plan would cost $1.25 trillion over 10 years, and Sanders says his would cost $2.2 trillion.

Critics question whether those proposals would fix the underlying problems in the way Americans pay for college, and also whether student-debt cancellation would entail a giveaway to well-off families. But the idea of mass student-debt cancellation is resonating with voters, and this is the closest it has gotten to becoming reality.

‘Weight off my shoulders’

To see how the idea of student-debt cancellation made it to the mainstream, it’s useful to understand the experience of borrowers such as Nathan Hornes. Hornes, 29, had his federal student debt discharged after years of activism. In 2015, he was part of a group of 15 former students of for-profit chain Corinthian Colleges who went on a debt strike and refused to repay their federal student loans, which they argued were fraudulent, as a way to pressure the government to discharge them.

Corinthian filed for bankruptcy in 2015 amid allegations that the company had misled students about job placement and graduation rates — tactics Hornes said he experienced firsthand.

‘You can’t talk about student debt without talking about the Great Recession.’ ~ Mark Huelsman, Demos

Along with his fellow students, Hornes also took advantage of a 1990s-era law rarely used until that point, known as borrower defense to repayment, that allows borrowers to have their federal loans canceled in cases where they’ve been defrauded. A combination of pressure from borrowers, activists and lawmakers, including Warren, ultimately pushed the Obama administration to create a clear process for scammed borrowers to seek a loan discharge through the borrower-defense process.

Hornes filed his borrower-defense application in 2015 and learned in 2017 that his debt would be discharged; he struggled to afford basic needs in the meantime. On the day he learned his more than $65,000 in federal student loans would be wiped away, “it was a weight off my shoulders,” Hornes said. “I was extremely excited and proud of the work that we had done up to that point, but I knew that the fight was going to continue.”

The process that the Obama administration created is now facing a potential rollback under Betsy DeVos, President Trump’s secretary of education. In August, the Department of Education announced that in order for borrowers to have their debt discharged under the law, they would need to file claims for relief within three years of leaving school. The department also eliminated an automatic discharge of debt for some students who attended a school when it closed, among other changes.

Still, efforts by legislators, consumer advocates, grassroots groups and others to use the borrower-defense provision and the government’s decision to ultimately discharge hundreds of millions of dollars in student loans “got a lot more policy makers comfortable with the idea that people’s debt ought to be wiped away in certain situations,” said Julie Margetta Morgan, a fellow at the Roosevelt Institute, a progressive economics think tank.

Before that, Margetta Morgan said, even left-leaning policy makers were squeamish about the idea of borrowers, including those filing for bankruptcy, having their debt discharged. Now, just four years later, the idea has “evolved pretty quickly,” she said, as presidential candidates are proposing to cancel student debt en masse.

Occupy Wall Street

The origins of the idea of student-debt cancellation date to at least Occupy Wall Street. As protesters gathered in New York’s Zuccotti Park in 2011 to rail against the financial industry’s central role in the near-destruction of the economy, student debt came to the fore, said Ann Larson, co-founder of the Debt Collective, a debtor-membership organization.

At the beginning of 2008, before the fall of Lehman Brothers, the nation’s outstanding student debt stood at about $580 billion — now it’s more than double that — about $1.5 trillion.

Occupy Wall Street was “the first time I remember a serious discussion of not only the scope of the problem” of student debt “but any discussion of possible solutions,” Larson said.

Those conversations were the genesis of a group called the Occupy Student Debt Campaign, which asked borrowers to sign a pledge to participate in a mass debt strike once 1 million fellow borrowers had done the same. The idea was that if enough borrowers refused to pay their loans, the government would feel pressure to cancel them. In addition, the group demanded the government make public college free.

A couple of years later, the group took the issue into its own hands. Having created an organization called Rolling Jubilee, it began, with the help of donations, to buy up medical students’ debt and private probation debt of borrowers who had attended for-profit colleges. “We wanted to be able to demonstrate that debt can be canceled,” Larson said.

In 2014 they started to work with former for-profit college students, like Hornes, and agitated for top Obama administration officials at the Department of Education and Consumer Financial Protection Bureau to give them an audience. (Warren proposed and established the CFPB.) Eventually, in 2015, the group found itself face-to-face with those officials.

“That was an important moment where they had to sit across the table from people suffering,” Larson said of the group’s first meeting with officials at the Department of Education, the CFPB and the Treasury Department. “That really was a breakthrough. They knew they had to do something — they couldn’t ignore it.”

The Great Recession’s role

At the same time, other factors were putting student debt at top of mind for more politicians and voters. The financial challenges that prompted Occupy Wall Street were making the economics of higher education untenable for many families.

At the beginning of 2008, before the fall of Lehman Brothers, the country’s outstanding student debt stood at about $580 billion, according to data from the Federal Reserve Bank of New York. Now it’s considerably more than double that — about $1.5 trillion.

“You can’t talk about student debt without talking about the Great Recession,” said Mark Huelsman, associate director of policy and research at Demos, a left-leaning think tank.

Wage stagnation meant families had less money to draw upon to pay for college, while recent graduates struggled to pay their debts. At the same time, states pulled back from funding their public universities, pushing up tuition costs. In addition, more people looked to attend or return to school to become more employable.

“All of these things led to student debt ballooning,” Huelsman said. “For the people who already had student debt, it became more of a crisis than it would have otherwise if we hadn’t gone through the Great Recession.”

The Americans who suffered most acutely from this dynamic are those who came of age politically over the past several years, Huelsman noted, and it only makes sense that they’d push the issue of student debt front and center.

Well-connected backers

At the same time that growing numbers of Americans were contending with mounting student debt, the idea of canceling it received a boost from a pair of well-connected supporters, Steven and Mary Swig. The husband-and-wife team, descendants of Benjamin Swig, a real-estate developer, are part of a prominent San Francisco family known for philanthropy and activism.

The couple first became concerned about student debt about six years ago, when their daughter told them she wanted to use money received through a trust from her grandfather to help a friend with student loans totaling more than $100,000. For the Swig parents, students in the public university system in California in the 1960s when tuition was free, the consequences of America’s college-finance system suddenly became clear.

So in 2014, when the two received a fellowship at Harvard’s Advanced Leadership Institute, they decided to use that time to crystallize their views on student-debt cancellation and formulate strategies for how the government could achieve it.

“Our project was to have all student debt canceled — we had never heard of it before,” said Mary Swig. “The emphasis is on all student debt,” her husband, Steven, added. “It’s a moral issue; it’s wrong to burden the future with student debt, and if you only snip at the edges you’re not addressing the moral issue — that the whole thing is just wrong.”

After they finished the fellowship, the Swigs committed to moving the idea forward. They launched an organization called Freedom to Prosper, which works with groups in 38 states to drive momentum for student-debt cancellation on the ground. They also started to push the concept in more rarefied circles through panels at esteemed venues, including Harvard, retreats with prominent thinkers, and conversations with legislators and White House officials.

The couple realized that for the idea of student-debt cancellation to be taken seriously, they’d need to demonstrate it could work and benefit the country. So they commissioned a study.

Scope of the problem

The research backed by the Swigs was the first in a series of papers from influential organizations that politicians look to when developing policy that illuminated the scope of the student-loan problem and the potential impact of large-scale solutions to it.

Published in February 2018 by the Levy Economics Institute of Bard College, the study found that canceling the total outstanding student debt at the time — about $1.4 trillion — would boost gross domestic product by up to $108 billion a year on average for the 10 years following the debt cancellation. U.S. GDP, the value of all goods and services produced, totaled $20.5 trillion in 2018.

“I don’t think that the authors of the report anticipated just how much of an initial splash it would make,” said Stephanie Kelton, a professor of economics and public policy at Stony Brook University, one of the authors of the study and a senior economic adviser to Sanders’s 2020 campaign. “I got a call from ‘Good Morning America.’ I did not anticipate that.”

Kelton said she suspects the report generated headlines for a number of reasons, including that the price tag for canceling student debt looked about the same as that of the Republican tax overhaul of late 2017, which has been criticized for benefiting mostly the wealthy and corporations.

In addition, the “ambitiousness” of the concept likely also captured Americans’ imaginations, Kelton said.

Other research, including an October 2018 paper published by the Roosevelt Institute and authored by the institute’s Margetta Morgan and Marshall Steinbaum, illuminated the ways in which borrowers who are technically current on their student loans may actually be struggling under the weight of them. And that’s more likely to be the case for minority students. Black students, in particular, are more likely to borrow for college and struggle more to pay off debt than their white peers.

“People kind of assumed that if you were someone with debt and a degree you were fine,” Huelsman said. “We now know that’s not really true if you ask the question about race in the data.”

That dynamic helped to propel the idea of student-debt cancellation into presidential politics, Huelsman said, where many of the Democratic candidates are keenly concerned with offering policy proposals that address racial inequality. Both Sanders and Warren have pitched their student-debt-cancellation plans as a way to help close the racial wealth gap. Research indicates mass student-debt cancellation would at least make a dent in that problem.

Uphill battle

Despite the momentum, student-debt cancellation faces an uphill battle. For one, for the policy to become law, it would take a Democratic president in the White House and likely a Democratic-controlled Congress.

What’s more, critics have derided the idea as a giveaway to a relatively well-off group. The borrowers with the largest student-debt loads tend to be those with graduate degrees. It’s that demographic that would see the biggest benefit — at least as measured in total dollars.

Warren’s plan aims to address some of that criticism by creating both an income and debt cap on forgiveness. Nonetheless, shortly after she released her proposals, two experts argued that the bulk of the benefits from her plan, at least as measured by dollars, would accrue to people in the second highest income quintile.

“If we’re going to spend several hundred billion dollars giving transfers from taxpayers to other Americans, are well-educated and relatively affluent Americans the ones that we should be spending the money on?” said Adam Looney, the Joseph A. Pechman senior fellow at the Brookings Institution and the author of one of those analyses.

“You’re asking people who haven’t gone to college, or have gone to college and repaid their loans, or have saved and gone to college, to repay the loans of people who did go to college,” he said. “That is hard to get around.”

Programs already exist to ensure student debt is manageable, Looney said, including income-driven repayment, which allows borrowers to repay their loans as a percentage of their income for 20 or 25 years and then have the remainder of the debt forgiven (under current law, that forgiveness is taxed).

“We ask affluent graduates to repay a modest amount of their annual income toward student debt,” he said. “I don’t know that there’s that much to gain from eliminating that system.”

What’s more, he said, there’s still the problem of underlying issues in the U.S. higher-education finance system.

According to research from Looney and others, it’s the behavior of bad actors, in many cases for-profit colleges, that have “caused a lot of distress in the student-loan market,” he said. More aggressive oversight of those schools would go a long way in addressing the challenges facing the student-loan program, Looney said.

What’s more, even if the student-debt clock were set back to zero, there would be little to prevent outstanding student debt from picking up again, Looney said.

Sanders and Warren are pairing their debt-cancellation proposals with plans to make public college tuition-free. But that still leaves large categories of borrowers — including those who attended private undergraduate colleges and public or private graduate schools — who would have their debt canceled but whose programs would charge tuition in the future, Looney said. In addition, for many borrowers, a large share of debt comes from living expenses, Looney noted, which wouldn’t be totally eliminated by tuition-free-college plans (though Warren and Sanders do propose taking steps to help low-income students attend college debt-free).

“That is a hidden and important and expensive element of these plans that is not discussed,” he said.

Public college reforms

Supporters of student-debt cancellation note that borrowers who are more likely to have paid off their student debt, or who didn’t have it in the first place, likely have advantages — such as the intergenerational wealth more common among white households — generally not available to those struggling the most under the weight of student loans.

In addition, they say, part of the reason our nation’s student-loan burden has become so unmanageable is that families don’t have a true public option for college — a situation Warren, Sanders and other Democratic candidates for president are hoping to address.

But more broadly, they argue, mass student-debt cancellation would help correct a policy failure that’s holding back individuals and the economy.

“Even with the policy tools at our disposal and even with an economy that has chugged along, you still have a high [number] of people who can’t make payments on their loans,” Huelsman said. “The political environment in which big ideas are really up for grabs in the way that they weren’t a few years ago lends itself to this conversation. People who are suffering do not have to suffer under the system — our hands are not actually tied on this.”

Written by Jillian Berman for Market Watch ~ September 18, 2019