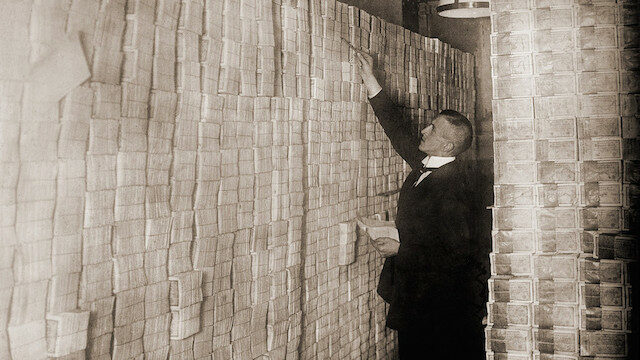

Cash. Lots and lots of cash, money, filthy-lucre, green, dinero…

Last week, Lim Chow Kiat, who runs some $440 billion for Singapore’s sovereign wealth fund, laid out his case for keeping powder dry. Before that, Chicago billionaire Sam Zell said his firm has never been this cash-heavy. Meanwhile, hedge-fund titan Paul Singer has been busy raising a big chunk of change.

So, yes, market heavyweights are taking a risk-off stance by wading deeper into the relative safety of cash. They’re not alone either, according to Avalon Investment’s Bill Stone, who talked with CNBC about all the cash on the sidelines.

“We’re at about $3.4 trillion in money market assets,” he explained. “Put in that perspective, we got up to $3.9 trillion during the worst of the financial crisis, then it fell to about $2.6 trillion, so obviously it’s been moving up.”

Money-market growth in recent years has been prompted by top-heavy stocks and, until last year, rising rates that made for decent yields in U.S. Treasurys. The Fed, however, has struck a dovish chord lately and bond yields are hovering near lows, which may lure investors back into equities again.

“With all that dry powder out there, the catalyst is that yield is going to start to fall away. We’ve already seen yield on short term, fixed income fall,” he said. “People will be looking for yield and looking for a return somewhere. And I think that’s the place where if they’re less concerned about a recession and the global slowdown, that could be a spot where you get money going into stocks.”

CNBC points out that more than half of the yields on the S&P 500 are more than the 10-year Treasury note .

Stone added that the likelihood of a recession is low, considering the strength of the consumer. “It’s the reason why the U.S. economy continues to hold together, he said. “And we don’t see a reason why that’s going to fall apart really soon.”

Written by Shawn Langlois and published by Market Watch ~ September 24, 2019