I’m no economist, but I’m not stupid either. I have two eyes, and I have a brain and I use them both; and they tell me that something is going on right now in regards to our economy; particularly the dramatic drops in the closing numbers of the NYSE, or New York Stock Exchange.

I’m no economist, but I’m not stupid either. I have two eyes, and I have a brain and I use them both; and they tell me that something is going on right now in regards to our economy; particularly the dramatic drops in the closing numbers of the NYSE, or New York Stock Exchange.

The following are just my observations and thoughts on the current state of affairs in America. Take them for what they are, my opinions. However, disregard them at your own peril; for they may prove to be true.

I don’t know if you’ve been paying attention, but the Dow Jones has been taking multiple, large scale hits; with the numbers plummeting. At the opening bell of trading today the DOW immediately took a hit of over 7%, triggering a Level 1 Circuit Breaker to trip; causing a 15 minute shutdown for the panic to subside…

There are three levels of Circuit Breakers on Wall Street, a Level 1 which causes a 15 minute shutdown; a Level 2, which occurs at a 13% drop and causes another 15 minute shutdown, and a Level 3, which happens after a 20% drop in market value; and this causes trading to be suspended for the remainder of the day; such as what happened on Black Monday in 1987.

I don’t play the stock market, it is too volatile for me; the only money I have in it is what is held by the trustees of my pension plan; which means that if the DOW continues to plummet, I won’t get any retirement when my body finally gives out and I’m no longer able to work.

The NYSE, or Dow Jones Industrial Average, is used as sort of a barometer to measure the health of our economy; if the numbers are up, the economy is good; and vice versa. I’ve never really understood the complexities of the stock market, and still don’t, but over the past week or so I’ve been doing a bit of research to try and get a workingman’s understanding of how it functions.

Basically what a stock is, is a slice of ownership of a company that it sells to investors looking to profit from owning a slice of the pie that is the company’s overall wealth/health. For instance, if a company decides to sell 10,000 shares of stock in their company, and you purchase 1,000 of them, you own 10% of that company. It’s a little bit more complicated than that; but that’s the basics of it.

If the company/s that you own stocks in are doing good; profits are up and they are hiring new workers to meet demands, you see the value of your stock increase as more and more people want to share in the wealth. In that regard it is simple supply and demand economics; as there are only so many stocks available per company, if everyone wants to own stock in that company, the value of the stock goes up. However, if the company begins trending downward, people start selling off their stocks and their value begins to plummet.

Many things can trigger a selloff of stocks; fears over world events or a company’s performance being but two of them. For instance, if Chevy announces that they are losing sales to Ford and Toyota, and that they will begin laying off workers and shutting down plants, that would cause people to begin selling off their stock in the company; causing stock value to drop dramatically.

However, that is an isolated instance of stock prices going down; based upon the individual performance of a company. World events, however, often trigger a market wide sell off as people begin dumping their stocks to have access to cash over fears of what might happen next. For instance, when Donald Trump was elected the market took a pretty big hit when investors began fearing what would happen once Trump took office. Then, of course, there is this Coronavirus and the news media’s campaign of fear that we are being told is behind the current downtrend in the stock market.

I don’t buy that as being the cause for what’s happening on Wall Street; not for an instance. Sure, people may be selling off a few stocks, but with the drastic hits that the stock market has been taking day after day, I think there is something else going on; it’s just what exactly that is that I’m not sure of.

As I said, I’m no economics whiz, but from what I understand there could be one of three things happening. First, we could be witnessing a correction in the stock market. When Black Monday hit in 1987 the Dow Jones Industrial Average was around 2,400, and with a drop of 22.6%, or 508 points, it triggered a shutdown of trading on Wall Street for the panic to subside. Now, even with all the hits it’s taken, the DOW sits at 21,000; nearly ten times what it was in 1987.

I think that growth was artificially created to cause a feeding frenzy of investors looking to cash in on all that economic growth. Eventually the trend had to end; but when and how high would it go before that happened is the question. I thought it was absolutely insane when the DOW hit 8,000; I truly did; even though I didn’t know much about the stock market when that happened. When it hit 10,000 I thought, “This is fucking crazy; something is going on here.” Now it’s at over 21,000; someone has to be playing games; pulling the strings.

Now think about that, and let’s do a little math. In 1987 when the DOW dropped 22%, the drop in the actual numbers was only 508 points when the DOW was at around 2400. Up until recently the DOW was sitting as high as 25,000, so a 20% drop would be 5,000 points. So, while the numbers may seem dramatic, percentage wise they are not as severe as what we witnessed in 1987; and may merely be the stock market seeking to restore a level of sanity to the record high numbers it has been seeing; in other words, a correction.

That’s one possibility. The next is it could be the beginning of an eventual market crash; which would affect all of us regardless of whether people pay attention to the stock market, or current affairs. You see, besides being a means for people to buy and sell shared in a company, and make money doing so, stocks are a means for companies to raise money. So, if people stop buying, and start selling off their stocks, that company loses a portion of its revenue stream and it has to curtail production, lay off workers, or even worse, shut down altogether.

The stock market crash of 1929 played a large role in kicking off the Great Depression; and it’s possible, not certain, but still possible that we may be witnessing the beginning of another depression of epic proportions. Although people may not pay any attention to the stock market, it affects almost anyone who has some sort of retirement plan in place. If you have a pension plan where you work there is a good chance that, unless your portfolio is based upon precious metals, you have a vested interest in the health of the stock market. If you pay into a 401k or an IRA account, you have a vested interest in the health of the stock market; for if the market crashes; your retirement money disappears. Well, that’s not exactly true, and I’ll get to that in a minute.

Finally, we could be witnessing a market manipulation. A market manipulation is when major banks or shareholders initiate a change in the market by either buying massive quantities of stocks, or selling them off, to cause a change either up or down in the market. This is usually done to benefit them; at the cost of the wealth of those who invest in the market as a means to generate wealth, or provide a nest egg for their retirement.

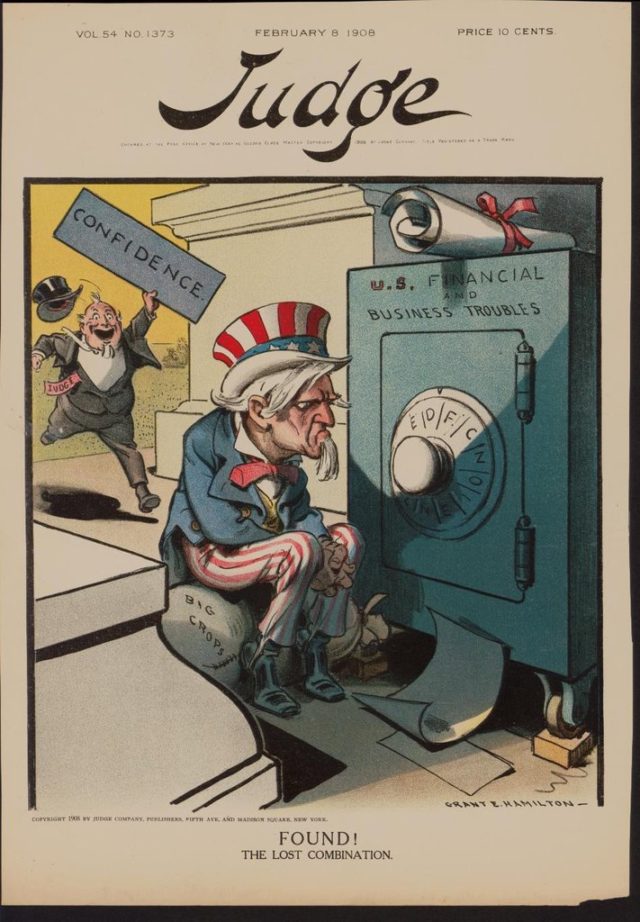

Now this might seem like conspiracy theory, but I’ve read a lot about how the FED, (The Federal Reserve) was created. A lot of what I’ve read states that the bankers who wrote the Federal Reserve Act, which was later passed by Congress, initiated a panic in the market by secretly selling off holdings in certain stocks; causing a market wide panic. Then these same bankers, JP Morgan to be exact, come to the rescue by infusing large amounts of cash into the market to stabilize it. This was supposedly done so that they could generate support for a central banking entity, (The FED), who could effectively manage our money supply by raising and lowering interest rates to minimize market fluctuations. Well gee, the FED was established in 1913 and the Great Depression began in 1929; so they sure got off to a good start, didn’t they?

I don’t think people realize what money is; they equate having lots of it to wealth. Money is not wealth, it is a tool by which people can engage in commerce; buying and selling goods or services. Wealth, true wealth, comes from the possession of real estate, or real property. If I owned, lock, stock and barrel, the entire State of California, but didn’t have a penny to my name, I’d be one of the richest men in the United States; if not THE richest.

I don’t know if you’ve heard of Josiah Stamp but he was head of the Bank of England for awhile years and years ago. Well Stamp once said, “Banking was conceived in iniquity and was born in sin. Then bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again.”

That stuff you carry around in your wallet or purse, unless all you use is a debit card, isn’t money; that’s just paper and clothe that you accept as being a form of currency. The only thing that gives that currency any value is your faith that you can use it to buy goods or services with it. Hell, I could open a game of Monopoly and tell you that the paper in it is ‘real’ money; and as long as people accept that it is, it holds as much value as that shit that you carry around in your wallet or purse.

Where did that ‘money’ come from; for it has to have some place of origin; it didn’t grow on a tree. It came into existence because someone, somewhere, printed it out on a printing press. The amount of money circulating in an economy determines the value of that money; not the number printed on its face, or whose image adorns it.

Regardless of what kind of legal tender laws, or fixed exchange rates exist between paper money and gold and silver, the real value of paper money is determined by the amount of it circulating in an economy; the less of it there is, the more it is worth, and the more of it there is, the less it is worth. That is what’s known as deflation and inflation; and it affects each and every one of us regardless of how little attention we pay to it.

Living in California I’ve heard a lot of people complain about not being able to earn a living wage; hence the push for the California Legislature to raise the minimum wage to $15 per hour. Did you know that, since the inception of the FED, the dollar has lost 96% of its value due to inflation? Did you know that, due to inflation, in comparison to the value of a dollar in 1913, it would take 26 of them to equal its value; meaning that if you earn $15 per hour, you would have been making $390 per hour in 1913.

That’s what inflation does, it makes your money worth less; taking more and more of those little pieces of paper to buy the same goods and services it used to take one or two of them to buy; which is why people are finding it increasingly difficult to get by in life. People go to the store and see that the cost for a tube of toothpaste or a gallon of milk has gone up by a couple of dollars. They see a prince increase, but that’s not really what’s happening. What is happening is the price is staying relatively the same; it’s just that it takes more of that worthless currency in your wallet to exchange for that commodity. That’s inflation; and it is killing us.

What’s causing this inflation? Well, for one thing, Uncle Sam is causing it. Have you noticed what our national debt is lately? Right now it sits at over $23 trillion. What that means is, above and beyond the money Uncle Sam steals from you through the income tax, it has also borrowed $23 trillion to keep paying for all the things it does.

It’s a complex process by which money is created in America, and a lot of our national debt is held by foreign investors. The bare bones of it though is that the money Uncle Sam borrows ends up circulating in our economy; causing inflation. Uncle Sam borrows money to pay the wages of all those working for him; it borrows money to pay our soldiers and for the weapons they use in this endless war on terror; it borrows money so that it can fund all these programs which people take advantage of. For whatever reason Uncle Sam borrows that money, it ultimately ends up in circulation in our economy; in your wallet or mine – causing inflation.

Do you know what a promissory note is? A promissory note is a document that states that the person holding it is entitled to a stated sum upon presenting that note to the person who handed it out. Our money used to be promissory notes; meaning that the bearer of them could go into any Federal Reserve bank and exchange them for their face value in gold or silver – real money.

America used to be on something known as the Gold Standard; which means that for every dollar in circulation there had to be $1 worth of gold backing it up. When the Federal Reserve was created in 1913 it gave the government the means to borrow money, but government was hamstringed by the fact that for every dollar in circulation there had to be a dollar’s worth of gold backing it up; limiting how much government could borrow. Well in the 70’s Richard Nixon took America off the gold standard; opening the floodgates, with the only limit as to how much they could borrow is what the people would allow them, or their own wild imaginations.

All this so-called wealth floating around; be it your home, your car, or the number of stocks you hold, it is all based upon the dollar; dollars purchased those things you call wealth, and dollars are nothing but debt currency; they were created out of thin air, on the promise that they will be repaid at a later date; with interest.

It’s a huge bubble that is going to keep expanding until it bursts. Think about it like this: the government borrows money from a bank to fund something it wants to do. The bank says sure, but you gotta pay it back, with interest. So the government now has to pay back the bank, so it borrows MORE money to make its payments on the initial loan. It keeps repeating this cycle; increasing the supply of money in circulation; until the system collapses and that paper you carry around becomes as worthless as that paper in your bathroom you use to wipe your ass with.

The thing about it is, wealth, true wealth, never vanishes; it merely changes hands. If you have a house, multiple cars, and lots of goodies for toys, and then you suddenly lose your job; do all those things you once owned disappear, or does someone else, (the banks most likely) take possession of them? You see, that wealth never goes away; someone else just takes possession of it.

Therefore, if everything you own was bought with paper money, (money created through debt), than those goods become collateral for that debt. Eventually, if the economic system collapses, all the goods, services, and even your labor becomes the property of those who loaned that money out; making you a serf or a slave working for your banking masters.

Now when I say banks I’m not talking about the bank you go into to cash your paycheck or make a withdrawal; I’m talking about the big banking houses like Chase, Citigroup, Bank of America and Wells Fargo; as well as their European counterparts. These major banks are stockholders in almost every Fortune 500 company in the world; and if the dollar collapses and our economy crashes, they will effectively take possession of those companies.

But who owns these banks; after all, they didn’t just spring up out of the ground like a weed, did they? Finding that out is next to impossible; for those who own them like to keep their identities out of the public spotlight. People like to think Michael Bloomberg, Warren Buffet, or Bill Gates are the richest men on the planet. Not by a long shot; they are only the ones whose wealth is known publicly; there are far richer men, and families, than them.

Above all else The Federal Reserve is a bank; a privately owned bank at that. It has no connection to Uncle Sam other than it was granted its charter by the Federal Reserve Act, and its director is chosen from among a list given to the president by the FED. But first and foremost it is a bank; and the goal of banks is to make money for their owners by loaning out money and collecting interest.

So who owns the FED, and all the other central banks scattered across the globe? Well it is said that just 8 families comprise 80% of the ownership of the FED; those families being, the Goldman Sachs, the Rockefellers, the Lehman and Kuhn Loeb’s; all from New York. Then there are the Rothschilds of Paris, the Warburg’s of Hamburg, the Lazard’s of Paris and the Israel Moses Seif’s of Rome.

Those are the bankers; you know, the ones Josiah Stamp said own the world. Our government borrows its money from them, and in turn we, our property and our labor become collateral upon that debt. This entire system of economics in America today is based upon fraud and the plundering of wealth of the people by the few, the powerful, the already insanely rich of the world – the big banking houses and the families that own them. When it all collapses, and it will, everything will belong to them; as they are the holders of the debt; and it doesn’t matter if you’ve worked all your life to buy that nice home and fancy car; it will all be theirs; and their puppets, (the government), will obey their orders if they demand that you be relocated from your homes and moved to a labor camp somewhere.

So, is what’s happening in the stock market now a correction, the beginning of the collapse of the system, or is it something else altogether; designed to cause fear and panic, and open the people up for a global currency so the game can start all over again under a global dollar…or whatever they decide to call it? Who knows; I certainly don’t.

The only think I do know for certain is, if the people truly understood the depth and scope of their betrayal by those they had elected, the two most valuable commodities on the planet would be either rope or bullets; for the people would either lynch or shoot those son’s of bitches for what they’ve done.

Oh, and there’s one other thing I am almost positively certain of; whatever is happening with Wall Street isn’t due to the Coronavirus; that’s just the patsy the news media is telling you is to blame for the recent craziness with the Dow Jones numbers.

The sad thing is, the Coronavirus was probably engineered in a laboratory somewhere; designed to be contagious, but not a world ender like Ebola or some of the other nasty diseases that Mother Nature has come up with. I think it was released for one of two reasons; either to see how people reacted, or to instigate panic and take people’s minds off something else that is going on, or is about to happen.

Honestly, people need to just calm down about this stupid virus; you have a better chance of being hit and killed by a drunk driver than you do of catching and dying from the Coronavirus. So calm down people, it’s not the Black Death; it’s just a really nasty cold. Believe me, I’ve probably had hangovers that were worse than the Coronavirus; so just calm down; the world’s not going to end…trust me.

March 12, 2020

~ The Author ~

Neal Ross, Student of history, politics, patriot and staunch supporter of the 2nd Amendment. Send all comments to: [email protected].

If you liked Neal’s latest column, maybe you’ll like his latest booklet: The Civil War: (The Truth You Have Not Been Told). Life continues to expand for this prolific writer and guardian of TRUE American history.