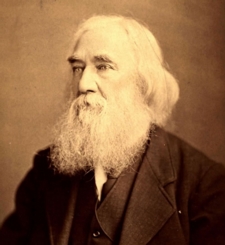

Lysander Spooner

All the usurpation, and tyranny, and extortion, and robbery, and fraud, that are involved in the monopoly of money are practised, and attempted to be justified, under the pretence of maintaining the standard of value. This pretence is intrinsically a false one throughout. And the whole motive for it is to afford some color of justification for such a monopoly of money as will enable the few holders of gold and silver coins (or of such other money as may be specially licensed and substituted for them) to extort, in exchange for them, more of other men s property than the coins (or their substitutes) are naturally and truly worth. That such is the fact, it is the purpose of this article to prove.

In order to be standards by which to measure the values of other things, it is plain that these coins must have a fixed and definite – or, at least, something like a fixed and definite – value of their own; just as a yard-stick, in order to be a standard by which to measure the length of other things, must necessarily have a fixed and definite length of its own; and just as a pound weight, in order to be a standard by which to measure the weight of other things, must necessarily have a fixed and definite weight of its own. It is only because a yard-stick has a fixed and definite length of its own that we are enabled to measure the length of other things by it. It is only because a pound weight has a fixed and definite weight of its own that we are enabled to measure weight of other things by it. For a like reason, unless gold and silver coins have fixed and definite – or, at least, something like fixed and definite – values of their own, they can serve no purpose as standards by which to measure the values of other things.

The first question, then, to be settled is this, – namely, what is that fixed or definite value (or something like a fixed or definite value) which gold and silver coins have, and which enables them to be used as standards for measuring the values of other things?

The answer is that the true and natural market value of gold and silver coins is that value, and only that value, which they have for use or consumption as metals, – that is, for plate, watches, jewelry, gilding, dentistry, and other ornamental and useful purposes. This is the value at which they now stand in the markets of the world, as is proved by the fact that doubtless not more than one-tenth, and very likely not more than one-twentieth, of all the gold and silver in the world (out of the mines) is in circulation as money. All the rest is in plate, watches, jewelry, and the like; except that in some parts of the world, where property in general is unsafe, large amounts of gold and silver are hoarded and concealed to prevent their being taken by rapacious governments, or public enemies, or private robbers. Leaving these hoards out of account, doubtless nine-tenths, and very likely nineteen-twentieths, of all the gold and silver of the world are in other forms than coin.

And as fast as new gold and silver are taken out of the mines, they are first carried to the mints, and made into coins; then they are carried all over the world by the operations of commerce, and given in exchange for other commodities. Then the goldsmiths and silversmiths, in every part of the world (unless among savages), are constantly taking these coins and converting them into such articles of plate, jewelry, and the like as they have call for. In this way the annual crops of gold and silver that are taken from the mines are worked up into articles for use as regularly as the annual crops of breadstuffs are consumed as food, or as the annual crops of iron, and cotton, and silk, and wool, and leather are worked up into articles for use.

And when the coins have thus been wrought into articles for use, they for ever remain so, unless these articles become unfashionable, or for some other reason undesirable. In that case, they are sent again to the mint, and converted again into coin ; then put into circulation again as money; then taken out of circulation again by the goldsmiths and silversmiths, and wrought again into plate, jewelry, and the like, for use. They remain in circulation as money only while they are going from the mint to the goldsmiths and silversmiths. And this route is a very short and quick one. An old coin is rarely seen, unless it has been hoarded.

Unless new gold and silver were being constantly taken from the mines, and old and unfashionable plate and jewelry were be≠ing constantly recoined, these metals would soon disappear altogether as money.

All this proves that they have no true or natural value as money beyond their value for use or consumption as metals. If they were worth more as money than they are for use or consumption as metals, they would, after being once coined, remain for ever in circulation as money, instead of being taken out of circulation and appropriated to these other uses.

In Asia, where these metals have been accumulating from time immemorial, and whither all the gold and silver of Europe and America-except so much as, is caught up and converted into plate, watches, jewelry, etc., – is now going, and has been going for the last two thousand years, very small amounts only are in circulation as money. Instead of using them as money, the people – or so many of them as are able – cover themselves with jewelry, fill their houses with plate, and their palaces and tern-

pies with gold and silver ornaments. Instead of investing their surplus wealth in fine houses, fine clothing, fine furniture, fine carriages, etc., as Europeans and Americans do, it is nearly all invested in gold, silver, and precious stones. In every thing else they are miserably poor. Even the rich are so poor that they cannot afford to indulge, as we do, in such luxuries as costly dwellings, clothing, furniture, and the like, which require frequent repairs, or quickly decay, or wear out with use. Hence their preference for ornaments of gold, silver, and precious stones, which never wear out, and retain their value for ever.

In China, which has at least a fourth, and perhaps a third, of all the population of the globe, gold and silver are not coined at all by the Government. The only coin that is coined by the Government, and that is in circulation as money, is a small coin, of a base metal, worth no more than a fifth, sixth, or seventh of one of our cents. This coin is the common money of the people. And gold and silver are not in circulation at all as money, except some few foreign coins, and some plates, bars, or nuggets of gold and silver that pass by weight, and are generally weighed whenever they pass from one person to another.

In India, among two hundred millions of people, although the few rich have immense amounts of gold and silver plate and ornaments, very little gold and silver is in circulation as money. The mass of the people have either no money at all, – taking their pay for their labor in rice or other articles of food, – or have only certain shells, called cowries, of which it takes from fifty to a hundred to be worth one of our cents.

In still other parts of Asia, gold and silver have little more circulation as money than in China and India. And yet Asia, I re peat, is the great and final market whither all the gold and silver of Europe and America – except what has been caught up and converted into plate, jewelry, and the like – is now going, and has been going for two thousand years, and whence they never return.

In Europe and America, the great increase of gold from the mines of California and Australia within the last thirty years has added only moderately to the amount of gold in circulation as money. But it has added very largely to the use of gold for plate, watches, jewelry, and the like. This greatly increased consumption of gold for ornamental purposes in England and America, and the increased flow of gold to Asia, to be there devoted to the same uses, account for the fact – which to many persons seems unaccountable – that the great amounts of gold taken from the mines have added so little to the amount in circulation as money.

And even though the amounts of gold and silver taken from the mines should hereafter be still greater – no matter how much greater – than they ever have been heretofore, they would all be disposed of in the same way; namely, first be converted into coin and put into circulation as money, and then taken out of circulation and converted into plate, jewelry, and the like. They would exist in the form of money only while they were performing their short and predestined journey from the mint to the goldsmiths and silversmiths.

These facts – let it be emphatically repeated – prove beyond all color of doubt, or possibility of refutation, that the true and natural market value of gold and silver coins is that value, and only that value, which they have for use or consumption as metals. Consequently it is at that value, and only at that value, that they have the least claim to be considered standards by which to measure the value of any thing else. And any body who pretends to write about the value of money from any other basis than this is either an ignoramus or an impostor, – probably the latter.

II. But that gold and silver coins can have no true or natural market value as money beyond their value for use or consumption as metals will still more clearly appear when we consider why it is that they are in demand at all as money; why it is that they have a market value; and why it is that every man will ac≠cept them in exchange for any thing he has to sell.

The solution of these questions is that the original, primal source of all the demand for them as money – the essential and only reason why they have market value, and sell so readily in exchange for other commodities – is simply because they are wanted to be taken out of circulation, and converted into plate, Jewelry, and other articles of use.

They are wanted for these purposes by all the people on the globe. Hence they are carried at once from the countries in which they are first obtained-the mining countries – to all the other countries of the world as articles of commerce, and given in exchange for such other commodities as the holders of them prefer for the gratification of their wants and desires.

If they were not wanted to be taken out of circulation and wrought into articles of use, they would have no market value as money, and could not circulate at all as money. No one would have any motive to buy them, and no one would give any thing of value in exchange for them.

The reason of this is that gold and silver, in the state of coin, cannot be used. Consequently, in the state of coin, they produce nothing to the owner. A man cannot afford to keep them as an investment, because that would be equivalent to losing the use of his capital. He must, therefore, either exchange them for something he can use-something that will be productive and yield an income; or else he must convert them into plate, jewelry, etc., in which form he can use them and get an income from them.

It is, therefore, only when gold and silver coins have been wrought up into plate, watches, jewelry, etc., that they can be said to be invested; because it is only in that form that they can be used, be productive, or yield an income.

The income which they yield as investments- that is, the in≠come which they yield when used in the form of plate, jewelry, etc. – is yielded mostly in the shape of a luxurious pleasure -the pleasure of gratified fancy, vanity, or pride.

This pleasure is the same as that which is derived from the use of ornaments generally; such as feathers, and ribbons, and laces, and precious stones, and many other things that have no value at all as food, clothing, or shelter, yet bring great prices iii the market simply for their uses as ornaments.

The amount of this income we will suppose to he six per cent. per-annum on their whole value. That is to say, a person who is able, and has tastes in that direction, will give six dollars a year for the simple pleasure of using one hundred dollars worth of plate, jewelry, etc.

This six dollars worth of pleasure, then, or six dollars worth of gratified fancy, vanity, or pride, is the annual income from an investment of one hundred dollars in gold and silver plate, jew≠elry, and the like.

This, be it noticed, is the only income that gold and silver are capable of yielding; because plate, jewelry, and the like are the only forms in which they can be used. So long as they remain in coin, they cannot be used, and therefore cannot yield an in≠come.

It is, then, only this six per cent. annual income, this six dollars worth of pleasure, which gold and silver yield as ornaments, – that is, as investments,-that is really the cause of all the demand for them in the market, and consequently of their being bought and sold as money.

By this it is not meant that every man who takes a gold or silver coin as money takes it because he himself wants a piece of gold or silver plate or jewelry; nor because he himself intends or wishes to work it into plate or jewelry, – for such is not the case probably with one man in a thousand, or perhaps one man in ten thousand, of those who take the coin. Each man takes it as money simply because he can sell it again. But he can sell it again solely because some other man wants it, or because some other man will want it, in order to convert it into articles for use. He can sell it solely because the goldsmith, the silversmith, the dentist, the gilder, etc., will sometime come along and buy it, lake it out of circulation, and work it up into some article for consumption, – that is, for use.

This final consumption or use, then, is the main-spring that sets the coins in circulation, and keeps them in circulation, as money.

It is solely the consumption or use of them, in other forms than coin, that creates any demand for them in the market as money.

It is, then, only the value which gold and silver have as productive investments in articles of use, – in plate, watches, jewelry, and the like, – that creates any demand for them, or enables them to circulate as money.

And since this value which the coins have for use or consumption as metals is the only value that enables them to circulate at all as money, it is plain that it necessarily fixes and limits their true and natural value as money. Consequently any body who gives more for them as money than they are worth for use or consumption as metals gives more for them than they are worth for any purpose whatever, – more, in short, than their true and natural market value.

We all can understand that, if wheat were to circulate as [*10] money, it could have no more true or natural market value as money than it had for use or consumption as food; since it would be its value for food alone that would induce anybody to accept it as money. All the wheat that should be in circulation as money would be destined to be taken out of circulation, and con≠sumed as food; and if anybody should give more for it as money than it was worth for food, he, or some subsequent owner, would have to submit to a loss, whenever the wheat should come to be consumed as food.

For these reasons, the wheat as money could be no true or natural equivalent for any commodity that had more true or natural market value for use or consumption than the wheat.

So anybody can understand that, if silk, wool, cotton, and flax were to circulate as money, they could have no more true or natural market value as money than they had for use or consumption for clothing, or other analogous purposes. Their value for these other purposes would alone give them their value as money. Of course, then, their true and natural market value as money would be fixed and limited by their value for these other uses. They could plainly have no greater value as money than they had for clothing and other articles of use. As they would all be destined to be taken out of circulation, and converted into clothing or other articles of use, it is plain that, if anybody should give more for them as money than they were worth for clothing and other articles of use, he, or some subsequent owner, would have to submit to a loss whenever they should come to be converted into clothing, or any other article of use.

The same reasons that would apply to wheat, and silk, and wool, and cotton, and flax, if they were to circulate as money, and that would fix and limit their value as money, apply equally to gold and silver coins, and fix and limit their value as money.

We are brought, therefore, to the same conclusion as before, – namely, that the value which the coins have for use for consumption as metals is their only true and natural value as money. Consequently, this value which they have as metals is the value, and the only value, at which they can be said to be standards by which to measure the value of any thing else.

III. Assuming it now to be established that the true and natural market value of gold and silver coins as money is absolutely fixed and limited by their value for use or consumption as metals, and that their value for use or consumption as metals is the only value at which they can be called standards for measuring the values of other things, we come to another proposition, – namely, that the use or circulation of any possible amount of paper money has no tendency whatever to reduce the coins below their true and natural market value as metals, or, consequently, to diminish their value as standards.

Plainly the paper can have no such power or tendency, because the paper does not come at all in competition with the coins for any of the uses which alone give them their value. We cannot make a watch, a spoon, a necklace, or an ear-ring out of the paper, and, therefore, the paper cannot compete with the coins for those uses. consequently it cannot diminish their market value for those uses, or – what is the same thing – their value as standards.

If the coins were never used at all as money, they would have the same true and natural market value that they have now. Their use or circulation as money adds nothing to their true and natural market value as metals, and their entire disuse as money would take nothing from their true and natural market value as metals. Consequently it would not diminish their value as standards. In other words, it would not reduce the coins below their true and natural value as standards.

Every dollar s worth of other vendible property in the world has precisely the same amount of true and natural market value as has a dollar in coin. And if every dollar s worth of other vendible property was bought and sold as money in competition with the coins, the true and natural market value of the coins would not be lessened thereby. They would still have their true and natural amount of market value, – that is, their value for plate, jewelry, and the like, – the same as though all this other property were not bought and sold in competition with them. The coins and all other property would be bought and sold as money only at their true and natural market values, respectively, for their different uses. One dollar s worth of any one kind of property would have the same amount of true and natural market value for its appropriate use that a coin, or any other dollar s worth of property, would have for its appropriate use.

But none of them would have any additional value on account of their being bought and sold as money.

Now, all the other vendible property of the world cannot be actually cut up into pieces or parcels, each capable of being carried about in the pocket, and each having the same amount of true and natural market value as a dollar in coin. But it is not only theoretically possible, but actually practicable, that nearly or quite all this other vendible property should be represented by contracts on paper, – such as certificates, notes, checks, drafts, and bills of exchange, -and that these contracts shall not only have the same value with the coins in the market as money, but that, as money, they generally shall be preferred to the coins.

These contracts are preferred to the coins as money not only because they are more convenient, but also because we can have so many times more of them.

Every solvent piece of paper that can circulate as money -whether it be a certificate, note, check, draft, bill of exchange, or whatever else – represents property existing somewhere that is legally holden for the redemption or payment of the paper, and that can either be itself delivered in redemption of it, or be otherwise made available for its payment. And if every dollar s worth of such property in the world could be represented in the market by a contract on paper promising to deliver it on demand, and if every dollar s worth could be delivered on demand in redemption of the paper that represented it, the world then could have an amount of money equal to its entire vendible property. And yet clearly every dollar of paper would be equal in value to a dollar of gold or silver. Clearly, also, all this paper would do nothing towards reducing gold and silver coins below their true and natural market values,-that is, their values for use or consumption as metals.

The gold and silver coins would be good standards – as good perhaps as any that can be had-by which to measure the values of all this other property. But a gold dollar, or a silver dollar, would have no more true or natural market value than would each and every other dollar s worth of property that was measured by it. [*13]

Under such a system of currency as this, there could evidently be no inflation of prices, relatively to the true and natural market values of gold and silver. Such a currency would no more inflate the prices of one thing than of another. It would just as much inflate the prices of gold and silver themselves as of any thing else. Gold and silver would stand at their true and natural market values as metals; and all other things would also stand at their true and natural values for their respective uses.

No more of this currency could be kept in circulation than would he necessary or convenient for the purchase and sale of commodities at their true and natural market values, relatively to gold and silver; for if at any time the paper was not worth as much, or would not buy as much, in the market as gold or silver, it would be returned to the issuers for redemption in gold and silver, and thus be taken out of circulation.

Thus we are brought again to the conclusion that it is only when gold and silver coins are suffered to stand at their true and natural values as metals – which are also their true and natural values as standards – that they can he said to measure truly the values of other things.

At their values as metals the coins serve as standards by which to measure the value of all other money, as well as of all other property. But at any other than their true and natural values as metals they will naturally and truly measure the value of nothing whatever, – neither of other money, nor of any thing else.

IV. We come now to still another proposition, – namely, that no possible amount of paper money that can be put in circulation in any one country that is open to free commerce with the rest of the world can affect the true or natural market value of gold or silver coins in that country.

If the coins should be entirely excluded from circulation by the paper, they still would have the same true and natural market value as if they were the only money in circulation; for, in both cases alike, their true and natural market value in that country would be determined by their value in the markets of the world.

The coins can be carried from any one part of the world to any other part at so small an expense that they can have no appreciably greater market value in any one part than in any other. And their true and natural market value in all parts of the world depends upon the general consumption of them as metals, and not at all upon their circulation as money. They are everywhere simply merchandise in the market of the world, waiting for consumption, like any other merchandise.

This fact-that the disuse of the coins as money in any one country cannot reduce their value in that country below their value in the markets of the world – was fully tested in the United States for fourteen or fifteen years, – that is, from 1861, or 1862, to 1876. During the whole of that time gold and silver were wholly absent from general circulation as money. Yet they had the same value here as metals that they had in other parts of the world either as money or as metals. And they were as much used during that time for plate, watches, jewelry, and the like as they ever were.

The people of the United States comprise not more than a twenty-fifth – perhaps not more than a thirtieth – part of the population of the globe. And if they were to abandon the use of gold and silver entirely, not only for money, but for plate, watches, jewelry, and every other purpose whatever; If they were even to banish the metals themselves from the country, – they thereby would reduce their value in the markets of the world by not more than a twenty-fifth, or perhaps a thirtieth, of their present value. How absurd, then, to pretend that the simple disuse of them as money by one twenty-fifth, or one-thirtieth, part of the population of the globe can have any appreciable effect upon their market value the world over!

These facts prove that all restrictions imposed by law in any one country upon all other money than gold and silver coins, under pretence of maintaining the true standard of value in that country, are the merest farces, not to say the merest frauds; that they have no tendency of that kind whatever; that they only serve to derange the standard in that country by estab≠lishing a monopoly of money, and giving a monopoly and extortionate price to the coins in that country, instead of suffering them to stand at their true and natural value, both as metals and as standards, and also at the same value that they have in the markets of the world.

Furthermore, if any or all other nations have been wicked and tyrannical enough to give, or attempt to give, a monopoly and extortionate price to gold and silver coins by restrictions upon any or all other money, that is no reason why we should be guilty of the same crime. So far as such restrictions may have affected the price of the coins in the markets of the world, we may not be able to save either ourselves or the rest of mankind from the natural consequences of such a monopoly. But we are under no more obligation to follow the bad example of these nations in this matter than in any other. Because other nations enslave and impoverish their people by depriving them of all money and all credit by establishing a monopoly of money, that is no reason why we should do so. All our efforts in this direction do nothing towards making the coins better standards of value than they otherwise would be.

V. It is an utter absurdity to talk about gold and silver coins having any more true or natural value as money than they have for use or consumption as metals. To say that they have more true or natural market value as money than they have for use as metals is equivalent to saying that they have more true and natural value for being bought and sold than they have as commodities for use or consumption. And to say that they have more true or natural market value for being bought and sold than they have as commodities for use or consumption is just as absurd as it would be to say that houses, and lands, and cattle, and horses, and food, and clothing, have more true and natural market value for being bought and sold than they have as commodities for use

VI. Finally, the true and natural market value of any and every vendible thing whatever is that value, and only that value, which it will maintain in the market in competition with any and all other vendible things that can be brought into the market in competition with it. This is the only rule by which the true and natural market value of any vendible thing whatever can be ascertained; and this rule applies as much to gold and silver coins as to any other commodities whatever.

Tried by this rule, we know that the coins will bear no higher value in the market as money than they will for use or consumption as metals; because mankind have other money which they prefer to the coins, and which – if permitted to do so – they will always buy and sell as money rather than give more for the coins as money than they are worth for use or consumption as metals.

VII. To give color to the idea that solvent notes, promising to pay money on demand, tend to reduce the standard of value below that of the coins, the advocates of that idea are accustomed to say that such notes cost nothing, and have no value in themselves; and, consequently, that to suffer them to be bought and sold as money in the place of coin, and as if they were of. equal value with coin, necessarily depreciates the market value of the coin at least for the time being ; that, in other words, it reduces the standard of value for the time being.

The answer to this pretence is that nobody claims or supposes that a promissory note, simply as so much paper, has any value. But the contract written upon the paper – if the note be a sol≠vent one – is in the nature of a lien upon so much material property of the maker of the note as is sufficient to pay the note, and as can be taken by legal process and sold for payment of the note.

Every solvent promissory note – whether it circulates as money, or not-is in the nature of a lien upon the property of the maker, – that is, upon the property that is legally holden for the payment of the note, and that can be taken by legal process, and applied to the payment of the note.

The value of the note, therefore, is not in the mere paper as paper, but in the property on which the contract written upon paper gives the holder a lien for the amount of the note.

In this respect, a banker s note, circulating as money, is just like any other man s note that is locked up in the desk or safe of the holder. The fact that it is bought and sold from hand to hand as money- that is, in exchange for other property-makes no change whatever in the character or value of the note.

In the case of a mortgage upon land, the value is not in the mere paper, as paper, upon which the mortgage is written, but in the land on which the mortgage gives the mortgagee a lien for the amount of his debt. So in the case of a note, if it be a solvent one, it is in the nature of a lien upon, or conditional title to, the property of the maker of the note, – property that is legally holden for the payment of the note, and that can be taken by legal process, and applied to the payment of the note.

To say that such a note has no value in itself is just as absurd as it would be to say that a mortgage on land has no value in it≠self. Everybody knows that neither the mortgage nor the note has any value as mere paper; that the value is in the land, or the property, that is holden, or liable to be taken, for the payment of the mortgage or note.

In every case where material property is represented by paper, – as in the case of a deed, mortgage, certificate of stock, certificate of deposit, check, note, draft, or whatever else, – the value is in the property represented, and not in the paper that represents it. The paper has no value, except as it contains the evidence of the right to the property represented by it. And this is as true in the case of what is called paper money as in all other cases where property is represented by paper. The value of the money is not in the paper as paper, but in the property represented by the paper, and to which, or on which, the contract writ≠ten on the paper gives a title, claim, or lien. The property that is represented by the paper, and which constitutes the real money, is just as real substantial property as is gold, or silver, or any other money or property whatever. And it is really an incorrect and false use of the term to call such money paper money, as if the paper itself were the real money; or as if there were no money, and no value, outside of the paper. A dollar s worth of land, wheat, iron, wool, or leather, is just as much a dollar in real value as is a dollar of gold or silver; and when represented by paper, it is just as real money, so far as value is concerned, as is gold and silver.

Every solvent promissory note is a mere representative of, or lien upon, or conditional title to, material property in the hands of the maker; property that has an equal value with coin; that is legally holden for the payment of coin; and that can be taken by legal process, and sold for coin, which must be applied to the payment of the note. When, therefore, a man sells a solvent promissory note, he sells a legal title to, or claim to, or lien upon, so much actual property in the hands of the maker of the note as is necessary to pay the note; property which men have just as much right to buy and sell from hand to hand as money, if they so please, – that is, in exchange for other property, – as they have to buy and sell coin, or any other money that can be invented.

And it matters not how many of these notes are in circulation as money, provided they are all solvent; since, in that case, each note represents a separate piece of property from all the others; each separate piece of property being equal in value to coin, and capable of insuring the payment of coin. If, therefore, all the material wealth of a country were thus represented by paper, the paper, – that is, the property represented by the paper – would all have the same value as the same nominal amount of coin; and the circulation of all this paper as money would do nothing towards reducing the coins below their true and natural value as metals, or below their value in the markets of the world. Consequently, it would do nothing towards depreciating the true and natural standard of value. All this other money would have the same value, dollar for dollar, as the coin; and the true and natural value of the coins as standards of value would not be changed.

There certainly can be no question that a solvent promissory note that circulates from hand to hand as money – which every≠body is willing to accept in payment for other property – is just as legitimate a piece of paper, and has just as much value as a lien, or as evidence of a lien, upon the property that is holden for its payment, as any other promissory note whatever. If such a note be not legitimate, if it have no value, then no promissory note whatever is legitimate, or has value. And if the issue of such notes for circulation as money-that is, among those who voluntarily give and receive them in exchange for other property – be illegitimate, and ought to be suppressed, then all promissory notes whatsoever are equally illegitimate, and ought to be suppressed. But if any one such note, which any one man, or company of men, can make, be legitimate, then any and every other similar note, which any other man, or company of men, can make, is equally legitimate.

VIII. But to hide the deception that is attempted to be practised under pretence of maintaining the standard of value, it is said that there is but a small amount of coin in comparison with the notes that can be put in circulation as money; and that it is therefore impossible that any great number of notes, promising to lay coin on demand, can be solvent; that the property that is nominally holden to pay the notes cannot be made to bring any more coin than there really is; and that, therefore, the notes, if more numerous than the coins, must be spurious; that they promise to pay something which the makers do not possess, and which they consequently are unable to pay, no matter how much other property they may have.

One answer to this argument is that, on this principle, no promissory note whatever – whether issued for circulation or not – could ever be considered solvent, unless the maker kept constantly on hand an equivalent amount of coin with which to redeem it. Whereas we know that all notes are considered solvent, provided the makers have sufficient property to bring the coin when it is likely to be called for. And this is the principle on which all ordinary commercial credit rests.

Another answer to this argument is that, however valid it may be against notes that are either not solvent, or not known to be solvent, – that is, not issued on the credit of property sufficient to pay the notes, – it has no weight against notes that are sol vent, and that are known to be solvent; because, first, if the notes are., solvent, and are known to be solvent, the holders usually prefer them to coin, and therefore seldom present them for redemption in coin; and because, secondly, the notes issued for circulation are issued by discounting other solvent notes that are to be held by the bankers, and the circulating notes are, therefore, all wanted for paying the notes discounted, and, with rare exceptions, will all come back to the bankers in payment of the notes discounted; and it is, therefore, only rarely that any other redemption of the circulating notes is called for.

The bankers soon learn by experience how often coin will be called for, and how much, therefore, it is necessary for them to keep on hand for such contingencies. This amount a clue regard for their own interests will induce them to keep on hand, because they cannot afford to be sued on their notes, or to have their credit injured by not meeting their notes when coin is demanded.

The opposers of a solvent paper currency either ignorantly overlook, or craftily and dishonestly attempt to keep out of sight, the vital fact that, in all safe, legitimate, solvent, and prudent banking, all the notes issued for circulation will be wanted to pay the notes discounted, and will come back to the banks in payment of notes discounted; and that it is only rarely that any other redemption-redemption in coin-will be demanded or desired.

The pretence, therefore, that no more notes can be honestly issued for circulation than there is coin kept constantly on hand for their redemption is nothing but a pretence, since, however great the amount of notes issued, – provided they be solvent ones, – it is only a mere fraction of them-probably not so much even as one per cent. – that will ever have any call to be re≠deemed in coin.

IX. But it is often said that the panics which have usually oc≠curred after any considerable increase of money by the issue of paper are proof that the paper was not equal in value, dollar for dollar, with coin. Those who say this claim that the panics are caused by the attempts of the holders of the notes to convert them into coin. These attempts have taken the form of runs upon the banks for the redemption of their notes in coin. And it is claimed that these runs upon the banks for coin are proof that the notes are not equal in value, dollar for dollar, with coin. And this proof, say they, is made complete by the fact that the banks, when thus run upon for coin, cannot redeem their notes in coin.

But these runs upon banks for coin by no means prove that solvent notes are not equal in value, dollar for dollar, with coin. They prove only that the holders of the notes have doubted the solvency of the banks. These runs have never occurred in coun≠tries where the banks were known to be solvent. They have occurred only in countries where the solvency of the banks was doubted, as in England and the United States. Thus, in Scot≠land there is no history (so far as I know or believe) of a single run upon the banks in a period of eighty years, – that is, from 1765 to 1845. There may have been runs in a few instances upon some particular bank, but none upon the banks generally. And why? Not at all because these banks kept on hand large amounts of coin, -for they really kept very little, -but solely because the public had a perfect assurance of the solvency of the banks; an assurance resulting from the facts that each of the banking companies had a very large number of stockholders, and that the private property (including the real estate) of all these stockholders was holden for the debts of the banks. The public, therefore, knew, or felt perfectly assured, not only that the notes of the banks were all solvent, but also that they would all speedily go back to the banks, and be redeemed by being accepted in payment of notes discounted. Under these circumstances, the public not only made no runs upon the banks for coin, but even preferred the notes to the coin.

In England, on the contrary, the runs upon the banks during the same period of eighty years were very frequent. And why? Because nobody had any abiding confidence in the solvency of the banks. The Government, for the sake of giving a valuable monopoly to the Bank of England, had virtually enacted that there should be no other solvent banks in England; or at least none that could be publicly known to be solvent. This enact≠ment was that, with the exception of the Bank of England, no bank in England should consist of more than six partners. Rich men-those who had credit and wished to use it-could generally do better with it than to put it into a company where there were only six partners, and where the credit of the partnership could not be sufficiently known to be of much value, or to protect them against runs for coin. The result was that, with the excep≠tion of the Bank of England, all, or very nearly all, the banking business in England was in the hands of men who were not only unworthy of credit, but really had no credit, except so long as they were ready to redeem their notes either in coin or Bank of England notes.

In many or most of the United States, up to i86o, the solvency of the banks was rendered doubtful, or worse than doubtful, by legislation that authorized the banks to issue notes to two, three, or four times the amount of their capital; that authorized the stockholders themselves to borrow these notes of the banks, and then exempted the private property of the stockholders from all liability for the debts of the banks. Of course it often hap≠pened that no reliance could be placed on the solvency of such banks, and that runs, which they could not meet, would be made upon them for coin.

But clearly the runs upon such banks as these did nothing to≠wards proving that the notes of banks, known to be solvent, were not equal in value, dollar for dollar, with coin.

But the panic of 1873, in the United States, did not proceed at all from any doubt as to the solvency of the banks, but wholly from the insufficiency in the amount of money. The destruction of the State banks by a ten per cent. tax on their issues; the lim≠itation upon the issues of the national banks to the sum of three hundred and fifty-six million dollars; and the limitation upon the greenbacks to three hundred million dollars, – reduced the currency to six hundred and fifty-six million dollars. And these six hundred and fifty-six million dollars, being, for want of redemption, some fifteen per cent, below par of specie, reduced the actual amount of money to about five hundred and fifty-eight millions. The population of the country in 1873 was at least forty millions, and the property probably forty thousand millions. This lack of money, compared with population and property, compelled traffic of all kinds to be done on credit, instead of for cash. Every thing was bought on credit, and sold on credit. And the same commodity, in going from producer to consumer, was generally sold two, three, four, or more times over on credit. The consequence was that this private indebtedness among the people had become so enormous, in proportion to the money with which to cancel it, as to place the credit of the whole community at the mercy of a few holders of money, who had no motive but to extort the utmost possible from the necessities of the community. The result was the general collapse of substantially all credit.

Had there been freedom in banking, nothing of this kind would have occurred. The bankers would have been so numerous as to be able to furnish all the money that could have been kept in circulation. They would probably have supplied three, four, or five times the amount we actually had. Traffic between man and man would have been almost wholly done for cash, in≠stead of on credit; and nothing in the form of a panic would have been known.

The panic of 1873, therefore, does nothing towards proving that solvent notes, issued for circulation as money, – no matter how great their amount, – are not equal in value, dollar for dol≠lar, with coin.

X. But the argument that is offered perhaps with the most assurance as proof that any increase of money by means of paper reduces for the time being the gold or silver dollar below its true and natural market value is derived from the rise that takes place in the prices of commodities, relatively to gold and silver, when≠ever the currency is increased by the addition of paper.

This argument, if it be an honest one, implies an ignorance of two things; namely, first, an ignorance of the fact that the paper is employed as capital to diversify industry and increase produc≠tion; and, secondly, an ignorance of the effect which a diversity of industry and increase of production have upon the prices of commodities, relatively to any fixed standard of value. This effect has been illustrated in a previous number of this Review, and need not be repeated here.

The diversity of industry and increase of production that follow an increase of currency by paper, and the effect which that diversity and production have upon the prices of commodities, utterly destroy the argument that the rise in prices results from any depreciation in the value of coin below its true and natural value as a metal.

A second answer to the argument drawn from the rise in prices under an abundant paper currency is to be found in the theory of the very men who oppose such a currency. Their theory is that, by the prohibition of the paper, the coins can be made to have a purchasing power as money indefinitely greater than their true and natural market value as metals. They hold that the coins already have a purchasing power as money far greater than their true and natural value as metals.

Now, inasmuch as every dollar of solvent paper currency rep≠resents-by giving a lien upon-so much real property as is equal to the coin in true and natural market value, it necessarily follows, on their own theory, that the paper has no other effect than to bring the coins down, from their unnatural, fictitious, and monopoly price, or purchasing power, to their true and natural value as metals; or, what is the same thing, to bring all other property up to its true and natural market value, relatively to the coins as metals.

XI. It will now be taken for granted that the following propositions have been established; namely, –

1. That the only true and natural market value of gold and. silver coins is that value, and only that value, which they have; for use or consumption as metals; that this is the value at which they now stand in the markets of the world; that it is the only value that has any stability; and that it is the only value at which they can be said to he standards for measuring the value of any. other property whatever.

2. That inasmuch as paper money does not compete at all. with gold and silver coins for any of those uses that give them their value, the true and natural market value of the coins can≠not be reduced below their value as metals, or their value in the markets of the world, by any possible amount of paper money that can be kept in circulation; and that, consequently, the pa.. per money, however great its amount, can do nothing towards reducing the coins as standards of value below their true and natural value as standards, -that is, their value as metals.

3. That the coins, standing at their true and natural value as metals, are as much standards by which to measure the value of all other money as of all other property; and, consequently, that all other money that has the same value in the market, dollar for dollar, with the coins, only increases the amount of money, without lowering the standard of value; and that, if all the other vendible property in the world were cut up into pieces or parcels, each of the same value with a dollar (or any given number of dollars) of coin, and each piece or parcel were represented by a promissory note, and all these notes were to be bought and sold as money in competition with the coins, the coins would not be thereby reduced below their true and natural market value as metals, nor, consequently, below their true and natural market value as standards.

4. That to say that the true and natural market value of the coins as standards of value is diminished by increasing the number of dollars, so long as the additional dollars arc of the same value, dollar for dollar, with the standards, is equivalent to saying that the coins have no fixed-nor any thing like a fixed – value of their own; and that they are, consequently, unfit for, and incapable of being, standards of value; that to say that increasing the number of dollars, all of one and the same value, is diminishing the value of the dollar is just as absurd as it would be to say that increasing the number of yardsticks, all of one and the same length, diminishes the length of the yard≠stick; or as it would be to say that increasing the number of pound-weights, all of one and the same weight, diminishes the weight of the pound-weight.

XII. The four propositions in the last preceding section are so manifestly true that no one, I apprehend, will even attempt to controvert them otherwise than by asserting that the present market value of the coins does not rest wholly upon their value as metals, but, in part, upon these further facts, – namely, that the coins are money, and, secondly, that they are made a privileged money by the prohibitions or limitations imposed by law upon all other money.

If it should be said -as it constantly is said – that the fact of the coins being made money, and the further fact of prohibitions or limitations being imposed upon all other money, have given the coins a purchasing power far above their true and natural value as metals, the answer is that such a purchasing power is an unjust and extortionate power-a mere power of robbery – arbitrarily granted to the holders of the coins, from no mo≠tive whatever but to enable them to get more for their coins than they are really worth; or, what is the same thing, to enable them to coerce all other persons into selling their property to the holders of the coins for less than it is worth. And this is really the only motive that was ever urged against the free pur≠chase and sale of all other money in competition with the coins.

The frauds and extortions that are attempted to be practised by making the coins a privileged money, under cover of the pretence of maintaining the standard of value, may be illustrated in this way; namely, In some parts of Europe, there is said to be quite a trade in humming birds. While living, they are wanted, I suppose, as pets, the same as parrots, canaries, and some other birds. When dead, after passing through the hands of the taxidermists, they are wanted as ornaments.

Let us suppose there were such a trade in this country. And let us suppose the whole number of humming birds, already caught, in the country, to be ten thousand. And let us suppose their market value as pets and for ornaments to be ten dollars each. The market value of the whole ten thousand humming birds, then, would be one hundred thousand dollars.

And suppose these ten thousand humming birds to he owned by one hundred men, each man owning one hundred birds, – that is, one thousand dollars worth.

But suppose further that, in consideration of humming birds being rare, beautiful, containing much value in small space, and incapable of being rapidly increased, the government should adopt and legalize them as money, as standards of value.

And suppose that, under pretence of maintaining this stan≠dard of value unimpaired, the government should prohibit all other money, and should also prohibit all substitutes and all contracts – such as notes, checks, drafts, bills of exchange, and the like-by which the necessity for buying and selling the humming birds themselves – the legalized money – should be avoided.

Suppose, in short, that, under pretence of maintaining this standard of value, the government should establish, in the hands of these hundred owners of the humming birds, an absolute mo≠nopoly of money, and of every thing that could serve the pur≠poses of money.

What, now, would be the market price of the humming birds? And what would become of the standard of value? Why, we know that the one hundred owners of these ten thousand humming birds, having thus secured to themselves an absolute monopoly of all the money in the country, would demand for their birds as money, a hundred, a thousand, or a million times more than their true and natural value, – that is, more than they were worth simply as humming birds. By the monopoly of money, they would be put in possession of a substantially absolute power over all the property and labor of our forty-five millions of people. There would be but one holder of money for every four hundred and fifty thousand people. These four hundred and fifty thousand people could sell neither their labor nor their property to anybody except this single owner of humming birds. And they could sell to him only at such prices as he should choose to give. And he, knowing his power over their necessities, would not part with one of his birds, unless he should get in exchange for it a hundred, a thousand, or a million times more than it was really and truly worth. In this way this pretended standard of value would be made to measure – that is, to procure for its possessor- a hundred, a thousand, or a million times more than its own true and natural value.

Of course, everybody in the country, except these hundred men, would be robbed of all their property at once, unless there should chance to be some few so situated that they could contrive to live within themselves without selling either their prop≠erty or their labor. And these hundred men would soon make themselves masters and owners of substantially all the property in the country. All the other people of the country would be at their mercy, and would be permitted to live, or suffered to die, as the pleasure of the one hundred men should dictate.

Such would be the effect of establishing a monopoly of money under pretence of establishing a standard of value.

But suppose, now, on the other hand, that all men were allowed to exercise their natural right of buying and selling as money any thing and every thing which they should choose to buy and sell as money. What would be the result? Why, we know from experience that, instead of buying and selling the humming birds themselves, they would rarely buy one of them. On the contrary, they would buy and sell notes, checks, drafts, and the like, representing perhaps a large portion of the property of the country. These notes, checks, and drafts would be nom≠inally and legally made payable in humming birds, and would be in the nature of liens upon the property of the makers. And any holder of one of them could, if he chose, not only de≠mand humming birds in payment, but, if that were refused, could sue for, and recover judgment for, so many actual hum≠ming birds as the note promised. And the property of the maker of the note would be taken by legal process, and sold for humming birds, and nothing else; and these birds would then be paid over to the holder of the note.

But we knew, at the same time, that the humming birds, when thus actually paid over to the holder of the note, would be worth no more in the market than the note was before he sued on it; that they would buy no more of any thing he wanted to buy than would the note; that nearly or quite everybody who had any thing to sell would rather have the note than the birds; and that, unless he wanted to keep the birds as Pets or for ornaments, he would have made a bad bargain for himself; that even if he wanted the birds to keep, he could have bought them in the market with the note at the same price and with much less trouble to himself than it cost him to obtain them by his suit; and finally, that he had made a fool and a curmudgeon of himself by bringing a suit, and taking trouble upon himself, and giving trouble to the maker of the note, in order to get something that he did not want, and which it would be a trouble and loss to him to keep, and a trouble to get rid of; for all which he would get no profit or compensation whatever.

As sensible men would not be likely to go through such unprofitable operations as this, the result would be that men generally, instead of buying and selling the humming birds themselves as money, would seldom or never buy them, except when they had a special use for them as humming birds; but, in place of them, would buy and sell such notes, checks, drafts, and the like as had an equal value in the market with the birds, and were more convenient to keep, handle, and transport than the birds. The birds themselves would continue to stand, in the market, at their true and natural value as humming birds, and, as such, would be very good standards of value by which to measure the value of all other money, as well as of all other property; and all traffic between man and man would be the exchange of one kind of property for another, each at its full, true, and nat≠ural value, with no extortion or coercion on either side.

This supposed case of the humming birds gives a fair illustration of the sense, motives, and honesty of all that class of men who are continually crying out for prohibitions or limitations upon all money except gold and silver coins, or some other privileged money, under pretence of maintaining the standard of value. They all have but one and the same motive, – namely, the monopoly of money, and the power which that monopoly gives them to rob everybody else.

~ NOTES ~

1. Old coins – those that are no more than twenty, thirty, or fifty years old-are so rare that they sell for high prices as curiosities.

2. That is, from Europe for two thousand years, and from America front its first discovery by Europeans.

3. I believe the English have recently attempted to introduce a small copper coin, called an anna: but what is its precise value, or what the number in circulation, I do not know.

4. The sale of them as money Is not a use of them any more than the sale of a horse is a use of the horse. For convenience in speech, we call the busing and selling of money a use of It, but it is no more a use of it than the buying and selling of any other merchandise is a use of such merchandise. When a man says he wants money to use, he means only that he wants to part with it,-that he wants either to pay a debt with it, or to give it in exchange for something that he can use or consume.

5. We can have at least a hundred and fifty times as many paper dollars as we can gold and silver dollars. And yet every one of these paper dollars, if it represents a dollar s worth of actual property that can either be itself delivered in redemption of the paper, or can otherwise be made available for the redemption of the piper, will have the same value in the market as the coins.

6. To say that a gold dollar, or a silver dollar, has any more true or natural market value than any other dollar s worth of vendible property is just as absurd as it would be to say that a yardstick has more length than a yard of cloth or a yard of any thing else; or is it would be to say that a pound weight has more weight than a pound of sugar or a pound of stone.

7. The bankers have no motive to issue more of their notes than are needed for circu≠lation at coin prices; because their only motive for issuing their notes at all is to get interest on them while they are in circulation. If they issue no more than are needed fur circulation at coin prices, the notes, as a general rule, will remain in cir≠culation until they come back to the bankers in payment of notes discounted; and the bankers will have no occasion to redeem them otherwise than by receiving them in payment of notes discounted. But if the bankers issue more notes than are needed for circulation at coin prices, the surplus notes will come back for redemption in coin before they have earned any interest. Thus the bankers will not only fail of getting any profit from their issues, but will subject themselves to the necessity and inconve≠nience of redeeming their notes with coin. They, therefore, have no chance of pro≠fit, hut necessarily subject themselves to inconvenience, and perhaps loss, if they issue more notes than arc wanted for circulation at coin prices.

8. The principle named in the text of course applies only to solvent banks. It has nothing to do with insolvent ones, whose business is to swindle the public. As a general rule, only those banks can be relied on as solvent where the private property of the stockholders is holden for the notes of the company. Not that there may not be other solvent ones, – for undoubtedly there may be,- but experience thus far has been largely against all others.

9. One cause that made the English banking companies – companies consisting of not more than six partners-unworthy of credit was that, although the Vrivatc property of the partners was holden for the partnership debts, yet the condition of land titles in England was such as to make land practically unavailable as a basis of credit. The credit of the bankers, therefore, rested only on their personal property. That is, the credit of each banking company rested, at best, only on the personal property of not more than six persons.

10. See: The Law of Prices in the Radical Review for August, 1877.

Reprinted from The Radical Review.

A. Williams And Company,

883 Washington Street

Boston

1878

[Got physical… close at hand?]

Let’s do something about that…

Perspectives on America is heard at 8:00 p.m. (Eastern Time), each Tuesday through Thursday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Perspectives on America is heard at 8:00 p.m. (Eastern Time), each Tuesday through Thursday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Added to the forum will be intense and sometimes dark and challenging commentary regarding daily events and circumstances, which are affecting the downward spiral of this once great nation. Programming will include topics such as the dark direction that our nation seems to be headed through the horrendous hatred in the political fields, our physical Health and the Good, the Bad and the Ugly of the nations’ public education system.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

1 – 602 – 799 – 8214

Kettle Moraine Ltd@cox.net