“For money, some men will allow the innocent to hang. They will turn traitor… they will lie, cheat, steal and they will kill. They appear brilliant, charming and generous! But they are deadly! Such are men as Dimitrios.”

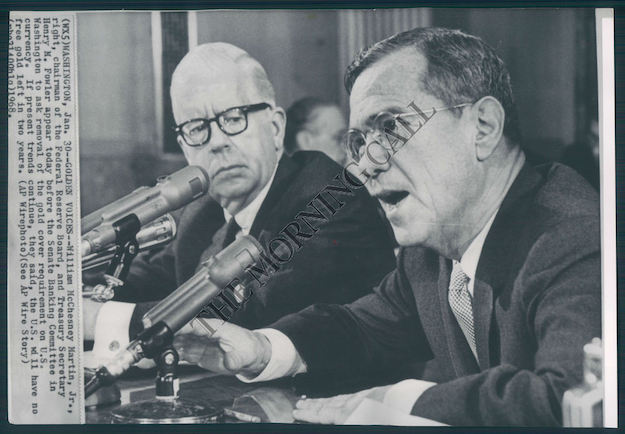

In a 1967 meeting of the FOMC nearly 55 years ago is clear and indisputable evidence of gold price suppression and currency manipulation of the world’s “free” and “open” market exchanges.

This criminal cabal has certainly built up their mechanisms since this time to conceal their sinister scheme from issuing dishonest money. It’s blatant now and all of “in your face” is their behavioral response to inquiry. Damn the torpedoes, full steam ahead!

In just a few short years this would all lead to Nixon’s closing of the gold market – so – don’t blame Tricky Dick on this one – the powers that be had laying the groundwork for all of this long before he came back form the “political” graveyard – and yet many years before – in 1933 – President Roosevelt begin laying a base for the future grab of the goods – and in doing so – was following through with the work laid down during the Wilson administration with the establishment of the Federal Reserve bank in 1913 – a topic which this broadcaster had covered many years ago with a four-hour series of broadcasts entitled, The Mask of Dimitrios – a program which I will be re-airing for the first time in many years – very soon.

In just a few short years this would all lead to Nixon’s closing of the gold market – so – don’t blame Tricky Dick on this one – the powers that be had laying the groundwork for all of this long before he came back form the “political” graveyard – and yet many years before – in 1933 – President Roosevelt begin laying a base for the future grab of the goods – and in doing so – was following through with the work laid down during the Wilson administration with the establishment of the Federal Reserve bank in 1913 – a topic which this broadcaster had covered many years ago with a four-hour series of broadcasts entitled, The Mask of Dimitrios – a program which I will be re-airing for the first time in many years – very soon.

President Roosevelt signs the Banking Act of 1933. In the Banking Act of 1933, Congress established the name and legal structure of the FOMC as a formal committee of all 12 Reserve Banks

MEMORANDUM OF DISCUSSION

A meeting of the Federal Open Market Committee was held in the offices of the Board of Governors of the Federal Reserve System in Washington, D. C., on Monday, November 27, 1967, at 9:30 a.m., at the call of Chairman Martin.

PRESENT: Mr. Martin, Chairman

Mr. Brimmer

Mr. Francis

Mr. Maisel

Mr. Mitchell

Mr. Robertson

Mr. Scanlon

Mr. Sherrill

Mr. Swan

Mr. Wayne

Messrs. Ellis, Hickman, and Galusha, Alternate Members of the Federal Open Market Committee

Mr. Irons, President of the Federal Reserve Bank of Dallas

Mr. Holland, Secretary

Mr. Sherman, Assistant Secretary

Mr. Kenyon, Assistant Secretary

Mr. Broida, Assistant Secretary

Mr. Hackley, General Counsel

Mr. Brill, Economist

Messrs. Baughman, Garvy, Hersey, Koch, Partee, and Solomon, Associate Economists Mr. Holmes, Manager, System Open Market Account

Mr. Cardon, Legislative Counsel, Board of Governors

Mr. Fauver, Assistant to the Board of Governors

Mr, Williams, Adviser, Division of Research and Statistics, Board of Governors

Mr. Reynolds, Adviser, Division of International Finance, Board of Governors

Mr. Axilrod, Associate Adviser, Division of Research and Statistics, Board of Governors

Miss Eaton, General Assistant, Office of the Secretary, Board of Governors

Miss McWhirter, Analyst, Office of the Secretary, Board of Governors

Messrs. Bilby, Eastburn, Mann, Brandt, and Tow, Vice Presidents of the Federal Reserve Banks of New York, Philadelphia, Cleveland, Atlanta, and Kansas City, respectively

Mr. MacLaury, Assistant Vice President, Federal Reserve Bank of New York

Mr. Deming, Manager, Securities Department, Federal Reserve Bank of New York

Mr. Anderson, Financial Economist, Federal Reserve Bank of Boston

Mr. Kareken, Consultant, Federal Reserve Bank of Minneapolis

Before this meeting there had been distributed to the members of the Committee a report from the Special Manager of the System Open Market Account on foreign exchange market conditions and on Open Market Account and Treasury operations in foreign currencies for the statement week ended November 22, 1967. A copy of this report has been placed in the files of the Committee.

In supplementation of the written report, Mr. MacLaury remarked that the financial world was quite different today from what it was when the Committee last met, less than two weeks ago: sterling had been devalued and, to paraphrase Secretary Fowler, the dollar had moved to the forefront in the defense of the international financial structure. Mr. Coombs was in Europe, along with Under Secretary Deming, Governor Daane, and President Hayes, trying to hammer out an agreement among the financial allies of the United States for dealing with the unprecedented pressures in the London gold market that broke loose last week, as anticipated, following sterling’s devaluation. In a past report to the Committee Mr. Coombs had described the sterling and gold markets as like twin time bombs: if one exploded, the other would explode as well.

That had now happened – and so now we begin!

I promise you, that you will find this too cumbersome to read, and in fact – after working on it for several hours – I have found it way to cumbersome to edit and prepare it for posting – for the few readers who actually would have enough interest to read it all at one sitting – HOWEVER the FED Source is (HERE) in pdf format.

NOTE: The premise of what we have provided above is based upon a column presented by a noted economic writer known as Charleston Voice and presented through 24h Gold ~ February 20, 2013 ~ Ed.