United States (1930s)

“The inability to predict outliers implies the inability to predict the course of history. . . But we act as though we are able to predict historical events, or, even worse, as if we are able to change the course of history. We produce thirty-year projections of social security deficits and oil prices without realizing that we cannot even predict these for next summer — our cumulative prediction errors for political and economic events are so monstrous that every time I look at the empirical record I have to pinch myself to verify that I am not dreaming. What is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.” ~ Nicholas Taleb, The Black Swan – The Impact of the Highly Improbable

“The inability to predict outliers implies the inability to predict the course of history. . . But we act as though we are able to predict historical events, or, even worse, as if we are able to change the course of history. We produce thirty-year projections of social security deficits and oil prices without realizing that we cannot even predict these for next summer — our cumulative prediction errors for political and economic events are so monstrous that every time I look at the empirical record I have to pinch myself to verify that I am not dreaming. What is surprising is not the magnitude of our forecast errors, but our absence of awareness of it.” ~ Nicholas Taleb, The Black Swan – The Impact of the Highly Improbable

Webster defines deflation as a “contraction in the volume of available money and credit that results in a general decline in prices.” Typically deflations occur in gold-standard economies when the state is deprived of its ability to conduct bailouts, run deficits and print money. Characterized by high unemployment, bankruptcies, government austerity measures and bank runs, a deflationary economic environment is often accompanied by a stock and bond market collapse and general financial panic – an altogether unpleasant set of circumstances.

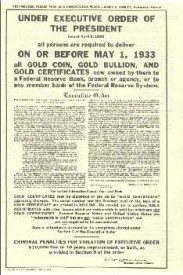

The Great Depression of the 1930s serves as a workable example of the degree to which gold protects its owners under deflationary circumstances. First, because the price of gold was fixed at $20.67 per ounce, it gained purchasing power as the general price level fell. In 1933, when the U.S. government raised the price of gold to $35 per ounce in an effort to reflate the economy through a formal devaluation of the dollar, gold gained even more purchasing power. President Franklin D. Roosevelt also confiscated gold bullion by executive order in concert with that devaluation, but exempted “rare and unusual” gold coins which later were defined by regulation simply as items minted before 1933. As a result, only those citizens who owned gold coins dated before 1933 were able to reap the benefit of the higher fixed prices.

The Great Depression of the 1930s serves as a workable example of the degree to which gold protects its owners under deflationary circumstances. First, because the price of gold was fixed at $20.67 per ounce, it gained purchasing power as the general price level fell. In 1933, when the U.S. government raised the price of gold to $35 per ounce in an effort to reflate the economy through a formal devaluation of the dollar, gold gained even more purchasing power. President Franklin D. Roosevelt also confiscated gold bullion by executive order in concert with that devaluation, but exempted “rare and unusual” gold coins which later were defined by regulation simply as items minted before 1933. As a result, only those citizens who owned gold coins dated before 1933 were able to reap the benefit of the higher fixed prices.

Second, since gold acts as a stand-alone asset that is not another’s liability, it functioned as an effective store of value before and after the 1929 stock market crash and the string of bank failures that followed in its wake. Those who either converted a portion of their capital to gold bullion or withdrew their savings from the banking system in the form of gold coins before the crisis struck weathered the breakdown. Those who did not found themselves at the mercy of events when the stock market crashed and the banks closed their doors (many of which had already been bankrupted).

Second, since gold acts as a stand-alone asset that is not another’s liability, it functioned as an effective store of value before and after the 1929 stock market crash and the string of bank failures that followed in its wake. Those who either converted a portion of their capital to gold bullion or withdrew their savings from the banking system in the form of gold coins before the crisis struck weathered the breakdown. Those who did not found themselves at the mercy of events when the stock market crashed and the banks closed their doors (many of which had already been bankrupted).

How gold might react in a deflation under today’s fiat money system is a more complicated scenario. Even in a fiat money system like the one we have today, the general price level would be falling by definition. Economists who make the deflationary argument within the context of a fiat money economy usually use the analogy of the central bank “pushing on a string.” It wants to inflate, but no matter how hard it tries the public refuses to borrow and spend. (If this all sounds familiar, it should. This is precisely the situation in which the Federal Reserve finds itself today.) In the end, so goes the deflationist argument, the central bank fails in its efforts and the economy rolls over from recession to a full-blown deflationary depression much like what happened during the 1930s.

Saint-Gaudens-Double-Eagle-Gold-Coin

How the government treats gold under a deflationary scenario will play heavily into its performance. If gold is subjected to price controls and restricted ownership, as it was in the 1930s deflation, it would likely perform as it did then, i.e., its purchasing power would increase as the price level fell. Under such circumstances, the ownership of “rare and unusual” gold coins might once again come into play. If ownership is not restricted, it would turn out to be the best of all possible worlds for gold owners. Its purchasing power would increase as the price level fell, and the price itself could rise as a result of increased demand from investors hedging systemic risks and financial market instability.

The disinflationary period leading up to and following the financial market meltdown of 2008 serves as a good example of how the second scenario might unfold. The disinflationary economy is a close cousin to deflation and is covered in the next installment in this series. It provides some solid clues as to what we might expect from gold under a full deflationary breakdown.

~ Michael J. Kosares