Leading Economic Indicators See Us on Cusp of Recession Yet Again

By many of the most reliable leading indicators of the U.S. economy, we are long overdue for a recession. Yet the economy stubbornly refuses to cooperate.

The Conference Board released its latest index of leading economic indicators on Thursday. It declined for the seventeenth consecutive month, dropping an additional 0.4 percent in August. That’s an acceleration of the pace of decline since July, when the index fell 0.3 percent.

The Conference Board’s index is a composite of ten so-called “leading indicators.” These are gauges of economic activity and sentiment that tend to move up or down several months before overall economic growth indicates an acceleration or a slowdown.

The Conference Board’s index is a composite of ten so-called “leading indicators.” These are gauges of economic activity and sentiment that tend to move up or down several months before overall economic growth indicates an acceleration or a slowdown.

The index is down 3.8 percent over the six-month period between February and August 2023. That’s close to unchanged from its 3.9 percent decline over the previous six months.

The Never Ending Cusp of Recession

Importantly, the index has been signaling that we are on the brink of a recession for over a year.

The traditional way of evaluating the leading economic index is to look at the duration, depth, and diffusion of a downturn. Duration refers to how long lasting a downturn is—now 17 months in our case. That’s a pretty long duration for a decline in the index without entering a recession, although there have been long declines in the past that did not result in a recession. If you look at the decline from 2004’s peak, it lasted years before a recession hit.

Depth refers to how far the index falls. It is down by 12.5 percent from its peak scores at the end of 2021 and start of 2022. That’s a large decline but not one of the worst in recent memories. Importantly, the past declines that were steeper did indeed lead to a recession.

Diffusion indicates how widespread the decline is. That is to say, what proportion of the indexes components are falling below 50 when a majority are in decline.

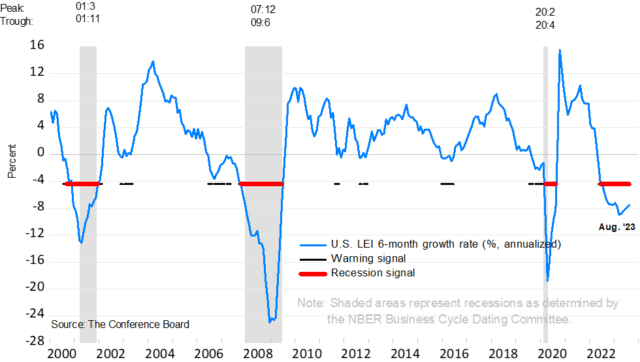

“The 3 D’s rule provides signals of impending recessions when two criteria are satisfied: (1) The rule requires that a majority of the 10 LEI components are in contraction territory (black dotted line in the chart), and (2) the magnitude of the decline over six months should be below the median, -4.0 percent, annualized (red dotted line). If both criteria are met simultaneously, the LEI signals a recession,” the Conference Board explains.

As you can see in the chart below, we’ve been in the zone signaling a recession since midway through last year.

“With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year,” said Justyna Zabinska-La Monica, the Conference Board’s senior manager of Business Cycle Indicators.

“With August’s decline, the US Leading Economic Index has now fallen for nearly a year and a half straight, indicating the economy is heading into a challenging growth period and possible recession over the next year,” said Justyna Zabinska-La Monica, the Conference Board’s senior manager of Business Cycle Indicators.

It was actually 13-months year ago that the Conference Board warned “LEI signals US on cusp of recession.” It’s sure been a long cusp.

Back in December of 2022, the Conference Board’s headline on the leading index report was: “Leading Economic Indicators and the Oncoming Recession.”

The story warned:

The Conference Board Leading Economic Index for the United States has long been lauded as a reliable leading indicator of recessions, and recent data suggest that the LEI is signaling an approaching recession. Indeed, given the LEI’s recent performance, The Conference Board projects that economic weakness will intensify and spread more broadly throughout the US economy over the coming months with a recession to begin around the end of 2022 or early 2023.

The Fed Is More Optimistic

The Conference Board’s latest report forecasts real GDP will grow by 2.2 percent in 2023, and then fall to 0.8 percent in 2024. That decline to 0.8 percent growth probably assumes one or two quarters of actual contraction and at least one quarter preceding it on very slow growth.

The Conference Board’s projection from this year is pretty close to the 2.1 percent median forecast from Fed officials released on Wednesday. But the Conference Board’s 2024 projection is considerably lower than the 1.5 projection from Fed officials. That spread indicates just how hard it has become to forecast growth reliably.

WASHINGTON, DC – SEPTEMBER 20: U.S. Federal Reserve Chair Jerome Powell speaks during a news conference after a Federal Open Market Committee (FOMC) meeting on September 20, 2023 in Washington, DC. (Photo by Chen Mengtong/China News Service/VCG via Getty Images)

The Fed’s projections basically now appear to signal a soft landing. There’s no significant chance of a recession built into the Fed’s projection, a big change from earlier this year when the forecasts seem to be quietly assuming a recession. If you average this year’s expected growth and next year’s, you get 1.8 percent. That’s the same as the Fed’s view of long-term trend growth for the U.S. economy. In short, the Fed is thinking that the combined effect of this year and next will be about average growth.

One thing that does seem clear is that the economy is not in a recession now and has not been in one this year. The Conference Board’s index of coincident indicators, which aims at showing how the economy is doing now but not to predict the future, improved by 0.2 percent in August following a 0.3 percent improvement in July. The coincident index is now up 0.8 percent over the six-month period between February and August 2023, faster than the 0.5 percent growth in the previous six months.

The economy has been strengthening and growth accelerating despite the ever-present Cusp of Recession.

Written by John Carney and Alex Marlow for the Breitbart Business Digest ~ September 21, 2023