Even as interest rates skyrocketed over the past 18 months, a good job market and strong consumer spending kept the US economy moving.

Even as interest rates skyrocketed over the past 18 months, a good job market and strong consumer spending kept the US economy moving.

This led to hope that a soft landing was coming, where the Federal Reserve could defeat inflation without millions of Americans losing their jobs.

However, there are growing signs that the strength of the US consumer is starting to crack.

First, the student-loan payment restart on October 1 is expected to drain $8 billion a month from consumers. The impact on spending will be enormous.

In a Morgan Stanley survey, 37% of respondents said student loan payments would force them to cut their spending in other areas, and 34% said they wouldn’t be able to make the payments at all.

Elsewhere, gas prices are soaring, with oil prices at their highest level of 2023. There are signs the cost of gas could ease next year, but that would only be after it gets worse first.

Insurance premiums are spiking across healthcare, home insurance, and autos, hitting Americans in their wallets.

And US personal savings have plummeted after surging during the pandemic. According to data from the San Francisco Fed, these excess savings could run out this quarter.

Then there are the unknowns.

How long will the United Auto Workers strike last? If it drags on, it could have a huge impact on Americans, the most obvious being a loss of jobs for auto workers. Beyond that there’s the potential to drive up inflation and monthly car payments, things that will be felt far beyond Michigan, where a local recession is now possible.

Will there be a government shutdown? It’s looking pretty likely (Well – it DIDN’T – Dammit! ~ Editor), and if so, the immediate impact would be volatility in the stock market and millions of government workers going without pay. It’ll get more worrisome if it drags on. A prolonged shutdown could increases the chances of the US going into a recession.

The punch Americans thought they avoided is still coming

The summer brought renewed hope for the economy.

The summer brought renewed hope for the economy.

In an August economic policy survey, the National Association of Business Economics found that 69% of business economists polled called a soft landing at least somewhat likely — up from 30% in March. The findings were similar to a July Bank of America survey that found 68% of surveyed fund managers expected a slowdown in the economy without a recession.

However, a new report this week by the Conference Board showed US consumer confidence had a much bigger drop in September than expected. This came just two months after the Board recorded its highest level in two years. And an August survey of CEO confidence from The Conference Board found that 84% of respondents believed a recession would occur in the next 18 months.

Earlier last month, the Fed kept interest rates unchanged, as expected. But commentary from Fed chair Jerome Powell hinted at rates staying longer for higher, sending stocks lower. The S&P 500 was on track for its worst month of the year.

Powell also said a soft landing is “possible” but also warned that it could be decided by factors “outside our control.”

Americans are tightening their hold on money

The economist David Rosenberg says it typically takes six months for a recession to hit the economy after interest rates increase by this much.

JPMorgan pointed out in a recent note a few reasons why the impact of those hikes has been delayed.

At the start of the rate increase, borrowers, like existing homeowners, had low mortgage interest rates locked in. Americans also had a large cash cushion, were given relief from student loan payments, and may have had a pent-up demand for certain services after the easing of COVID restrictions.

That lag is starting to come to an end.

A recent Bloomberg Markets Live Pulse survey found that 21% of more than 500 investors predicted personal consumption would shrink in the fourth quarter. A further 56% said consumption would reverse in early 2024.

We are already starting to see the signs.

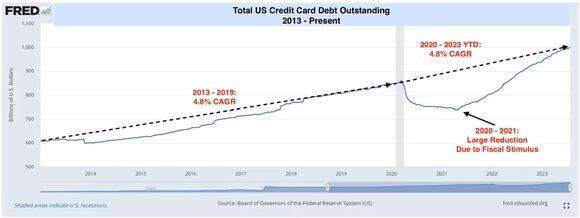

Americans have accrued a record level of credit card debt. In addition, delinquencies on credit cards and auto loans, as well as Chapter 11 bankruptcy filings are all on the rise.

And people are spending less on non-essentials and big-ticket items at places like Costco . Even dollar stores are starting to feel the pressure of more measured spending after initially benefiting from inflation as wealthier people looked for more value.

And people are spending less on non-essentials and big-ticket items at places like Costco . Even dollar stores are starting to feel the pressure of more measured spending after initially benefiting from inflation as wealthier people looked for more value.

So if you’re adjusting your budget to account for some of these pressures, you’re not the only one — and the health of the economy hangs in the balance.

Written by Cork Gaines for Business Insider ~ September 28, 2023