The gold market was moribund for the first half of the week, but contradictory U.S. CPI and PPI data pushed gold prices sharply down on Wednesday and back up on Thursday, while a sudden escalation of conflict in the Middle East on Thursday evening saw gold prices posting steady gains heading into the holiday weekend.

The gold market was moribund for the first half of the week, but contradictory U.S. CPI and PPI data pushed gold prices sharply down on Wednesday and back up on Thursday, while a sudden escalation of conflict in the Middle East on Thursday evening saw gold prices posting steady gains heading into the holiday weekend.

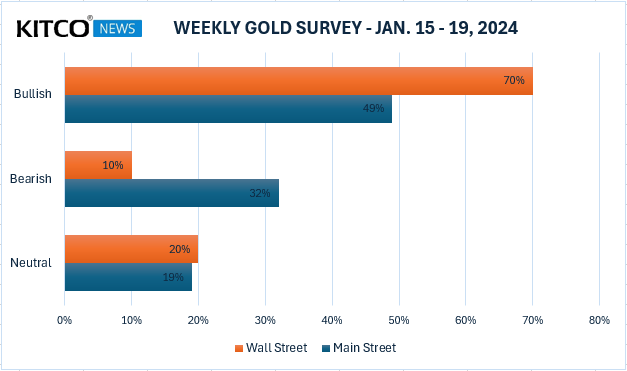

The latest Kitco News Weekly Gold Survey showed a continuation of last week’s sentiment, with half of retail investors predicting gains for gold next week, while more than two-thirds of market analysts are taking a bullish stance on the yellow metal’s near-term prospects.

Marc Chandler, Managing Director at Bannockburn Global Forex, sees more strength from gold next week. “The US-UK strike on Yemen helped lift gold through the recent highs short of $2050 to nearly $2060, where the downtrend line off the December highs is found,” he said. “The threat of a broadening war in the Middle East may trump the role of the dollar and interest rates in the short run.”

Chandler noted that before the attack, gold recorded its 2024 low around $2013 per ounce. “The momentum indicators are turning up and a return to the late December high near $2088 is possible,” he said.

Adrian Day, President of Adrian Day Asset Management, thinks gold prices have probably gone as far as they can in the near term. “Gold may need to settle down after the big jump that followed Friday’s Produce Price Index,” he said. “The sentiment tide is turning however, and surprises may well be on the upside.”

“Looking at gold, we’re up $38 here, silver is rocking too,” said, Bob Haberkorn, Senior Commodities Broker at RJO Futures. “It’s no secret why either. Last night’s action in the Middle East has a lot of safe haven buying coming into this market, and I expect that to continue into next week. There still is a concern that there’ll be attacks by Iranian proxies, or the Houthis, so that’s a concern that probably will linger on into next week, keeping good support in gold.”

Haberkorn said the gold market is also reacting to this week’s “mixed bag” of inflation data. “CPI on Thursday was hot, today PPI was lower than expected,” he said. “The PPI today would signal the Fed is more likely than it was 24 hours ago to be looking at a rate cut. CPI was such a miss, and the PPI as well, and with PPI being the leading indicator, I still think gold would be up. Even if you take the airstrikes out of the scenario, there still is geopolitical risk. That’s just another thing to add fuel to the fire. The unknowns this year, heading into the election, I think will be supportive for gold.”

He said the geopolitical situation right now is overshadowing the inflation data in the gold market. “Had nothing had happened overnight and that PPI number came out, gold would not be up $38, it’d probably be up around five or ten dollars.”

For next week, Haberkorn said markets will be watching what happens in the Middle East. “Is there any type of retaliation by Iran proxies in the Middle East or anywhere else across the globe? That’s going to be front and center,” he said. “People will be thinking about that. Then if something does happen, what will be the next response? There’s a lot of geopolitical moving parts here that will support gold and I think will continue to push gold higher.”

“I could see gold realistically pushing up towards those all-time highs again, given the geopolitical risk, next week,” he said.

This week, ten Wall Street analysts participated in the Kitco News Gold Survey, and they were even more bullish than they were last week. Seven experts, or 70%, expected to see higher gold prices next week, while only one analyst, representing 10%, predicted a drop in price. The remaining two experts, or 20% of the total, were neutral on gold for the coming week.

Meanwhile, 121 votes were cast in Kitco’s online polls, with market participants continuing their recent trend of caution about gold’s potential performance. 59 retail investors, representing 49%, looked for gold to rise next week. Another 39, or 32%, expected it would be lower, while 23 respondents, or 19%, were neutral on the near-term prospects for the precious metal.

While the multi-party conflict between Israel and Hamas, and between the United States and Iran, will continue to be the biggest risk event for gold prices next week, some data releases also have the potential to move markets. These include the Empire State Manufacturing Survey on Tuesday, U.S. retail sales on Wednesday, weekly jobless claims, U.S. housing starts and the Philly Fed Survey on Thursday, and the Friday release of existing home sales and preliminary University of Michigan Consumer Sentiment.

While the multi-party conflict between Israel and Hamas, and between the United States and Iran, will continue to be the biggest risk event for gold prices next week, some data releases also have the potential to move markets. These include the Empire State Manufacturing Survey on Tuesday, U.S. retail sales on Wednesday, weekly jobless claims, U.S. housing starts and the Philly Fed Survey on Thursday, and the Friday release of existing home sales and preliminary University of Michigan Consumer Sentiment.

Colin Cieszynski, chief market strategist at SIA Wealth Management, said he is bullish on gold for the coming week. “I think the headwind from the Bitcoin ETF rally may start to fade now that the ETFs are trading,” he said. “Inflation is coming down. If anything, that’s less of a tailwind for gold. Right now, oil is picking up. Gold being a hedge against political upheaval, that’s starting to pick up again in the Middle East and gold being a hedge against stress in the financial markets or the financials in the banking sector basically is not as much as it used to be. Bank earnings are coming out, so gold could be volatile around that. We’ll see but only if banks get into trouble. Otherwise, it’s a non-factor for gold unless something happens.”

“I’m still generally bullish on gold because the U.S. dollar has generally been soft,” he said. “Gold has settled into, let’s call it a $1,960 to $2,140 trading range, and I think it’ll probably stay there for a while to digest the moves it’s had, unless something happens.”

Cieszynski said gold remains very sensitive to the rate expectations, and while today’s PPI numbers were cooler than expected, they don’t make up for Thursday’s hotter CPI report.

“The reality is PPI is more volatile,” he said. “It might be a leading indicator, but it’s also more volatile and it’s even more dependent on which way commodity prices were going in whichever week the survey was done. Even the central banks themselves never talk about PPI. Core CPI, core PCE and wage growth are far more important to central banks than PPI.”

He noted the big move up in oil prices following the U.S. and UK airstrikes on Houthi rebels in Yemen, while gold’s move was slower and steadier, but more sustained. “Gold is not as volatile as crude oil, and there’s more factors driving gold,” he said. “There’s not just the commodity price and inflation story. There’s the defensive story, both political and with regards to the financial system. There’s what the U. S. dollar is doing.”

He said he doesn’t expect gold to be very influenced by oil prices in the current environment. “You might see something over the shorter term, over a few hours or a day, but that’s usually not sustainable because there’s a lot of factors at play in the gold price.”

Looking at Friday’s price action, Cieszynski said that traders and investors could be positioning themselves in case the conflict in the Middle East heats up over the long weekend.

“That’s probably another reason why you’re seeing some capital moving into gold, because you’ve got the U. S. holiday on Monday,” he said. “Look what happened the last time we hit the all-time highs. We had a big spike on no volume on a Sunday night, and by the time most people woke up on Monday morning, it was all over.”

“Theoretically, you could see somebody try to pull something over the long weekend, but who knows? The reality is that you can’t really read much of anything into gold trading until Tuesday,” he said.

James Stanley, senior market strategist at Forex.com, was the lone voice of dissent this week, as he expects gold prices to decline. “I think resistance at 2075/2081 will remain as somewhat of a roadblock until we test below $2k again, and see stops washed out from longs that have been holding on for continuation.,” he said.

“A tough call again this week,” said Darin Newsom, Senior Market Analyst at Barchart.com. “While I still see the intermediate-term trend as down, increased tensions in the Red Sea (and elsewhere) could bring buyers back to gold again next week. I don’t see this as a technical or fundamental play, but rather the continued ebb and flow into and out of a safe haven market.”

“Heading into next week, resistance is at the previous 4-week high of $2,098.20 for the Feb issue, with support at this week’s low of $2,017.30,” Newsom added.

Mark Leibovit, publisher of the VR Metals/Resource Letter, said he’s bullish on the yellow metal’s prospects for the coming week. “Sympathy for war rally,” he said. “Unsure if this is the big one yet!”

And Kitco Senior Analyst Jim Wyckoff expects gold prices to trade higher next week. “Bulls late this week have gained upside momentum to suggest follow-through price strength next week,” Wyckoff said.

Spot gold is currently up nearly 1% on the day but has gained only 0.13% during the week, last trading at $2,048.41 per ounce at the time of writing.

Written by Ernest Hoffman for KITCO ~ January 12, 2024