“Is gold any good as a currency?”

“Is gold any good as a currency?”

The idea behind a gold standard is that a currency becomes tied to a commodity with a stable value. The great problem with this is that gold does not have a stable value. Like any other commodity, its relative value goes up and down. For instance, in September 2022, US dollar milk prices were rising over 16%. In gold terms milk prices were rising over 23% – dangerously high inflation.

Gold-backed currencies experience both inflation and deflation with volatile economic cycles, as demand for liquidity and the value of gold shift relative to other commodities swing about. A gold-backed currency is no guarantee of price or economic stability.

Meanwhile, the price of gold has surged… (Continue to full article)

The Gold Price Is Up Nearly 19% in This Rally…

The Gold Price Is Up Nearly 19% in This Rally…

But You Haven’t Seen Anything Yet!

Although Western investors continue to ignore gold even as prices continue to hit record highs, they are no longer actively getting in the way of higher prices, which means the current rally has legs to run higher, according to one market analyst.

In an interview with Kitco News, Robert Minter, Director Of Investment Strategy at abrdn, said that gold’s rally to record highs above $2,350 an ounce is just getting started, and it’s only a matter of time before retail investors jump into gold-backed exchange-traded funds to kick off the next major leg higher.

If you were a prudent central bank fund manager in some of these countries, you would diversify away from the dollar to reduce your risk, plain and simple… (Continue to full article)

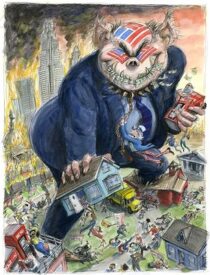

No Bank Is Safe, Implosion Coming: ‘EVERY Single Bank Is Insolvent!‘

No Bank Is Safe, Implosion Coming: ‘EVERY Single Bank Is Insolvent!‘

A little more than a year since the March 2023 banking crisis, when the U.S. saw three of the four largest bank failures in its history, the banking sector is arguably even more vulnerable.

They’ve been buying up all of this government debt with interest rates at zero or even negative. Now that the interest rates are pushed up to quote-unquote fight inflation, all the valuation of that debt is way underwater. It’s not just commercial real estate,” she said. “If the valuations of all the banks, including the central banks, are based on debt, which they are because the entire system is based on debt. Those interest rates have pushed down the market valuations of all of that debt.

What will the next banking crisis look like, and what are the triggers?… (Continue to full article)

Gold Is Rallying Again, But Silver Could Get REALLY Interesting

Gold Is Rallying Again, But Silver Could Get REALLY Interesting

Another week, another record high for gold.

On Wednesday, the monetary metal surged above $2,300 per ounce. It took a bit of a breather Thursday ahead of today’s key employment report but it rallied again on Friday.

Turning to silver, it made a significant breakout of its own this week. The white metal shot up above the $27 level to a fresh 2-year high and rallied to over $27.50 on Friday

As gold prices continue to reach new heights, bulls are eying even higher highs. Detractors, meanwhile, are pushing the narrative that gold has gotten too expensive.

They could both turn out to be right, though for different reasons… (Continue to full article)

Grocery Prices Nearing 40 Percent Higher Than In 2019

Grocery Prices Nearing 40 Percent Higher Than In 2019

A $100 grocery haul in 2019 costs almost $140 today — nearly 40 percent more for the same common items, causing consumers to “become creative to cope” with crippling inflation.

According to a Wall Street Journal analysis of NielsenIQ data on the prices of everyday foods such as meat, vegetables, starches, and snacks, Americans are facing a dramatic increase across all categories.

Consumers have been forced to “become creative to cope with a stretch of record food inflation,” choosing cheaper versions of the products they prefer or strategically looking for sales, coupons, and deals… (Continue to full article)

Gold and Silver Surge Higher

Gold and Silver Surge Higher

Gold and silver continued their run higher, defying predictions of profit-taking. From last Thursday’s close (Friday was Easter and market were closed), gold rose $50 to $2280 in early European trade this morning, after flirting with $2300. That’s a rise of $300 since St Valentine’s Day. And silver traded at $26.60, up nearly 19% over the same time period having traded as high as $27.30. Comex volumes in the silver contract were exceptionally high, but relatively subdued in gold.

The lack of volume in the gold contract together with the recent decline in Open Interest as the price rose strongly into new high ground is mystifying traders. They don’t know who is buying: it certainly isn’t the hedge funds.

Gold’s performance smacks of a massive bear squeeze on one or more bullion banks… (Continue to full article)