While physical gold is a well-known safe haven asset which investors flock to in times of market turbulence as a way of protecting their wealth, gold is also the ultimate asset to own and possess in times of crisis and emergency. These crisis situations can range from episodes in which fiat currencies collapse, to times in which gold buys safe passage across international borders, and even to periods in which only gold can bail out and rescue an entire nation. Sometimes gold even ensures self-survival and can literally be the difference between life and death.

While physical gold is a well-known safe haven asset which investors flock to in times of market turbulence as a way of protecting their wealth, gold is also the ultimate asset to own and possess in times of crisis and emergency. These crisis situations can range from episodes in which fiat currencies collapse, to times in which gold buys safe passage across international borders, and even to periods in which only gold can bail out and rescue an entire nation. Sometimes gold even ensures self-survival and can literally be the difference between life and death.

History is replete with examples of gold being the ultimate asset in times of crisis and desperation, where time and time again, gold comes to the rescue and provides its holders with choice and freedom, choice and freedom that are not available to those who do not hold gold. This is not ancient but recent history, history in our lifetimes and in some cases even events ongoing now.

In this article we will look at some examples of gold in crisis, which while distinct to their times and places, contain commonalities, and which illustrate why gold is the only monetary asset that is universally trusted and recognized in crises, why gold is the only asset with universal liquidity and purchasing power during emergencies, and in short why physical gold is the only asset that can truly provide economic freedom and liberty when confidence in all else fails.

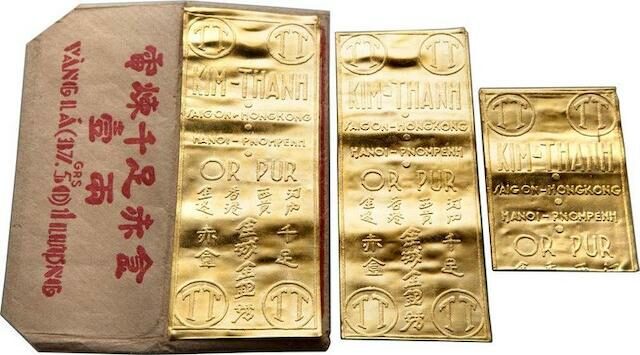

Distinctive slim gold bars from Vietnam’s Kim Thanh refinery, 1 tael

Gold as a safe passage for refugees from Vietnam

Following the Vietnam War, the Fall of Saigon, and Vietnam’s reunification in 1976, the southern part of Vietnam experienced a mass exodus of people, driven by a crippled economy, government discrimination and forced departures. Hundreds of thousands of ethnic Chinese and Vietnamese fled to other parts of Asia over both land and sea, an exodus which peaked in 1978-1979.

Those refugees fleeing by sea sometimes did so in large ships organised by people smugglers and often with the support of the Vietnamese communist government. An exit route on these ships was only assured for those who could pay these government officials and people smugglers what they demanded. The price for safe passage? Between 10 and 12 taels of 24 karat gold for an adult and half that for a child (1 tael = 1.2 troy ounces).

This gold payment was often in the form of traditional Kim Thanh gold bars, two slim large bars and one small bar wrapped together in rice paper, making a total weight of 1 tael. While these bars were popular in Vietnam, they were also recognized and accepted across all of South East Asia as portable wealth and so were monetary liquidity for the region.

From Vietnam to Hong Kong: Skyluck, the ship that smuggled 2,600 refugees.

Although some Vietnamese and Vietnamese Chinese had their stored wealth in the form of these bars, many didn’t and so an entire gold tael banking system arose in Saigon in the 1970s allowing those fleeing the crisis to convert their belongings into gold. Those without tael gold bars paid for their passage in gold ornaments.

Refugees also took with them emergency money in the form of gold tael bars as well as jewelry such as small gold rings and gold wedding bands, all of which could be sold in emergencies. For example, after one giant ship of refugees, the Skyluck, arrived in Hong Kong in 1979, Vietnamese gold tael bars began popping up in the Hong Kong gold market.

Refugees from Vietnam who took huge risks sailing into the unknown to a better life could only do so because they had physical gold to buy safe passage, and because gold is a universal money that can be sold almost anywhere to help finance a new life abroad.

South Korea – Gold mobilization to pay external debt

As the Asian financial crisis spread to South Korea in late 1997 and torpedoed the country’s financial markets, it triggered a currency and banking crisis that decimated the Korean won and pushed the country to the verge of bankruptcy. Rapidly burning through its foreign exchange reserves and with international lenders circling, the government called in the International Monetary Fund (IMF) in December 1997 with a multi billion rescue package to bail-out the country’s spiraling external debt. At that time the largest ever IMF bail-out, the rescue came as a massive blow to the Korean nation both economically and psychologically.

Embarrassed and at a loss to understand how a star Asian tiger economy could implode so quickly, the South Korean nation then did something quite extraordinary and spontaneous by collectively confronting the adversity via the mobilization of a patriotic gold collection campaign to help pay off South Korea’s foreign debts.

Initiated by the Korean broadcast networks and the large Korean banks, and coordinated by the industrial conglomerates such as Hyundai, Daewoo and Samsung, the ‘love of nation’ and ‘national debt repayment’ campaign saw Korean citizens selling their gold, but at prices far lower than market value. The gold collected was then melted into gold bars and sold on the international gold market.

With gold held widely by Korean households in many shapes and forms, long lines formed outside the nation’s banks and collection points of Samsung, Daewoo and Hyundai as Koreans swarmed to sell everything from investment gold coins and bars to gold rings and gold bracelets, and from gold medals to gold trinkets. All to fix their ‘broken economy’. The items sold even included brides’ gold jewelry, gold doljanchi presented to babies on their one-year birthdays, retirees’ gold keychains and gold watches, and the solid gold buttons found on traditional Korean clothing.

Kim Daejung, then president elect, donated his gold in Sotuh Korea’s gold campaign

And it wasn’t just ordinary citizens who took part in the campaign. Celebrities and politicians led by example. Korean baseball star Lee Chong-bum brought in 31 ounces of gold to his local bank in the form of gold trophies and medals. President-elect at the time Kim Daejung walked into a bank in Seoul donating a miniature golden tortoise and four golden good luck keys. Said Daejung:

”When I think of the patriotism, my eyes almost become wet with tears of appreciation. I promise that my new government will do its best to pull the country out of its current crisis.”

Running over four months from January to April 1998, the gold collection campaign collected 227 tonnes of gold worth $2.13 billion, with 165 tonnes alone collected in the first month January. The collection involved 3.5 million households, representing 23% of the nation’s 15 million households and 10% of the gold held in South Korea at that time, and the gold collection drive helped restore the nation’s credibility abroad, thereby allowing South Korea to fully repaid the IMF-backed debt in August 2001, three years ahead of schedule.

With gold playing a strong role in Korean society, South Korea’s population knew instinctively that in the midst of a dark economic crisis, only physical gold could help rescue their economy. And so they collectively mobilized to donate and sell the one true asset that had retained its value in Korea’s financial crisis, their gold.

Argentina – Accustomed to crisis, accustomed to gold

Beyond providing safe passage and saving a nation, gold comes into its own during periods of hyperinflation, economic stagnation, currency collapses and frozen bank accounts. Events unfortunately all too familiar to the majority of Argentinians in South America´s third largest economy. Lurching from one economic crisis to the other as it does, at times the economic history of Argentina can appear to be a long drawn out car crash of hyperinflationary events, currency collapses, debt crises, and general market panic.

Argentinians unfortunately are accustomed to this drama, having seen years of high inflation, hyperinflation in 1989-1990, a severe economic crisis in 2001-2002, and many instances of rapid loss of value and confidence in their currency, the peso. For example, during the hyperinflationary period in 1989, prices in Argentina rose by an annualized 5000%. During the 2001-2002 crisis, the peso lost three-quarters of its value at the same time that bank accounts across Argentina (in both US dollars and pesos) were more or less frozen.

With the local population accustomed to rapidly escalating prices, evaporating savings and a plummeting peso, Argentinians have on a number of occasions done what everyone across the world eventually does when confronted with this same problem: they buy hard currencies and gold.

And when prevented from buying currencies such as the US dollar due to government imposed capital controls, banking restrictions or bank account freezes (the Corralito), Argentinians take the only available option – they flock to buy physical gold as a form of saving and wealth preservation, buying locally refined gold bars and coins from banks such as Banco de la Ciudad in Buenos Aires. Popular coins include Mexican and Chilean gold bullion coins, South African Krugerrands and British gold Sovereigns.

Transacting in gold – Libertad Street, Buenos Aires. Source: Lanacion

And since they are accustomed to economic crises, Argentinians also hold gold items such as gold rings and gold jewelry as a form of savings. This is because when prices are spiraling and the currency collapsing, Argentinians know from experience that gold is one of the few things that keeps its value. As gold’s value in the local peso adjusts upwards, gold holders can readily sell their gold when needed in such informal gold trading districts as Libertad Street in Buenos Aires.

With a plunging peso and reignited inflation, Argentina could soon be on the verge of another crisis. But as much as Argentinians are so used to crises and inflation, so too are they accustomed to holding physical gold, as a way of raising emergency money, and as a way of preserving their accumulated wealth.

Venezuela – Gold the ‘go to asset’ in ongoing chaos

One place which is not on the verge of a crisis, since it is actually in one, is fellow South American nation Venezuela. Marked by a collapsing currency, hyperinflation, banknote scarcity, social unrest and shortages of essentials, gold has replaced paper currency across most aspects of Venezuela’s economic life as a means of payment, as a form of barter to acquire goods and services, and in some cases literally for day-to-day survival.

Sometimes it’s a direct exchange of gold for goods or food, but in Venezuela, gold is also money. For example, in the capital Caracas, in the central El Silencio district, citizens flock to the gold dealers who trade on the streets around the Esquinas of Padre Sierra, La Pedrera and La Bolsa. Amid the hyperinflation and rapid price rises, even previously well-off families and pensioners are now forced to sell their valuable gold jewelry and family treasures to supplement their incomes.

Caracas – Tips for the waiters in worthless bolivars. Source: LaPatilla

Venezuelans also sell their gold in neighboring Columbia. For example, in the country’s western states of Táchira, Zulia, and Trujill near the Columbian border, thousands of Venezuelans swarm into Columbia daily to sell their gold for a better and more certain price in Columbian pesos than they would get in the constantly inflating and worthless Venezuelan bolivar. Typical sales are about 20 -30 gram of gold according to Columbian jewellers.

Across in the east of Venezuela in the industrial centres of Puerto Ordaz and Guayana City, which is the gateway to the Arco Minero del Orinoco gold mining area, the entire economy has now switched to gold as the illegal artisanal gold mines in the region flourish and trust in the Venezuelan bolivar has vanished.

Here property buyers now pay estate agents in gold, and even the local university in Puerto Ordaz accepts gold for course payments. Gold is also the medium of exchange further south-east in the El Callao area near the illegal gold mines and those who hold gold can trade it for cars or in fact any item, and if they want to legalise the transaction at a notary public and register the payment in bolivars.

In Venezuela, as the fiat currency bolivar has died and the economy collapsed, gold has emerged to perform the role that it has performed for thousands of years – which is a trusted form of money and a real form of wealth. In Venezuela’s case also, gold has become a survival mechanism for the struggling population.

Zimbabwe – Grams of gold for a loaf of bread

Beyond Venezuela, hyperinflation has reared its ugly head in another troubled economy – Zimbabwe (Once known as Rhodesia ~ Ed.). Ravaged by dictatorship, corruption, election fraud, and economic collapse, the failed state of Zimbabwe has come to represent one of the world’s best-known cases of modern hyperinflation in the midst of famine and food shortages.

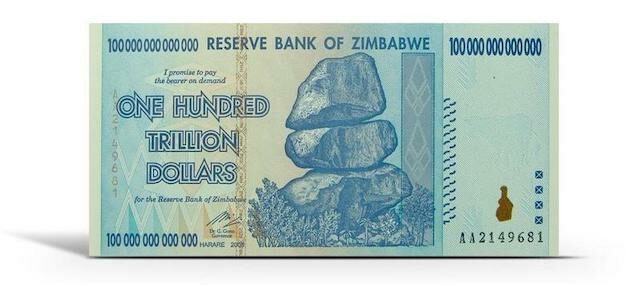

After years of economic mismanagement and uncontrolled government expenditure, Zimbabwe spun into official hyperinflation in 2007 due to the classic cause of money printing followed by more money printing. By mid-2008, Zimbabwe’s annual inflation rate had reached 231 million percent, and between 2007 and 2008 the Zimbabwean dollar lost 99.9% of its value.

Insanity – 100 trillion Zimbabwean dollars

In such a hyperinflationary environment, the wealth and savings of ordinary Zimbabweans, who hadn’t much to begin with, were totally wiped out, with spirallng prices and resulting price controls leading to real hardship in the form of food shortages and even famine. With a collapsed local currency, the Zimbabwean economy had to adapt to barter and trade in foreign currencies and in gold, with food suppliers in many places only accepting gold.

Although a gold resource rich country, Zimbabwe’s local population, which on the whole did not have any experience or inclination to hold gold as a survival mechanism, found themselves forced to resort to illegal gold mining in disused mines or panning for gold in rivers just to acquire even tiny quantities of gold to trade for food.

Pathetically, even larger denomination Zim dollars (such as Z$ 50,000 notes) were so worthless that they were only good for wrapping up the small quantities of gold that the illegal miners found. As for the gold panners, they sifted through tonnes of soil every day, in the attempt to find enough gold just to buy a loaf of bread. The alternative was starvation.

Sam Chakaipa who fled from Zimbabwe after 2008 recalls:

“If you needed cooking oil, you had to exchange gold, if you needed soap, you have to trade it for gold, if you needed grain, you had to have gold. It was 0.1 grams of gold for a loaf of bread, 0.1 grams of gold for a tin of grain, they only accepted gold. Without 0.3 grams of gold a day you would not survive. Without gold you would have died.”

In Memory of Robby Noel of Rhodesia.

Zimbabwe will forever be ever known as the first country to experience hyperinflation in the twenty first century. Peak madness was reached in January 2009 with the printing of a Z$100 trillion note, the world’s largest currency denomination ever issued. Two months later in March 2009 the Zimbabwean central bank abandoned the Zim dollar and moved to dollarize the economy, using the US dollar as its official currency.

But this 10-year dollarization experiment, which was itself a smoke and mirrors trick of the Zimbabwean government, has itself now been abolished, and foreign currencies have now been banned as legal tender. There is now nothing to stop Zimbabwe from firing up the printing presses one more time as it has done in the past. With inflation soaring again, Zimbabwe is potentially on the verge of its hyperinflation 2.0. Those who have gold will be prepared for such a crisis. But those who do not have gold will unfortunately repeat the mistakes of the past.

NOTE: In the Spring of 2024, Zimbabwe Launched a New Gold-Backed Currency – ZiG. Apparently they woke up! ~ Editor

Conclusion

Although each of the above examples are different, they all illustrate the power of gold in times of crises and emergency, a universal currency that is universally accepted and recognized, a universal asset that is borderless, liquid, and portable. In Vietnam, gold bought freedom of passage across international borders, with refuges using portable gold wealth to pay fares and as emergency money to start new lives.

“Gold, Mr. Bond?”

In South Korea, an entire nation helped to rescue its economy using the only widely held asset which had held value and which was internationally liquid. Beyond the nationalism and patriotism, most Koreans sold their gold, albeit at a lower than market price, so for them too gold was emergency money as their economy imploded, a store of value that worked as expected and when expected.

Likewise in Argentina, Venezuela, Zimbabwe and Vietnam, physical gold was a safe haven and financial insurance for those that had the foresight to held it. Gold fulfilled its role of saving for those who had held it, a role that fiat currencies utterly failed in. Gold also played the role of medium of exchange in all of these situations, when trust in paper currencies had died.

The causes may differ – hyperinflation, death of paper currencies, economic mismanagement, capital controls, wars – but the outcome is always the same. People and economies instinctively turn to the ultimate asset gold as a safe harbor in times of crisis and emergency. Because only gold persists as a store of value and is trusted as a medium of exchange. Gold allows choices that are not available to those who do not hold gold. In crises, only gold provides economic freedom and liberty.

Written by Ronan Manly and published by Zero Hedge ~ November 6, 2019

[Got physical… close at hand?]

Let’s do something about that…

Contact Jeffrey Bennett, your personal representative with 35 years in the precious metals markets.

Contact Jeffrey Bennett, your personal representative with 35 years in the precious metals markets.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

Call or TEXT: 1 – 602 – 799 – 8214

kettlemoraineltd@cox.net