As I am sure you are aware, we have entered tumultuous times. In this article we are going to consider the Big Picture and what it means to us as investors.

As I am sure you are aware, we have entered tumultuous times. In this article we are going to consider the Big Picture and what it means to us as investors.

The core of the problem facing the financial system is debt saturation and this is much more of a problem for the western world than for the East for the reason that the West, especially the US, has eviscerated its productive capacity – in the US most production has been moved overseas to places like China which works fine until the day arrives when they are no longer prepared to accept piles of intrinsically worthless paper in exchange for goods and services.

For many years interest rates in the US and elsewhere were almost zero and this created an easy money environment which fostered an explosion in debt financing – for everything, and as a result debt of all kinds ballooned to fantastic levels which was only sustainable until interest rates rose. Well, they did rise and the Western financial system, crippled both by massive debt and soaring interest payments, was heading rapidly for the rocks. This was one reason they did the Covid scam-demic, which provided an excuse to create trillions of dollars out of thin air for emergency financing and damage and destroy many thousands of small businesses so that big corporations could mop up all their business. Debt creation went parabolic and it continues to with the Fed now creating a trillion new dollars every 100 days. Nothing creates a better excuse for emergency debt creation than war, which is a big reason why wars are proliferating around the world.

Economic depression and war go hand in hand, the first leads to the second. That’s a reason why the economic depression of the 30’s was followed by the second world war – war serves to distract the masses from the failings of their government, since everything can be blamed on the enemy, and it also provides the perfect excuse to create more and more money or debt to fund the war. As Gerald Celente says “When all else fails, they take you to war”.

What is precipitating the current massive crisis is the confluence of debt in the Western world having risen to such critical extremes that even at low interest rates it has become unserviceable with the East, where most productive activity is now centered, basically saying “You sort it out yourselves, we’re going our own way”. That’s what the BRICS is all about and it is expanding fast as new members flock to join and many countries are inclined to head in this direction as they are tired of being threatened by the US with sanctions or even military force and they are doubtless well aware of how the US stole a large amount of money from Russia.

What is precipitating the current massive crisis is the confluence of debt in the Western world having risen to such critical extremes that even at low interest rates it has become unserviceable with the East, where most productive activity is now centered, basically saying “You sort it out yourselves, we’re going our own way”. That’s what the BRICS is all about and it is expanding fast as new members flock to join and many countries are inclined to head in this direction as they are tired of being threatened by the US with sanctions or even military force and they are doubtless well aware of how the US stole a large amount of money from Russia.

It cannot be overstated how serious these developments are for the US empire. The BRICS countries and others are no longer buying US Treasuries which means that the Fed has to take up the slack and monetize them and it has to create trillions of new dollars for this purpose, which eventually feed into the system and stoke rapidly accelerating inflation. This is why inflation is running red hot in the US and set to get white hot, regardless of the government rigging the inflation data to make it look a lot less than it is. Starved of capital inflows, the US is staring ruin in the face, and it is not lost on many people that the current President of the US is the perfect symbol of a country in terminal decline.

With the passage of time it is becoming increasingly difficult for the US government to fund public services and its huge military machine with the 800 or so military bases around the world that all have to be maintained. This is why the empire building Neocons are scrambling to fulfil their long held objectives like overrunning Russia to neuter it and plunder its resources and then threaten China, subjugate Europe as a collection of vassal States (they already control its politicians) and take down Iran partly in order to keep Israel happy and also to exert dominion over the Mid-East. By this exercise of raw power they intend maintaining the dollar as the global reserve currency by force. The problem they have is some of these countries have no intention of being turned into fields of rubble like Iraq and Libya and they have the power to not just defend themselves but turn the US into a radioactive wasteland. This is what makes the current situation so dangerous. Russia has shown exemplary restraint, for despite being endlessly provoked by the Ukraine and the West launching long-range missiles at infrastructure and strategic targets in the country, it has refrained from leveling a western city with a nuke, which it could easily do. Instead it appears to be playing the long game and waiting for the Western financial system to collapse, destroyed by a combination of impossible debts, lack of manufacturing capacity and foreign capital inflows drying up and with respect to the latter a big reason for this to happen is that many countries, having observed the US’ unconditional support for Israel’s genocide of the Palestinians, have hardened their attitude and know that the way to “take the wind out of their sails” is to stop playing along with the dollar reserve currency system.

We should also be aware that if war flares up between Israel and Lebanon then it is likely to spread across the Mid-East which could cause a huge spike in the oil price that will be another nail in the coffin of the world economy.

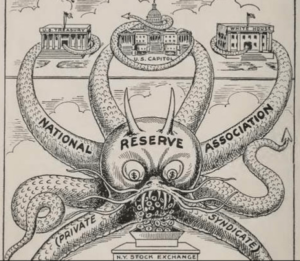

You may well ask “If the US economy is in freefall (which it is) then why do US stockmarkets keep making new highs?” The explanation for this is very simple. The vast majority of stocks are held by a relatively small number of very wealthy people. The Federal Reserve, which exists to serve its own interests and the interests of the other very wealthy people, not surprisingly conspires to keep the stock market propped up at public expense. This it does through the simple mechanism of creating trillions of dollars out of thin air on a more or less continuous basis to use for the purpose of propping up both the debt market and stock markets – it engages in “window dressing” operations to rig the índices by buying the biggest most important stocks. This clearly benefits the very wealthy and “the man in the street” picks up the tab for it all via inflation down the road, since the increase in dollars reduces their purchasing power. The Fed should therefore be seen for what it is – it is a wealth transfer engine whose purpose is to move money and wealth up the pyramid from the poor and middle class at its bottom and middle layers up to the wealthy elites at the top.

You may well ask “If the US economy is in freefall (which it is) then why do US stockmarkets keep making new highs?” The explanation for this is very simple. The vast majority of stocks are held by a relatively small number of very wealthy people. The Federal Reserve, which exists to serve its own interests and the interests of the other very wealthy people, not surprisingly conspires to keep the stock market propped up at public expense. This it does through the simple mechanism of creating trillions of dollars out of thin air on a more or less continuous basis to use for the purpose of propping up both the debt market and stock markets – it engages in “window dressing” operations to rig the índices by buying the biggest most important stocks. This clearly benefits the very wealthy and “the man in the street” picks up the tab for it all via inflation down the road, since the increase in dollars reduces their purchasing power. The Fed should therefore be seen for what it is – it is a wealth transfer engine whose purpose is to move money and wealth up the pyramid from the poor and middle class at its bottom and middle layers up to the wealthy elites at the top.

It has always done this from its inception in 1913, but its biggest coup that really accelerated the process was when it achieved the abandonment of the gold standard so that fiat could be created in unlimited quantities, which it did via the politicians that are its servants.

With the system set at best to limp along with ever increasing inflation trending in the direction of hyperinflation or at worst completely implode in smouldering ruins if the debt market melts down, the obvious way to preserve capital is to own assets with intrinsic value such as commodities, farmland (if not already owned by Bill Gates) or collectables.

This is why you can sleep easy in your bed if you have a decent portion of your assets in gold and silver, regardless of short and medium-term gyrations in their paper (fiat) price and our investment strategy going forward will be based on an understanding of this reality.

Written by Clive P. Maund and published on Clivemaund.com ~ July 05, 2024

[Got physical… close at hand?]

Let’s do something about that…

While there’s no guarantee on any investment, it is clear we have entered a period of great economic uncertainty. In recent economic news, several banks and major financial institutions have filed for bankruptcy leading our country into what is likely a recession period. The US dollar is losing significant value caused in part by monetary inflation, overspending, and fading market confidence. Some economists speculate that the US will consider a centrally controlled, government issued, cryptocurrency as a means to promote Modern Monetary Theory.

Throughout history, as fiat currencies have come gone, gold has stood the test of time again and again, and there’s reason why… Give Gold a Look in These Uncertain Times

Always and again the magic of money presents us with problems. These problems change constantly. Time after tiine experience teaches us that there is no universally-valid system by means of which monetary problems may be solved. Every new situation demands new deliberations, new measures, new insights, new ideas. Each of these ideas must be informed by and subservient to the sole and single purpose of maintaining the soundness of the currency. ~ Hjalmar Schacht

Seeking out the most efficient and most secure route to owning gold, and converting it into widely-accepted currency, is the next best thing to enjoying gold-backed currency.

In a world of central bankers hell-bent on devaluing your savings you need your own private gold standard.

Call us!

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

602 – 799 – 8214

kettlemoraineltd@cox.net