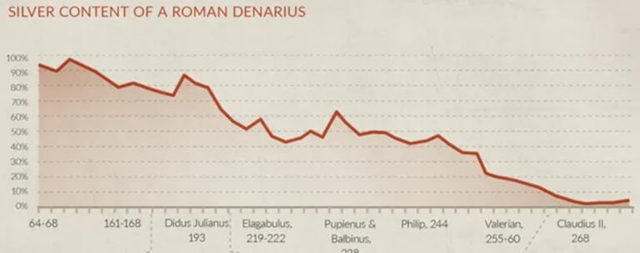

Well, here’s an interesting historical repeat. Apparently, it took the Roman Empire about 200 years to reduce the value of its currency, the silver Denarius, by 95%. As shown in the chart below, the silver content of the Roman currency had been nearly 100% at the peak of the Empire in 65 AD, but by 268 AD the coin had been clipped and debased so thoroughly that it was comprised of less than 5% silver.

Well, here’s an interesting historical repeat. Apparently, it took the Roman Empire about 200 years to reduce the value of its currency, the silver Denarius, by 95%. As shown in the chart below, the silver content of the Roman currency had been nearly 100% at the peak of the Empire in 65 AD, but by 268 AD the coin had been clipped and debased so thoroughly that it was comprised of less than 5% silver.

Needless to say, inflation became rampant, causing the financial foundation of the Roman Empire to eventually collapse. In the process, future generations and nations got an unmistakable lesson: Debauching the money is absolutely not the road to sustainable prosperity.

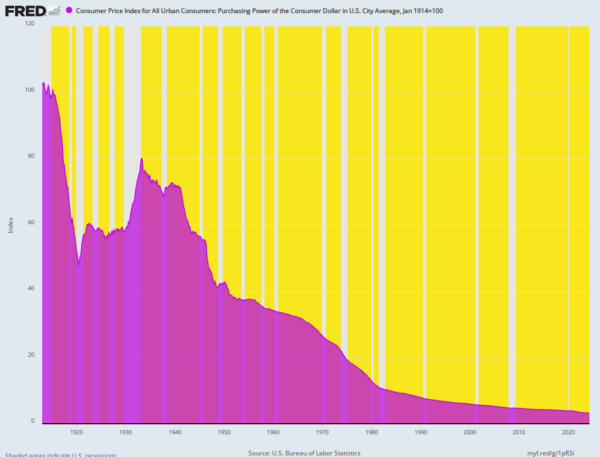

Unfortunately, that has not prevented governments from attempting the currency depreciation route again and again. In our own era, the 111 year history of the Federal Reserve provides a striking case in point. In roughly half the time it took the Romans, the Fed has managed to accomplish the same 95% depreciation of the US dollar.

Unfortunately, that has not prevented governments from attempting the currency depreciation route again and again. In our own era, the 111 year history of the Federal Reserve provides a striking case in point. In roughly half the time it took the Romans, the Fed has managed to accomplish the same 95% depreciation of the US dollar.

That’s right. The purchasing power of the consumer dollar as measured by the CPI has dropped from 100 cents when the Fed opened for business in 1914 to barely 3 cents today.

Index of Dollar’s Purchasing Power Since 1914 As Measured By The CPI

And yet and yet. After the most recent surge of inflation, the Fed is at it again. In today’s Congressional testimony, Chairman Powell as much as claimed victory and implied that the next round of rate cuts would soon commence, perhaps as early as September.

And yet and yet. After the most recent surge of inflation, the Fed is at it again. In today’s Congressional testimony, Chairman Powell as much as claimed victory and implied that the next round of rate cuts would soon commence, perhaps as early as September.

Reducing policy restraint too late or too little could unduly weaken economic activity and employment,” Powell said as part of his semiannual update on monetary policy. “More good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.”

Let’s not mince words. What in the hell is he talking about?

The implication is that the Fed never has to make amends. If the inflation genie gets out of the bottle and pushes the general price level sharply higher, why the thing to do is to just brake the surge and advise the people to lick their wounds with respect to the depleted value of their savings and the waning purchasing power of their paycheck.

In fact, current Fed policy is simply a one-way ratchet. If inflation exceeds its utterly arbitrary 2.00% target, there is no off-setting correction and restoration of purchasing power. Effectively cumulative inflation is written off as a bad debt.

Unfortunately for main street households and businesses, this embedded inflation-ratchet policy assumes inflation is an equal opportunity cipher. That is to say, even at the Fed’s sacrosanct 2.00% target, the cost of goods and services goes up 2.00% and so, purportedly, wages, rents, profits, interest and all other forms of income rise in lockstep. No one is worse for the inflationary wear – households and businesses just need to keep adjusting both sides of their income statements and balance sheets by the Fed’s preferred PCE deflator and all will be copacetic.

Unfortunately for main street households and businesses, this embedded inflation-ratchet policy assumes inflation is an equal opportunity cipher. That is to say, even at the Fed’s sacrosanct 2.00% target, the cost of goods and services goes up 2.00% and so, purportedly, wages, rents, profits, interest and all other forms of income rise in lockstep. No one is worse for the inflationary wear – households and businesses just need to keep adjusting both sides of their income statements and balance sheets by the Fed’s preferred PCE deflator and all will be copacetic.

That’s absurd on its face, of course. Right from the get go its obvious that borrowers would get a windfall of depreciated debts and savers would suffer severe confiscation of wealth over even a quarter century – to say nothing of the one and two century debauch of the silver Denarius and dollar shown above. In fact, after 25-years at the Fed’s precise 2.00% target, borrowers would be 40% richer and savers 40% poorer than under a regime of true price stability.

Why in the world today’s central bankers insist upon punishing savers and rewarding borrowers is no mystery. They embrace lock, stock and barrel – whether they acknowledge it or not – the horrid Keynesian fallacy that capitalism is inherently defective because humankind is wont to excessively save and hoard when they should be spending freely and living high on the hog.

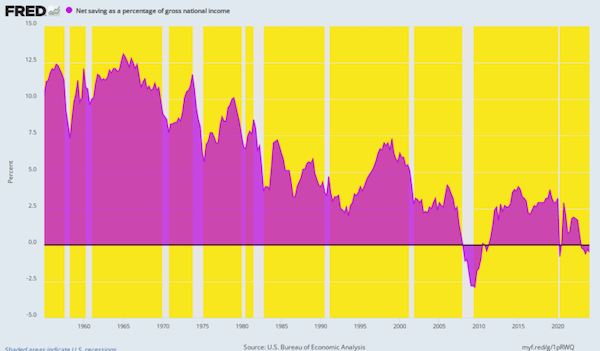

It’s really that simple. Even a decent regard for the truism that economic growth and wealth gains are a function of savings and investment would negate the Fed’s pro-inflation policy on its face. Yet as it has happened, the drastic bias of central bank policy in favor of borrowers in all sectors – government, business, households and finance – has essentially extinguished America’s generation of net national savings.

As shown below, the latter measures the entirety of savings in the household and business sectors minus government borrowings. Yet since the Fed began de facto inflation-targeting in the late 1980s, the net national savings rate has headed steadily toward the zero bound. In fact, during Q1 2024 it was actually -0.5% of GDP – a figure on the opposite side of the universe compared to the +7-10% of GDP levels that prevailed during the heyday of middle class prosperity prior to the era of Bubbles Alan Greenspan and his heirs and assigns.

Needless to say, when there is nothing left in the savings till after governments gorge themselves at the borrowing window, where is the investment for productivity and growth supposed to come from?

In truth, the Fed never troubles itself with the question of savings. If the word is even mentioned at all in its post-meeting communiques it’s in the context of a short-run downward blip in household spending levels owing mathematically to what usually amounts to a tiny and transient increase in the savings rate.

Still, seven decades of data do not lie. Systematically and relentlessly, the Fed’s baleful bias against savers and for borrowers has literally dried-up the US economy’s supply of growth oxygen.

Net National Savings Rate. 1955 to 2024

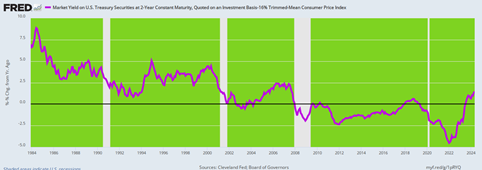

For want of doubt, here is the inflation-adjusted interest rate on a two-years savings instrument, proxied here by the risk-free yield on the two-year UST minus the Y/Y change in the 16% trimmed mean CPI. The chart obviously speaks for itself, but it needs be noted that during the entire 15-year period between July 2008 on the eve of the Great Financial Crisis and July 2023, the geniuses in the Eccles Building had pegged the real yield at negative levels!

For want of doubt, here is the inflation-adjusted interest rate on a two-years savings instrument, proxied here by the risk-free yield on the two-year UST minus the Y/Y change in the 16% trimmed mean CPI. The chart obviously speaks for itself, but it needs be noted that during the entire 15-year period between July 2008 on the eve of the Great Financial Crisis and July 2023, the geniuses in the Eccles Building had pegged the real yield at negative levels!

Even now after what the acolytes at the Wall Street Journal call the most rapid rise in interest rates in two decades, the real yield in May was just +1.4%. So why in the world is that considered onerous – a threat to the Fed’s alleged twin goal of maximum employment?

Stated differently, if the US economy can’t stand real rates peeking above the zero bound at just 1.4% on two-year instruments and is therefore in dire need of a new round of rate cuts, how in the world can the net national savings rate be lifted out of the economic gutter where it now resides?

Of course, the Fed never mentions real interest rates, either, except for the squirrely extractions it derives by comparing yields on inflation-protected treasuries (TIPS) versus their fixed coupon counterparts. But that has absolutely nothing to do with real yields, and merely reflects trading games played by technicians down in the bond pits.

Inflation-Adjusted Yield On 2-Year USTs, 1984 to 2024

Then again, the Fed subscribes to what amounts to bathtub economics. It thinks growth happens when demand is stimulated up to the brim of potential GDP, and that left to its own devices free market capitalism always whiffs by saving too much and spending too little. So cheap interest rates become the instrument of macro-economic stimulus, purportedly goosing demand until the bathtub of spending is full to the brim and economic growth and employment are maximized.

Then again, the Fed subscribes to what amounts to bathtub economics. It thinks growth happens when demand is stimulated up to the brim of potential GDP, and that left to its own devices free market capitalism always whiffs by saving too much and spending too little. So cheap interest rates become the instrument of macro-economic stimulus, purportedly goosing demand until the bathtub of spending is full to the brim and economic growth and employment are maximized.

Alas, in a fully integrated and seamless $110 trillion global economy, the bathtub model of domestic economics is just plain hideous nonsense. Yet here were are again with the Keynesian fools in the Eccles Building itching to restart the printing presses and drive real interest rates and the net national savings rate back into the economic dungeon below the zero bound.

They never learn. Ever!

Written by David Stockman and published by Lew Rockwell ~ July 13, 2024