Thousands of books have been written on personal finance, financial planning, investments, debt management, and the topic of money in general.

Thousands of books have been written on personal finance, financial planning, investments, debt management, and the topic of money in general.

Upon reading such books, a common theme becomes obvious: Personal finance is a straightforward discipline, at least in theory.

It boils down to harnessing a few principles that govern the generation of wealth: “Spend less than you earn.“ “Own more than you owe.” “Quickly pay-off high-interest debt.“ “Pay yourself first.” You’ve heard these principles before. Simplicity always prevails.

But if these basic principles are so easy to understand, why is it that many people, Canadians and Americans alike, are having problems with their finances?

Why can’t we manage to control our spending behaviour and save some money? Even worse, why do we have a huge appetite for spending and continue to overspend?

It’s because there are several other mental, behavioural, and social factors at play that influence our behaviour, and I’m going to outline a way to put them into perspective and start dealing with them.

We can always fault the economy, the government, or inflation, of course. These variables also impact our finances. But if our goal is controlling spending behaviour, balancing our budget, and getting rid of debt – without the emotional pain and burden normally associated with it – we certainly need to go beyond those and look deeper.

We should dismantle some of our current beliefs about money and consciously start evaluating our spending choices from the lens of priorities rather than impulses. The key is to bring spending behaviour to a conscious state, and start scrutinizing it with full awareness and self-control.

In this article I’m going to expound on a way to do this, including using Benjamin Franklin’s method to list, rank, and prioritize your expenses, purchases, and saving needs.

The truth is, if you don’t consciously make your own list of spending priorities, someone else is going to try to do it for you (i.e., marketers, advertisers, the urge to “keep up with the Joneses,” etc.), so be on your guard and don’t let that happen.

Ben Franklin’s Wisdom on Spending

In several of his writings, including his “Poor Richard’s Almanack“ series, Benjamin Franklin wrote about the “necessaries, conveniences, and superfluities” of life.

Necessaries are “things absolutely necessary.” Conveniences are things that make your life easier and more comfortable, but that you can live perfectly well without. And superfluities are luxuries you should avoid at all costs.

Franklin’s advice in “Poor Richard Improved, 1756“ was simply to limit spending to necessities and maybe only a few conveniences and save the rest.

“You spend yearly at least Two Hundred Thousand Pounds, ’tis said, in European, East-Indian, and West-Indian Commodities: Supposing one Half of this Expence to be in Things absolutely necessary, the other Half may be call’d Superfluities, or at best, Conveniences, which however you might live without for one little Year, and not suffer exceedingly,” he wrote. He then listed some ideas on how to find ways save.

He even cautioned about the dangers of pride and vanity, and avoiding debt to pay for the luxuries of life.

“But what madness it must be to run in debt for these superfluities? We are offered, by the terms of this sale, six months credit; and that, perhaps, has induced some of us to attend it, because we cannot spare the ready money, and hope now to be fine without it. But, ah! think what you do when you run in debt; you give to another power over your liberty,” he wrote.

Whether you can save half of your current expenses as Franklin suggested is another question. We all face different realities and situations. But his message was clear: Be conscious about how much you’re spending and prioritize accordingly so you are able to save money. Live within your means.

The Role of Beliefs and Notions

In the book, “Uncommon Cents: Benjamin Franklin Secrets to Achieving Personal Financial Success,” co-authors Lynn G. Robbins, Dennis Web, and Lisa Vermillion expand on Franklin’s expenses classification and wisdom on personal finances, and distill it into tips we can use today. Specifically, they talk about two useful concepts for prioritizing expenses: “The Belief Window” and “The Spending Window.”

“Projected onto each individual’s Belief Window are beliefs about what we should and what we should not purchase, and how much money should be spent on each item,” they write.

To help you see your own beliefs more clearly, they “developed a matrix called ‘The Franklin Spending Window.’ It is a simple method for seeing desired purchases in relation to your priorities.”

In a way, your “Belief Window” comprehends all your current beliefs about money – your preferences, choices, and ranking of priorities. Your “Belief Window” has been shaped during your entire life by internal and external factors such as lifestyle, background, and social circle. These are beliefs and notions that are ingrained in your mind and affect every spending choice you make.

The “Spending Window” on the other hand, helps you see your current expenses and desired purchases in relation to your priorities. It brings perspective. This is important because if you ever hope to change your spending behaviour, you need to define your priorities.

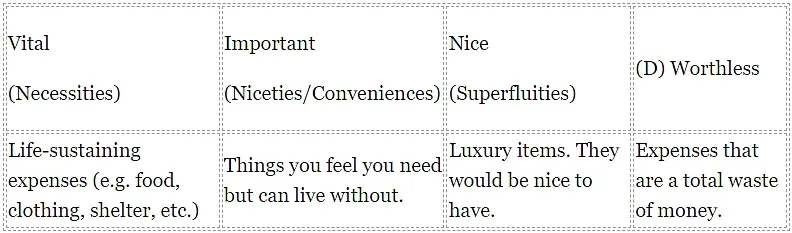

For this, the authors use the matrix they developed to help you classify and rank your current expenses, purchases, and saving needs into four main categories: “Vital,” “Important,” “Nice,” and “Worthless.”

The four categories to rank your expenses, and their related Franklin equivalence, from “Uncommon Cents.”

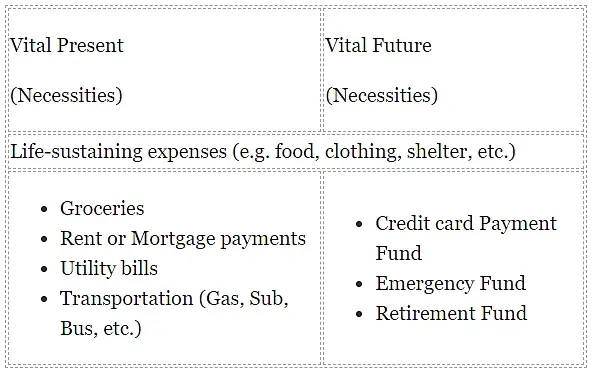

The authors also suggest making the distinction between “present” and “future,” which they call “Vital Present” and “Vital Future.” You classify as “present” every item that occurs within a 12-month period, and as “future” everything beyond a year.

The following table is an example of how it would look for your vital expenses, present and future, but to make the exercise complete, you should do the same for the other categories defined in the book, i.e., “Important,” “Nice,” and “Worthless.”

The “Uncommon Cents” authors consider saving for retirement (i.e., RRSP/TFSA in Canada or IRA/401-K in the United States) as a “Future Vital,” so make sure you allocate a portion of your income to this item first before allocating to the “Important” or “Nice” category, which could be a home repair and/or upgrading your TV. This is in line with the principle of “pay yourself first.”

The “Uncommon Cents” authors consider saving for retirement (i.e., RRSP/TFSA in Canada or IRA/401-K in the United States) as a “Future Vital,” so make sure you allocate a portion of your income to this item first before allocating to the “Important” or “Nice” category, which could be a home repair and/or upgrading your TV. This is in line with the principle of “pay yourself first.”

I would add that building an emergency fund or allocating money toward paying down your credit card debt would also apply here. This will give you more comfort than spending the money on items you don’t need or can live without. If your income is not enough to reasonably allocate a portion to your retirement account or to the building of an emergency fund, that probably means you are spending more than you should. You are living beyond your means.

This exercise is very useful because it helps you see the big picture in one place—your current and future expenditures in relation to one another. It can dramatically affect the way you perceive potential expenses or purchases, which in turn will help you control your spending and save more money.

The “Uncommon Cents” authors said Franklin “saved so much during these early years, that he was subsequently free to enjoy both niceties and superfluities.” This is the “Delayed Gratification” principle at play. One way to apply this principle in your life would be moving items from “Current” to “Future” (e.g., putting off buying that new TV until next year), or deprioritizing items from “Important” to “Nice.” For example, having three streaming subscription services would be for some “Important” while for others it would be “Nice” (i.e., a luxury).

The “Spending Window” possesses the power to change your financial situation “because it brings the subconscious forward into the conscious mind where you can see it, work with it, and influence it,” the book says.

“As long as a thought is subconscious, we cannot control it – we act as if on autopilot. On the other hand, when we bring spending priorities and emotions forward into the conspicuous mind, we can change and direct them.”

One critical aspect of this method for being successful is that you have to actually do the exercise. Use pen and paper or a file on your computer, whatever you prefer. You can’t neglect this step. This is the typical exercise where people say “Oh, I already know that,” but they avoid doing it and continue overspending and getting buried in debt. At the end of the day you’ll still have to have a harsh conversation with yourself and face reality. Better to have it sooner than later.

“The more you can bring your money decision-making process into conscious awareness, the more control you have over those decisions,“ the ”Uncommon Cents” authors write.

You can be misled. This approach will save you from falling into the emotional spending trap.

“The spending window is an exercise that brings both the present and future into focus so that we can have greater control over both.”

Why You Shouldn’t Wait to Implement the ‘Spending Window’

There are a couple of critical reasons why bringing your spending behaviour into conscious awareness could be the most important financial decision in your life.

First, managing your life in a way that allows you to spend less than you earn and create regular savings (a surplus) is the only way to increase your financial reservoir. You can’t grow your net worth if you don’t have money to invest.

Second, and even more important than financial reasons, this is really about our personal growth. Developing self-control or self-restraint in spending behaviour (and in other aspects of your life as well) is a critical element of your personal character. It will make you stronger and help you to better navigate any tough times ahead.

Indirectly, I’ve learned that this could also be an element of our spirituality. I have the conviction that God wants us to live with self-control. Our thoughts and conduct define who we are, wouldn’t you agree?

If you want to implement this financial approach right away, you only need a few sheets of paper.

Use one to make a list of your expenses, planned purchases, and saving requirements. List everything that comes to mind and list your monthly budget for each item.

Then, determine in which of the four categories the item should go, such as “Vital,” “Important,” “Nice,” or “Worthless.” You can always postpone “Important” and “Nice” items to make room for “Vital” ones, including saving for retirement or building an emergency fund. If you want, buy a copy of “Uncommon Cents“ to see the matrix and learn more about Ben Franklin’s wisdom.

When you see the matrix visually, it will be easier to rank, allocate to categories, prioritize or postpone, and in general make conscious, wise decisions.

Written by Daniel Rios for The Epoch Times ~ August 19, 2024