8 Places That No Longer Accept Cash in 2025

8 Places That No Longer Accept Cash in 2025

Not long ago, cash was considered the universal form of payment. Fast-forward to 2025, and a growing number of businesses and venues across the U.S. have completely phased it out.

Whether driven by speed, security, or sheer convenience, many retailers now require credit, debit, or digital wallet payments.

While some applaud the cashless trend for cutting down on theft and streamlining transactions, others argue it excludes those without access to banking. If you still like paying with bills and coins, you might want to avoid these eight places that no longer accept cash.

Wait until YOU Check out THIS list… (Continue to full article)

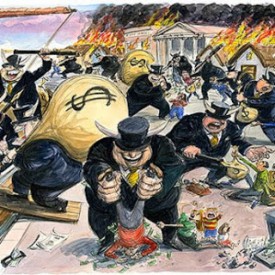

The Looting Bankers

10 Questions Bank Tellers Are Now Required to Ask You

Walking into a bank branch used to be a straightforward affair, but you may have noticed that interactions with tellers have become more inquisitive lately.

Tellers are now trained, and in many cases required, to ask a series of questions that go beyond a simple “how can I help you?” This isn’t because they are being nosy; it’s a result of stricter federal regulations designed to combat financial crimes like money laundering and fraud.

Understanding why they are asking these questions can make your banking experience smoother and help you appreciate the security measures in place.

“This isn’t because they are being nosy”??? The Hell it isn’t. BE CAREFUL!!! (Continue to full article)

Retired Workers to See Frustrating Change to Medicare in 2026

Retired Workers to See Frustrating Change to Medicare in 2026

It’s only an estimate — but if history is any guide, it’s one you’ll want to watch.

Tucked deep inside the 267-page 2025 Medicare Trustees report is a projection that the standard monthly Medicare Part B premium could rise to $206.50 in 2026.

That’s an 11.6% jump from the $185 premium set for 2025 — and it would be the largest single-year increase since 2016, when premiums climbed 16.1%, from $104.90 to $121.80.

This estimate, however, is not the final number. In fact, it could be even higher… (Continue to full article)

US Dollar Plunges in Worst New Year Collapse in 50 Years Sparking Panic Over Rising Prices

US Dollar Plunges in Worst New Year Collapse in 50 Years Sparking Panic Over Rising Prices

Analysts have sounded the alarm after the value of the U.S. dollar suffered its worst drop in nearly five decades. The sudden plunge in value is reportedly likely to trigger a price hike in everyday items as well as cause visitors to the country to experience a jump in expenses.

According to FactSet, the U.S. dollar has plunged almost 11%. ABC News reported that investors triggered the sudden decrease out of fear of inflation, which could devalue the currency.

It was also reported that the devaluing of the dollar comes as the U.S. Congress is set to implement Donald Trump’s “Big, Beautiful Bill,” which is set to worsen a decades-long trend of expanding the debt that the U.S. owes to other countries.

Panic surrounding the dollar also comes as Trump continues to fluctuate on his trade policy with tariffs… (Continue to full article)

What You Should Know About Social Security if Your Spouse Passes Away

What You Should Know About Social Security if Your Spouse Passes Away

Losing a spouse is one of life’s most painful and challenging experiences. Along with the emotional toll, it can also bring financial uncertainty. Social Security is here to support you during this difficult time.

You may be eligible for Social Security survivor benefits after your spouse passes away – even if you’re divorced. Your eligibility depends on a few key factors Administration, the idea of privatizing Social Security has reared its head once again… (Continue to full article)