If the United States’ central bank, the Federal Reserve, stops printing money, the stock market will crash. However, the continual printing of money could cause a crash of its own. Either way, we are in a lose-lose situation when it comes to the decisions made by central bankers.

If the United States’ central bank, the Federal Reserve, stops printing money, the stock market will crash. However, the continual printing of money could cause a crash of its own. Either way, we are in a lose-lose situation when it comes to the decisions made by central bankers.

Will the stocks crash in 2019? Or 2020? Perhaps, and there’s an easy way to tell. “If the Fed stops printing money, stocks will crash. If central banks print money and the global monetary supply increases, we could see stocks rising. If central banks decide to print less money or even contract the money supply, stocks will fall. End of story,” said David Quintieri of The Money GPS.

Federal Reserve chairman Jerome Powell told reporters that after the Fed left its main rate unchanged, their policy stance is “appropriate right now” and “we don’t see a strong case for moving in either direction.” The central bank is urging patience.

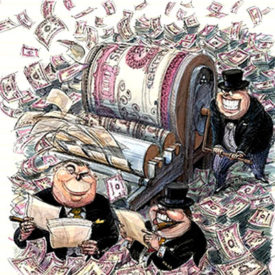

Central banks completely control everything that’s happening to the stock market. This is out of the hands of everyone else. When the bankers decide to tank the market, they can do so. When they decide to print more money, the stock market will go even higher.

But the Fed “fears” low inflation with Powell recently calling it “one of the major challenges of our time.’’ That could result in yet another rate cut and more money printing, and an even higher place for the stocks to fall from. The Fed is intentionally devaluing the debt that they owe by making low inflation seem bad. How is low inflation bad? Not one single person would be upset if they paid the same amount for a gallon of milk today as their parents did in 1985.

Quintieri is the author of The Money GPS: Global Economic Collapse. The Financial Crisis [The Great Recession] was intentionally caused by those in control behind the scenes. They designed the monetary system using private central banks, forcing the public to accept their fiat currency as legal tender. They loan it out at interest, creating a perpetual downward spiral of debt slavery.

Quintieri is the author of The Money GPS: Global Economic Collapse. The Financial Crisis [The Great Recession] was intentionally caused by those in control behind the scenes. They designed the monetary system using private central banks, forcing the public to accept their fiat currency as legal tender. They loan it out at interest, creating a perpetual downward spiral of debt slavery.

In The Money GPS, Quintieri covered the entire spectrum.

Written by Mac Slavo for SHTF Plan ~ May 20, 2019