If any pair of investors had the financial clout and lack of scruples required to engineer the bedlam of Black Friday, it was Jay Gould and Jim Fisk. As president and vice president of the Erie Railroad, the duo had won a reputation as two of Wall Street’s most ruthless financial masterminds. Their rap sheets boasted everything from issuing fraudulent stock to bribing politicians and judges, and they enjoyed a lucrative partnership with Tammany Hall power player William “Boss” Tweed.

If any pair of investors had the financial clout and lack of scruples required to engineer the bedlam of Black Friday, it was Jay Gould and Jim Fisk. As president and vice president of the Erie Railroad, the duo had won a reputation as two of Wall Street’s most ruthless financial masterminds. Their rap sheets boasted everything from issuing fraudulent stock to bribing politicians and judges, and they enjoyed a lucrative partnership with Tammany Hall power player William “Boss” Tweed.

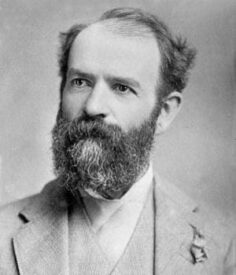

Gould in particular had proven an expert at devising new ways to game the system, and was once dubbed the “Mephistopheles of Wall Street” for his preternatural ability to line his own pockets. “[Gould’s] nature suggested survival from the family of spiders,” historian Henry Adams later wrote. “He spun huge webs, in corners and in the dark…he seemed never to be satisfied except when deceiving everyone as to his intentions.”

Jay Gould

In early 1869, Gould spun a web aimed at conquering what was perhaps the most audacious target in the American financial system: the gold market. At the time, gold was still the official currency of international trade, but the United States had gone off the gold standard during the Civil War, when Congress authorized $450 million in government-backed “greenbacks” to fund the Union march to war. Competing currencies—gold and greenbacks—had been in circulation ever since, and Wall Street had formed a special “Gold Room” where brokers could trade them. Since there was only around $20 million in gold in circulation at any given time, Gould wagered that a speculator with deep enough pockets could potentially buy up huge amounts of the precious metal until they had “cornered” the market. From there, they could drive up the price and sell for astronomical profits.

Gould’s gold ploy faced one very significant hurdle: President Ulysses S. Grant. Since the beginning of Grant’s tenure as chief executive, the U.S. Treasury had continued a policy of using its massive gold reserves to buy back greenbacks from the public. This meant that the government effectively set the value of gold: when it sold its supply, the price went down; when it didn’t, the price went up. If a speculator like Gould tried to corner the market, Grant could simply order the Treasury to sell off huge amounts of gold and drive the price through the floor. For his gold scheme to work, Gould needed President Grant to keep a tight grip on his purse strings.

Jim Fisk

“The Mephistopheles of Wall Street” found an elegant solution to the government problem in the form of Abel Corbin, a former Washington bureaucrat who happened to be married to Ulysses Grant’s sister, Jennie. In the spring of 1869, Gould befriended Corbin and persuaded him to help with his secret plan to corner the gold market. As a quid pro quo, he deposited a cool $1.5 million in gold in an account under Corbin’s name. The president’s brother-in-law sprang into action that summer. To ensure Gould would have an ear on the government’s actions, Corbin used his political influence to help install General Daniel Butterfield as the U.S. sub-treasurer in New York. In exchange for providing advance notice of any government gold sales, Butterfield was given a $1.5 million stake in the scheme and a $10,000 loan. Corbin also used his family connections to cozy up to Grant and try to persuade him that high gold prices would benefit U.S. farmers who sold their harvest overseas. He arranged for Gould to meet with Grant to discuss the matter, and even helped anonymously author an editorial in the New York Times claiming that the president had reversed his financial policy. The constant wheedling eventually paid off. During a meeting with Corbin on September 2, Grant confided that he had changed his mind on gold and planned to order the treasury not to sell over the next month.

Jay Gould and a few other conspirators had been secretly stockpiling gold since August, but upon learning that the fix was in, they disguised their identities behind an army of brokers and proceeded to gobble up all the gold they could. Gould also enlisted the help of his fellow financial buccaneer Jim Fisk, who promptly dropped $7 million on gold and became one of the cabal’s leading members. As the Gould-Fisk ring increased its stake, gold’s value climbed to dizzying heights. In August, a $100 gold piece had sold for around $132 in greenbacks, but only a few weeks later, the price spiked as high as $141. In Wall Street’s Gold Room, distraught speculators and gold short-sellers suddenly found themselves caught in a vise. Rumors spread about a nefarious group of investors who were trying to “bull,” or drive up, the gold market, and many began calling for the Treasury to intervene by selling its gold reserves. Fisk and Gould kept mum, but by that point, they personally owned a combined $60 million in gold—three times the amount of the public supply in New York.

Ulysses S. Grant

Gould’s shopping spree continued unabated until September 22, when he learned from Abel Corbin that the president was on to them. Corbin had written Grant a letter looking for assurance that he remained firm on his new, non-interventionist gold stance, and the note had finally aroused the president’s suspicions that his brother-in-law might be involved in a gold scheme. Furious at having been manipulated, the president had gotten his wife to write a response chastising Corbin and warning that Grant would not hesitate to “do his duty to the country” and break the corner. Gould was stunned, but in true robber baron fashion, he neglected to divulge the new information to Fisk or his other partners. Instead, when the buying bonanza resumed on September 23, he began secretly selling off as much of his own gold as he could.

By September 24, 1869 – the day that would become known as “Black Friday”—the hubbub over gold had reached a fever pitch. Mobs of spectators and reporters gathered near Wall Street, and many of the Gold Room’s indebted speculators walked to work like men on their way to the gallows. Gold had closed the previous day at $144 ½, but shortly after trading resumed, it took a tremendous leap to $160. Unaware that the game might soon be up, Fisk continued buying like a madman and bragged that gold would soon top $200.

In Washington, D.C., Ulysses S. Grant resolved to bust Gould and Fisk’s corner on the gold market. Shortly before noon, he met with Treasury Secretary George Boutwell, who had been following the chaos via telegraph. After a brief conversation, Grant ordered Boutwell to open his vaults and flood the market. A few minutes later, Boutwell wired New York and announced the Treasury would sell a whopping $4 million in gold the following day.

Along with finally loosening Gould and Fisk’s grasp on the gold market, the news sent Wall Street into a tailspin. “Possibly no avalanche ever swept with more terrible violence,” the New York Herald later wrote. Within minutes, the inflated gold prices plummeted from $160 to $133. The stock market joined in on the plunge, dropping a full 20 percentage points and bankrupting or inflicting severe damage on some of Wall Street’s most venerable firms. Thousands of speculators were left financially ruined, and at least one committed suicide. Foreign trade ground to a halt. Farmers may have felt the squeeze most of all, with many seeing the value of their wheat and corn harvests dip by 50 percent.

…and nearly 150 years later, JP Morgan (the Pirate) Chase continues to play the game. Dimon IS the modern day, “Mephistopheles of Wall Street.” ~ Ed.

Morgan the Pirate, Jamie Dimon

Ripples from “Black Friday” affected the U.S. economy for several years and blighted the rest of Ulysses S. Grant’s tenure as president. Nevertheless, Jay Gould and Jim Fisk managed to escape the disaster none the worse for wear. Despite multiple allegations of malfeasance and an official investigation by Congress, the two leveraged their political connections and employed a brigade of attorneys to avoid spending a single night in jail. Fisk even ducked out on his massive losses, claiming third party brokers had made the trades without his knowledge. Gould may have proved even more fortunate. It’s unclear how his finances fared on Black Friday, but according to some estimates, his last minute fire sale may have netted him somewhere around $12 million.

Written by Evan Andrews and published by HISTORY ~ August 29, 2018