…and most of us don’t even have close to enough money saved

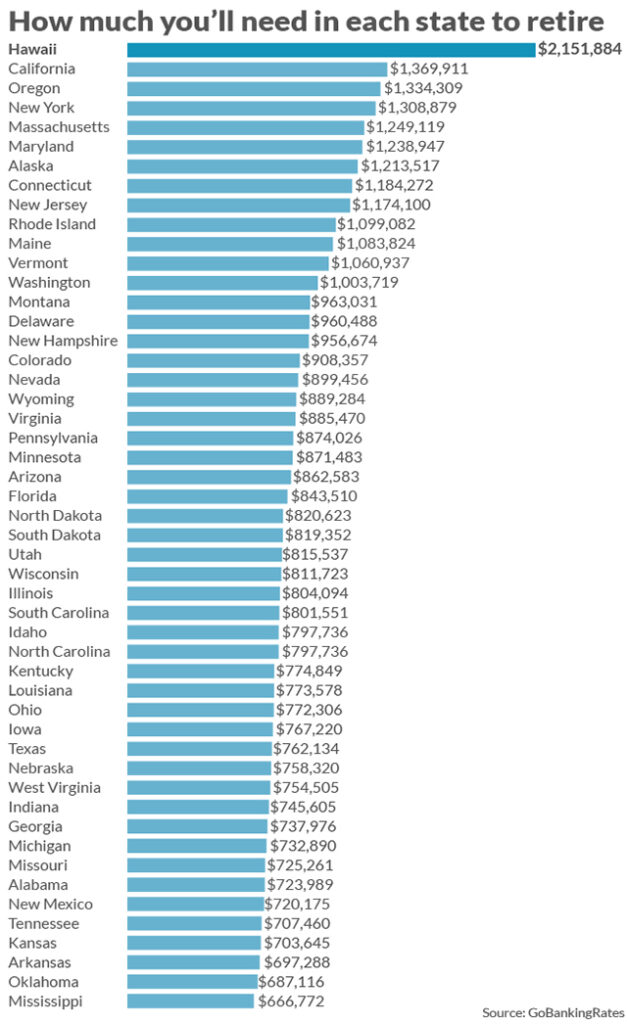

We’re in a state of low savings. Depending on what state you choose to retire in, you could need anywhere from $666,000 to upward of $2 million saved. And that’s outside of what you get from your Social Security checks.

Those figures are according to an analysis released Thursday by personal finance site GoBankingRates, which estimated how much money you’ll need to save to retire in every state in America. To determine this, the site looked at the estimated average annual expenditures of a typical retired person in each state and then subtracted that from the average annual Social Security check. It assumed retirees would be drawing down savings by 4% each year and the money would last 26 years.

The cheapest state to retire in, according to their calculations, was Mississippi, where you’ll need about $667,000 to retire. That’s thanks, in part, to low housing and transportation costs. That’s followed by Oklahoma and Arkansas.

Meanwhile, Hawaii will set you back the most, upward of $2 million — as costs there on everything from food to utilities to transportation to health care are high, the analysis found. California, Oregon and New York were also very pricey.

Of course, these are just estimates — and the city or town you choose to live in will also impact these numbers. And, to be safe, you’ll want to save more in case your expenses are higher than average or you have a longer than expected lifespan.

Of course, these are just estimates — and the city or town you choose to live in will also impact these numbers. And, to be safe, you’ll want to save more in case your expenses are higher than average or you have a longer than expected lifespan.

However, many of us are far from having saved these amounts. A study by the Transamerica Center for Retirement Studies found that the median retirement savings by age in the U.S. is $16,000 for people in their 20s, $45,000 in their 30s, $63,000 in their 40s, $117,000 in their 50s, and $172,000 in their 60s.

But don’t panic if you’re nowhere near your goal. There’s plenty you can do to save more, including examining your budget to see where you can make cuts in spending, ensuring you are getting at least the match from your employer and ideally more, and upping contributions every time you get a raise.

Written Catey Hill for Market Watch ~ January 9, 2020