The unilateral response from governments to the coronavirus is to helicopter money to people and their businesses in unlimited quantities. Their priority is to keep the debt-driven Keynesian show on the road, and policy makers are approaching the task with unseemly gusto.

The unilateral response from governments to the coronavirus is to helicopter money to people and their businesses in unlimited quantities. Their priority is to keep the debt-driven Keynesian show on the road, and policy makers are approaching the task with unseemly gusto.

There was evidence that the credit cycle was already on the turn with the global economy entering its regular period of financial and economic crisis even before the coronavirus hit. Thinking it is only a matter of dealing with the pandemic before returning to normal is therefore a common and fatal mistake. The combination of current events is leading to an infinite problem: central banks, and the Fed in particular, are trying to backstop everything and they will undoubtedly fail.

The central issue is the dawning inability of the Fed, in charge of the world’s reserve currency, to keep financial markets under control. The quantities of money required to rescue the US economy and dollar-centric supply chains abroad are potentially far greater than anyone realises and will destroy not just the dollar, but the whole fiat money system of rigged financial markets upon which debt financing depends. The EU is in a similar but more parochial fix with the addition of a banking system visibly on the verge of collapse.

The timescale for the demise of unsound fiat currencies is likely to be very short, by the end of 2020 – exactly three centuries since a similar fiat currency experiment failed in John Law’s Mississippi bubble.

Introduction

Doubting Thomases must surely realise by now that the central banks are in danger of losing control over financial market prices, not just for a short period of time, but more drastically than that. Besides a new round of quantitative easing announced last Sunday – $500bn into Treasuries and $200bn into agency debt – the new target for the Fed funds rate was lowered to 0 – ¼ %. This 1% cut followed an earlier reduction in the funds rate of ½ % as well as last Thursday’s announcement of a $1.5 trillion cap on three-month and one-month repos. To these sums we must add the $60bn in purchases of coupon-bearing securities also announced last Thursday.

Taken together, that is a liquidity injection into the American banking system of $2.206 trillion, which in context will be the equivalent of a 59% increase in the Fed’s balance sheet since the repo crisis started in September.

A further source of monetary inflation is in the dollar swap lines with the Bank of Canada, Bank of England, Bank of Japan, the ECB and the Swiss National Bank.

Clearly, the Fed is doing everything it can to achieve a number of objectives simultaneously. It needs to ensure the funding is in place for the US Government, which is dramatically increasing its spending. It must ensure the banks have sufficient reserves so as not to foreclose on its customers, thereby preventing a deflationary contraction of bank credit. It needs to inject liquidity into wholesale money markets to ensure no financial entity becomes insolvent. It is trying to anticipate future negative effects of the coronavirus, which are likely to be far greater than anyone dares admit in public. Heroically, the Fed’s public mission is to rescue the American economy single-handedly by providing the money required. And last but not least, it must retain control over financial market pricing to deliver these objectives.

Over the last fortnight that control was demonstrably lost. Equities crashed and government bonds soared, but values of the latter were somewhat false, because in the absence of liquidity market makers increased their bid/offer spreads and reduced their size; that is to say the quantity of bonds they were prepared to deal in on the widened quote were nominal. As well as volatility, the market makers, being brokerage subsidiaries of the banks, were restricted in the amount of liquidity provided by their parents, reflecting a wider systemic shortage.

The Fed hopes that by providing an unprecedented quantity of dollar liquidity that normality will return, and all its objectives listed in the penultimate paragraph above can be achieved. But, returning to a theme of recent Goldmoney Insights, the relationship between the dollar and financial assets has become eerily similar to that between John Law’s livres and his Mississippi bubble three-hundred years ago. The massive printing of livres and livres bank credit to support Law’s asset bubble failed, firstly by undermining the purchasing power of his livres to zero measured against gold and silver, and then by failing to prevent a collapse in the targeted financial asset, his Mississippi venture.

Today, the situation is only different in that the Fed is trying to save the status quo rather than construct a new one. But from December 2015 the gold price began to rise from $1050 to current levels, which is the appropriate non-fiat measure of the dollar’s purchasing power. This fact says much about gold and silver’s reaction last week and this, which was to fall heavily in paper form, while physical demand led to shortages and premiums everywhere. And now we have credible reports of refinery output being curtailed, particularly in Switzerland’s Ticino canton where three of the large Swiss refiners are based.

After the mid-eighties, gold was used as a low interest rate form of collateral for the purchase of other higher-yielding assets. In recent years that function has ceased, and it has become a plaything of bullion banks, skilled at using futures and forwards to soak up speculative demand in a highly profitable fleecing of speculative interest. The continuance of this game depended entirely on the Fed and other central banks setting the framework for prices of financial assets in the wider context by retaining an iron control over markets. Recent events have shown that that has almost certainly come to an end and increasingly the bullion banks see a logic in getting out of the gold and silver paper business by squaring their books.

Estimating dollar liquidity requirements

It is worth noting that the global economy as well as that of the US is on the cusp of a credit cycle that was turning into its regular contractionary stage, even before the coronavirus exploded onto the world stage. The massive expansion of both base money and bank credit since the Lehman crisis coupled with American trade protectionism replicates the situation in late-1929 when the Wall Street crash began, the Dow fell 89% and the great depression followed. The twin vectors behind those events are of different relative force today. Then, trade tariffs were jacked up 30% on average by the Smoot-Hawley Tariff Act, more than today’s American protectionism against Chinese imports. But this time, the expansion of money and bank credit over recent decades is far, far larger, and we are entitled to expect a synergistic effect between these two factors leading towards a similar result.

That being the case, the coronavirus is an added burden on the world’s economy which was already tipping into a slump, and will be particularly damaging for its reserve currency, the dollar. The disruptions the pandemic brings to supply chains are a dramatic advancement and escalation of what would have happened over time anyway.

Across all businesses there are those which have assets that can be sold and have cash at the bank to draw down, and there are those whose cash and liquid assets are limited or barely exist. When the former category draws down on cash reserves, deposits at the banks are reduced. The banks then have to either borrow the difference in money markets or reduce their holdings of assets, usually in the form of loans, Treasury bills, Treasury bonds, commercial bills or commercial bonds. Inevitably, the choice will devolve down to a reduction in the banks’ individual balance sheets, satisfied by reducing their loan books and by asset sales.

On the other hand, there are businesses running on overdrafts, which will find out if their banks are still good for pre-agreed overdraft ceilings. Given the drawdowns on business deposits from their more liquid customers, it is likely they will seek to reduce overdraft ceilings to help balance their books.

But businesses also face decisions as to whether they and their customers will survive the pandemic. Government promises to help is usually offered in loans, in which case they will have to be repaid, merely putting off the evil day. Many SMEs will choose to close in order for their owners to rescue what they can rather than face a drift into bankruptcy. Some will try to survive by cutting costs, such as airlines laying off staff on unpaid leave, or by lengthening payment times, passing the problem to their suppliers.

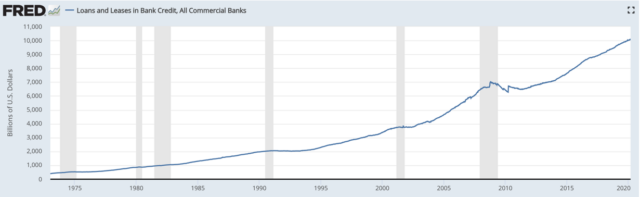

The notional exposure of America’s banks to this aspect of difficulties faced by private sector businesses is illustrated in outstanding loans and leases, which according to the St Louis’s FRED database stands at $10.12 trillion.

FRED’s chart above shows how the last credit crisis caused a contraction in outstanding loans and leases, and we know that this crisis is bound to do so again. But what will be the scale of the developing credit crisis, given that by bunching payment issues the coronavirus has increased the impact and its suddenness?

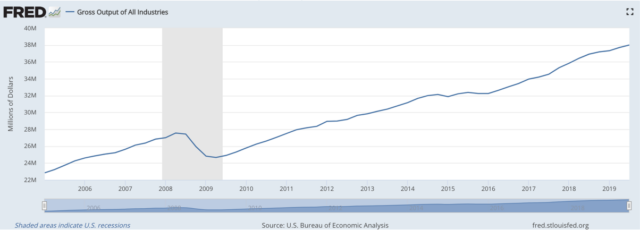

To estimate a ballpark figure, we should look at gross output (GO). Unlike GDP, which captures final sales value, GO includes the payments between production stages, and is illustrated in FRED’s chart below.

The effect of the last credit crisis in 2008-2009 was significant, knocking about $4 trillion off the total. This time, with the added burden of widespread supply chain payment failures it obviously will be far larger. We can only guess what a national shutdown will do. If, as in Italy and France, Americans end up only being able to buy pharmaceuticals and food, that would preserve only 8% of GO. Payment failures will therefore be a significant part of the remaining $36 trillion of the GO statistic.

Not only are all goods, but services are affected as well. And supply chains are not as simple as the term might suggest with a one-dimensional series of inputs leading to a final product. Inputs from many other sources are required in each step of the way. It is no exaggeration to say that the interconnectedness of all these processes accounts for nearly all of private sector GO.

That payment failures are beginning to have an impact is seen in the enhanced level of repo facilities daily extended by the Fed. It can only escalate from here.

Dollar payments in supply chains are not confined to US domestic manufacturing but apply to dollar-denominated chains of imported goods in other jurisdictions, of which Apple’s iPhone manufacturing supply chain is a prime example. All it takes is one small delivery hitch and suddenly expected payments that do not materialise have to be covered all down the line, We cannot know the true extent of the likely problem, but with major economies being disrupted by the virus for more than a month or two and with everyone working on a just-in-time basis the banking system will end up with deposit drawdowns, demands for increased overdraft facilities and non-performing loans totalling as much as two or three times FRED’s total loans and leases outstanding from businesses, not just in America, but in dollar trade settlement chains abroad as well.

No wonder there are emerging liquidity issues in the system. But with the Fed and the US government promising to underwrite all businesses facing difficulties as a consequence of the virus, the inflationary consequences for the dollar will be staggering. The responsibility of the dollar being the world’s reserve currency is that the Fed’s remit must also cover both domestic and foreign dollar settlements if it is to continue to maintain control over pricing in American financial markets.

Realistically, the chances of success are close to nil, partly because the Fed will be slow to offer facilities to those parts of dollar-settling supply chains outside the countries with existing currency swap agreements. China, South Korea and Taiwan, and others will have to resort to liquidation of dollar reserves, including US Treasuries. And then there are those that rely on dollar funding in the broader sense: Credit Suisse’s Zoltan Pozsar highlights Scandinavia, Southeast Asia, Australia and South America, to which we can add the entire shadow banking systems in London and all other non-US financial centres.[i]

Unless it implements Section 133.3 of the Federal Reserve Act (which allows the Fed to lend directly to non-banks) the only channel for liquidity flows is through commercial banks in the federal system. Even if the Fed makes infinite liquidity available to them, the Fed will be unable to stop banks from managing their risks as they see fit. Banks will at the margin reduce their balance sheet leverage and collectively risk descending into a cycle whereby collateral liquidation leads to falling values for financial assets, forcing further liquidation of collateral when formally secure lending becomes uncovered. This was one of the evils of fractional reserve banking identified by Irving Fisher in the great depression. And logic simply tells us liquidity provided by the Fed will be readily absorbed by the banks and not passed to many of their riskier customers, particularly in the SME sector.

We should be in no doubt that while it is easy for the government and its central bank to promise funds to businesses so they can continue to trade, it is virtually impossible in practice for them to do so in a timely manner. But if, as hopefully this article has demonstrated, payment disruption and failure is likely to be on a scale far greater than outstanding loans and leases, the debauchment of the currency will without doubt undermine its purchasing power. As we have shown above, the total settlement chain at risk onshore in the US is captured in GO, which officially stands at $38 trillion. For comparison, the amount of money in public hands, that is cash, checkable deposits and savings deposits, is just under $14 trillion, the bulk of which is matched by bank credit, which will almost certainly contract. If the US Government and the Fed are to make good on their promise to rescue businesses from the coronavirus, they are committing themselves potentially to helicopter considerably more money through the banks than is currently held in public hands.

It cannot happen in one hit: that would be absurd. It is more likely that it will be dispensed in tranches, of which last week’s $2.206 trillion is the first. Whether Mnuchin’s announcement of $1.2 trillion being helicoptered nationwide is part of or additional to that announced by the Fed is immaterial. Once that is absorbed, not only would markets depend on further tranches being rapidly announced and rapidly delivered, but they will begin to discount the consequences as well.

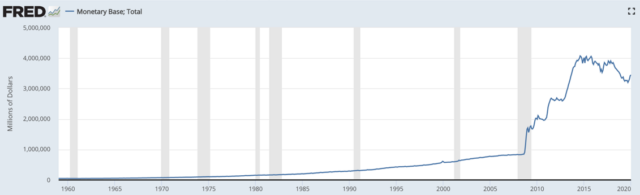

Given that the Fed is backstopping it all by expanding its own balance sheet, in a matter of a few months its monetary base will have to expand to unknowable multiples of the current $3.44 trillion, shown in FRED’s chart, above.

The government funding problem

It will be impossible for the Fed to dramatically expand the monetary base without undermining the purchasing power of the currency, particularly since it had already been expanded by an unprecedented 350% in the wake of the Lehman crisis eleven years ago. The principal method deployed is expected to be the same, that is to say quantitative easing. The advantage to the Fed is QE funds the government borrowing requirement and bolsters commercial bank reserves at the same time.

Before the current hiatus the Congressional Budget Office forecast a Federal Government budget deficit of just over a trillion dollars. Government spending, not least on coronavirus related issues, is likely to be greater than forecast, and tax revenues, if they are not merely put into abeyance will fall considerably. Consequently, the deficit will rise, and it is conceivable it will be running at twice the forecast level. When markets settle down from recent events, traders will be asking themselves who else, other than the Fed, will buy US Treasury bonds. And then there will be a further question: with banks, non-banks and foreigners dashing for dollar liquidity, who will buy their existing holdings of Treasury debt?

The funding problem can only be estimated in an omnibus fashion, by wrapping up government borrowing needs, bolstering bank balance sheets, dealing with global payment failures etc. into one solution. Before the coronavirus hit and began dislocating the entire financial system, credit cycle analysis assumed a slump could double the budget deficit, adding a further trillion or so to existing government funding requirements. Rarely has consideration been given to additional systemic issues because they were unknown. That is no longer the case.

Given that through QE or asset purchase programmes all the funding and liquidity problems highlighted in this article are likely to be addressed, it is no exaggeration to say that by the year-end that could involve doubling or tripling the quantity of US Treasury bonds and bills in the secondary market, perhaps taking them from $16.7 trillion currently to over $40 trillion. Then there is a secondary problem: of the existing pile of $16.7 trillion, $9.8 trillion is owned by foreigners, likely to be forced to sell them down in the search for liquidity or simply to avoid portfolio losses.

Since we are focused on the dollar as reserve currency, we have not even scratched the surface of problems in other currencies. The eurozone in particular has banking problems, which given the likely economic and financial effects of the coronavirus will see major bank failures in a matter of months, if not in weeks.

Only last night the ECB announced a further €750bn stimulus to its existing asset purchase programmes, from which individual nations will fund their promises to subsidise industry and employment. The British and European governments stand ready to shower their populations with money. The British this week announced a package of support amounting to an estimated £320bn, helicoptering money and bridging loan facilities to small businesses everywhere. Echoing Mario Draghi, in the words of both Boris Johnson and his Chancellor Rishi Sunak repeated multiple times, whatever it takes.

France announced a similar €300bn package as well, Germany has promised €500bn, and others are following suit. The ECB’s €750bn is already too little. Everywhere, the fiat currency solution is print, print, print. With interest rates at or below the zero bound it is all that central banks can do, while their governments will face declining tax revenues as well as increasing welfare commitments.

Thus far, there is no recognition yet of the pan-European supply chain problem. The EU’s GO is similar in scale to that of US GO, additional to all announced inflationary support allocated so far.

It is suddenly becoming clear that the global Keynesian experiment of the last ninety years faces an existential crisis. The explosion of funding requirements can only be satisfied so long as bond markets maintain current valuation levels. In other words, we have become dependent and complicit on markets rigged by the state and are facing the same fate as that of John Law’s France exactly three hundred years ago. Once the problems started, his unbacked currency became valueless in about ten months. As then, the fate of financial markets today depends entirely on fiat currencies, because their issuers are becoming the only buyers of their own debt.

Price inflation; myth and reality

Government statisticians have succeeded in goal-seeking a two per cent rate of price inflation by statistical method. Part of the market control mechanism has been for this and other government statistics to be accepted by investors as true. That being the case, a low-growth outlook, in other words one that does not threaten a rise in price inflation, broadly justifies the current pricing levels of government bonds. Given their personal experience that the rate of price inflation is actually considerably higher, one would think that managers of bond funds would realise the deceit, but the fact is that they are blind to it. Being prepared to ignore the reality of their own experience and accept the authorities’ version of the rate of price inflation is central to government control over price levels in financial markets. If, as independent sources such as Shadowstats.com and the Chapwood Index conclude, prices are rising at approximately a ten per cent clip then a 10-year maturity US Treasury bond should have a gross redemption yield of at least that, implying a market price below well below fifty cents on the dollar.

A collapse in US Treasury prices of that magnitude would be a disaster for government finances, and the whole Keynesian scheme. The cost of debt funding would rapidly spiral out of control. Given our thesis that funding payment failures and other objectives will require a veritable explosion in the quantity of government debt forced on the market, it is almost certain the dollar’s value in terms of purchasing power will be fatally compromised. It will initially be reflected in the dollar price of gold, as described in the introduction to this article.

Supplies of the basics that people buy for their day to day existence are already in short supply with supermarket shelves empty, which tells us that following the initial stages of the current economic and financial dislocation prices will rise, even before taking into account the acceleration of monetary debasement already in the works. Price rises of these staples could lead to price controls, which will only make things worse, a playbook seen throughout history from the time of Diocletian (284-305AD) onwards.

But this inflation is different in many ways. Instead of being primarily a collapse of purchasing power driven by the public’s rejection of their state’s fiat currency, it will be driven by a matching, but slightly lagging collapse of the whole panoply of financial asset values. That at least is the lesson of the only other recorded instance of it happening, John Law’s pre-Keynesian scheme.

The outlook for gold and silver

The current market hiatus has seen a breakdown between financial markets and physical bullion, with supplies of coin and small bars sold out. To add to supply problems, it is rumoured that the three major Swiss refiners based in the Ticino canton are either in lockdown or having logistical problems.

The dichotomy is between the world of financial assets and the real world of people. Events over the last few weeks have raised the possibility that the central banks, particularly the Fed in whose dollars everything is priced, are losing control over the whole financial system. Normally scared into financial submission, ordinary people are not buying the establishment’s Kool-Aid anymore. They know nothing, they do not understand what is happening, but at the margin they want precious metals at any price.

The monetary find this behaviour unacceptable. They have routinely killed off embarrassing price rises in gold and silver as the means of subduing public interest. The prospect of monetary inflation following a coronavirus lockdown will make it impossible to repeat the exercise successfully, because of the monetary inflation involved.

Meanwhile, bullion banks are in a bind, having far greater gold and silver obligations than their access to physical gold for cover. These obligations are overwhelmingly in paper, futures and forwards, as well as liabilities to customers with unallocated accounts. Anecdotal evidence also suggests that customers with allocated accounts have already had difficulties getting physical delivery in recent years. Therefore, while public demand for physical bullion has been increasing, the bullion establishment has become badly exposed to the monetary consequences of the coronavirus pandemic.

Central banks and the Bank for International Settlements cannot afford to see a bullion bank blow-up, and doubtless have been working behind the scenes to prevent one. Gold is likely being leased to the bullion banks, giving them some liquidity on paper, but in practice it never leaves the central bank’s vault and therefore its possession. Futures are sold with the purpose of triggering the speculators’ stops, creating an avalanche effect on the price. The intention is for bullion banks to either get at least square in their positions or preferably long, because they know that when the suppression exercise is over, the price of gold and silver will rise dramatically in the face of fiat money expansion.

What they don’t know yet is the fate of fiat currency. We know from analysing John Law’s experience in 1720 that in 2020 we are likely to see the end of it very soon. Conventionally expressed, that gives gold and silver prices of infinity, and moves of a hundred bucks or so are immaterial.

Written by Alasdair Macleod for Gold Money ~ March 19, 2020

[Got physical… close at hand?]

Let’s do something about that…

Edge of Darkness is heard at 8:00 p.m. (Eastern Time), each Monday through Friday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Edge of Darkness is heard at 8:00 p.m. (Eastern Time), each Monday through Friday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Jeffrey Bennett, host of the program shares over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Jeffrey Bennett, host of the program shares over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Added to the forum will be intense and sometimes dark and challenging commentary regarding daily events and circumstances, which are affecting the downward spiral of this once great nation. Programming will include topics such as the dark direction that our nation seems to be headed through the horrendous hatred in the political fields, our physical Health and the Good, the Bad and the Ugly of the nations’ public education system.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

1 – 623 – 327 – 1778

[email protected]