How long could you sustain your household if you were to stop earning income? If you are like most Americans, the answer is not for long. Only 40 percent of Americans can afford an unexpected $1,000 expense with their savings. In fact, nearly 80 percent of workers are living paycheck to paycheck. It is no surprise that the probability of an economic recession brought on by the coronavirus pandemic caused many to worry.

How long could you sustain your household if you were to stop earning income? If you are like most Americans, the answer is not for long. Only 40 percent of Americans can afford an unexpected $1,000 expense with their savings. In fact, nearly 80 percent of workers are living paycheck to paycheck. It is no surprise that the probability of an economic recession brought on by the coronavirus pandemic caused many to worry.

In major cities such as Boston, New York, Los Angeles, and San Francisco, restaurants and businesses have been ordered to close. For many hourly workers, this means no paychecks in the coming weeks. Almost one in five Americans have already lost their jobs or have reduced hours. At the same time, salaried workers are concerned about job security, as mass layoffs at numerous companies loom. While the situation is understandably stressful for every person affected, it serves as a sobering reminder that Americans must learn to live within their means and regularly save money.

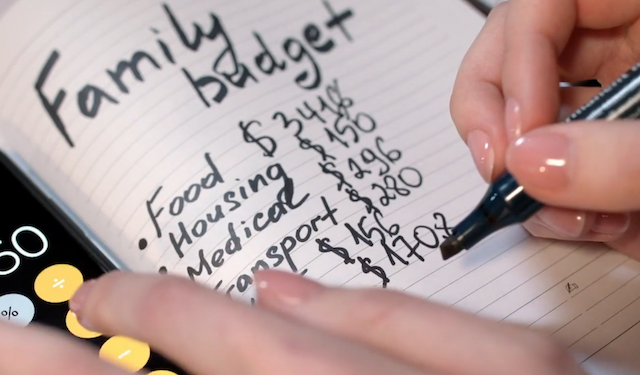

The need for all Americans to be able to sustain themselves for at least a few months on savings is accentuated during a time of crisis. This means planning ahead when times are good. Financial planners suggest saving at least 20 percent of take home income, while spending at most 30 percent on discretionary items. Yet too many workers still fail to think twice about spending entire paychecks for things they want but do not need.

Recent decades have offered us relative luxury. More than 80 percent of Americans own smartphones. The same portion of households own one high definition flat screen television, while over half of households own more than one. Over 60 percent of Americans dine out at least once a week, while nearly 20 percent dine out three or more times a week.

The current panic is refocusing us on what is important. We now stockpile the things necessary for our health. Smartphones, fancy televisions, and restaurant meals are usually luxuries rather than necessities. Living within our means is not just rhetoric. It is a means of guarding ourselves during times like these. We have so much to learn from those who came before us. How many of our grandparents fared the austerity of the World Wars and the Great Depression, discovering to save, mend, and repair?

The availability of credit gave us an opportunity with a great hangover. It made nice homes, flashy cars, and expensive consumer products within reach for earners across income levels. But purchasing on installment is often a trap and a major contributor to our $14 trillion in consumer debt. Financing items as diverse as furniture, laptops, clothing, and more with easily obtained credit opened the door to fiscal recklessness. Consider that average Americans spend $800 monthly on car payments.

It is not only low income and middle income earners who blow through their paychecks every month. Many high income earners also live above their means. Indeed, at least a quarter of households making $150,000 and above live paycheck to paycheck. Our fiscal irresponsibility means that when an unexpected crisis like the one today hits, Americans are unable to sustain their own families, even for a short time period.

So politicians from both parties urge the federal government to step in and dole out checks to everyone across the country. Treasury Secretary Steven Mnuchin has announced that the administration wants to send checks to citizens totaling $1,200 per adult and $500 per child, with another round of assistance to follow if the pandemic continues.

While our leaders must act decisively in times of disaster, our own errors have made this situation untenable over the long run. On top of consumer debt, our government holds $23 trillion in national debt. A combination of stimulus checks, a potential recession, and new bureaucracies to oversee a recovery will further accelerate our rendezvous with financial default in the next generation. The money will eventually come due in the form of taxes, deferred payments for benefit programs, or outright inflation.

We each have a civic responsibility to our families and to our country. The more fiscal control we show at the kitchen table, the better our ability to handle the next crisis. A solid balance of fiscal government and personal finance courses at the high school level is a start. For most young people, however, true financial literacy is taught at home. We have a chance to show the next generation that saving is earning by another means.

I have hope during this crisis. It is a reminder, much like other traumatic events in history, of what is truly important. The survival and prosperity of our families is the key to our success. As the pandemic unfolds, the ability to budget, prioritize, and teach is our chance to make things better. Our grandparents suffered tremendously during the Great Depression. With the right attitude, we can teach our children how to prevent one.

Written by Kristin Tate for The Hill ~ March 22, 2020

[Got physical… close at hand?]

Let’s do something about that…

Edge of Darkness (Protecting Your Wealth) is heard at 8:00 p.m. (Eastern Time), each Monday through Friday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Edge of Darkness (Protecting Your Wealth) is heard at 8:00 p.m. (Eastern Time), each Monday through Friday on Republic Broadcasting Network. Jeffrey Bennett, host of the program will be sharing over 60 years of his personal experience in the precious metals markets, in addition to educational commentary regarding YOUR financial health and welfare.

Jeffrey Bennett, host of the program shares over 60 years of his personal experience in the precious metals markets, in addition to educational commentary  regarding YOUR financial health and welfare.

regarding YOUR financial health and welfare.

Added to the forum will be intense and sometimes dark and challenging commentary regarding daily events and circumstances, which are affecting the downward spiral of this once great nation. Programming will include topics such as the dark direction that our nation seems to be headed through the horrendous hatred in the political fields, our physical Health and the Good, the Bad and the Ugly of the nations’ public education system.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

1 – 623 – 327 – 1778

gold@sierramadrepreciousmetals.com