As the media begins to roil with reports of bank delays in the distribution of business recovery loans from the government plan to save business from the effects of quarantine and closure, it is important to ask if there is more to the story than the mere miserly attitude of the run-of-the-mill bank.

As the media begins to roil with reports of bank delays in the distribution of business recovery loans from the government plan to save business from the effects of quarantine and closure, it is important to ask if there is more to the story than the mere miserly attitude of the run-of-the-mill bank.

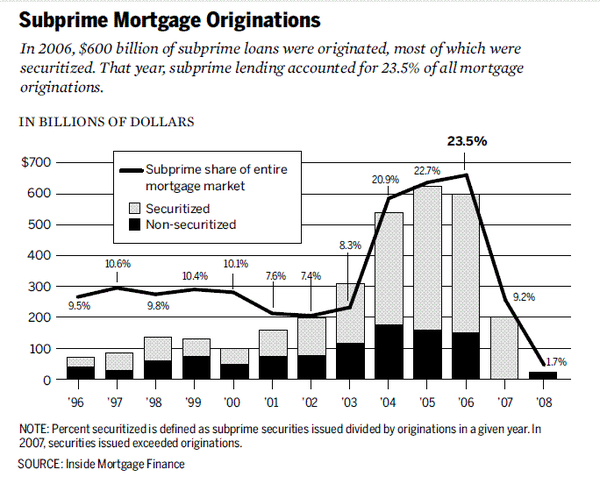

Back in early 2000, Barney Frank and a lot of other politicians passed legislation forcing banks to throw away traditional mortgage underwriting guidelines to make mortgages to low-income Americans (or no income Americans). If the banks didn’t, they would not get permission to open new branches and grow. That contributed largely to the 2008 financial crisis, in which eight trillion dollars in mortgages failed, an amount that broke the system because it simply couldn’t all be insured. The very same politicians then blamed the banks for reckless lending and resisted the bailouts.

Now, as part of the federal relief plan for businesses affected by the coronavirus, the politicians are leveraging banks to give out loans with little due diligence applied to the recipients’ ability to repay it. The banks, and bankers, including past ones such as myself, see this as more of the same. There is incredible pressure to make unsupported loans with a “promise” that the government will pay these bad loans off. But as one would reasonably expect, there is no trust. The Small Business Administration (SBA) will — and I will guarantee this — come back later and say, “Hey wait a minute, you didn’t abide by this degree of minutiae so we are not going to honor our promise to pay the bank back for these loans.” Every day the SBA comes out with new rules. If you made a loan yesterday and a new rule comes out today, well, you’re plain out of luck. Everyone is dragging their feet waiting for a period and time when the rules are clear and there is less likelihood the banks will be denied reimbursement for the loans that made no sense in the first place.

Now, as part of the federal relief plan for businesses affected by the coronavirus, the politicians are leveraging banks to give out loans with little due diligence applied to the recipients’ ability to repay it. The banks, and bankers, including past ones such as myself, see this as more of the same. There is incredible pressure to make unsupported loans with a “promise” that the government will pay these bad loans off. But as one would reasonably expect, there is no trust. The Small Business Administration (SBA) will — and I will guarantee this — come back later and say, “Hey wait a minute, you didn’t abide by this degree of minutiae so we are not going to honor our promise to pay the bank back for these loans.” Every day the SBA comes out with new rules. If you made a loan yesterday and a new rule comes out today, well, you’re plain out of luck. Everyone is dragging their feet waiting for a period and time when the rules are clear and there is less likelihood the banks will be denied reimbursement for the loans that made no sense in the first place.

Banks are being told: don’t pay attention to bad credit, don’t collect more than one year of data, and do this all on a one-page document. This will result in loan losses of 10% or more. Losses that are normally under 1%. It could destroy hundreds of banks. Loan loss reserves for banks nationally run about 1%. They don’t have the capital to absorb 10% in loan losses. The FDIC will come in to close them down long before Congress gets around to paying the banks back, if at all, for any bad loans. And I guarantee that Congress will blame the banks for all these losses.

Should we help out business that are in the rough because of no fault of their own, who are simply abiding by the restrictions imposed on them by the government? Absolutely. But this does not mean that we should destroy our economic recovery before it ever gets started by sloppy work now. Banks want business to succeed, a healthy economy means expansion, more business loans for growth, more avenues for investment. Banks also understand that our struggling local businesses are on life-support and due for emergency surgery if we are to keep them around. However, this does not mean that we should throw away aseptic technique and every other lesson learned through our vivid and recent history of financial carnage.

Written by Richard Lawless for the American Thinker ~ April 16, 2020