Gold will be the asset to beat in 2021, according to Bloomberg Intelligence, which sees the precious metal outperforming U.S. stocks.

Gold will be the asset to beat in 2021, according to Bloomberg Intelligence, which sees the precious metal outperforming U.S. stocks.

“Gold may gain increasing reference as the performance benchmark to beat,” said Bloomberg Intelligence senior commodity strategist Mike McGlone.

Gold’s price advance of 2020 appears to be sustainable, McGlone said on Tuesday, noting that the current resistance of $2,000 an ounce will become the metal’s support.

“In an investment landscape increasingly dominated by how low — or negative — central banks will set base rates, along with rising debt-to-GDP and QE, we see the foundation solidifying under the price of gold. Resistance at about $2,000 an ounce in 2020 is set to transition to support in 2021,” McGlone wrote.

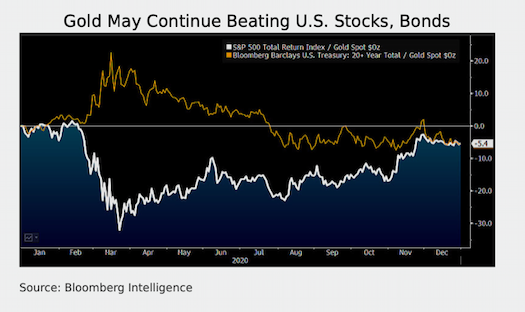

With all the main drivers still supportive of higher gold prices, the precious metal is bound to continue beating U.S. stocks.

“The unlikeliness of reversing the unprecedented global fiscal and monetary stimulus that helped boost gold and copper about 25% in 2020 — vs. less than 20% for the S&P 500 — should keep the metals atop the leader board,” McGlone pointed out.

For 2020 data, the strategist cited the Bloomberg All Metals Total Return Index, which gained almost 21%, beating the record-setting S&P 500 by about 3%.

“Our bias is that the greater potential for quantitative easing (QE) and debt-to-GDP levels to keep rising should keep metals prices — notably gold and silver — going up,” McGlone said.

Also, more market volatility in 2021 will benefit gold to the upside. “It should be hard for gold to do anything but appreciate, particularly when the metal is in close proximity to its upward-sloping 12-month moving average,” McGlone wrote.

Also, more market volatility in 2021 will benefit gold to the upside. “It should be hard for gold to do anything but appreciate, particularly when the metal is in close proximity to its upward-sloping 12-month moving average,” McGlone wrote.

The outlook for silver is also very positive, with the precious metal on the path towards $50, the strategist added.

“Silver is poised to keep outperforming in 2021 as it did in 2020. Silver’s unique attribute as being about half precious and half industrial should keep it a top beneficiary of a favorable macroeconomic backdrop,” he said. “New highs for gold in 2020 should mean it’s a matter of time for similar moves in silver and most other metals.”

McGlone specified that the path towards $50 is more sustainable this year than in 2011, with the new low being set at $12.

“We see the metal following a similar trajectory as the aftermath of the financial crisis toward $50 an ounce, but with greater potential for staying power on a path paved by gold,” he said. “There’s a good chance that the 2020 low at about $12 will be as enduring as about $8.50 from 2008, which hasn’t traded since.”

Written by Anna Golubova for Kitco ~ January 7, 2021