I know you, like me, have parents or grandparents that lived through the Great Depression and will never forget it. Ever since, they saw saving money as absolutely essential. This was even more true for my homesteading grandparents whose very survival could come down to a few bills hidden under the mattress during a tough winter month. Yet, by the 1950s, millions of Americans were borrowing billions of dollars to buy everything from toasters to holiday trips.

I know you, like me, have parents or grandparents that lived through the Great Depression and will never forget it. Ever since, they saw saving money as absolutely essential. This was even more true for my homesteading grandparents whose very survival could come down to a few bills hidden under the mattress during a tough winter month. Yet, by the 1950s, millions of Americans were borrowing billions of dollars to buy everything from toasters to holiday trips.

Article #1551, Published on our original precious metals site, ‘Flying Eagle Gold‘ in the category, ‘Protecting Your Wealth‘ on September 2, 2005. ~ Editor

‘Easy credit and deficit spending have been the prescription for every sick economy dating back to World War II. With that war ending, the Truman administration fretted that unless demand could be created for goods, America’s monstrous industrial base would sit idle – this at a time when millions of GIs were coming home needing work. Some in the administration believed that the war was only an interruption in the Depression.

‘Easy credit and deficit spending have been the prescription for every sick economy dating back to World War II. With that war ending, the Truman administration fretted that unless demand could be created for goods, America’s monstrous industrial base would sit idle – this at a time when millions of GIs were coming home needing work. Some in the administration believed that the war was only an interruption in the Depression.

It should go without saying, but you wouldn’t know it by taking a spin around the mainstream press: periods of large social and economic upheaval have hit us before.

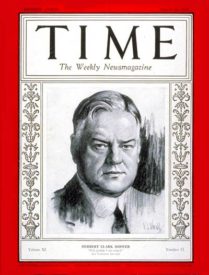

Steering us out of the Great Depression would probably have been better handled by the Hoover who made vacuums than the man who sat in the White House. It is hard to believe now, but as the economy was weakening in the late 1920s, taxes were actually raised. To top it off, after the stock market crash, the federal government slashed spending. The result was the worst economic crisis since the onset of the Industrial Revolution.

Politicians and economists (at least some of them) learned their lesson: pull in the monetary reins during a slowdown. It has become a religion since the great Crash… a mantra of presidents from FDR through Bill Clinton, and now George W. Bush (Obama, Trump and Biden, etc…) – the thing to do during a slowdown is pump money, slash interest rates and, if possible, increase government spending.

But the economy didn’t slow down. In fact, it began a period of unprecedented growth.

What happened? Millions of Americans embraced the Credit Age. By the 1950s, millions of Americans were borrowing billions of dollars to buy everything from toasters to holiday trips.

John Maynard Keynes was the father of the Credit Age. He believed in the necessity of aggregate demand – the total spending of consumers, business investors and public agencies. When aggregate demand was low, sales and jobs suffered. But when it was high, all was well.

John Maynard Keynes was the father of the Credit Age. He believed in the necessity of aggregate demand – the total spending of consumers, business investors and public agencies. When aggregate demand was low, sales and jobs suffered. But when it was high, all was well.

Keynes’ theories live on today. His disciples believe that it is not only the right of government to borrow money to stimulate the economy, but also its responsibility. In the Western world debt was no longer shunned but embraced. The bigger the problem, the more credit and spending is needed. You don”t just buy your way out of trouble, you borrow your way.

As The Wall Street Journal explains it: “Wars often act as catalysts for expanding the reach of the federal government, and the size of its budget. We are now in a war on terrorism, and polls record high levels of trust in Washington. The implication is obvious – open the spending floodgates – and liberal activists, long stymied by a general fear of deficits, have not missed it.”

Today all but the most die-hard conservatives want the government to spend more money, to become even bigger.

“[President Bush] has stopped worrying about the reborn deficits that his tax cuts, the war on terror and the business cycle will be visiting upon America for the next several years,” writes The Wall Street Journal.

Another $75 or $100 billion is a drop in the red-ink bucket. But he is becoming very conscious (again) that his father’s wildly popular war on Saddam didn’t save him from the 1991 recession, that the longer the 2001 recession lasts – and the longer George W. is seen to be gazing overseas while the home front burns – the fainter voters’ memories will be in 2004 of the way he fought his war.

The lifestyle of borrowing and spending still hasn’t really gone out of fashion – at least for consumers. The fact is Americans are addicted to spending, even if it is off the back of borrowed dollars. Since 1960 consumer credit has risen from $56 billion to today”s total of $1.6 trillion. The government is hoping that with interest rates at 40-year lows, Americans will continue to borrow and spend.

During the Credit Age, buying and having the means to buy had little to do with each other. Since 1960 consumer credit has risen by a factor of 29, but real non-farm compensation has increased by a factor of 10.

That means that for the majority of Americans, their debts have increased three times faster than their wages.

Gold Wars: Chapter I

GOLD: THE POWER OF THE VETO

The price of gold has been making another of its upward moves. These upward moves have been beaten back so consistently over the last 22 years that there is not much interest by the financial press or investors. But there will come a day when the threat of central banks to sell gold – mainly to each other – will no longer scare gold buyers. They will start taking delivery.

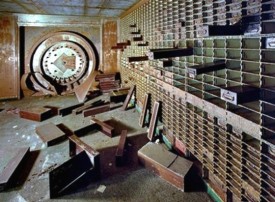

If officials in the central bank of China ever decide to use the banks enormous reserves to start buying gold, they will make that bank the dominant central bank. At some point, they will do this. They will understand how vulnerable the G-8 nations are to a determined central bank that wishes to get their hands on the gold. If they follow this with actual delivery from the vault in the New York Federal Reserve Bank to Beijing, they will announce to the world, “The days of wine and roses have ended. Call this revenge for the opium wars.”

New York Federal Reserve Bank

The Chinese could do this tomorrow. I think they are certain to do it sometime in this decade. When they do, they will become the dominant central bank. I think this is what they want: symbolic affirmation of their new-found international economic might. They are fast becoming the 800-pound gorilla in the world”s markets. By 2010, they will be the gorilla, if you count Hong Kong, which they control, and Taiwan, which has sent $180 billion in private investment into China since 1991, and 40 million overseas Chinese, who serve as the middlemen in the expansion of Chinese foreign trade.

TIME WARP: JANUARY, 1980

Why has the price of gold trended lower since January, 1980? Part of this drop was a reaction to the large price rise in 1978-80, which had been driven by the inflationary policies of the Federal Reserve System under the long-forgotten and unlamented Chairman of the Board of Governors, G. William Miller. He was not an economist. He was a corporate executive without any known understanding of monetary theory. His tenure of office was brief: March, 1978 to August, 1979, but public confidence had been lost. He was replaced by Paul Volcker, who adopted tight money policies in October, after being persuaded by other members of the Board.

Meanwhile, OPEC had driven up the price of oil for the second time in the decade, this time under Jimmy Carter. By 1979, there was deep pessimism regarding Carter”s political leadership and the economy. This elected Ronald Reagan in 1980.

In late 1979, Iranians kidnapped the staff of the American embassy.

Throughout 1979, there was also Bunker Hunt‘s squeeze on silver, which drove up the price to $50/oz from under $5 a year earlier. He had been taking delivery of silver contracts all year, terrifying the shorts. Poor Hunt. He was about to lose his second fortune. The first had taken place in 1971, when Qadaffi had nationalized Hunt’s oil holdings. As soon as the Gulf sheikhs saw that Qadaffi had gotten away with this massive theft, they decided to squeeze the West. That fabulously successful oil squeeze began in 1973, the same year that Hunt began buying silver futures at $1.95/oz. What stopped Hunt in 1980 was two-fold: Volcker”s tight money policies and the COMEX, which changed the rules. No further purchases of future contracts were accepted by the exchange except for shorts who were covering their positions. By March, 1980, the price of silver was at $11. Hunt lost a billion dollars. He had to borrow from the FED to cover his position. He then uttered those memorable words, “A billion dollars just doesn’t go as far as it used to.” Silver never has recovered.

Throughout 1979, there was also Bunker Hunt‘s squeeze on silver, which drove up the price to $50/oz from under $5 a year earlier. He had been taking delivery of silver contracts all year, terrifying the shorts. Poor Hunt. He was about to lose his second fortune. The first had taken place in 1971, when Qadaffi had nationalized Hunt’s oil holdings. As soon as the Gulf sheikhs saw that Qadaffi had gotten away with this massive theft, they decided to squeeze the West. That fabulously successful oil squeeze began in 1973, the same year that Hunt began buying silver futures at $1.95/oz. What stopped Hunt in 1980 was two-fold: Volcker”s tight money policies and the COMEX, which changed the rules. No further purchases of future contracts were accepted by the exchange except for shorts who were covering their positions. By March, 1980, the price of silver was at $11. Hunt lost a billion dollars. He had to borrow from the FED to cover his position. He then uttered those memorable words, “A billion dollars just doesn’t go as far as it used to.” Silver never has recovered.

The last two decades have seen a fall of the price of all raw commodities. The nominal price of oil has stayed up, but price increases of finished goods and services have dramatically lowered the purchasing power of the dollar since 1980. It costs $2,150 to buy what $1,000 bought in 1980, according to the inflation calculator at the Bureau of Labor Statistics. The percentage of American family incomes that is spent on food, for example, has gone down year by year. So, the all metals have dropped in price and have stayed down except for brief upward moves.

Is this a permanent feature of the West’s economy? Those who think that we are running out of raw materials say no. They are generally not economists. Most economists say yes. They argue that improved extraction techniques and resource-discovery techniques and technological substitutes will continue to place a premium on the knowledge-service economy in relation to commodities. Throughout the twentieth century, the economists have been correct about this except during wartime.

This scenario applies to commodities that are used in production. But one commodity is not generally used in production: gold. From about 2,000 B.C. until today, gold has been used mainly as money. The issue is: Used by whom?

THE INVENTION OF COINAGE

To facilitate exchange, a medium of exchange is crucial. Barter is too inefficient. If you don”t have what I want to obtain, or I don’t have what you want to obtain, there will not be an exchange unless a third party steps in. He will get a high commission for his specialized knowledge of markets.

Money reduces these commissions by making exchange between producers easier, i.e., converting them from producers into consumers. The best definition of money was provided by Ludwig von Mises in 1912: “the most marketable commodity.” Historically, the most widely acceptable money commodities have been gold and silver. We read of the patriarch Abram, “And Abram was very rich in cattle, in silver, and in gold.” (Genesis 13:2)

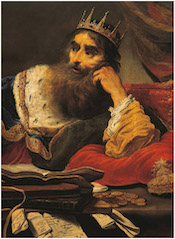

King Croesus

Sometime between 700 B.C. and 635 B.C., the king of Lydia, in Asia Minor, began producing the first coins. They were round, uniform, and stamped with a lion”s head, the symbol of the Lydian dynasty. This invention was soon imitated by the Greeks. Originally, the coins were electrum: silver and gold. Under King Croesus (“Creesis”), all of the Lydian coins were gold. He was the famous king discussed by Herodotus, who made war on the Persians and lost his empire. But his economic innovation reigned until 1933. I think it will reign again, but that’s another story.

The world was re-shaped by that invention: the extension of trade and the division of labor. Wealth increased. But there was another consideration, one which became the basis of the visible destruction of the gold standard in the 20th century. Lydia’s invention carried with it an assertion, an implication, and a symbol: the sovereignty of the State over coinage. The stamp of the dynasty marked the coins as the monopoly of the State.

Civil governments have claimed this sovereignty over money ever since. The stamp not only announced the coin’s authenticity; it announced a monopoly. He who counterfeited a coin by adding base (cheap) metals was a violator of the State’s exclusive right. The State had to authority to bring negative sanctions against the violator – not on the basis of his having committed a fraud, but on the basis of violating the exclusive authority of the State to produce the coinage.”The practice of debasement had been condemned by the prophet Isaiah two generations before the invention of coinage. “Thy silver is become dross, thy wine mixed with water.” Isaiah 1:22 His condemnation was an extension of the law against false weighs and measures.

“Ye shall do no unrighteousness in judgment, in meteyard, in weight, or in measure.” (Leviticus 19:35)

“But thou shalt have a perfect and just weight, a perfect and just measure shalt thou have: that thy days may be lengthened in the land which the LORD thy God giveth thee. For all that do such things, and all that do unrighteously, are an abomination unto the LORD thy God.” Deuteronomy 25:15-16

The presence of an authoritative stamp made a coin more acceptable in trade. It reduced the product-seller”s risk of not weighing or testing the coins. The fact that the stamp was imposed by the authority of the king did not, in and of itself, make the coin a monopoly instrument of trade. What made it a monopoly was the decision of the king to monopolize the production of coins. He did not authorize others to use his stamp even when their coins matched the weight and purity of his coins. He could have charged them a stamping fee for use on their coins – a trademark fee, in other words. He refused. From that time on, civil governments resisted the production of coins by private parties. Coins were deemed an aspect of State sovereignty.

The presence of an authoritative stamp made a coin more acceptable in trade. It reduced the product-seller”s risk of not weighing or testing the coins. The fact that the stamp was imposed by the authority of the king did not, in and of itself, make the coin a monopoly instrument of trade. What made it a monopoly was the decision of the king to monopolize the production of coins. He did not authorize others to use his stamp even when their coins matched the weight and purity of his coins. He could have charged them a stamping fee for use on their coins – a trademark fee, in other words. He refused. From that time on, civil governments resisted the production of coins by private parties. Coins were deemed an aspect of State sovereignty.

So, three separate analytical issues were involved:

(1) the reduction of transaction costs associated with small coins compared to large ingots;

(2) the reduction of transaction costs associated with officially stamped metal;

(3) the assertion of State sovereignty over coinage.

The third was not necessary to the first two.

THE FINAL COURT OF APPEAL

The judicial issue of sovereignty in the pre-modern world (say, pre-1660) was the issue of divine right. The assertion of divine right was the judicial-theological issue of the final earthly court of appeal. He who possesses legal sovereignty cannot be sued, apart from his permission, for he is judged by no human court. Sovereignty is why the U.S. government cannot be sued without its permission, according to the Constitution. This is why there is so much political pressure on the U.S. government to allow American or foreign citizens to appeal to the World Court and other international jurisdictions above the U.S. Supreme Court. To be the King of the Hill, a court must be the final court of appeal. Without a world supreme court, there cannot be world government.

The final judicial court of appeal for money is a nation’s supreme court. But the final economic court of appeal is the free market. A court can determine what is lawful money. The free market determines what is actual money. A civil government can legislate the price of money: exchange rates between two forms of money; price controls on goods. The free market will determine what the rates of exchange are in actual exchanges: the black market rate of exchange.

Gresham’s mid-16th century law says, “Bad money drives out good money.” This form of Sir Thomas’s law is imprecisely stated. Here is the correct version: “The monetary unit that is artificially overvalued by law will drive out of circulation the monetary unit that is artificially undervalued by law.” This means that there will be a shortage of any artificially undervalued currency. The best recent example was the U.S. dollar in relation to Argentina’s currency unit in December, 2001. The dollar was artificially undervalued by Argentina’s law. Almost no one could buy dollars at the government”s fixed exchange rate. There was a shortage of dollars at the phony low price.

As always, government-enforced price ceilings create shortages (too much demand). Government-enforced price floors create gluts (too much supply).

The government can pass all the price controls it wants. The free market will respond: shortages and gluts. Whenever you hear of a shortage or a glut, think: “At what price?” Whenever a price is established by law, the shortage or glut will remain until this legislated price randomly matches the free market price, at which time, there is no further need for the legislated price.

Politicians do not understand that the final court of appeal is the free market. The economy trumps the State. Governments, by imposing added risk for the detection of an illegal transaction, do raise transaction costs, but governments cannot establish the price at which exchanges will take place. There is no appeal beyond the free market. The market, not civil governments, is sovereign.

Politicians rarely believe this. So, they play power games with prices. By establishing by law which currency unit is acceptable for paying taxes, politicians can determine which currency unit functions as money in tax-related transactions. But politicians cannot determine at what prices this tax/currency unit will function as money.

The free market – buyers and sellers of money – establish the money prices of goods and services. Consumers, not governments, are sovereign over the value of money.

COUNTERFEITING: LEGAL AND ILLEGAL

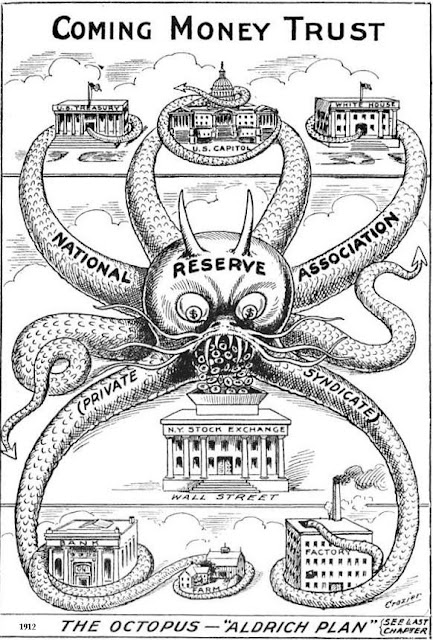

Gold has served as money in free markets for over four millennia. Paper money was an invention of the Mongols less than a millennium ago. Within a century, they had destroyed their currency. Commercial bank-created money is less than six hundred years old. Central bank-created money began in 1694, with the Bank of England.

Here is a nearly unbreakable rule: politicians serve their own self-interest by paying off their constituents with money collected from their opponents’ constituents. When the taxation of their opponents’ constituents threatens to create a tax revolt, or the defeat of the incumbents at the next election, or both, incumbent politicians seek ways to keep the money flowing to their special-interest voting blocs without visibly taxing their opponents” special-interest voting blocs.

Here is a nearly unbreakable rule: politicians serve their own self-interest by paying off their constituents with money collected from their opponents’ constituents. When the taxation of their opponents’ constituents threatens to create a tax revolt, or the defeat of the incumbents at the next election, or both, incumbent politicians seek ways to keep the money flowing to their special-interest voting blocs without visibly taxing their opponents” special-interest voting blocs.

The key word here is “visibly.”

Monetary inflation is the preferred solution of politicians. The real cause of the public”s increased cost of living can be hidden from most voters, who are economically ignorant, naive, and trusting. Price increases can be blamed on profit-seeking speculators and capitalistic price-gougers.

If the currency system were exclusively private, then there can be no element of sovereignty for counterfeiters. Counterfeiters could be brought into a court of law and prosecuted for fraud: false weights and measures. They could not claim that they are beyond the law, above the law, and immune from law suits.

Governments can and do make these claims of immunity. They transfer by law to central banks this same political sovereignty. This is why the mixing of judicial sovereignty over money and economic sovereignty over money eventually leads to fraud on the part of governments: monetary debasement, either openly (“thy silver has become dross”), or through the printing of more paper IOU”s for gold or silver than there is metal on reserve, or through the adding of digits in bank computers.

When a national government has established a State-run gold standard by persuading the public to exchange their gold for the government”s IOU”s of gold at a fixed price, then the public can retaliate against future monetary inflation. Prices rise due to the increase in the money supply. This would raise the money-price of gold, except that the government or its central bank has promised to sell gold at an official price to anyone who brings in an IOU. The demand for gold therefore rises at the government;s artificially legislated price. This is a rational response of the IOU-holders. The government is subsidizing the price of gold.

Two groups want access to the promised gold:

(1) people who think the government will soon change the rules and

(a) stop paying gold for IOU”s (default), or

(b) reduce the amount of gold that has been promised (devalue the currency);

(2) industrial or ornamental users of gold who want to take advantage of the subsidy.

If the government wants to maintain full value of its IOU”s for gold, then it must stop inflating the currency. This will cause a recession: the reversal of the prior policy of monetary inflation, and the restoration or prices, especially of capital goods.

If the government wants to maintain full value of its IOU”s for gold, then it must stop inflating the currency. This will cause a recession: the reversal of the prior policy of monetary inflation, and the restoration or prices, especially of capital goods.

Politicians lose elections during recessions. “It’s the economy, stupid.” So, they want the good times to continue to roll, which means the printing presses must continue to roll. But then the gold reserves of the government will be depleted.

What’s a government to do?

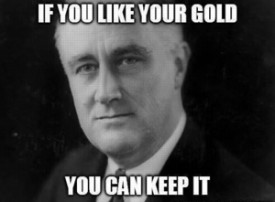

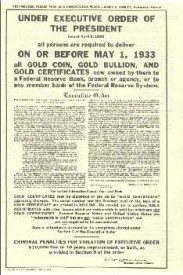

Franklin Roosevelt’s answer was two-fold:

(1) confiscate the gold of American citizens in 1933, and, once the gold had come in and had been turned over to the privately owned Federal Reserve System,

(2) raise the price by 75% in 1934, thereby transferring to the FED a huge windfall profit.

The FED’s monetary base rose because of the higher monetary value of its newly received gold, so commercial banks created new credit money to take advantage of these increased central banking reserves. The result was the economic recovery of 1934-36. But when the FED raised bank reserve requirements in 1936, this produced the recession – a whopper – of 1937.

Because the government also raised taxes in 1936, this added to the economy”s woes: a double-whammy.

After 1932, Americans were no longer able to pressure the government to change its monetary policies. They lost the right of redemption. This abolition of the public’s right of redemption had been the decision of European governments, 1914-1925, in response to the war: a suspension of gold payments. Whenever a major war broke out in Europe, governments suspended gold redemption. Why? Because they planned to inflate the money supply to pay for the war. It happened during the Napoleonic wars. It happened in 1914. In between, 1815-1914, Europe enjoyed a century of price stability.

After 1932, Americans were no longer able to pressure the government to change its monetary policies. They lost the right of redemption. This abolition of the public’s right of redemption had been the decision of European governments, 1914-1925, in response to the war: a suspension of gold payments. Whenever a major war broke out in Europe, governments suspended gold redemption. Why? Because they planned to inflate the money supply to pay for the war. It happened during the Napoleonic wars. It happened in 1914. In between, 1815-1914, Europe enjoyed a century of price stability.

The public’s right of redemption of gold serves as a veto on the government’s expansion of fiat money, or the central bank”s expansion of credit money. Until the right of redemption is suspended by the government, the public holds the strong hand.

Every government-run monetary system is a compromise with the free market. Every government-run gold standard is based on promises: IOU’s issued for gold at a fixed price. This promise is no better than the promise of politicians. The government can always invoke its sovereign right to change the rules. It can legally renege on its promises. It is judicially sovereign.

This is the war of political sovereignty – the State’s self-imposed immunity from law suits – against free market sovereignty: the public’s right to select whatever they as individuals want to use as their currency unit, and their right to bring counterfeiters to justice in the State”s courts. Private, profit-seeking counterfeiters have no immunity from law suits, unlike legalized private counterfeiters (central bankers).

This is the war of political sovereignty – the State’s self-imposed immunity from law suits – against free market sovereignty: the public’s right to select whatever they as individuals want to use as their currency unit, and their right to bring counterfeiters to justice in the State”s courts. Private, profit-seeking counterfeiters have no immunity from law suits, unlike legalized private counterfeiters (central bankers).

In the case of the law suits brought by Americans against the Roosevelt Administration in 1933, the Supreme Court refused to hear the cases. (The most detailed account of this subterfuge was available in a 1,600-page book on the Constitutional history of the dollar, written by Ed Viera, author of the shorter but excellent book, PIECES OF EIGHT. Viera is a Harvard- trained lawyer who has devoted his career to the money question. He is also an Austrian School economist.)

Every gold standard that is established by a civil government is a pseudo-gold standard. It is no better than a government promise, a government that claims sovereignty over money, i.e., legal immunity from prosecution for breaking its promise to redeem gold for its earlier IOU”s.

WHO VETOES WHOM?

With any pseudo-gold standard, the government retains the right to veto any attempt by the public to veto the governments’ monetary policies. When holders of government IOU’s for gold begin to present their IOU’s and take home their gold, the government can intervene and refuse to pay. Remember, it is not the governments’ gold; it is the IOU-holders’ gold. Anyway, that was what was originally promised. But agents of governments lie. This is their primary function operationally in every democracy: to deceive the citizenry. A pseudo-gold standard allows undeceived citizens to call the deceivers’ bluff until the government publicly reneges. This is why any gold standard is hated by all modern political liberals and most conservatives: it places a veto in the hands of citizens. The overwhelming majority of the intellectual defenders of State power dismiss the gold standard as a barbarous legal institution based on a barbarous relic (Keynes). Why barbarous? Because it places a veto in the hand of the barbarians: citizens and non-citizens who can legally buy up the IOU’s with depreciating paper money and then launch a gold run on the government”s treasury or the government-licensed counterfeiters: central banks and their clients, commercial banks.

The monetary skeptics announce, “There’s gold in them thar vaults!” When the gold flows out, the day of reckoning draws closer for the purveyors of counterfeit IOU’s for gold. The counterfeiters grow desperate. “Their” gold is now being demanded by barbarians – arrogant citizens who think that a government promise is worth its weight in gold.

The monetary skeptics announce, “There’s gold in them thar vaults!” When the gold flows out, the day of reckoning draws closer for the purveyors of counterfeit IOU’s for gold. The counterfeiters grow desperate. “Their” gold is now being demanded by barbarians – arrogant citizens who think that a government promise is worth its weight in gold.

Finally, the counterfeiters end the illusion of their pseudo-gold standard. They had persuaded the public to sell the government their gold in exchange for IOU’s. Then the government defaults. “Tough luck, suckers!”

This has been going on for three hundred years. The suckers – IOU-holding citizens – never learn. We are more trusting of known crooks (legally immune politicians) than money center bankers are who lend money to Latin American dictators.

CONCLUSION

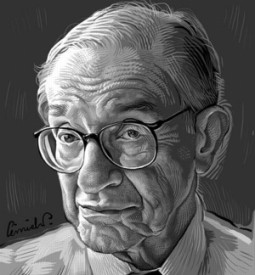

Alan Greenspan

The public trusts the government, which claims sovereignty: immunity from law suits. The public also trusts Alan Greenspan. The American public has not had legal IOU”s to hold in their collective hands since 1933. They have voluntarily renounced the power of the veto. It has been even longer for most Europeans.

The economic veto over monetary policy has been transferred to bond speculators. There are fewer of them than citizens who used to hold gold coins. But they do have a lot of power. They are hated by the government. The Street.com’s Daniel Gross reminded us in November, 2001: In 13 years at the helm of the Fed, Greenspan has built up an enormous amount of credibility and clout – in Washington and New York. His actions in controlling the movement of interest rates have been credited with making or breaking the past two presidencies. George Bush – the elder – explicitly blamed Greenspan for dooming his one-term presidency by not cutting rates quickly enough in 1991. “I reappointed him, and he disappointed me,” Bush said.

Greenspan, on the other hand, made Clinton’s presidency. The Fed Chairman strongly suggested, early on, that the president focus on deficit reduction because that would please him and, in turn, the bond market. Clinton exploded: “You mean to tell me that the success of the program and my reelection hinges on the Federal Reserve and a bunch of [bleeping] bond traders?” But with the market-savvy Robert Rubin whispering in his ear, Clinton chose the path of budgetary restraint. Greenspan ratified his 1993 budget plan, and the rest is economic history.

In today’s political/investing culture, it is difficult for policymakers to make much progress without the cooperation of the bond market. And because the bond market regards Greenspan as an oracle par excellence, the 74-year-old former devotee of Ayn Rand now occupies the catbird seat.

In today’s political/investing culture, it is difficult for policymakers to make much progress without the cooperation of the bond market. And because the bond market regards Greenspan as an oracle par excellence, the 74-year-old former devotee of Ayn Rand now occupies the catbird seat.

The bleeping bond traders today are called “bond vigilantes.” This fits. Vigilantes in the old West used to string up suspected malefactors when the government refused to prosecute, or when, in some cases, the people at the end of the ropes were the local government.

For politicians, the free market’s speculators who publicly expose the government”s monetary policies as detrimental to the public are regarded by the government as barbarians or vigilantes. Politicians hate any veto power held by the public. The government will do what it can to bankrupt US, hamper US, or in some way remove our veto power. But, in the long run, there is no escape. The free market will veto bad economic policies. The free market, not the State, is economically sovereign. Economic sovereignty trumps judicial sovereignty in the long run.

Keynes dismissed the long run. “In the long run, we are all dead.” Well, Keynes is dead, and his theoretical legacy is dying. But, for the moment, the rival sovereignties are about equally matched. That”s why veto-holding citizens can get burned in the short run when we attempt to exercise our veto.

If you think price inflation is coming, sell bonds and buy gold. I think price inflation is coming. That’s because monetary inflation is here, all over the world.

Beware a Trojan Horse!

~ Demythologizing the Golden Myth! ~

By March 4, 1933, the day F.D.R. was inaugurated, most commercial banks had already been closed and the economy of the United States was in a death spiral with the gross national product having fallen by 46% since 1929. Wholesale prices had fallen in excess of 35%, hitting debtors with both barrels of the financial shotgun: as the value of their collateral declined, the value of the dollars was steadily increasing. Gold clauses in loan agreements allowed lenders to be paid in either gold or currency (the dollar was “as good as gold”, because they were one in the same), thereby protecting creditors against inflation or against a devaluation or even collapse of the dollar.

As a candidate, Roosevelt had lambasted Herbert Hoover for the mere suggestion that the US could be forced to abandon the gold standard, stating that Hoover”s warning was, “a libel on the credit of the United States.” The President therefore gave Congress little warning of what was to come, when two days after taking office, on March 6, 1933, Roosevelt set in motion a chain of events that would end the international gold standard. On that fate filled day, Roosevelt unprecedented and unconstitutional step of closing the nations banks in addition to prohibiting them from paying out or exporting gold coin or bullion. The Presidential Proclamation made reference to a “national emergency”, without ever stating what the emergency was, and sought legitimacy by referencing the Trading with the Enemy Act of World War I.

As a candidate, Roosevelt had lambasted Herbert Hoover for the mere suggestion that the US could be forced to abandon the gold standard, stating that Hoover”s warning was, “a libel on the credit of the United States.” The President therefore gave Congress little warning of what was to come, when two days after taking office, on March 6, 1933, Roosevelt set in motion a chain of events that would end the international gold standard. On that fate filled day, Roosevelt unprecedented and unconstitutional step of closing the nations banks in addition to prohibiting them from paying out or exporting gold coin or bullion. The Presidential Proclamation made reference to a “national emergency”, without ever stating what the emergency was, and sought legitimacy by referencing the Trading with the Enemy Act of World War I.

When brought to the attention of the President that there was no legislative justification for either branches of government, the executive or legislative, to close privately owned banks, he “immediately” prepared legislation to confirm what had already taken place.

Five days after taking office, Roosevelt sent to the Congress the Emergency Banking Relief Act, which sought to amend the Trading with the Enemy Act of 1917 by authorizing the President in times of war to “investigate, regulate, or prohibit. . . the importing, exporting, hoarding. melting or earmarking of gold. . . ” These changes now provided the President the authority to act, “during any other period of national emergency declared by the President”, thereby expanding his authority beyond that limitation of war.

When he “introduced” the bill, House Majority leader Joseph W. Burns asked that it be immediately considered with debate being limited to forty minutes. despite the fact that few Representatives new of its contents. When the deed was done , Congressman Lundeen stated for the record, “. . . we therefore have the spectacle of the great House of Representatives of the United States of America passing, after a forty minute debate, a bill that Members never read and never saw, a bill whose author is unknown.”

With no gridlock, the Democratic majority was able to secure passage of the bill in the Senate that very day – at which time it was signed into law by Roosevelt. The following day, acting under his new authority, the President issued Executive Order No. 6073. In addition to authorizing the Secretary of the Treasury to decide which banks could be reopened, the Order prohibited the exportation of gold from the United States. Soon afterwards, under that same authority, F.D.R. issued Executive Order No. 6102 (April 5, 1933) which was the provision used to confiscate all privately owned gold held within the United States. As just compensation, the owners would receive paper money – whether they liked it or not.

With no gridlock, the Democratic majority was able to secure passage of the bill in the Senate that very day – at which time it was signed into law by Roosevelt. The following day, acting under his new authority, the President issued Executive Order No. 6073. In addition to authorizing the Secretary of the Treasury to decide which banks could be reopened, the Order prohibited the exportation of gold from the United States. Soon afterwards, under that same authority, F.D.R. issued Executive Order No. 6102 (April 5, 1933) which was the provision used to confiscate all privately owned gold held within the United States. As just compensation, the owners would receive paper money – whether they liked it or not.

“Even during the period when Rome lost much of her ancient prestige, an Indian traveler observed that trade all over the world was operated with the aid of Roman gold coins which were accepted and admired everywhere.” ~ Paul Einzig

By joint resolution, Congress then voided all contractual clauses, private and public, which required payment in gold, declaring that such clauses were against public policy. From that moment on, all agreements regarding “payment in gold”, past, present and future – were declared null and void.

This legislative blitz had one purpose – to knock the United States off the gold standard. Of course, the fact that this grand scheme was Roosevelt”s objective – and was never made clear to either Congress nor the public.

On March 8, 1933, four days after assuming the Office of the President, Roosevelt joked, “As long as nobody asks me whether we are off the gold standard. . ., that is all right, because nobody knows what the . . . gold standard really is. . .” It appears that his primary reason for abandoning the gold standard was to allow him to devalue the dollar – and devalue it he did.

Within ten weeks of Roosevelt’s inauguration, Congress unwittingly gave him authorization to devalue the dollar. For 96 years, the price of gold had been set at $20.67 per fine ounce. Once the “confiscation” of the yellow metal had been completed at the old rate, F.D.R. fixed the value of gold at $35.00 per ounce – a dollar devaluation of nearly 41%. With a single stroke of a pen, Roosevelt created a gigantic redistribution of wealth from creditor to debtor, while increasing the gold assets of the US Government and “stabilizing” the monetary system. Stay tuned – much more radical methods of redistribution are now under consideration by our outrageous government.

Within ten weeks of Roosevelt’s inauguration, Congress unwittingly gave him authorization to devalue the dollar. For 96 years, the price of gold had been set at $20.67 per fine ounce. Once the “confiscation” of the yellow metal had been completed at the old rate, F.D.R. fixed the value of gold at $35.00 per ounce – a dollar devaluation of nearly 41%. With a single stroke of a pen, Roosevelt created a gigantic redistribution of wealth from creditor to debtor, while increasing the gold assets of the US Government and “stabilizing” the monetary system. Stay tuned – much more radical methods of redistribution are now under consideration by our outrageous government.

“There can be no other criterion, no other standard than gold. Yes, gold which never changes, which can be shaped into ingots, bars, coins, which has no nationality and which is eternally and universally accepted as the unalterable fiduciary value par excellence.” ~ Charles De Gaulle (1890-1970)

It’s O.K. to “own” gold again!

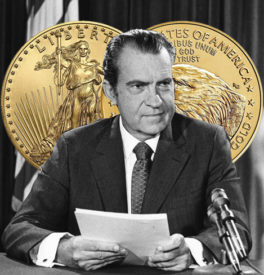

In 1973, legislation was passed in Congress giving the President discretionary authority to legalize private ownership of gold for the first time in forty years, with the stipulation that the “legalization” would not “adversely affect the United States” international monetary position.” Then President, Richard M. Nixon chose not to exercise the option given him by Congress.

“The private ownership of gold is a privilege, not a right. Congress revoked the privilege of private ownership in 1933 and restored it in 1974. Congress could easily revoke the privilege again. In fact, at no time during this century has the US Government recognized the right of private gold ownership. The Trading With The Enemy Act, which President Roosevelt invoked in 1933 to restrict private gold transactions, remains law. The government could reactivate the machinery, which the Trading With The Enemy Act established, to implement gold confiscation.” ~ Boston College International and Comparative Law Review

“The private ownership of gold is a privilege, not a right. Congress revoked the privilege of private ownership in 1933 and restored it in 1974. Congress could easily revoke the privilege again. In fact, at no time during this century has the US Government recognized the right of private gold ownership. The Trading With The Enemy Act, which President Roosevelt invoked in 1933 to restrict private gold transactions, remains law. The government could reactivate the machinery, which the Trading With The Enemy Act established, to implement gold confiscation.” ~ Boston College International and Comparative Law Review

With respect to the subject of “confiscation”, Section 2, paragraph 2 of Mr. Roosevelt’s Executive Order, exempted “. . . gold coins having a recognized special value to collectors of rare and unusual coins.”, to include “gold coin made prior to April 5, 1933,” – the date of the Executive Order. (Federal Register 4309/4312).

Published articles, erroneous advertising and “sales pitches” over the last fifteen to twenty years might lead one to believe that a rare coin included gold coins which exceeded by more than 15% the value of its underlying property (i.e. its gold content). It should be noted that this explanation was included in a proposed US Treasury Regulation in 1984 and has been repeatedly on the Agenda of Regulatory Actions although none of the pertinent provisions relevant to the proposed regulation have ever been adopted by law. Therefore, as relates to gold ownership, there is no requirement for Certified “Rare” Coins by any independent grading service, nor requirement, specifically for US coins with any “grade” of condition referenced. The laws make reference to “. . . collectors of rare and unusual coins” minted “prior to April 5, 1933“, no matter what their nation of origin.

“Gold, Mr. Bond.”

Should we once again experience inflationary policies (which I believe already exist) and huge budget deficits which contrary to current “spins” by our illustrious leaders – will escalate immeasurably – and oh goody! – as of this writing the irascible Mr. Greenspan has spun his web ELEVEN times and raised the interest rates – to “slow the economy down”! What about the ongoing costs of our continued military involvement on behalf of NATO and the UN? Oh, but let”s not forget all the “excess” monies the then, current administration “found” during 1999 – money that rightfully belonged to the taxpayers – We the People! Many suspected that it was smoke and mirrors then – and it has certainly proven to be that.

Measures taken by this government could possibly include exchange controls and regulation of the sale and ownership of gold. Although our privilege to own was restored in the United States on August 15, 1974, the confiscatory machinery remains in place to this very day. The President still retains the “right”, under the Emergency Banking Relief Act, to “investigate, regulate or prohibit. . . the importing, exporting, hoarding, melting or earmarking of gold” in times of a declared national emergency. Does this also give the President the right to confiscate gold owned by private citizens? In the event of a severe inflation, economic collapse, institution of Martial Law or official devaluation of the dollar, given the current “state of affairs” in America, our President – under the guise of Homeland Security – will be prepared to take whatever steps he deems as “necessary”.

Now, you should give some thought to the legal and historical precedents which were established nearly 90 years ago, when another Administration was confronted with the monetary “crises” caused by the mother of all recessions – The Great Depression. Those precedents are especially relevant when you consider the fact that the last two presidents with activist agendas during comparable economic situations were Lyndon B. Johnson and Franklin D. Roosevelt.

Remember, gold is an objective value. It cannot be printed, artificially inflated or deflated, meaningfully manipulated or misvalued on perception. As global economics of the past few decades have demonstrated, the paper economies of the world can be incredibly fragile. Holding gold coins is the ultimate protection against the greed, mistakes or stupidity of others. Gold produces nothing, but protects all.