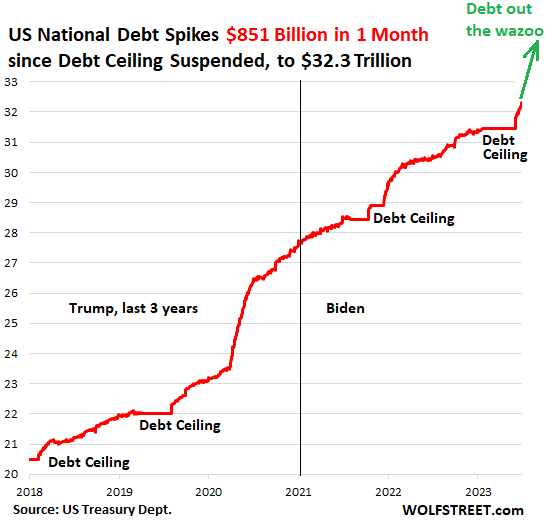

A month ago, the fake debt ceiling fight ended and Congress suspended the federal government’s borrowing limit for two years. Since the debt ceiling deal, the US Treasury has added a staggering $851 billion to the national debt.

A month ago, the fake debt ceiling fight ended and Congress suspended the federal government’s borrowing limit for two years. Since the debt ceiling deal, the US Treasury has added a staggering $851 billion to the national debt.

Within a week of the debt ceiling suspension, the national debt cracked $32 trillion and as of June 30, it stood at $32.33 trillion.

I warned that we would see a big jump in the national debt with the passage of any debt ceiling deal. After nearly six months up against its borrowing limit, the federal government had some ground to make up. It needed to replenish cash reserves and unwind the extraordinary measures it took to keep the government running while it couldn’t borrow any money. But the pace of borrowing even surprises me.

WolfStreet called it “an amazing freakshow.”

Goldman Sachs analysts had projected that the US Treasury would have to sell up to $700 billion in T-bills within six to eight weeks of a debt ceiling deal just to replenish cash reserves spent down while the government was up against the borrowing limit. The Treasury blew through that number in just four weeks.

Goldman Sachs analysts had projected that the US Treasury would have to sell up to $700 billion in T-bills within six to eight weeks of a debt ceiling deal just to replenish cash reserves spent down while the government was up against the borrowing limit. The Treasury blew through that number in just four weeks.

There are two types of Treasury Department securities. “Nonmarketable” securities included inflation-protected I-bonds that customers can buy directly from the Treasury, along with securities that entities such as Government pension funds and the Social Security Trust Fund can hold. These do not trade on the open market. “Marketable” Treasuries are sold through auctions and then trade on the public bond market. These include bonds and notes.

Last month, nonmarketable debt rose by $123 billion. Nonmarketable securities make up a relatively small amount ($6.8 trillion) of the outstanding debt. Marketable debt increased by $728 billion since June 3 with $25.43 trillion outstanding.

Even with the big borrowing spree, the Treasury Department has only partially refilled the Treasury General Account. (Basically, the federal government’s checking account.) The TGA cash balance increased from $23 billion on June 1 to $465 billion as of June 30. This fell short of the Treasury’s $550 billion goal and remains well below the nearly $600 billion balance “consistent with Treasury’s cash balance policy.”

Part of the problem is that government tax receipts are dropping. That means the Treasury will have to borrow even more to make up the difference.

Meanwhile, the Treasury must pile even more debt on top of that to cover massive monthly budget deficits.

Now, you might be thinking that with the spending cuts in the [misnamed] Fiscal Responsibility Act, Congress fixed this problem. But we live in an upside-down world where spending cuts mean spending still increases.

Even if Congress and the president manage to stick to the plan, the so-called spending cuts will not put a dent in actual total spending. That means we can expect massive deficits to continue month after month. And it’s only a matter of time before Congress and the Biden administration abandon the pretense of spending cuts to address the next crisis.

In order to cover current spending and finish replenishing the TGA, the Treasury estimates it will have to sell $733 billion in marketable securities during the third quarter.

Who is going to buy all these bonds?

With the Fed still engaged in the inflation fight, the Treasury can’t depend on the central bank to put its thumb on the bond market and create artificial demand through quantitative easing. (I think this is coming in the not-too-distant future.) That means that the Treasury will have to sell bonds cheap enough with high enough yields to stimulate enough demand to absorb all the supply. As WolfStreet noted, “Yield solves all demand problems. If demand sags at current yields, yields automatically rise until sufficient demand emerges. If the yield is high enough, there is always demand.”

But that means higher interest rates — not a good scenario for a government trying to borrow trillions of dollars. This is why I called the national debt a ticking time bomb.

WolfStreet pointed out another problem. The Treasury will soak up a lot of liquidity with its borrowing spree.

Refilling the TGA pulls liquidity from the markets, in the opposite way that drawing down the TGA had added liquidity to the markets. Stocks had soared during the drawdown phases, and they had swooned during the first refill phase from late 2021 through April 2022, when the TGA absorbed nearly $1 trillion.”

“an amazing freakshow”

This will create upward pressure on other interest rates, including those on corporate bonds, mortgages, auto loans and other debt instruments.

How this will play out remains unclear. But we can say this with confidence: the spending will continue. The debt will continue to rise. And if the Fed keeps rates elevated, paying the interest on the national debt will become a big problem for Uncle Sam.

The national debt has been growing for so long that most people just shrug when we talk about it. Nobody seems particularly concerned outside of a handful of contrarians. Sure, most everybody recognizes that it might be a problem “down the road.” But they believe the road is long, so we can get away with continuing to kick the can. But mark my words, eventually, they will run out of road.

Written by Michael Maharrey for Schiff Gold ~ July 5, 2023