As I look at the incredible numbers we see in our nation’s budget, it becomes readily apparent that this is a shipwreck looking for a reef to hit and unsustainable as all hell. It has to be in their plans to destroy the economy. There’s just no other sound or sane explanation for it.

As I look at the incredible numbers we see in our nation’s budget, it becomes readily apparent that this is a shipwreck looking for a reef to hit and unsustainable as all hell. It has to be in their plans to destroy the economy. There’s just no other sound or sane explanation for it.

Biden’s policies do make one’s mind go straight to Alinksky’s Rules for Radicals and the manner in which one can bring a nation to its knees, ripe for a Communist takeover. It’s more than possible that it would succeed in America today, given the weakness that has spread throughout our society. Driven into the depths of poverty, the most dependent and weak-minded people will immediately cry out for more and greater government.

I wonder how many will go it on their own and try to survive independently, despite the country’s hard push into communism. I’m in no rush to see who arises to the occasion, but still it’s an interesting thought in these intriguing, curious and dangerous times. ~ J.O.S.

~ I Have a Bad Feeling… ~

Sane, normal, logical men and women can read the handwriting on the wall, and we all recognize the warning signs that come with a government engaged in dangerous out-of-control spending, as some sort of “stimulus” for a failing, stagnating economy, and regardless of their best efforts, any future administration will be hard-pressed to stop America’s economy from sliding over the edge of the cliff and into the dark netherworld of economic hell. A day is arriving soon when the bottom drops out of the economy within this decade, to such a point that no amount of cheerleading and wishful thinking from the Biden regime’s central bank cheerleaders, toadies, apologists and apparatchiks will save it from a final hard fall.

Sane, normal, logical men and women can read the handwriting on the wall, and we all recognize the warning signs that come with a government engaged in dangerous out-of-control spending, as some sort of “stimulus” for a failing, stagnating economy, and regardless of their best efforts, any future administration will be hard-pressed to stop America’s economy from sliding over the edge of the cliff and into the dark netherworld of economic hell. A day is arriving soon when the bottom drops out of the economy within this decade, to such a point that no amount of cheerleading and wishful thinking from the Biden regime’s central bank cheerleaders, toadies, apologists and apparatchiks will save it from a final hard fall.

Think of modern-day America as speeding towards a Weimar Republic moment witnessed between 1921 and 1923, where money became only so much useless paper.

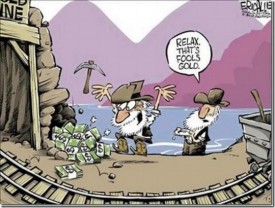

The printing of massive amounts of new money wouldn’t be such a detrimental and damaging thing to the economy and the people if it were distributed evenly to everyone, rather than being handed to large financial institutions at nearly zero interest to be loaned out to us peons at much higher interest rates. This, along with the massive artificially created market bubbles and their boom-and-bust gambits – a ploy the Federal Reserve Bank and Big Business have used since 1913 – is the manner in which they are able to capture the lion’s share of what passes for new wealth, although most of us know this so-called “new wealth” is fool’s gold. And it has also facilitated the current massive increase in wealth inequality, the huge gap between the very poor and the vulgar elitist rich – fascists and crony-capitalists – who have concentrated the bulk of America’s wealth into their own hands, with the help of our Congress and regulations that work against everyday, ordinary Americans and small businesses.

The printing of massive amounts of new money wouldn’t be such a detrimental and damaging thing to the economy and the people if it were distributed evenly to everyone, rather than being handed to large financial institutions at nearly zero interest to be loaned out to us peons at much higher interest rates. This, along with the massive artificially created market bubbles and their boom-and-bust gambits – a ploy the Federal Reserve Bank and Big Business have used since 1913 – is the manner in which they are able to capture the lion’s share of what passes for new wealth, although most of us know this so-called “new wealth” is fool’s gold. And it has also facilitated the current massive increase in wealth inequality, the huge gap between the very poor and the vulgar elitist rich – fascists and crony-capitalists – who have concentrated the bulk of America’s wealth into their own hands, with the help of our Congress and regulations that work against everyday, ordinary Americans and small businesses.

In 1971, the median household income was approximately $53,300 in today’s dollars. Today, U.S. productivity is 2.3 times higher than it was in 1971. At that rate, the current American household’s median income should be approaching upwards of $162k rather than $70,700 today in 2023. This means the Federal Reserve Bank’s policies are currently stealing approximately $82k from the typical family every year.

A huge fraction of our labor currently benefits an infinitesimally small number of people. We may not be getting beat like the black slaves on the cotton plantations, but one would think we’d all be awake to the fact we are slaves nevertheless, regardless of color.

When Biden signed a bill two months ago that effectively ended the spending debt ceiling for the federal government until 2025, federal borrowing jumped more than $350 billion in the first day, adding an extra trillion to the national debt in addition to the six trillion the Biden regime has already spent, and our national debt rose above $32 trillion in less than two weeks. The national debt currently sits at $32.7 trillion with an attached annual net interest payment of $657 billion, an interest payment that has nearly doubled from four years ago and a national debt that is 120 percent of the U.S. GDP, and Biden has more than a year to go to do his worst.

When Biden signed a bill two months ago that effectively ended the spending debt ceiling for the federal government until 2025, federal borrowing jumped more than $350 billion in the first day, adding an extra trillion to the national debt in addition to the six trillion the Biden regime has already spent, and our national debt rose above $32 trillion in less than two weeks. The national debt currently sits at $32.7 trillion with an attached annual net interest payment of $657 billion, an interest payment that has nearly doubled from four years ago and a national debt that is 120 percent of the U.S. GDP, and Biden has more than a year to go to do his worst.

But, as presidential candidate Nikki Haley accurately pointed out during the first Republican presidential debate on August 23rd 2023, let’s not forget that President Trump and the Chamber of Commerce establishment Republicans and Republicans-In-Name-Only “added $8 trillion to our debt”, something that future generations will find hard to forgive. The actual number was $7.8 trillion, but who’s counting a few billion when we’ve leaped into such a surreal world where we are speaking of debt in the trillions.

Now we learn from the Treasury Borrowing Advisory Committee that starting from last month and proceeding through December of this year, the U.S. Treasury will borrow $1.8 trillion – that’s 1,850 billion – dollars in six short months. Never before has such a level of spending been seen in U.S. history, except during the Covid imbroglio, although there isn’t even any crisis today. And worse yet, this incredibly stunning borrowing now seems to be a fundamental feature of Congress and the U.S. Treasury.

Maybe none of this matters. It certainly doesn’t matter to the Democratic Party Communists such as Alexandria Ocasio-Cortez and Chuckie Schumer and scores of others in Congress who have successfully urged Joe Biden to ignore the Supreme Court ruling that named his student loan scheme unconstitutional. Joe went ahead with a new plan last month to forgive $39 billion in student loans – no need to worry about rising interest rates if you’re a member of the new Marxist-Maoist movement or willing to submit to their edicts and diktats.

Maybe none of this matters. It certainly doesn’t matter to the Democratic Party Communists such as Alexandria Ocasio-Cortez and Chuckie Schumer and scores of others in Congress who have successfully urged Joe Biden to ignore the Supreme Court ruling that named his student loan scheme unconstitutional. Joe went ahead with a new plan last month to forgive $39 billion in student loans – no need to worry about rising interest rates if you’re a member of the new Marxist-Maoist movement or willing to submit to their edicts and diktats.

Never mind that someone will get left holding the bag, possibly reduced to financial ruin themselves.

As of five months ago, forty-four million Americans collectively owed more than $1.6 trillion in federal student loans, with private loans making the total $1.7 trillion, surpassing both auto loans and credit card debt. And at $12 trillion, home mortgage debt eclipses it all.

Welcome to Biden-Flation

The weaponization of the U.S. dollar by the Treasury by the Biden regime to force adversaries and allies alike to do its bidding, as seen with Russia, Iran, Uganda and Japan, will most certainly have the direct consequence of eventually making the federal government almost completely dependent on domestic funding sources and our Federal Reserve Bank. Once this becomes the rule rather than the exception throughout our market system, interest rates on all U.S. Treasury securities will rise.

The government started monetizing a large portion of U.S. debt during the Obama years, and now we are witnessing it done again under Biden, with the American taxpayer being set up to take the hit directly in the teeth.

The days of low inflation are long gone and so too are the zero-interest rate policies. The Federal Reserve Bank is now perched at the edge of our economic abyss like a big, fat lemming prepared to jump. To boost our declining growth, it needs to lower interest rates – a strange trick they learned off some dark web spam site, but with the dollar as the U.S. global reserve currency and their lead that allowed inflation to become embedded in geopolitics, raising real-world costs everywhere, the usual trick of dropping interest rates to near-zero and flooding the markets with “free money for financiers” to create liquidity will reignite the smoldering flames of an inflation event that is far from over and poised to become a massive, catastrophic economic bonfire that destroys wealth like nothing before has ever done.

The inflation rate could go to zero today, but that wouldn’t erase the damage done from the highest inflation experienced in decades over the past few years, and it wouldn’t magically make the high costs of goods go away or make them suddenly less expensive. Inflation can’t be measure each year, as tho’ it magically resets each year, because it doesn’t; all the inflation from previous years is still crushing America’s wage earners. much of which was brought on by the Covid lockdowns and further compounded exponentially by Biden’s energy and “climate change” policies and his massive spending bills.

The inflation rate could go to zero today, but that wouldn’t erase the damage done from the highest inflation experienced in decades over the past few years, and it wouldn’t magically make the high costs of goods go away or make them suddenly less expensive. Inflation can’t be measure each year, as tho’ it magically resets each year, because it doesn’t; all the inflation from previous years is still crushing America’s wage earners. much of which was brought on by the Covid lockdowns and further compounded exponentially by Biden’s energy and “climate change” policies and his massive spending bills.

Wages certainly haven’t caught up with real-world inflation or asset bubble inflation, such as seen in the housing market. Value for value in labor for pay has lagged far behind where it should have been for over forty-five years, not so much in the actual dollar amount paid but in the true value of the dollar and its purchasing power in the market place.

And in the meantime, the cable new business networks and Democratic Party mouthpieces like the Gray Lady are slobbering all over themselves to declare that “rents are softening”. Well they most assuredly are thirty percent higher today across the country than they were in 2020, and all those massive rent increases and the many other manifestations of inflation in other sectors of the economy over the past few years are still strangling renters.

Just how did we ever survive before the constant Federal Reserve Bank stimulus and its intervention on behalf of corporations and the elitist top ten percent – to the detriment of America’s hardworking men and women? Why have we blindly accepted the false narrative that any company is “too big to fail”? Every central bank save, since the Fed’s creation, further distorted the financial system and the economy, creating greater social instability and bringing more harm to the American people.

Just how did we ever survive before the constant Federal Reserve Bank stimulus and its intervention on behalf of corporations and the elitist top ten percent – to the detriment of America’s hardworking men and women? Why have we blindly accepted the false narrative that any company is “too big to fail”? Every central bank save, since the Fed’s creation, further distorted the financial system and the economy, creating greater social instability and bringing more harm to the American people.

The American economy has had its struggles before the creation of the Federal Reserve Bank, but nothing like what we’ve seen since this monstrous central bank came to be with its manipulative boom and bust philosophy that enriches it and its cronies, while making the ordinary working American ever the more poorer.

Expect to see the interest cost of the U.S. national debt to hit $1 trillion at some point in the first quarter of 2024, at which time, our debt’s interest rate is going to become our economy’s most deadly existential threat, racing along and growing by leaps and bounds, with the financial institutes made too weak to save anyone from the collapse of market bubbles, since there won’t be any money available to loan. And in fact, this will become a dire threat to the ultimate survival of all Americans.

I will be most surprised if our country makes it past 2032 without seeing our economy reduced to shambles from the abuse of our so-called leaders. Barring an unforeseen financial calamity during the next two years, the years between 2028 and 2035 will be critical years, which will reveal if we’re righting our economic ship or sending her straight to Davy Jones’ locker and Hell.

America is well on its way to an unimaginably tough time and an incredible turning point for us all, and there won’t be anyone there to save us but ourselves, each other and whatever God one speaks to at night. This will be an event that will seem downright Biblical to many, and it will change America forever, in ways that may well fully depend on each of us and what we do in its aftermath.

Stay strong and steadfast. Help one another in the same way so many individuals helped one another during the Great Depression and don’t give up hope, even tho’ it’s hard not to mumble “I have a bad feeling about this” under one’s breath, as we leave our community gathering spot.

August 29, 2023

Justin O. Smith ~ Author

~ The Author ~

Justin O. Smith has lived in Tennessee off and on most of his adult life, and graduated from Middle Tennessee State University in 1980, with a B.S. and a double major in International Relations and Cultural Geography – minors in Military Science and English, for what its worth. His real education started from that point on. Smith is a frequent contributor to the family of Kettle Moraine Publications.