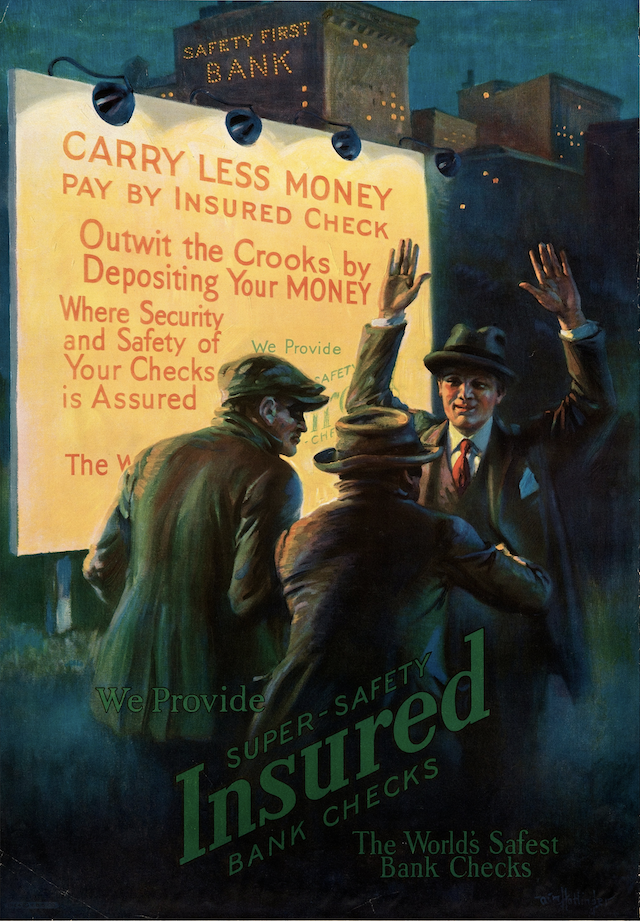

Will the Second-Most Powerful U.S. Bank Finally Explain Why It ‘De-Banks’ Christian Customers?

Will the Second-Most Powerful U.S. Bank Finally Explain Why It ‘De-Banks’ Christian Customers?

Bank of America is being advised to quit punishing customers for their beliefs, or else consider a name change, but first it has to come clean about its motives.

Bank of America, the second most powerful bank in the U.S., is being questioned by a coalition of state attorneys general for allegedly refusing service to Christian customers and to politically conservative groups.

Closing just one account of an unwanted customer is harder to notice, the Kansas attorney general said, but it has now happened “again and again and again… (Continue to full article)

Biden Calls for 44.6% Capital Gains Tax Rate, Highest Capital Gains Tax Since Its Creation in 1922

More units of public debt mean weaker productive growth, higher taxes, and more inflation Under the Biden proposal, the combined federal-state capital gains tax exceeds 50% in many states. California will face a combined federal-state rate of 59%, New Jersey 55.3%, Oregon at 54.5%, Minnesota at 54.4%, and New York state at 53.4%.

Worse, capital gains are not indexed to inflation. So Americans already get stuck paying tax on some “gains” that are not real. It is a tax on inflation, something created by Washington and then taxed by Washington. Biden’s high inflation makes this especially painful.

Many hard working couples who started a small business at age 25 who now wish to sell the business at age 65 will face the Biden proposed 44.6% top rate, plus state capital gains taxes. And much of that “gain” isn’t real due to inflation. But they’ll owe tax on it… (Continue to full article)

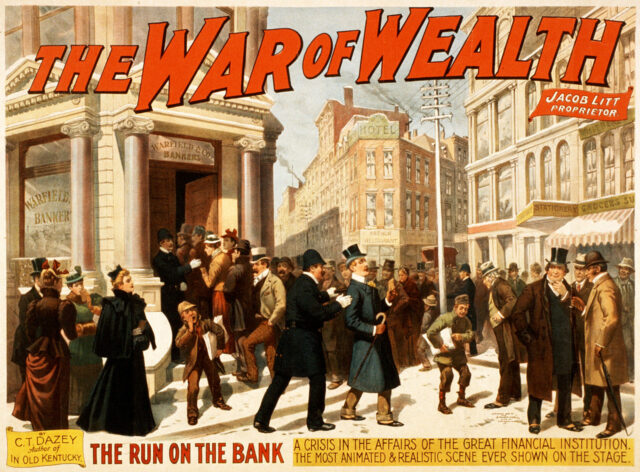

US banks shut a total of 36 branches in just one week – is YOURS affected?

American banks notified their regulator that they would close 36 branches in just one week this month – with TD Bank and Wells Fargo alone responsible for 28.

Bank of America, Chase, Citibank, Citizens, US Bank and Liberty Bank in California arebehind the closure of the remaining eight.

TD Bank’s batch of 20 closures, reported to the Office of Comptroller of the Currency (OCC) between April 7 and 13, are mainly along the East Coast… (Continue to full article)