In discussing the Mises Institute’s June 24th full-page Wall Street Journal ad entitled “Who Needs the Fed?” on talk radio recently most of the interviewers naturally expressed skepticism over whether the Fed could ever actually be abolished and a gold-and-silver standard reinstituted. It reminded me of something Murray Rothbard said about this. If the government had monopolized say, shoe production a hundred years ago and someone suggested the privatization of shoe production, there would be cries of: “Who will make shoes? The government has always made shoes!”

In discussing the Mises Institute’s June 24th full-page Wall Street Journal ad entitled “Who Needs the Fed?” on talk radio recently most of the interviewers naturally expressed skepticism over whether the Fed could ever actually be abolished and a gold-and-silver standard reinstituted. It reminded me of something Murray Rothbard said about this. If the government had monopolized say, shoe production a hundred years ago and someone suggested the privatization of shoe production, there would be cries of: “Who will make shoes? The government has always made shoes!”

Well, America has not always had a central bank and in fact, the three precursors of the Fed — the Bank of North America, the First Bank of the United States, and the Second Bank of the United States — were all abolished in the eighteenth and nineteenth centuries.

It happened then, and it can happen again.

In The Mystery of Banking Murray Rothbard explained how the Bank of North America (1782-1783) was “driven through Congress” by Rep. Robert Morris, a Philadelphia financier and a leader of the Federalist party. The agenda of the Federalists, said Rothbard, was “to reimpose in the new United States a system of mercantilism and big government similar to that in Great Britain, against which the colonists had rebelled.”

Alexander Hamilton

That would have included a powerful central government with a king or “permanent president,” as Alexander Hamilton said, that would “be built up by high taxes and heavy public debt . . . high tariffs . . . a big navy to open up and subsidize foreign markets for American exports, and launch a massive system of internal public works” (aka pork barrel spending). The United States was to have “a British System without Great Britain.”

A key component of what Rothbard called “the Morris scheme” was “to organize a central bank [modeled after the Bank of England] to provide cheap credit and expanded money for himself an his allies.” The Bank was given a monopoly privilege of its notes being receivable in all tax payments to state governments and the federal government, and no other banks were permitted to exist in the country! Despite these monopolistic privileges a lack of public confidence in the bank’s notes led to their severe depreciation, so much so that the bank was privatized after about a year and a half.

Former Fed Chairman Ben Bernanke once proudly announced that Alexander Hamilton was the founding father of central banking in America and indeed he was. He was what Rothbard called “Morris’s youthful disciple” and, as Treasury Secretary, he helped Morris and his business associates re-established a central bank by championing the First Bank of the United States (1791-1811), created after a historic a debate with Thomas Jefferson over the constitutionality of a national bank run by politicians.

Jefferson correctly argued that such an institution was not among the delegated powers of the federal government and that the constitutional convention debated the issue and decided against it. Hamilton responded by inventing his theory of “implied powers” of the constitution which, to this day, has the effect of allowing politicians to say that just about anything and everything the federal government does is “constitutional.”

Jefferson correctly argued that such an institution was not among the delegated powers of the federal government and that the constitutional convention debated the issue and decided against it. Hamilton responded by inventing his theory of “implied powers” of the constitution which, to this day, has the effect of allowing politicians to say that just about anything and everything the federal government does is “constitutional.”

Created in 1791, “The Bank of the United States promptly fulfilled its inflationary potential,” Murray Rothbard wrote in History of Money and Banking in the United States. It issued millions of dollars in paper money and demand deposits, on top of $2 million in gold and silver. It invested heavily in loans to the U.S. government. “The result of the outpouring of credit and paper money,” Rothbard wrote, was “in increase [in prices] of 72 percent” from 1791 to 1796.

Northern merchants and bond speculators supported the Bank, but the growing tax burden imposed by the Federalists to support the rapidly-growing public debt led to a political backlash that ended in Congress allowing its charter to lapse in 1811.

The War of 1812 was then used as an excuse to bring back the bank to monetize the war debt. It went back into business in January of 1817 and quickly inflated the currency, causing the Panic of 1819, which Murray Rothbard called the first depression in the “new country.”

In his book The Sovereign States James J. Kilpatrick devotes a chapter to the effects of the Second Bank on various states. He wrote of mismanagement, speculation, and fraud that was so pervasive that it created “a wave of hostility toward the Bank of the United States all throughout the country. Indiana and Illinois amended their constitutions to prohibit the Bank of the United States (BUS) from operating there. North Carolina, Georgia, Maryland, Tennessee, and Kentucky imposed heavy taxes on BUS branches that popped up in those states ($60,000 per year in Kentucky). The obvious purpose of these taxes was to drive the BUS out of the state. When the BUS refused to pay the $50,000 per year tax on each of two branches to the state of Ohio the Ohio legislature sent an armed marshal to the bank who walked into the vault and retrieved $100,000. Connecticut, South Carolina, New York, and New Hampshire then followed Ohio’s lead.

By the 1820s the BUS had become a bureaucratic behemoth with twenty-nine branches; its main headquarters in Philadelphia “looked like a Greek temple,” wrote historian Robert Remini, and “had earned widespread hatred and fear throughout a substantial part of the nation.”

Andrew Jackson

Upon taking office in March of 1829 President Andrew Jackson condemned the BUS as “a monster, a hydra-headed monster . . . equipped with horns, hoofs, and a tail so dangerous that it impaired the morals of our people, corrupted our statesmen, and threatened our liberty. It bought up members of Congress by the dozen . . . subverted the electoral process, and sought to destroy our republican institutions.”

The BUS’s supporters were the corrupt remnants of the old Hamiltonian/Federalist political machine, primarily from the ranks of the “one percenters” of the day. Its opponents were by contrast “men from all classes,” and “from all sections of the country,” wrote Remini in Andrew Jackson and the Bank War.

On July 10, 1832 President Andrew Jackson vetoed the bill to recharter the BUS and his veto was not overridden. The BUS eventually went out of business over the next several years. Jackson’s veto statement roundly condemned the institutionalized political cronyism of the BUS, which of course was always Hamilton’s (and Morris’s) main objective. “It is to be regretted that the rich and powerful too often bend the acts of government to their selfish purposes,” said Jackson. Government grants of “titles, gratuities, and exclusive privileges, to make the rich richer and the potent more powerful” are illegitimate, he said. “The humble members of society . . . who have neither the time nor the means of securing like favors . . . have a right to complain of the injustice of their Government.” He then vetoed the bill.

The statist court historians of the American academic history profession have long slandered this classic, libertarian declaration as “beneath contempt,” wrote Robert Remini. Of course they have. Court historians are always rewarded in myriad ways for being the apologists, propagandists, and mouthpieces of corrupt political establishments.

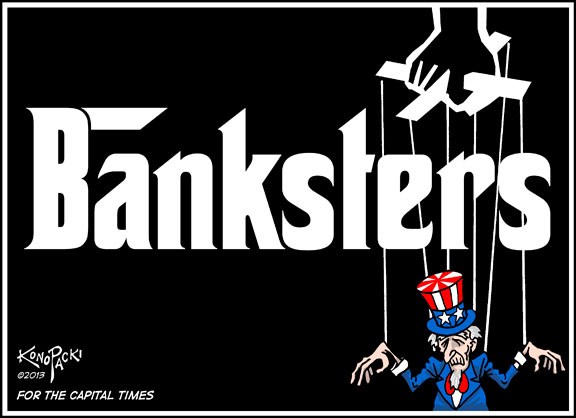

So there are three examples in American history of central banks being abolished. It took the political descendants of the old Hamilton/Federalist coalition another seventy five years to re-establish another central bank that has, for the past 111 years, caused the worst boom-and-bust cycles in American history, the worst price inflation in American history, bailed out crooked and incompetent banks with untold billions of dollars, and fostered the exact same kind of cronyism and corruption that so incensed the Jacksonian libertarians.

The Fed cannot be reformed!

It is time that it went the way of the Bank of North America and the BUS.

Written by Thomas DiLorenzo for The Mises Institute ~ July 23, 2024