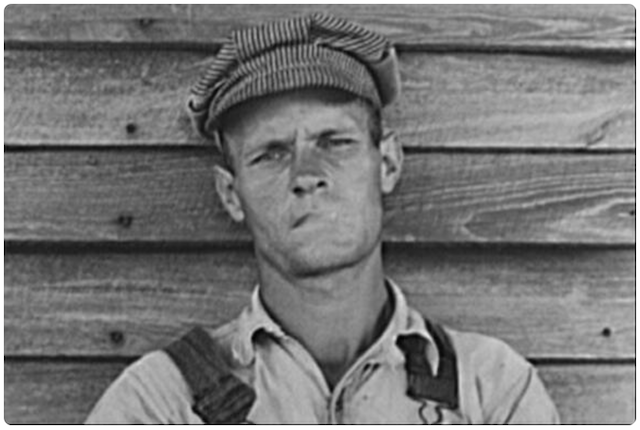

Great Depression photo by Library of Congress

People love to say, “Times are different now.” Sure, technology has advanced, and we’re not waiting in bread lines, but human nature hasn’t changed.

Money mistakes today look a lot like money mistakes back then. People overspend, rack up debt, ignore risks, and assume good times will last forever.

The Great Depression taught a generation the hard way that financial security isn’t guaranteed.

This isn’t a history lesson. This is about real financial lessons that still apply today. Some of these will sound familiar because they are timeless. Others will challenge how you think about money.

Either way, these lessons could be the difference between financial independence and financial disaster. Let’s get into it.

Live Below Your Means

Spending everything you make is a guaranteed way to stay broke. During the Great Depression, people didn’t have a choice, they cut back because they had to.

Today, the choice is yours, but the principle hasn’t changed. The less you need to live on, the more control you have over your future. That doesn’t mean extreme deprivation. It means making smart trade-offs.

Do you need the latest car lease, or would an older paid-off vehicle give you more freedom? Is that big house helping you, or is it a financial anchor? When you keep expenses low, you’re in control. When you overextend, you’re at the mercy of the next economic downturn.

Keep an Emergency Fund

When banks failed in the 1930s, people lost everything. No warning, no safety net, just financial ruin. Cash reserves were the difference between survival and disaster. Most experts today recommend keeping 6-12 months of living expenses in an emergency fund.

That’s solid advice, but I take a different approach. I base mine on a rolling average of past spending and factor in major upcoming expenses, big ticket items like replacing a car, home repairs, or unexpected medical bills.

It’s not just about surviving layoffs. It’s about making sure a financial curveball doesn’t wipe you out. Think ahead, plan for what could go wrong, and build an emergency fund that actually protects you.

Avoid Excessive Debt

Debt makes you fragile. When the economy crashed, people buried in debt lost everything. Mortgages were foreclosed, businesses folded, and overleveraged investors were wiped out.

The lesson? Debt is not your friend. A reasonable mortgage or an investment that generates cash flow is one thing. Credit card balances, car loans, and buying things you can’t afford are another.

Debt puts you on a leash, and the longer you stay in it, the tighter it gets. If you’re financing things that don’t appreciate, you’re working for your lender, not for yourself. Cut the leash.

Diversify Your Income Streams

In the 1930s, losing a job meant losing everything. One paycheck, gone. No backup. No options. The mistake was relying on a single source of income.

Today, the same risk applies. Jobs disappear. Industries change. If your entire financial life depends on one paycheck, you’re gambling. Multiple income streams give you insurance against that.

A side hustle, rental income, dividends, contract work, anything that adds a layer of security. The goal isn’t to burn yourself out working 100-hour weeks. It’s to have enough income streams that if one dries up, you’re not scrambling.

Understand the Risks of the Stock Market

The 1929 crash didn’t just wipe out reckless speculators, it wiped out people who thought the market could only go up. That’s the problem with blind optimism. The market is a wealth-building machine, but it doesn’t reward the careless.

The 1929 crash didn’t just wipe out reckless speculators, it wiped out people who thought the market could only go up. That’s the problem with blind optimism. The market is a wealth-building machine, but it doesn’t reward the careless.

If you’re investing with money you can’t afford to lose, you’re doing it wrong. Stocks will crash, corrections will happen, and if you panic every time, you’ll make the worst possible moves.

The winners aren’t the ones who trade emotionally. They’re the ones who buy quality investments, hold through downturns, and understand that wealth is built over decades, not weeks.

Own Essential Skills

When money was tight, people didn’t just buy their way out of problems. They fixed things. They grew their own food. They did repairs instead of calling someone. That’s self-sufficiency, and it’s an underrated financial weapon.

When money was tight, people didn’t just buy their way out of problems. They fixed things. They grew their own food. They did repairs instead of calling someone. That’s self-sufficiency, and it’s an underrated financial weapon.

The more skills you have, the less money you need to throw at problems. Cooking saves thousands over eating out. Basic home maintenance keeps you from paying a handyman for simple fixes.

Learning to do things yourself isn’t about being cheap, it’s about keeping more of your money and being less reliant on the system.

Don’t Trust “Too Good to Be True” Investments

The 1920s were full of investment scams, sketchy stock deals, and people promising easy money. When the crash hit, those schemes unraveled, and investors lost everything.

The same thing happens today. Crypto scams, Ponzi schemes, overpriced real estate bubbles, people get lured in because they think they’ve found a shortcut. There are no shortcuts.

If someone’s promising guaranteed high returns, they’re lying. Wealth isn’t built on gambling. It’s built on patience, strategy, and knowing that if something looks like a sure thing, it’s probably a trap.

Appreciate the Value of Hard Work

During the Great Depression, people took any job they could find. Pride didn’t matter. Survival did. That kind of mindset is rare today, but it shouldn’t be.

Hard work isn’t about grinding yourself into the ground, it’s about being valuable. Skills matter. Work ethic matters. Lazy thinking leads to financial disaster.

The world doesn’t owe anyone a high-paying job or an easy life. The people who came out ahead were the ones willing to learn, adapt, and do what needed to be done. Complaining doesn’t pay bills. Taking action does.

Learn to Make Do with Less

Scarcity forced people to stretch every dollar, and it turns out that’s a skill worth keeping. Wasting money on stuff that doesn’t matter is a guaranteed way to stay broke.

Scarcity forced people to stretch every dollar, and it turns out that’s a skill worth keeping. Wasting money on stuff that doesn’t matter is a guaranteed way to stay broke.

Instead of always upgrading, replacing, and chasing the newest thing, focus on getting the most out of what you already have. Keeping a car longer, repairing instead of replacing, and actually using what’s in the fridge instead of eating out makes a difference.

The habit of squeezing value out of every dollar builds wealth. Throwing money around for short-term gratification doesn’t.

Prioritize Needs Over Wants

When the economy collapsed, people stopped buying luxuries because survival came first. That’s a lesson most ignore today. If financial security matters, the essentials always come first. Food, housing, healthcare, non-negotiables. Everything else is optional.

The problem is that modern life blurs the line. A phone that works fine gets replaced just because a new one came out. Streaming subscriptions pile up because canceling takes effort.

Social pressure tricks people into believing they need things that add nothing to their financial future. Separating wants from actual necessities is how financial control is built.

Be Cautious About Housing Costs

The Great Depression hit homeowners hard. People stretched themselves thin with mortgages they could barely afford, then lost everything when times got tough. That mistake happens every economic cycle.

Buying too much house, taking on massive debt, and assuming the market will always go up leads to trouble. Housing should provide stability, not financial stress.

Keeping payments reasonable, having a solid emergency fund, and avoiding the trap of constant upgrades makes homeownership a tool for wealth, not a liability waiting to implode.

Stay Flexible in Your Career

Industries collapsed overnight, leaving millions unemployed. Those who refused to adapt stayed stuck. Those willing to pivot found ways to survive. That still applies. Relying on a single skill or assuming a job will always be there is risky.

Staying ahead means constantly learning, building new skills, and being open to change. Technology, automation, and economic shifts will always create winners and losers.

The people who win are the ones who move fast, adjust their approach, and stay valuable no matter what happens.

Avoid Bank Runs: Choose Financial Institutions Wisely

The Crash in New York started a run on the Banks around the Nation!

When banks failed, people lost everything. There was no FDIC insurance, no safety net, just complete financial ruin. Keeping money in stable institutions is critical.

Spreading funds across multiple banks reduces risk. Understanding what’s insured and what’s not keeps money safe. The smartest move isn’t just trusting a bank, it’s knowing exactly what happens if one collapses.

Blind trust in the system is what led to financial wipeouts in the past.

Grow Your Own Food When Possible

During the Depression, people planted gardens to keep their families fed. Grocery stores weren’t an option for many, and learning to produce food meant survival. That skill still has value.

During the Depression, people planted gardens to keep their families fed. Grocery stores weren’t an option for many, and learning to produce food meant survival. That skill still has value.

Even a small garden lowers food costs. Basic knowledge of growing, preserving, and cooking stretches a budget further than most realize. It’s not about becoming a full-time farmer. It’s about reducing reliance on a fragile system and keeping more control over costs.

Invest for the Long Term, Not Short-Term Gains

The 1929 crash wiped out investors who chased quick profits. The ones who held onto solid investments saw those losses eventually turn into gains. That hasn’t changed.

Get-rich-quick thinking leads to failure. Jumping in and out of the market, chasing fads, and making emotional decisions guarantees bad results. Wealth comes from long-term discipline, not trying to outsmart the system.

The best strategy is simple, buy strong assets, hold through the downturns, and let time do the heavy lifting.

Build a Strong Community Network

People survived the Great Depression because they had support systems. Families helped each other, neighbors shared resources, and communities worked together. Going it alone isn’t smart.

A strong network opens doors to job opportunities, financial advice, and support when things go wrong. Wealth isn’t just about money, it’s also about having the right people in your corner.

Connections matter, and those who invest in relationships end up in a stronger position.

Adapt Quickly to Economic Changes

Some businesses thrived during the Depression. Others disappeared. The ones that survived adjusted fast. That lesson applies to personal finances too.

Economic downturns will happen. Inflation, job losses, market crashes, they’re inevitable. The difference between struggling and thriving comes down to speed. The faster someone recognizes a shift and adapts, the better the outcome.

Sticking to outdated strategies, ignoring warning signs, and assuming things will stay the same is how people get caught off guard.

Government Assistance is Not a Long-Term Solution

New Deal programs helped, but they weren’t enough. People still struggled, and many learned that relying on government aid wasn’t a sustainable strategy.

Assistance programs can provide a temporary safety net, but depending on them permanently leads to financial weakness. The goal should always be financial independence, having enough assets and income sources to stand on solid ground.

The best way to avoid financial hardship is to build personal resilience instead of waiting for outside help.

Know That Wealth Can Be Lost Overnight

The wealthiest people of the 1920s assumed their money would always be there. When the market crashed, fortunes vanished. Nothing is guaranteed. Assuming wealth is permanent leads to complacency.

The wealthiest people of the 1920s assumed their money would always be there. When the market crashed, fortunes vanished. Nothing is guaranteed. Assuming wealth is permanent leads to complacency.

The only real financial security comes from diversification, smart risk management, and always having a plan for downturns. Nothing lasts forever, not bull markets, not high salaries, not booming industries.

Preparing for the worst is how financial strength is built.

Final Takeaway…

The Great Depression proved one thing, nothing is guaranteed. Jobs disappear, markets crash, and the economy doesn’t care who’s unprepared.

The ones who made it through didn’t rely on luck. They controlled their spending, avoided reckless debt, built real assets, and stayed adaptable. Those lessons aren’t outdated. They are the foundation of lasting financial strength.

The choice is simple, build stability now or risk learning these lessons the hard way later.

Written by Greg Wilson, CFA for NewsBreak ~ February 22, 2025