The US Social Security and Medicare programs for seniors will both run short of funds to pay full benefits in 2033.

The go-broke dates the two trust funds have moved up due to rising health care costs and new legislation affecting Social Security benefits, according to an annual report released Wednesday.

The go-broke dates the two trust funds have moved up due to rising health care costs and new legislation affecting Social Security benefits, according to an annual report released Wednesday.

The yearly assessment found that Medicare’s hospital insurance trust fund will be unable to fully cover costs beginning in 2033 — three years earlier than last year’s estimate.

Higher-than-forecast hospitalizations of Americans over 65 years old was a key factor.

Social Security’s combined trust funds, which support retirement and disability benefits to 70 million Americans, are also expected to be depleted in 2033.

While the year was unchanged from last year’s report, it was advanced by three calendar quarters within that year.

The projections reflect higher-than-expected healthcare spending, along with recent legislation that increased Social Security benefits for some workers.

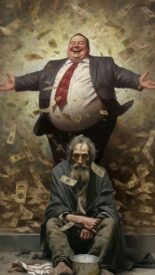

Once the funds are exhausted, beneficiaries would still receive payments, but at reduced levels. Medicare would be able to cover just 89 percent of hospital costs, while Social Security could pay only about 81 percent of promised benefits.

Once the funds are exhausted, beneficiaries would still receive payments, but at reduced levels. Medicare would be able to cover just 89 percent of hospital costs, while Social Security could pay only about 81 percent of promised benefits.

The trustees say the latest findings show the urgency of needed changes to the programs, which have faced dire financial projections for decades.

But making changes to the programs has long been politically unpopular, and lawmakers have repeatedly kicked Social Security and Medicare´s troubling math to the next generation.

President Donald Trump and other Republicans have vowed not to make any cuts to Medicare or Social Security, even as they seek to shrink the federal government´s expenditures.

‘The financial status of the trust funds remains a top priority for the administration,’ said Social Security Administration commissioner Frank Bisignano in a statement.

The new forecast adds urgency to a long-standing challenge facing Congress, which has repeatedly delayed making reforms due to political sensitivity around the issue.

Lawmakers would need to act — either by raising taxes, reducing benefits, or both —to ensure long-term solvency.

President Donald Trump and many Republican lawmakers have pledged not to cut Medicare or Social Security benefits, but critics say recent legislative changes have worsened the programs’ financial outlook.

One provision enacted in January – the Social Security Fairness Act –

The Broken Social SUCK-urity!

eliminated two rules that had reduced benefits for certain workers, effectively increasing payments and accelerating the trust fund’s projected depletion.

Romina Boccia, director of budget and entitlement policy at the CATO Institute, called the change ‘a political giveaway masquerading as reform.’

Instead of tackling Social Security´s structural imbalances, Congress chose to increase benefits for a vocal minority-accelerating trust fund insolvency.’

About 68 million Americans are currently enrolled in Medicare, and more than 70 million receive Social Security benefits.

Both programs are primarily funded through payroll taxes, but costs are projected to outpace revenues due to the country’s aging population and rising healthcare expenses.

Experts say failure to act soon could result in sudden benefit cuts and instability for millions of retirees and disabled Americans.

‘Congress must act to protect and strengthen the Social Security that Americans have earned and paid into,’ said AARP CEO Myechia Minter-Jordan.

Several policy proposals have been floated in recent years, but none have gained significant momentum.

The last major reform to Social Security came in 1983, when the eligibility age for full retirement benefits was raised from 65 to 67.

Without further legislative changes, the federal programs that serve as the backbone of retirement security in the US could face significant challenges within the next decade.

Last year, billionaire CEO Larry Fink said Americans should work beyond the age of 65 to stop the Social Security system collapsing.

Meanwhile, experts recently said Americans are making a big mistake by claiming their Social Security checks early, since delaying their claims could lead to higher payments.

Every year you delay taking a Social Security payment after full retirement age you receive a significant increase in payments up to the age of 70.

Written by Daniel Jones for Daily Mail ~ June 20, 2025