Is Gold in a bubble? This is the one question that has been discussed in every financial website since quite a while now. Commentators have taken opposing views, calling tops or prognosticating further upside for the yellow metal. But who has, if anyone, answered accurately the initial question of whether Gold is in a bubble? To understand that, we must first define what a bubble is!

Is Gold in a bubble? This is the one question that has been discussed in every financial website since quite a while now. Commentators have taken opposing views, calling tops or prognosticating further upside for the yellow metal. But who has, if anyone, answered accurately the initial question of whether Gold is in a bubble? To understand that, we must first define what a bubble is!

One of the most logical ways to define a bubble is to look at the fair value of the asset in question and then compare the current market value with that fair value number. If the current market value is significantly higher then, presto, bubble it is! This then begs the question as to what is the fair value of Gold?

To answer the last question, we dont need a PhD in Quantitative Finance. We just need to go back to economics class in high school. We might recall that the price of a commodity, very simply, is the intersection point of its supply curve and demand curve. But who knows, if anyone, the supply and demand curves for Gold to an acceptable degree of accuracy? Indeed, no one knows what is the demand for Gold, let alone draw the demand curve with accuracy. A lot of this has to do with the fact that, today, when one uses the term demand, one does not merely mean demand from end-users. Demand, today, means the demand from everyone who wishes to purchase Gold in whatever form, physical or paper, and that includes short-term traders, long-term asset managers, central banks, ETF managers and individual investors. And the demand that all these participants will create is not something anyone can estimate with any degree of accuracy. So, the bottom line is that no one knows what the demand for Gold is and therefore, no one knows what the fair value of Gold is. Hence, and this might be anticlimactic to some, no one really knows whether Gold is in a bubble or not!

Now, what does it really mean that there really is no objective way to know whether Gold is in a bubble or not? What it really means is that Gold is a perfect candidate for hand-waving bull arguments. Arguments that have little numerical foundation. (Here, when I say numerical, I am not referring to the exhaustive numerical analysis submitted along with a piece of research such that the same is accepted as a research paper in a journal.) These are arguments which cannot be supported even on the basis of back-of-the-envelope math and do not yield any clear and objective numerical conclusion e.g. the fair value of an asset.

But these arguments sound perfectly logical on a qualitative level and which, importantly, cannot be negated. And thats the crux of the matter. Bull arguments that are qualitatively logical-sounding and cannot be readily disproved are readily bought into during bull runs e.g. during the mid to late 90s, it was believed that the tech industry was a new type of industry and did not depend on traditional economic concepts when it came to generating profitability. Valuation metrics such as Price-to-click were used to forward bull arguments in favour of dotcoms that had no revenues, let alone profits.

Gold too has been backed by many such hand-waving arguments. Some of these are: (1) it is a safe haven and we are in a period of extended financial market turmoil (2) it is a hedge against inflation and we are in period in which we will see high inflation (3) it is an under-owned asset and investors have only begun to warm up to Gold (4) the Dollar is falling and Gold is denominated mostly in Dollars (5) all fiat currencies have failed and Gold is the only alternative. Note carefully that none of these statements are qualitatively wrong. In fact, they are particularly wise statements that look at things from a thirty-thousand-feet view and get the big picture right. Indeed.

But, most importantly, none of these arguments yield a clear, objective fair value for Gold. This is the stuff that manias are made of. Now, please note, and I could not emphasize this more, that I am not saying that Gold is in a mania. I have already said that no one, absolutely no one, can stick his neck out and say that Gold is in a bubble. But what we may want to pay attention to is that no one can say that it isn’t in one. What investment managers need to ask themselves is whether they possess knowledge and understanding of an asset that can help them create wealth in a systematically repeatable way or are they just shooting in the dark.

Written by Shivaji Thapliyal for MarketWatch.com, November 7, 2011

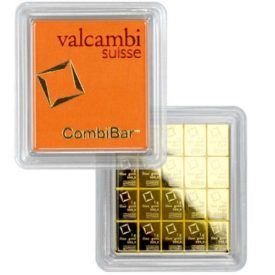

NOTE: When you buy Gold bullion, the Gold spot price is the base price of Gold in its unfabricated form, and this price is important because it affects your bottom line. When buying 1 oz Gold bars, the higher the spot price, the higher premium price you pay. When you buy Gold bars and other Precious Metals, the premium price includes the costs of fabrication, distribution, minor dealer fees and any numismatic or collector value. When buying Gold bars, you typically pay a slightly higher premium for smaller bars, but often these smaller bullion products are popular with people who have a tight budget. ~ Editor

NOTE: When you buy Gold bullion, the Gold spot price is the base price of Gold in its unfabricated form, and this price is important because it affects your bottom line. When buying 1 oz Gold bars, the higher the spot price, the higher premium price you pay. When you buy Gold bars and other Precious Metals, the premium price includes the costs of fabrication, distribution, minor dealer fees and any numismatic or collector value. When buying Gold bars, you typically pay a slightly higher premium for smaller bars, but often these smaller bullion products are popular with people who have a tight budget. ~ Editor

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml