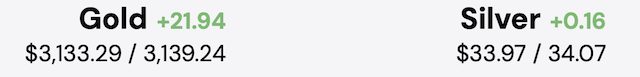

March 31, 2025 – 19.00 p.m.

November 24, 2017 ~ Throughout human history, gold has constantly emerged as an unparalleled form of savings, investment and wealth preservation. Due to its unique characteristics and features, gold has inherent value and cannot be debased. When holding physical gold, there is no counterparty risk or default risk. Wealth in the form of gold can also be held and stored anonymously.

November 24, 2017 ~ Throughout human history, gold has constantly emerged as an unparalleled form of savings, investment and wealth preservation. Due to its unique characteristics and features, gold has inherent value and cannot be debased. When holding physical gold, there is no counterparty risk or default risk. Wealth in the form of gold can also be held and stored anonymously.

From its ability to retain its purchasing power over time, to its safe haven status in times of financial turmoil and uncertainty, to gold’s ability to diversify investment risk, there are many and varied reasons to own physical gold in the form of investment grade gold bars and gold coins.

1. Tangible with Inherent Value

Physical gold is real and tangible. It is indestructible, impossible to create artificially, and difficult to counterfeit. Mining physical gold is arduous and costly. Physical gold therefore has inherent value and worth. In contrast, paper money doesn’t have any inherent value.

2. No Counterparty Risk

Physical gold has no counterparty risk. When you hold and own gold bars and gold coins outright, there is no counterparty. In contrast, paper gold (gold futures, gold certificates, gold-backed ETFs) all involve counterparty risk.

3. Scarcity

Gold deposits are relatively scarce across the world and difficult to mine and extract. New supply of physical gold is therefore limited and explains why gold is a precious metal. Gold’s scarcity reinforces it’s inherent value.

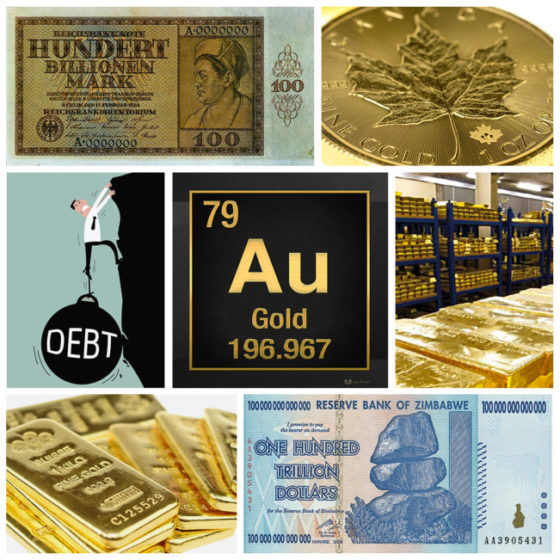

4. Cannot be Debased

Because of its physical characteristics and features, gold cannot be debased, and gold supply is immune to political meddling. Compare this to fiat money supplies which are constantly being debased and destroyed via deficit government spending, central bank quantitative easing and financial system bailouts. On a survivorship scale, gold has far outlived all fiat currencies by thousands of years.

5. A 6000 Year History

5. A 6000 Year History

Gold has played a central role in society for thousands of years from the early civilizations of ancient Egypt, right up to the contemporary era. Gold has facilitated international trade throughout history, has been directly responsible for the economic expansion and prosperity of numerous civilizations throughout history, and has even been, due to gold exploration and mining, the direct catalyst for the growth of some of today’s best-known cities such as San Francisco, Johannesburg, and Sydney.

6. Store of Value

Gold is a preeminent store of value. Physical gold, in the form of gold bars or gold coins, retains its purchasing power over long periods of time despite general increases in the price of goods and services.

In contrast, fiat currencies such as the US Dollar are not stores of value and their purchasing power consistently becomes eroded by inflation or the general increase in the price level. Fiat currencies have a long history of either becoming totally worthless and going out of circulation, or else becoming completely debased, such as the US dollar, while remaining in circulation.

Since the creation of the US Federal Reserve in 1913, the US dollar has lost over 98% of its value relative to gold, i.e. the US dollar has lost over 98% of its purchasing power relative to gold.

Since 1913, the US Dollar has lost more than 98% of its value, while gold has retained its value.

7. Long- Term Inflation Hedge

Physical gold’s ability to retain its purchasing power over time is sometimes referred to as the “Golden Constant”. This reflects the fact that gold’s purchasing power is constant over long periods of time. This ‘constant’ exists because the gold price adjusts to changes in inflation and future inflation expectations. Therefore, physical gold is a long-term hedge against inflation.

8. A 2500 Year Track Record as Money

Because of its ability to retain value and act as a store of value, physical gold has been used as money for over 2500 years. Gold coins were first issued in the Lydian civilization in what is now modern Turkey. Subsequently gold was used as a stable form of money in Persia, ancient Greece, ancient Rome, the Spanish and Portuguese Empires, the British Empire, and right through to the various international gold standards of the 20th century.

It was only in August 1971 that the US famously suspended the convertibility of the US dollar into gold, a move which triggered the debt fueled expansion that is still having repercussions within today’s monetary system.

To put gold’s monetary importance into perspective, for 97% of the last 2500 years, gold has been chosen by numerous sophisticated civilizations as the form of money par excellence and an anchor of stability, precisely because of its ability to retain its value.

9. Safe Haven

Physical gold acts as a safe haven asset in times of conflict, war and geopolitical turmoil. During the financial market stresses and heightened uncertainties caused by wars, conflicts and turmoil, the counterparty risk of most financial assets spikes. But since physical gold does not have any counterparty risk, investors rush to gold during these periods so as to preserve their wealth. This is analogous to sheltering in a safe harbor. Gold can thus be seen as a form of financial insurance against catastrophe.

10. Portable Anonymous Wealth

Gold bars and gold coins combine high value with high portability. In times of conflict and war, gold bars and gold coins are ideal for transporting wealth and savings across borders and within conflict zones in an anonymous fashion.

11. Universal Acceptance

Gold is universally accepted as money across the world, with the highly liquid global market always providing ample sales opportunities for gold bars and gold coins. This means that whichever city you are in across the world, you can always sell or trade your gold bars and gold coins.

12. Emergency Money

Military personnel are often issued with gold coins that they carry with them in conflicts zones as a form of emergency universal money. For example, the British Ministry of Defense often issues RAF pilots and SAS soldiers with Gold Sovereign coins to carry on their persons during combat missions and activities, such as in the Middle East.

Worthless paper Currencies vs the Inherent Value of Owning Physical Gold

13. Outside the Banking System

In the current era of global financial repression, physical gold is one of the few assets outside the financial system. Gold is not issued by any monetary authority or central bank or government. Because its not issued by any government or central bank, gold is independent of the banking system. Fully owned physical gold, if stored in a non-bank vault or held in one’s possession, is outside the banking system.

14. No Default Risk

Unlike a government bond, there is also no default risk with gold because it is not issued by any authority that could default. Gold bars and gold coins are no one else’s liability. Physical gold cannot go bankrupt or become insolvent. Therefore, there is no need to have to trust any other party when holding physical gold.

15. Portfolio Diversification

Adding an investment in gold to an existing portfolio of other investment assets such as stocks and bonds, reduces the volatility (risk) of the investment portfolio and can increase portfolio returns. This is because the gold price has a low to negative correlation with the prices of most other financial assets, because gold is less influenced by business cycles and macro-economic cycles than most other assets.

Numerous empirical studies by financial academics, as well as industry bodies, such as the World Gold Council, have validated gold’s role as a strategic portfolio diversifier. Optimal allocations to gold in multi-asset portfolios have found to be in the 5% to 10% range.

16. Currency Hedge

There is generally an inverse relationship between the gold price and the US dollar, in that the gold price generally moves in opposite directions to the US dollar. Therefore, holding gold can act as a currency hedge of the US dollar, and help manage the currency risk of portfolios denominated in US dollars.

17. Gold’s Metallic Properties

Gold has many and varied metallic properties. These properties provide gold with many technological and commercial applications and uses, which in turn contribute as additional demand drivers in addition to the investment and monetary demand for gold.

Gold is highly ductile (can be drawn into very thin wire). It is also highly malleable (can be hammered and flattened into very thin film). Gold is a very good conductor of electricity and heat. Gold does not corrode or tarnish. It is chemically unreactive and non-toxic to the human body. Gold has a high luster and shine, and an attractive yellow glow.

These properties explain gold’s use in electrical and electronic wiring and circuits (e.g. computers and internet switches), its use in the medical and dental fields, gold’s use in solar panels, space travel, and gold’s traditional uses in jewelry, decoration, and ornamentation. With new technological uses being found for gold all the time, gold’s demand pattern is diversified and underpinned by its commercial importance.

18. Physical gold – A tiny fraction of Paper Gold

The London wholesale gold market and the US-based COMEX gold futures market generate huge trading volumes of paper gold that dwarf the size of the physical gold market. However, these markets only trade derivatives on gold (futures and unallocated positions), representing fractionally-backed and unbacked claims on gold that could never be convertible into physical gold by claim holders.

In a scenario under which these paper gold markets became unsustainable, the prices of paper gold and physical gold would diverge, with the paper gold markets ceasing to trade and collapsing, and only physical gold retaining any real value. Physical gold is therefore an insurance against the collapse of the world’s vast paper gold markets.

19. By Definition – Not an ETF

Physical gold Provides all the benefits that gold-backed Exchange Traded Funds (ETFs) do not. ETFs provide exposure to the gold price, not to gold. Holding physical gold is by definition direct exposure to gold. With most gold-backed ETFs, you cannot convert the units into gold and take delivery of the gold, and in many cases, the locations of the vaults are not even known. If holding physical allocated gold bars or gold coins in a vault, such as with BullionStar in Singapore, you can always take delivery.

Gold ETFs have many counterparty risks since there are many moving parts in an ETF such as a trustee, a custodian, and a sponsor / issuer. Physical gold has no counterparty risks. When you hold a gold-backed ETF, the quantity of gold backing the ETF declines over time due to management fees being offset against the gold holdings. When you hold physical gold, you always remain with 100% of the actual gold you first purchased. There is no erosion of holdings.

20. Anonymous Storage

Gold can be stored anonymously, either in your possession within your house or property, or in a vault in a jurisdiction, such as Singapore, that has no reporting requirements. Since gold has a high value to weight ratio, storing gold does not take up much space. *

21. Independent of Internet

21. Independent of Internet

Owning physical gold is not reliant on having internet access and access to electronic wallets and cryptocurrency exchanges. Furthermore, gold cannot be stolen by hacking an electronic address or by transferring or deleting a number in a computer.

22. Real Gold is Measured by Weight

Physical gold is measured in weight, not through a number set by a politician or central banker. When you buy a 1 Kilo gold bar, or a 10 Tola gold bar, or a 1 troy ounce gold coin, or a 5 Tael gold bar, you will always have that gold bar or gold coin, irrespective of the fluctuations of fiat currencies.

While thinking of the value of physical gold in terms of a fiat currency might be convenient, a better way is to think of a gold holding in terms of weight.

23. Coins and Bars – Build a Collection

Buying investment gold bars and bullion gold coins allows you to build a diverse collection ** of bars and coins that are at the same time a fascinating pastime and a form of investment and saving.

Bullion gold coins from the world’s major mints are beautifully illustrated and often have a connection to history. Investment gold bars from the world’s major gold refineries are distinctively different from each other and you can vary a collection by cast or minted bars, and a selection of weights.

** BEWARE of the word “collection” – do NOT be confused nor conned into purchasing ‘hi-grade’ numistmatic coins – unless you have been properly educated and understand exactly what you are getting involved with. Read Beware: The Ide(a)s of ‘Rare Coin’ Dealers.

24. Physical Gold Feels like Real Wealth

Physical gold feels like real wealth. When you hold ten 1 ounce gold coins in your hand, you intrinsically know that you are holding real wealth, gold that is scarce and that has been costly to produce.

25. Gold as Loan Collateral

Gold can be used as loan collateral. Since gold is highly liquid and valuable, it can be lent and used as a form of financing, and as a way of generating interest. The wholesale gold lending market between central banks and bullion banks is highly active. Likewise, retail gold holders can also in various ways lend their gold to receive financing or interest, with new innovations to do this arising all the time.

26. Central Banks hold Gold

Although the world’s central banks like to downplay the importance of gold because it competes with their fiat currencies, most central banks continue to hold substantial amounts of physical gold bars and gold coins in vaults around the world. They hold this gold as a reserve asset on their balance sheets, and they value this gold at market prices.

Like private gold investors, central banks hold physical gold because it is highly liquid, it lacks counterparty risk, and because gold is a safe haven or ‘war chest’ asset that acts as a financial insurance in times of crisis. Central banks also hold gold for the unpublished reason that if and when gold re-emerges at the centre of a new monetary system, these very same central banks will not be caught out having no gold.

27. Gold for Gifting

Gold coins and small gold bars make great gifts and presents, and gold is a traditional form of gifting in many societies around the world. Gifting a gold coin or small gold bar to mark a birth, or anniversary, or a wedding or other special occasion, is an ideal present that will be highly appreciated by the recipient.

28. Gold for Inheritance

Gold bars and gold coins are a great form of inheritance for your children and family members. Because gold is real, tangible, valuable, and has a highly liquid trading market, it is an ideal asset for inter-generational wealth transfers. Because physical gold is fabricated in convenient weight denominations, such as troy ounces and kilograms, it can be distributed equitably among recipients, and specified equitably in wills and trusts.

Published by Bullion Star~ November 2017.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml“

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml“