Goldfinger failed to consider the stock and flow dynamics within a gold system.

“Gold, Mr. Bond.”

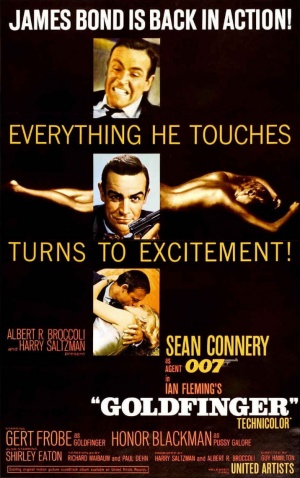

Gold has been the subject of many action films. From being lost in forbidden jungles to locked away in formidable vaults, many films involve the pursuit of the precious metal. However, 1964’s Goldfinger stands particularly unique when compared to the others.

Auric Goldfinger, Bond villain and gold tycoon, had his sights set on the infamous Fort Knox. However, he did not plan to steal the gold. Stealing the gold would have required transporting 13,000 tons before authorities could arrive, a feat even Goldfinger acknowledged was impossible. So instead, Goldfinger planned to detonate a nuclear device in order to contaminate the gold with radioactivity. In effect, the $15 billion in bullion would be unusable.

Goldfinger had clearly taken note of the principles of economics. By reducing the supply of gold available, the price of existing gold would rise. Namely, the price of his gold supply would rise. Goldfinger failed to consider the stock and flow dynamics within a gold system.

Therein lies the beauty of Goldfinger’s plan. He didn’t need to fully break into Fort Knox nor transport the gold. He only needed to reduce the supply of gold available to the world by contaminating the famous Fort Knox vaults. Fortunately for the world, Goldfinger failed to check all his bases despite naming his plan “Operation Grand Slam.”

Losses in the Long Run

As Lawrence White describes in chapter two of his book The Theory of Economic Institutions, Goldfinger failed to consider the stock and flow dynamics within a gold system. Goldfinger’s plan was designed to increase the price of his supply of gold. However, White points out entrepreneurs, mine owners, investors, and owners of jewelry would also face that same increase in price.

At the higher price of gold, hard-to-reach mines are suddenly worth the expense, investments in gold become more attractive, and grandma’s necklace does not feel so sentimental anymore. The increased mining and diversion of gold to monetary use would effectively restore the “lost” gold and reestablish the market price of gold to what it was prior to Goldfinger’s scheme.

Thus, it’s not just a matter of destroying one supply and ruling the world. Our villain would have needed to destroy the supply, then quickly sell gold holdings faster than the market could adjust yet slow enough to capitalize on desperate consumers. Even for one of the most astute of Bond villains, this is no easy feat.

Unfortunately for Goldfinger, his ignorance of market dynamics was not his only failure. In addition, he failed to understand how gold was actually used during the gold standard.

The Danger of Simplifying Assumptions

Like many lessons in a principle course, there are deeper forces at work than what a cursory understanding may suggest. As many economists of the Austrian School have emphasized, highly stylized theoretical models are illuminating, but they are not complete depictions of reality. Had Bond not thwarted his plan, Goldfinger would have been quickly confronted with this lesson.

Consider the history of money. As it evolved, banknotes began to displace gold and silver coinage due to convenience and durability. Until 1971, banknotes acted as claims to gold. This practice allowed gold to sit in vaults free from wear-and-tear, or depreciation.

With banks using gold to back their notes, it became common practice within a banking network to accept one another’s notes at par value and clear them at regular intervals. After a few clever porters stumbled (maybe literally) upon the convenience of settling bank balances in a single location, Clearing House Associations became the norm. Banks kept reserves on location so notes could be exchanged with remaining balances settled in gold on site.

With this context in mind, we can see Goldfinger’s great mistake: the gold does not need to be touched.

Society evolved to a point where citizens agreed it was more convenient to use paper backed by gold, and bankers agreed it was more convenient to keep portions of reserves together for clearing. From this, I argue that while irradiated gold cannot be touched, it does not need to be in order to perform these functions.

The irradiated gold remains durable, divisible, fusible, and uniform. Only its portability suffers from the contamination. However, this may be remedied with ease due to modern technology. Costs of containment could be reduced by utilizing a central location akin to a clearing house, and transfers between accounts could occur through robotic systems similar to those that occur in Amazon warehouses.

One Last Lesson

One Last Lesson

Were this not enough, the radiation would not be a permanent effect. Goldfinger admitted the gold would be rendered useless for “58 years.” However, this calculation was not quite correct. Due to only one isotope of gold having a nuclear half-life of more than a few days, the gold would have actually been safe within one month.

A temporary suspension of redemption similar to what was practiced historically would easily mitigate the issue of irradiated gold.

Redemption suspensions have historically occurred where interest is paid on the suspension period. Although its consumers may be wary at first glance, it is in their best interest. In the event of a bank run, a temporary suspension allows time to gather funds in what would otherwise require fire sale losses. In that event, the suspension lowers the risk of default and protects consumers and shareholders in the long run. A temporary suspension of redemption similar to what was practiced historically would easily mitigate the issue of irradiated gold, and the world would go on without concern.

Although Goldfinger’s plan incorporates economic principles in an extremely clever manner, it goes to show even the most cunning of plans requires understanding beyond the principle. Neither limitless budgets nor the power of a nuclear bomb can transform the world into a model that has been assumed away from reality. When a theory is applied, it must always be done with a robust understanding of the mechanisms at work and of what the theory was designed to shed light on.

Written by Nicholas Anthony for Foundation for Economic Education ~ November 11, 2018.

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml

FAIR USE NOTICE: This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U. S. C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml