You have to choose [as a voter] between trusting the natural stability of gold and the natural stability and intelligence of the members of the government. And with due respect to these gentlemen, I advise you, as long as the capitalist system lasts, to vote for gold. – George Bernard Shaw (1856-1950)

~ Welcome to Sierra Madre Precious Metals ~

As the continuing upheaval in the American financial markets have shown, the paper economies of the world are proving to be incredibly fragile – and the dollar is proving not to be immune. If you don’t believe it – keep your eyes on the daily market headline. With the current roller-coaster ride

As the continuing upheaval in the American financial markets have shown, the paper economies of the world are proving to be incredibly fragile – and the dollar is proving not to be immune. If you don’t believe it – keep your eyes on the daily market headline. With the current roller-coaster ride  being provided by Wall St. and the disaster in the sub-prime mortgage markets, which affected the entire building and real estate markets in 2008 – we may be on the brink of the next global depression.

being provided by Wall St. and the disaster in the sub-prime mortgage markets, which affected the entire building and real estate markets in 2008 – we may be on the brink of the next global depression.

Since the introduction of the Euro as a legal-tender currency in January 2002 – the US dollar has lost in excess of 60% of it’s value, while gold has increased in excess of nine-fold – and future increase will once again take place. What does the future hold for the dollar with the continued talk of the formation, of a North American Union and the introduction of the rumored global currency (Crypto-Currencies? Cashless Society?)?

The historical importance of owning gold coins is well known throughout the world and the greatest opportunity for diversification exists today by adding historical, collectible gold and silver coins to your physical holdings. This may be the most affordable “wealth insurance” you’ll ever own and Sierra Madre Precious Metals offers one of the largest selections of coinage in the world, with a vast selection of American and International issues, which affords you the opportunity to acquire a wonderfully diversified holding of quality gold, silver and platinum coins at exceptional value.

Although having gained in value sharply over the past few years – and subsequently dropping off – with gold – and silver at today’s levels, the opportunity is within your grasp and remains a great value in your quest to protect your future with the ownership of precious metals. Whether you choose to acquire silver for everyday use in the uncertain economy of the day, or just wish to hold the security of gold & silver to provide for the future of your loved ones, or interest lies with our International Collection, or the highly sought after American dream coins, certified by the experts – we can fulfill your needs, as Sierra Madre Precious Metals offers the most private, non-confiscable gold and silver coins in the world – at competitive cost, and in the strictest of privacy – and we take personal pride in putting your interests ahead of all else. After all – it’s your money!

Although having gained in value sharply over the past few years – and subsequently dropping off – with gold – and silver at today’s levels, the opportunity is within your grasp and remains a great value in your quest to protect your future with the ownership of precious metals. Whether you choose to acquire silver for everyday use in the uncertain economy of the day, or just wish to hold the security of gold & silver to provide for the future of your loved ones, or interest lies with our International Collection, or the highly sought after American dream coins, certified by the experts – we can fulfill your needs, as Sierra Madre Precious Metals offers the most private, non-confiscable gold and silver coins in the world – at competitive cost, and in the strictest of privacy – and we take personal pride in putting your interests ahead of all else. After all – it’s your money!

Consider the examples contained within our gallery and contact us for a private consultation by calling 602 – 799 – 8214 for the truth about Protecting Your Wealth! Whatever your reasons for purchasing precious metals – we will be proud to serve your needs.

Please allow me to introduce myself; I am Jeffrey Bennett, President of Kettle Moraine, Ltd., the parent of Sierra Madre Precious Metals.

Please allow me to introduce myself; I am Jeffrey Bennett, President of Kettle Moraine, Ltd., the parent of Sierra Madre Precious Metals.

I have been married for 54 years with two children and four grand-children, a veteran of Viet Nam, student of history (both American and film), and was host for fifteen years of Perspectives on America on the alternative airwaves, covering such subjects as, health and wellness, news, political satire, education and editorial commentary on current events through the teaching of history, and Protecting Your Wealth. In early 2018, I took a several month hiatus to complete some family business but returned to airwaves April 17, 2018).

At the age of ten, I sat in a bank-vault in the Citizens Bank of Mukwanago, Wisconsin with my grandfather going through bags of old American Peace dollars, hand-selecting each coin as dated rolls of 20 coins were carefully put together and rolled. Learning of the history of these beautiful pieces of Americana, I asked my grand-father, “Why are we doing this?” to which he replied, “Because someday they are going to do the same thing with the silver in our money that, that (S.O.B.) Roosevelt did with gold in 1933.” It took only six-years for his prediction to come to pass at the hands of a disciple of Roosevelt’s… and what will a Federal Reserve ‘dollar’ purchase today – and what will that old 90% Silver Peace Dollar purchase?

Although at the age of ten, there was little understanding of the meaning of it all, over the next half-century I became well-versed on the subject matter. During this summer of my education, I began to purchase silver coins as a collector and some small, international gold coins two years later – not an easy feat in the shadow of the Roosevelt confiscatory policies of 1933. Although those policies remained in effect until the mid-1970’s, it was not until 1991 that I found that one could make a living providing precious metals and collectible, historic numismatic coins to a willing and concerned clientele.

Although at the age of ten, there was little understanding of the meaning of it all, over the next half-century I became well-versed on the subject matter. During this summer of my education, I began to purchase silver coins as a collector and some small, international gold coins two years later – not an easy feat in the shadow of the Roosevelt confiscatory policies of 1933. Although those policies remained in effect until the mid-1970’s, it was not until 1991 that I found that one could make a living providing precious metals and collectible, historic numismatic coins to a willing and concerned clientele.

It was also during that year, that I began a relationship with one of the first Trust companies to give the public access to gold and silver as part of an Individual Retirement Account (IRA) – and Kettle Moraine, Ltd., founded in 1995, but have ceased providing service due the the intense change-over of the provider.

In November 2011, after a 15 month broadcast on another network, I returned to the airwaves with my then revamped program, Life, Liberty & All That Jazz, and for over a quarter-century, I have been proud to serve the family of listeners of my numerous broadcast programs for physically-held precious metals for investors and collectors alike – and thus continue to remain available to our long time clients and their families. Ah yes – find out what “inter-generational” wealth provision has done for our clients over the past three decades.

Don’t buy the sizzle of that steak until you understand the cost! In other words, don’t buy the bull being dispensed by the ‘rare coin’ pitchmen until you understand the full story. We, at Sierra Madre Precious Metals, will be proud to serve your needs.

~ Frequently Asked Questions ~

~ FAQ: Buying, Selling, and The Law ~

Question: “Are gold bullion coins legal tender?“

- Answer: Yes, most of them are. Their nominal face value ($5.00, $10.00, $25.00 and $50 in the case of the modern American Eagle issue) allows them to travel across national borders without the taxation or fees imposed by many countries on bullion itself. Typically bullion coins of this type would include the American Eagle series from the U.S. Mint, the Canadian Maple Leaf, Austrian Vienna Philharmonic series (from the world’s oldest active mint), and other releases from China, Australia and other nations.

Question: “Do bullion coins come with a certificate of authenticity?“

- Answer: Generally not in a printed form but with a maker’s mark and statement of weight and fineness, which is stamped directly onto gold bullion, whether coins or ingots (bars). The bullion itself, in effect, bears its own ‘certificate’ from whichever Mint or refiner produced it. Fortunately, gold is an element with a unique specific gravity, and other attributes which make it very easy to test for authenticity. The ancient Egyptians pioneered the ‘acid test’ for gold, and any jeweler, pawnbroker, or high school chemistry teacher can demonstrate the basics of gold.

Question: “Are there counterfeit gold coins?”

- Answer: Yes, over the centuries, crude copies of gold coins have been made. But because of gold’s unique density (only platinum is as heavy), these copies are not very convincing. Once you’ve held a real gold coin in your hand, and you feel the heft and density of it, you’re not likely to be fooled later by a non-gold copy. Of course, we recommend that you know your supplier when buying gold, just as you would with anything of real value.

Question: “Was gold illegal to own at one time?”

- Answer: Yes, in this country, from 1933 to 1974 it was illegal for U.S. citizens to own gold in the form of gold bullion, without a special license. On January 1, 1975, these restrictions were lifted and gold can now be freely held in the U. S. without any licensing or restrictions of any kind. The primary exception to the banning of gold ownership was to “collectors of rare and unusual coins…” For a more in depth discussion on this, please read Franklin D. Roosevelt & Gold Confiscation within this site, paying particular attention to Section 2, paragraph (b). NOTE: One of the key sales pitches within the industry, is to use the Roosevelt order, and subsequent reversal of same to “pitch” the privacy and security of the so-called “rare” (pre-1933) gold coins. Buyer Beware!

Question: “When were gold restrictions lifted?”

- Answer: December 31, 1974 ended the era of private U.S. gold ownership restrictions which had begun in 1933. As of January 1, 1975, U.S. citizens were again free to own gold in any form, including bullion, and in any amount that they can afford, without restrictions or any federal ‘reporting’ of those holdings.

Question: “Is there any limit on how much gold I can own?”

- Answer: No, there are no restrictions on private gold ownership in the United States. You are limited only by your budget and common sense.

Question: “Are pre-1933 U.S. gold coins really better to buy?“

- Answer: It totally depends on what you are trying to accomplish. If you want to become a coin ‘collector’ and wish to purchase as wide a variety of dates, mint marks and denominations, then go ahead and begin your quest, and we will be happy to assist – BUT understand that coins of this type are generally misrepresented by over 90% of the industry – and grossly overcharged for their net gold content. The market is generally “cartel’ controlled and these coins rarely perform in the manner suggested by the sellers, however – if this is the direction you wish to move, then Sierra Madre Precious Metals will acquire these for you at the lowest and fairest prices in the country – NOT at the typical 20 to 40% markup currently being practiced.

Question: “With all of the ‘certified’ U.S. coins being promoted by dealers all over the nation and through media, why do you continue to offer international gold and silver coins?“

- Answer: Our answer is simple: we believe in owning U.S. gold coins and in fact we own many, however, we just don’t believe in putting all of our eggs in one basket. Coins from Europe, Central and South America and other regions of the world, provide you with a strong financial foundation of your ‘collection’ through the purchase of fractional denominations – for somewhat less than that of their American counterpart – a coin providing similar weight. If you were building a house, would you begin by building the walls or the roof first, then come back later and pour the foundation? Of course not – you always begin with the foundation (The ‘Three Little Pigs’ syndrome). If you are purchasing gold for the purpose of providing a sound financial base for the uncertain times ahead – start with your foundation – and acquire as much as you can for as little as possible.

Question: “What is a good way to start buying gold? All at once, or a little every month?“

- Answer: Once again, this depends on what you are attempting to accomplish – BUT it also depends on your ability to fully commit yourself to a program, which in the long run will provide wealth insurance to you and your family. If can at the present time afford to convert $5,000, $50,000 or $500,000 thousand dollars to precious metals – then do so, in order to take advantage of the current pullback in the precious metals markets. If all you can afford to “spend” in a given period is $50 to $500.00 – then you will be somewhat limited at the present time. Gold in fact is probably out of your reach – but silver or copper is not, and both should be seriously considered. If you should decide to make a purchase every month or every quarter – then commit that to your self – and stick to it.

Question: “What size or denominations should I purchase? One oz. or fractional sizes?“

- Answer: As relates to gold – purchase as many ounces as you can for the money. Ounces will be king. Bullion gold coins are generally available in a number of sizes, including one, half, quarter and tenth ounce sizes. There are of course exceptions to these, such as the Mexican 1/20th ounce specimens, which can be quite beneficial for those, who live in the Southwest region of the U.S. Other selections for your consideration can be found at The International Vault on this site. Each of these coins have the advantage of being pre-1933 (having historical value without the “rare” coin price of U.S Gold of the period), but are all fractional in size. The most recognizable of these are the Swiss 20 franc, Helvetica and the world renowned British Sovereign. As relates to silver and copper, there are now .999 fine fractional specimens of each, in addition to their one ounce counterparts, which should be seriously considered as an addition to your holdings.

Question: “What is junk silver, why is it called junk silver, where can I get it and what should I look for?“

- Answer: What is referred to as “junk” is not junk at all. It is comprised of dimes, quarters and half dollars minted by the United States Mint prior to 1965. As of early July 2013, each of these denominations were trading (valued) at approximately eighteen times their face value (dime @ $1.80/quarter @ $4.50 and half-dollar @ $9.00) all because of their silver content. For a further breakdown and explanation/description of “junk” silver, visit The Silver Bullion Vault on this site.

Question: “In the event of major economic upheaval, how will I know how to ‘spend’ (junk) silver if the time should come?“

- Answer: First of all, you must be able to calculate junk-silver’s value at the appropriate time. Go ahead, try it out at http://www.silverandgoldaremoney.com

Question: “What’s better, gold, silver or copper? Should I buy all of them, and if so, in what diversification?“

- Answer: The answer to this question is not the same for everyone. How many are in your family? What is your liquid net worth? Do you own any specie now, or are you just beginning? Unless you have a large amount of funds to begin with, our recommendation is to start with the smaller denominated and affordable items, such as copper and silver. Get to the gold later, as you can afford it, but overall a solid recommendation would be to eventually earmark 60 to 70% of your total designated holdings to be in gold with the rest in the lesser metals. Remember, gold is small and compact and easy to put a roll of fractional gold coins in your pocket if you have to bug-0out as people were forced to do under Hurricane Katrina some years ago. An equal dollar value of silver will anchor your boat and is not as portable – BUT – is more easily traded for smaller purchases – a couple of bags of groceries or a tank of fuel. An ounce of copper breaks down further to a hot dog or loaf of bread. Each serves their purpose. Currently (July 2013) a box of 500 1 oz. copper rounds will cost about the same as a roll of silver American Eagles. Strike where you can get the most security for the dollar spent.

Question: “Why should I be considering buying copper rounds?“

- Answer: See answer above. Why pull out an ounce of silver to trade when all you need is a loaf of bread – or a bandage? An ounce of copper will do you well under those circumstances. Subsequently, you wouldn’t pull out a 1/10th ounce gold piece to buy a tank of gas, when a few rounds of silver would do the trick – would you? What form of “change back” would you be prepared to accept for the gold? Paper?

Question: “Why should I spend my money on metals, when I can’t eat them?“

- Answer: Metals have been a form of monetary exchange for over 5,000 years and are tradeable all over the world – no matter the economic circumstances one has faced. In the absolute worst of conditions of any nation – hard, tangible assets have always maintained a value, when paper (fiat) currencies collapsed. It happened at the end of the Roman Empire, in the Weimar Republic of post WWI Germany, twice in Viet Nam in 1968 and ’69 (I was there for both of these), and three times in Argentina since 1990. Look at Greece, Spain, Portugal and other nations of the European Continent today. With a precious metal coin or ingot, you will always be able to trade for food, but may not have enough food to trade for a piece of gold. In 2020 – it was Venezuela – who’s NEXT?

Question: “How can I use these coins in a high-inflation or hyperinflation period?“

- Answer: Read WEIMAR: Here’s The Real Story Of The Devastating Currency Collapse That Still Haunts Europe Today and understand your history. This just wasn’t all that long ago, and history repeats itself somewhere, because governments and bankers never learn the harsh lessons of the past.

Question: “What are premiums and why do I need to pay them?”

- Answer: Premiums are the figure one pays above “spot,” which is but an arbitrary figure used by Wall Street to sell PAPER gold, silver, corn, wheat, etc. ETF’s, Futures and Options contracts and more. You can’t buy precious metals at “spot” – unless you are the miner, the fabricator, etc. You are purchasing a mined, refined, poured, stamped, finished product, and each specimen has it’s own market – known as supply and demand. The higher the demand for a particular item – the higher the cost to you and I.

How much is a loaf of bread worth to you? I guess that it depends on whether you want a basic store brand white bread, or a loaf of multi-grain bread – or some highly crafted loaf. None of them have more than .10¢ to .65¢ worth of ingredients in them, but their cost above spot “wheat, egg, flour and yeast” will range between $1.00 and $5.00.

NOTES: Don’t get ripped off, but these are strange times and during the first half of 2013, the premiums above spot on nearly all precious metals products went far beyond normal levels – all due to demand – and during a time when the asset markets were in decline. Work with a dealer that you can trust – one that will spend the necessary time with you to insure that your holdings are developed to meet your ever changing circumstances. We hope that Sierra Madre Precious Metals will be your choice – but if for some reason it’s not – you’ll be armed with the right knowledge so that you well NOT be taken by some slick salesman with the best sounding song and dance.

Question: “How do I buy from Kettle Moraine, Ltd.“

- Answer: To place an order, call 602 – 799 – 8214! We offer gold, silver (and other precious metals) and NOW – copper rounds for those smaller barter and trade transactions that will become so important in the future – at the lowest possible prices direct to you from the largest US importers and wholesalers. When selling to you we lock in the current price and give you a confirmation number.

Question: “What form of payment does Sierra Madre Precious Metals accept?“

- Answer: Personal checks or bank-wire transfers are the method of payment most acceptable. Money orders may no longer be used to pay for purchases. Although and “acceptable” form of payment, we do NOT recommend payment with bank-issued certified or cashiers checks, as in many instances they become a “reportable” transaction. (Make all checks payable to Kettle Moraine, Ltd. – the Parent company of Sierra Madre Precious Metals)

Question: “Can I purchase precious metals from your firm online?“

- Answer: No! In order for Sierra Madre Precious Metals to keep our prices low, we must avoid the fees normally associated with the Credit Card service providers. In addition, although many companies offer products via a shopping cart, purchases made in that manner are generally higher cost due to bank fees charged, and more. In addition – and this is most important – you open yourself up to identity theft and a loss of transaction privacy. The prime purpose of the Sierra Madre Precious Metals website, is to provide information and financial news headlines, so that one may better understand the REAL reasons for owning specie instead of fiat currency. In addition to that stated above – there are privacy issues, which we will be glad to share with you on the phone.

Question: “Can I put gold, silver or platinum bullion in my IRA?“

- Answer: Yes, you can, however after over a quarter century of providing this service to our clients and listeners, we No longer offer this service.

Question: “Is gold, silver, platinum or palladium taxable?“

- Answer: Sierra Madre Precious Metals does not collect any sales tax at this time. Pending discussion in Congress however could change all of the in the future. That is why it best for us to avoid the on-line ordering procedures. We do not want the precedent established before any changes in the law. You should consult your tax adviser for specific taxation advice in your jurisdiction. Some states have a sales tax on gold coins and bullion. if you spend less than $1,000.00.

Question: “Aren’t transactions of $10,000 or more reported to the government?“

- Answer: Only if they involve actual currency, i.e., a suitcase full of $100 bills, or cash instruments such as multiple cashiers checks which are smaller than $10,000 each but total over $10,000. There is no reporting, or registration, or any such paperwork on transactions involving single checks or bank wires of whatever size. Currency regulations involving amounts of over $10,000 were designed to thwart money launderers and drug dealers. This is a common area of misunderstanding, but the bottom line is that there is no report made on ordinary transactions of any size, paid with a personal check or a bank wire.

Question: “If I sell gold to you, is that reported?“

- Answer: Certain forms of gold which traded as commodity contracts in 1982 fall under the Broker Reporting Act of 1982. Specifically named are South African Krugerrands, Canadian Maple Leafs, and Mexican gold Onzas in quantities of 25 ounces (one ‘contract’) or more. Sales of these items in contract quantities require a 1099B IRS information form, reporting the sale of a regulated commodity contract.

Question: “Do I have to report my gold coin purchases to the Government?”

- Answer: No, as of July 2013, there is no branch of federal, state, or local government that is interested in how much gold you might own. The U.S. Mint, a division of the Treasury Department, strikes the gold Eagle bullion coins, and supports their sale with national advertising, sales brochures, gift boxes, and so on, but in the fifteen years that we’ve sold their product, they have never asked us to keep track of who is buying it. (see above)

Question: “Do I have to pay taxes if I sell my gold bullion coins for a profit?

- Answer: Yes. If you hold gold as an investment, and later sell it at a profit, you will have either a long-term or short-term taxable gain or loss.

Question: “Do you add a commission fee to your posted prices?“

- Answer: No. The prices quoted will the price you pay, Shipping costs range between $15.00 and $25.00 on many orders, but most larger orders are shipping/handling/insurance inclusive.

Question: “Do you have quantity discounts?“

- Answer: Yes. Our prices have already been calculated for high volume wholesale orders, but special offers sometimes may be more beneficial with even steeper discounts.

Question: “Do you have a holding period on personal checks?“

- Answer: Yes. Personal checks – as a general rule are held for no longer than ONE business day – unlike most companies in the industry, who will hold your funds for up to two weeks prior (10 BUSINESS days) to shipping. With firms holding your funds in this manner, by the time you calculate in weekends and holidays – it could take three weeks fro the time they receive your check before you are put into que for shipping – at which time – legally they can hold your shipment for up to 28 business days AFTER clearance of your funds. Ultimately – we have seen customers wait for six to eight weeks – or longer – before they actually receive their orders. These practices are common in the industry and unacceptable to Sierra Madre Precious Metals.

Question: “What about bank-wires?“

- Answer: Orders are normally shipped within 24 to 48 hours

Question: “Do you have a minimum order?“

- Answer: Not generally, however some of our suppliers DO have minimum orders, which may affect you. At the present time (January 2019) none of the major suppliers will ship silver orders of less than 500 ounces and gold bullion at less that ten ounces. At Sierra Madre Precious Metals we do deal with several smaller, local suppliers, which generally will reduce our minimum order to 100 ounces of silver and as little as one ounce of gold – however we can expect to purchase on your behalf at a higher rate per ounce than one would pay for larger purchases

Question: “How do I sell to you?“

- Answer: Selling your items to us is easy, call our trading desk and lock in current buy back prices, ship the package to us or our assignee. Upon receipt of your package, it will be inspected to insure that we have received the proper goods – and we will them submit payment to you according to your instructions.

Question: “What if Sierra Madre Precious Metals cannot be reached or you were to go out of business? How would I sell my metals?“

- Answer: That is an easy question to answer. Any product purchased through Sierra Madre Precious Metals is Internationally recognized and can be sold to any brokerage firm or coin shop in the nation – and all over the world.

Question: “What products do you buy?“

- Answer: We are active market makers in all forms of gold and silver

Question: “When will I receive my payment?“

- Answer: When we receive your package we generally send payment within 24 hours, but upon occasion – this has stretched out to as long as a week. Many times it is dependent on where your liquidation is sold, which can delay payment a few days.

Question: “Do you buy gold back at the same price you sell it?“

- Answer: No, there is a ‘spread,’ or difference between our buying and selling prices which enables us to stay in business. The gold bullion business is a very competitive one, and the profit margin, or spread, is a very small one compared to any other inventory business. Our purpose is to provide the narrowest spread possible for the precious metals-buying public.

Question: “Do you charge a receiving fee?“

- Answer: No, when you sell your items to us there are no hidden charges. The prices quoted are the prices we will pay, less any special funding transmission fees (bank wires, etc.).

Question: “Will you buy back my gold if the price goes way up?“

- Answer: Absolutely. When gold goes up, that just means that demand has increased and it takes more paper currency to purchase gold than it did previously. When that happens, we will buy gold at the higher prices, because our customers will be willing to pay us higher prices. At its heart, the gold market is a very simple one. The price of gold is constantly re-adjusted, in terms of how many U.S. dollars it takes to buy an ounce of gold. This price is determined by the whole world’s faith in the dollar, and gold is the constant element that the dollar is measured against. Every day, gold is traded for dollars, and vice versa. We ask, ‘what is the price of gold?’ as if gold actually changed. But gold stays the same, it’s just the number of dollars required to purchase gold that changes.

Question: “How is my order shipped?”

- Answer: Most Sierra Madre Precious Metals orders are shipped Registered/Insured U.S. Mail – although with the current issues with the US Postal Service (October 2024) more larger orders are being shipped via FedEx or UPS. The parcel’s registration number will be given prior to shipping and can be used to track the parcel using the US Mail tracking web-site. This number is also used by the United States Postal Service to trace a package if it hasn’t been received within 30 days from the date shipped. Some shipping exceptions do apply, when relating to larger shipments of silver bullion products. Certain types of shipment may in fact come to you via UPS or Federal Express, with even others being shipped via Priority U.S. Mail.

Question: “How long will it take to get my package?“

- Answer: Delivery can be expected, based on method of payment – in most cases – within a week of receipt of payment. Some of our clients have received their “goods” within 3 days of our having received their funds – but don’t hold us to that one. Sometimes the stars align just right.

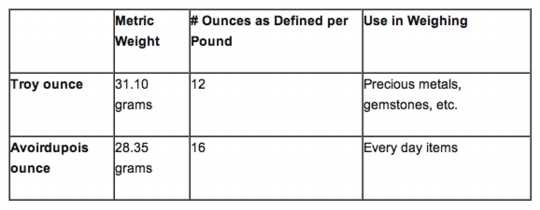

Question: “What is a Troy Ounce?”

- Answer: Troy vs. Avoirdupois Weight, Weighing Precious Metals

Since many coins contain a precious metal, we expanded our website to include charts and spot prices of silver, gold and platinum (found here). In doing so, I was reminded of a common misconception many people have regarding the system of weight for precious metals. Many think an ounce of gold is the same ‘weight’ as an ounce of beef. It’s not!

When you step on the scale, you don’t think of it but what’s being measured uses the system of weight known as avoirdupois. If we’ve lost a few pounds, we’d say something like, “I lost 2 pounds!” We wouldn’t say, “I lost 2 avoirdupois pounds!”

We’ve used the avoirdupois weight system in every day use for so long that we don’t even use its silly-seeming name. We can even break the system down. For example, most of us know there are 16 ounces in a (avoirdupois) pound.

What many don’t know or fail to remember is that silver, gold, platinum and other precious metals use the troy weight system. It’s completely different. When comparing the two systems – apples to apples – a troy ounce is heavier than an avoirdupois ounce – about 10 percent more. Or, more clearly, 10 troy ounces or 10 American Silver Eagles weigh more than a 10 ounce cut of steak.

Yet, and this is what can add to the confusion or what is often times forgotten, one troy pound weighs less than one avoirdupois pound. What? How!? Well, that’s ONLY because a troy pound has its own definition. One troy pound is defined as having 12 ounces – not the 16 ounces as defined in an avoirdupois pound.

This table may be useful:

Knowing how coins containing silver, gold or platinum stack up against our “every day” weight system isn’t super critical for a collector. But it doesnt hurt either! Especially when so many collectible coins these days contain a precious metal.

Knowing how coins containing silver, gold or platinum stack up against our “every day” weight system isn’t super critical for a collector. But it doesnt hurt either! Especially when so many collectible coins these days contain a precious metal.

PLEASE NOTE:

The IRS has revised its cash reporting form. The new form is similar to the old form except for the addition of the designation as “FinCEN Form 8300.” As part of federal anti-terrorism initiatives, the Financial Crimes Enforcement Network (FinCEN), in addition to the IRS, is notified of cash payments of over $10,000 in a single transaction. The revised form satisfies dealer cash reporting requirements under the recent USA Patriot Act. NOTE: Cash payment are generally construed as ‘cash‘ or money orders.

~ US Treasury Info ~

Currency & Coins

View the latest Currency & Coins press releases and access information about the production and distribution of paper currency and coins, anti-counterfeiting programs and resources, and currency and coin related gifts you can purchase on line.

Enforcement

View the latest Enforcement press releases and access information about the war on terrorist financing, programs against money laundering, counterfeiting, and narcotics trafficking.

Taxes

View the latest Tax press releases and access information about on line tax filing, tax wage reporting, and tax crime. Also access important IRS tax forms.

Kettle Moraine, Ltd.

P.O. Box 579

Litchfield Park, AZ 85340

602 – 799 – 8214

kettlemoraineltd@cox.net