OH – do you find the title of today’s post offensive? Then it is past time to WAKE UP! It’s not the title that one should be offended by – it should be the subject matter.

OH – do you find the title of today’s post offensive? Then it is past time to WAKE UP! It’s not the title that one should be offended by – it should be the subject matter.

“Pal” Joey and Company are at the bottom of this crap for one reason or another and many of his cohorts are more than likely on the receiving end of some heavy ‘moolah‘!

Hey folks – it’s the ‘Green New Deal’. Let’s save the Planet by forcing EV autos down people’s throats. Let’s outlaw the sales of BBQ’s and gas stoves.

But tonight, I drove by numerous gas stations that had tried to “Pump me UP!” for a .40-cent hike in less than 24 hours. Who in the hell iz zooming who? I will not waste my time trying to share other reasons for all of this crap. It is time that America WAKE UP and smell the coffee being heated up on your GAS stoves. Follow the headlines below – and then READ ‘EM and WEEP! How about, “Getcher head out of your ASS!” ~ Jeffrey Bennett, Editor

US to Sell Off Entire Northeast Gasoline Supply Reserve

The sale of the Northeast Gasoline Supply Reserve is among the provisions intended to raise funds in one of six bills setting out appropriations for some federal departments this year after Congress narrowly avoided another shutdown last week.

The sale of the Northeast Gasoline Supply Reserve is among the provisions intended to raise funds in one of six bills setting out appropriations for some federal departments this year after Congress narrowly avoided another shutdown last week.

Under a bill providing funding for the U.S. Department of Energy (DOE) for the fiscal year, a million barrels of the government’s strategic reserve of petroleum would be sold off—the same amount as in the NGSR, which is located in New York Harbor, Boston, Massachusetts and South Portland, Maine.

“Upon the complete of such sale, the Secretary [of Energy] shall carry out the closure of the Northeast Gasoline Supply Reserve,” the bill states, and “may not establish any new regional petroleum product reserve unless funding of the proposed regional petroleum product reserve is explicitly requested in advance in an annual budget.”

The proceeds of the sale are to be deposited into the Treasury’s general fund, and the proposed appropriations act provides stipulations for the sale of the oil and the use of the money generated by it.

Congress is expected to pass the package, which is the result of cross-party negotiations, with votes set to take place this week. Negotiations on a further six spending bills continue…. (Continue to full article)

Oil Supply Is Looking Tighter and Prices Could Climb as US Production Outlook Gets Cut in Half This Year

Oil Supply Is Looking Tighter and Prices Could Climb as US Production Outlook Gets Cut in Half This Year

The global head of commodity strategy at RBC Capital Markets pointed to signs that supply-demand imbalance in oil markets could soon tip in the other direction, as the world’s crude production is poised to slow. That could cause Brent crude, the international benchmark, to hit $85 in the second half of 2024, Croft predicted.

The US, which saw a “blockbuster” year for oil production in 2023, isn’t likely to churn out crude at the same speed it did last year. US production growth could crater in half from 1 million to just 500,000 barrels a day this year, Croft predicted, citing her conversations with other oil market watchers at the recent International Energy Week conference.

“It’s not that we’re saying … US production is not going to grow,” Croft said in an interview with CNBC on Monday. “It’s just a question about, were the gains that we saw last year due to particular unique circumstances that are not going to be replicated this year… (Continue to full article)

Gas Prices Are on the Rise Again

Gas Prices Are on the Rise Again

Drivers have enjoyed lower gas prices this winter between $3 and $3.30 nationally, but costs are rising and experts say the trend will likely continue in the spring.

A regular gallon of gas costs an average of $3.34, which is 10 cents more than a week ago and 22 cents more than last month, according to gas-price tracking site GasBuddy.

Unfortunately for drivers, there are several reasons why the outlook calls for gas prices to keep climbing — and why it’s wise to keep looking for ways to save on gas… (Continue to full article)

U.S. Northeast Gasoline Reserve Could Be Sold Off

U.S. Northeast Gasoline Reserve Could Be Sold Off

WTFU – READ the first post above…

Under the draft text of the bill, “the Secretary of Energy shall draw down and sell one million barrels of refined petroleum product from the Strategic Petroleum Reserve during fiscal year 2024.”

The House is yet to vote on the bill, which allocates funding for half of the federal segments that Congress is in charge of organizing funding for, Reuters reported, but with anti-Chinese sentiments pretty popular among both Democrats and Republicans, its chances appear pretty good… (Continue to full article)

Gas Prices: ‘Stark Increases’ Expected Amid ‘Stunted’ Refineries, Higher Oil

Gas Prices: ‘Stark Increases’ Expected Amid ‘Stunted’ Refineries, Higher Oil

The national average at the pump sat at $3.35 per gallon on Monday, up $0.09 from a week ago, but still $0.05 lower from exactly one year ago, according to AAA data.

“US refining has been stunted by severe weather and some power losses at key plants. We may in the next few days see US retail gas prices at a higher number than year-ago,” Tom Kloza, global head of energy analysis at OPIS, told Yahoo Finance.

In December, 24 states across the Midwest and Gulf Coast had their averages sitting below the $3 level. On Monday averages in just nine states were sitting below that threshold… (Continue to full article)

Chevron Indefinitely Closes Two U.S. Midwest Biodiesel Plants as Profits Slip

Chevron Indefinitely Closes Two U.S. Midwest Biodiesel Plants as Profits Slip

Chevron has indefinitely idled two biodiesel production facilities in the U.S. Midwest, the company confirmed on Friday, citing poor market conditions.

The second-largest U.S. oil producer bought biodiesel maker Renewable Energy Group for $3.15 billion in 2022 to expand its renewable fuels production to 100,000 barrels per day by 2030. The deal brought it 10 biodiesel plants and one renewable diesel facility.

Chevron idled plants in Ralston, Iowa, and Madison, Wisconsin, that combined can process 50 million gallon per year of biodiesel. Biodiesel production capacity was 2.07 billion gallons in December, according to U.S. government estimates.

Biodiesel is made from agricultural oils and animal fats, is more costly to make than petroleum-based diesel but is a cleaner burning fuel. Production also generates credits that can offset the cost of production.

Biodiesel is made from agricultural oils and animal fats, is more costly to make than petroleum-based diesel but is a cleaner burning fuel. Production also generates credits that can offset the cost of production.

Prices have slumped in recently months as supplies have grown and the value of renewable credits recently fell to a three-year low

Biden’s administration last year increased the amount of biofuels that oil refiners must blend into the nation’s fuel mix over the next three years, but the plan includes lower mandates for corn-based ethanol than it had initially proposed and sent credit prices lower… (Continue to full article)

These 10 States Have the Highest Gas Prices in 2023

These 10 States Have the Highest Gas Prices in 2023

Americans have been feeling the pain at the pump for quite some time. While prices are starting to dip slightly, whether you will feel a difference depends on which state you live in, according to new research by Now Patient, which has revealed the top 10 states where gas prices are the highest.

According to research, over 200 million people hold a valid driving license in the U.S., which means for the majority of these citizens, gas prices are a regular expenditure,” said Rajive Patel, medical writer at Now Patient . “As gas prices continue to fluctuate due to the rising cost of oil, our study which looks at the most costly states to live in the U.S. has revealed that some Americans are paying a considerable amount more for gas due to the location they live in.”

According to the Now Patient study, here are the top 10 states with the highest average gas prices… (Continue to full article)

Oil Prices Slump After OPEC+ Extension Disappoints Investors

Oil Prices Slump After OPEC+ Extension Disappoints Investors

Crude oil futures slumped to kick off the first full trading week of March despite global energy markets potentially facing tighter supply conditions in the coming months. Oil prices have been on a tear this year, rising double digits. Can oil sustain the upward trend?

April West Texas Intermediate (WTI) crude oil futures tumbled $1.27, or 1.59%, to $78.68 per barrel at 17:26 GMT on Monday on the New York Mercantile Exchange. US crude is coming off a monthly gain of about 8%. Year-to-date, the WTI contract has rallied 10.3%.

But it’s better if we just jack up the prices at the pump…… (Continue to full article)

The U.S. Might Bar Sales to China From Its Strategic Oil Reserve

The U.S. Might Bar Sales to China From Its Strategic Oil Reserve

A measure in a funding bill introduced to avert a government shutdown includes the prohibition.

The provision was included in legislation unveiled by congressional leaders Sunday as lawmakers work to avert a government shutdown.

Meanwhile, two Democratic senators last week introduced legislation that would indefinitely ban exports of U.S. oil and liquified natural gas to China. Whether or not that bill gains traction, energy — both renewable and fossil fuel-based — will be a highly contested domain in U.S.-China relations…. (Continue to full article)

Lower Gasoline Prices in 2024: A Positive Outlook with Impressive Reductions

Lower Gasoline Prices in 2024: A Positive Outlook with Impressive Reductions

As the U.S. Energy Information Administration (EIA) unveils its Short-Term Energy Outlook (STEO), a promising forecast emerges with lower gasoline prices in 2024 taking the spotlight. This anticipated decrease is attributed to a surge in refinery capacity and strategic adjustments in gasoline consumption, setting the stage for a more economically friendly fuel market.

The expected closure of LyondellBasell’s Houston refinery and the conversion of Phillips 66’s Rodeo refinery to renewable diesel production are indicative of the evolving landscape of the U.S. refining sector. These changes reflect a broader industry trend towards diversification and sustainability, aligning with global efforts to reduce carbon emissions and transition to cleaner energy sources.

The EIA’s forecast for lower gasoline prices in 2024 offers a glimpse into the future of the U.S. fuel market… HAHAHAHAHA – who in the Hell iz Zoomin’ WHO? (Continue to full article)

OOPS!!! Electric Cars Release MORE Toxic Emissions Than Gas-Powered Vehicles and Are Worse for the Environment

Electric vehicles may release more pollution than gas-powered vehicles, according to a report that has recently resurfaced.

Electric vehicles may release more pollution than gas-powered vehicles, according to a report that has recently resurfaced.

The study, which was published in 2022 but has begun circulating again after being cited in a WSJ op-ed, found that brakes and tires release 1,850 times more particulate matter compared to modern tailpipes which have filters that reduce emissions.

It found that EVs are 30 percent heavier on average than gas-powered vehicles, which causes the brakes and tire treads to wear out faster than standard cars and releases tiny, often toxic particles into the atmosphere.ele

EV batteries weigh about 1,000 pounds, and can result in tire emissions that are nearly 400 times more than tailpipe emissions.

Particle pollution can increase health problems including heart disease, asthma, lung disease and in extreme cases, can lead to hospitalization, cancer, and premature death… (Continue to full article)

OH – but if you just want to buy a NEW Car – here is a selection that uses NO Gas!

I’ve been talking about this for a long time: higher oil prices are inflationary. And I think 2024 will be the year that people finally start to realize that the inflation monster has not been slayed. Month after month we see these ‘surprise’ inflation numbers showing prices remain ‘stubbornly high’. It’s not stubborn, it’s just stupid policy… and oil prices have a lot to do with it. Continue reading

I’ve been talking about this for a long time: higher oil prices are inflationary. And I think 2024 will be the year that people finally start to realize that the inflation monster has not been slayed. Month after month we see these ‘surprise’ inflation numbers showing prices remain ‘stubbornly high’. It’s not stubborn, it’s just stupid policy… and oil prices have a lot to do with it. Continue reading

In case you thought anybody in Washington was driving this thing, they are not.

In case you thought anybody in Washington was driving this thing, they are not. Last month, the US Senate passed a resolution saying the over 34 trillion dollars (and growing) national debt threatens national security. A few days later, a bipartisan majority of the Senate voted for a 1.2 trillion dollars spending bill. In addition to the usual increases in war and welfare spending, the bill funds gender transitioning for minors without parental consent and red flag laws, which allow law enforcement to seize an individual’s firearms without due process.

Last month, the US Senate passed a resolution saying the over 34 trillion dollars (and growing) national debt threatens national security. A few days later, a bipartisan majority of the Senate voted for a 1.2 trillion dollars spending bill. In addition to the usual increases in war and welfare spending, the bill funds gender transitioning for minors without parental consent and red flag laws, which allow law enforcement to seize an individual’s firearms without due process. Utah Governor Spencer Cox has signed legislation explicitly empowering the state treasurer to protect state funds with an allocation to physical gold and silver.

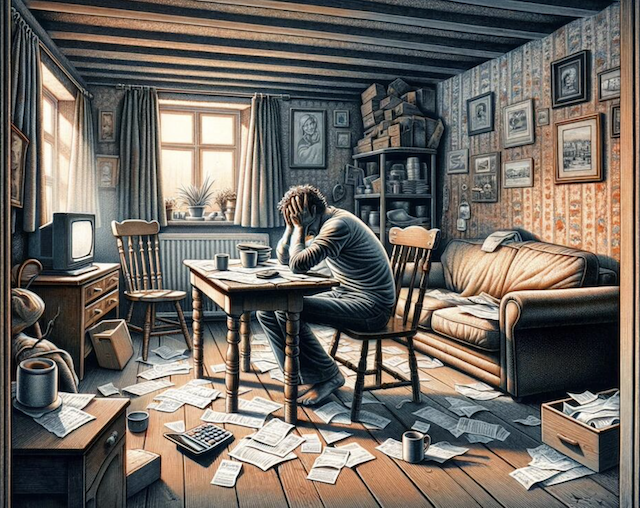

Utah Governor Spencer Cox has signed legislation explicitly empowering the state treasurer to protect state funds with an allocation to physical gold and silver. How much longer will the Biden administration and the mainstream media continue to deny that we are in the midst of a very painful economic downturn? Debt levels have never been higher, delinquency rates are spiking, the commercial real estate market is crashing, the banking industry is mired in turmoil and large companies are conducting mass layoffs all over the nation. Anyone that attempts to claim that the U.S. economy is in good shape is just being delusional. Unfortunately, it is those that are at the bottom of the economic food chain that are being hurt the most.

How much longer will the Biden administration and the mainstream media continue to deny that we are in the midst of a very painful economic downturn? Debt levels have never been higher, delinquency rates are spiking, the commercial real estate market is crashing, the banking industry is mired in turmoil and large companies are conducting mass layoffs all over the nation. Anyone that attempts to claim that the U.S. economy is in good shape is just being delusional. Unfortunately, it is those that are at the bottom of the economic food chain that are being hurt the most. The manufacturing and consumer confidence weaknesses of the United States are deeply concerning, particularly considering that all those allegedly infallible Keynesian policies are being applied intensely.

The manufacturing and consumer confidence weaknesses of the United States are deeply concerning, particularly considering that all those allegedly infallible Keynesian policies are being applied intensely. The tale of the Confederate gold, lost somewhere in the depths of South Carolina’s history, has intrigued historians, treasure hunters, and enthusiasts alike for over a century and a half. This story is not just about lost treasure; it represents a tumultuous period in American history, filled with intrigue, desperation, and unfulfilled dreams…

The tale of the Confederate gold, lost somewhere in the depths of South Carolina’s history, has intrigued historians, treasure hunters, and enthusiasts alike for over a century and a half. This story is not just about lost treasure; it represents a tumultuous period in American history, filled with intrigue, desperation, and unfulfilled dreams…

OH – do you find the title of today’s post offensive? Then it is past time to WAKE UP! It’s not the title that one should be offended by – it should be the subject matter.

OH – do you find the title of today’s post offensive? Then it is past time to WAKE UP! It’s not the title that one should be offended by – it should be the subject matter. The sale of the Northeast Gasoline Supply Reserve is among the provisions intended to raise funds in one of six bills setting out appropriations for some federal departments this year after Congress narrowly avoided another shutdown last week.

The sale of the Northeast Gasoline Supply Reserve is among the provisions intended to raise funds in one of six bills setting out appropriations for some federal departments this year after Congress narrowly avoided another shutdown last week. Oil Supply Is Looking Tighter and Prices Could Climb as US Production Outlook Gets Cut in Half This Year

Oil Supply Is Looking Tighter and Prices Could Climb as US Production Outlook Gets Cut in Half This Year Gas Prices Are on the Rise Again

Gas Prices Are on the Rise Again U.S. Northeast Gasoline Reserve Could Be Sold Off

U.S. Northeast Gasoline Reserve Could Be Sold Off Gas Prices: ‘Stark Increases’ Expected Amid ‘Stunted’ Refineries, Higher Oil

Gas Prices: ‘Stark Increases’ Expected Amid ‘Stunted’ Refineries, Higher Oil Chevron Indefinitely Closes Two U.S. Midwest Biodiesel Plants as Profits Slip

Chevron Indefinitely Closes Two U.S. Midwest Biodiesel Plants as Profits Slip  Biodiesel is made from agricultural oils and animal fats, is more costly to make than petroleum-based diesel but is a cleaner burning fuel. Production also generates credits that can offset the cost of production.

Biodiesel is made from agricultural oils and animal fats, is more costly to make than petroleum-based diesel but is a cleaner burning fuel. Production also generates credits that can offset the cost of production. These 10 States Have the Highest Gas Prices in 2023

These 10 States Have the Highest Gas Prices in 2023 Oil Prices Slump After OPEC+ Extension Disappoints Investors

Oil Prices Slump After OPEC+ Extension Disappoints Investors The U.S. Might Bar Sales to China From Its Strategic Oil Reserve

The U.S. Might Bar Sales to China From Its Strategic Oil Reserve Lower Gasoline Prices in 2024: A Positive Outlook with Impressive Reductions

Lower Gasoline Prices in 2024: A Positive Outlook with Impressive Reductions Electric vehicles may release more pollution than gas-powered vehicles, according to a report that has recently resurfaced.

Electric vehicles may release more pollution than gas-powered vehicles, according to a report that has recently resurfaced.

The economy has changed in many ways, and it’s difficult to track the glacial movements over decades. One change that few seem to recognize or discuss is the disappearance of bargains: cheap rent, cheap meals at hole-in-the-wall restaurants, cheap transport, cheap travel, cheap services – all gone.

The economy has changed in many ways, and it’s difficult to track the glacial movements over decades. One change that few seem to recognize or discuss is the disappearance of bargains: cheap rent, cheap meals at hole-in-the-wall restaurants, cheap transport, cheap travel, cheap services – all gone.