Hjalmar Horace Greeley Schacht

Always and again the magic of money presents us with problems. These problems change constantly. Time after time experience teaches us that there is no universally-valid system by means of which monetary problems may be solved. Every new situation demands new deliberations, new measures, new insights, new ideas. Each of these ideas must be informed by and subservient to the sole and single purpose of maintaining the soundness of the currency. ~ Hjalmar Schacht

I’m no economic expert, and it will probably be apparent to those who are, but I damn for sure know that a country cannot keep spending and borrowing money like ours is doing and still expect to thrive for too very much longer. They can spout all their Keynesian Modern Monetary Theory bullshit they want, and at the end of the day, financial trickery and manipulations will only prop our economy up for so long.

I’ve always been the sort to save ten dollars before spending one. Continue reading →

Market conditions are aligning for the gold market as the precious metal benefits from safe-haven demand and growing expectations that the Federal Reserve will cut rates sooner than expected.

Market conditions are aligning for the gold market as the precious metal benefits from safe-haven demand and growing expectations that the Federal Reserve will cut rates sooner than expected.

The gold market was moribund for the first half of the week, but contradictory U.S. CPI and PPI data pushed gold prices sharply down on Wednesday and back up on Thursday, while a sudden escalation of conflict in the Middle East on Thursday evening saw gold prices posting steady gains heading into the holiday weekend.

The gold market was moribund for the first half of the week, but contradictory U.S. CPI and PPI data pushed gold prices sharply down on Wednesday and back up on Thursday, while a sudden escalation of conflict in the Middle East on Thursday evening saw gold prices posting steady gains heading into the holiday weekend. I’m referring to the US Secret Service’s very own role in the destruction of sound money in America.

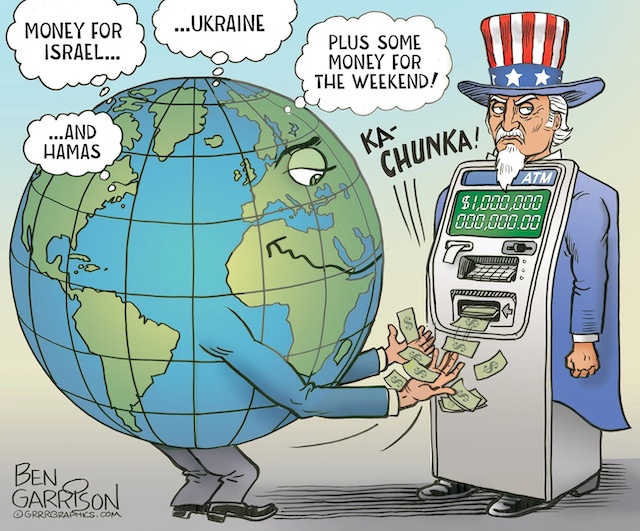

I’m referring to the US Secret Service’s very own role in the destruction of sound money in America. We did it Joe! It took a tremendous push down the stretch, but the U.S. national debt was able to hit the 34 trillion dollar mark before the end of 2023. At this moment I am just so overwhelmed that I don’t know who to thank first. Over the past few years, Joe Biden, Kamala Harris, Chucky Schumer, Nancy Pelosi, Kevin McCarthy and so many other hard working spenders have been instrumental in helping us reach this remarkable achievement. And we never would have gotten here without the relentless help of CNN, MSNBC, Fox News, the New York Times, the Washington Post and all of the other mainstream news outlets that kept assuring the American people that it was okay to steal trillions of dollars from our children and our grandchildren.

We did it Joe! It took a tremendous push down the stretch, but the U.S. national debt was able to hit the 34 trillion dollar mark before the end of 2023. At this moment I am just so overwhelmed that I don’t know who to thank first. Over the past few years, Joe Biden, Kamala Harris, Chucky Schumer, Nancy Pelosi, Kevin McCarthy and so many other hard working spenders have been instrumental in helping us reach this remarkable achievement. And we never would have gotten here without the relentless help of CNN, MSNBC, Fox News, the New York Times, the Washington Post and all of the other mainstream news outlets that kept assuring the American people that it was okay to steal trillions of dollars from our children and our grandchildren.

The Lost Dutchman’s Gold Mine has been the source of intrigue and mystery for treasure seekers for generations. Situated in the forbidding Superstition Mountains of Arizona, the legend of the mine is rooted in tales of immense gold deposits and the tragic fates of those who sought to claim them. The mine, named after the German prospector Jacob Woltz, who reportedly found it in the 19th century, has never revealed its location, keeping its fortune a secret and igniting a fervor of exploratory quests.

The Lost Dutchman’s Gold Mine has been the source of intrigue and mystery for treasure seekers for generations. Situated in the forbidding Superstition Mountains of Arizona, the legend of the mine is rooted in tales of immense gold deposits and the tragic fates of those who sought to claim them. The mine, named after the German prospector Jacob Woltz, who reportedly found it in the 19th century, has never revealed its location, keeping its fortune a secret and igniting a fervor of exploratory quests. For the last 2 1/2 years, price inflation has been eating away the paychecks and savings of the public.

For the last 2 1/2 years, price inflation has been eating away the paychecks and savings of the public.

Some have suggested that the 70s economy under the peanut farmer, Jimmy Carter, was worse, but I don’t see it. Not nearly so many were out of work as there are today – some 106 million – and even as young as I was, I wasn’t without a job from the time I was thirteen and toting shingles for one of our local roofers. Whatever is happening across the board, it’s almost as if some black plague has hit at the heart of our economy and businesses aren’t quite as willing to give new entry level workers as much as a chance as what I witnessed during the 1970s, much of which stems from corporation’s current lack of tolerance for anyone who is unwilling to go along with political correctness and the Woke ideology that’s being forced down everyone’s throat.

Some have suggested that the 70s economy under the peanut farmer, Jimmy Carter, was worse, but I don’t see it. Not nearly so many were out of work as there are today – some 106 million – and even as young as I was, I wasn’t without a job from the time I was thirteen and toting shingles for one of our local roofers. Whatever is happening across the board, it’s almost as if some black plague has hit at the heart of our economy and businesses aren’t quite as willing to give new entry level workers as much as a chance as what I witnessed during the 1970s, much of which stems from corporation’s current lack of tolerance for anyone who is unwilling to go along with political correctness and the Woke ideology that’s being forced down everyone’s throat.  Sen. Bob Menendez (D-NJ) is weathering

Sen. Bob Menendez (D-NJ) is weathering