The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the last seventy years. McDonald’s has grown from a tiny hamburger stand in Des Plaines, Illinois, to the second largest fast-food chain on earth. Scale economies alone (never mind process and productivity improvements) should’ve allowed the price of a burger to decline materially over this period.

The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the last seventy years. McDonald’s has grown from a tiny hamburger stand in Des Plaines, Illinois, to the second largest fast-food chain on earth. Scale economies alone (never mind process and productivity improvements) should’ve allowed the price of a burger to decline materially over this period.

Why didn’t it? What forces and institutions have conspired to inflate the cost of a simple meal by more than thirteen times over two generations? Continue reading

Little by little, pharmacy benefit managers (PBMs) are getting their comeuppance and American consumers are getting their due when it comes to the cost of prescription drugs.

Little by little, pharmacy benefit managers (PBMs) are getting their comeuppance and American consumers are getting their due when it comes to the cost of prescription drugs.

Titled “

Titled “ It doesn’t matter how much is thrown at the gold market; despite its recent price performance, it remains a highly resilient asset.

It doesn’t matter how much is thrown at the gold market; despite its recent price performance, it remains a highly resilient asset. Sentiment in the gold market is slowly shifting back to the bullish side as the precious metal’s resilience in the face of rising bond yields shines through. However, some analysts are warning that there is still insufficient momentum to push gold prices through critical resistance levels.

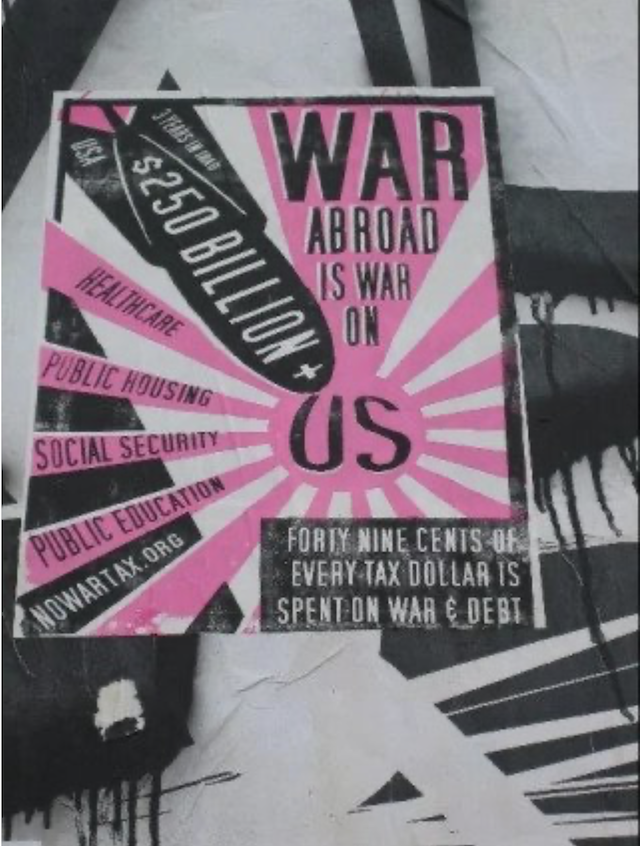

Sentiment in the gold market is slowly shifting back to the bullish side as the precious metal’s resilience in the face of rising bond yields shines through. However, some analysts are warning that there is still insufficient momentum to push gold prices through critical resistance levels.  A month ago, the fake debt ceiling fight ended and Congress suspended the federal government’s borrowing limit for two years. Since the debt ceiling deal, the US Treasury has added a staggering $851 billion to the national debt.

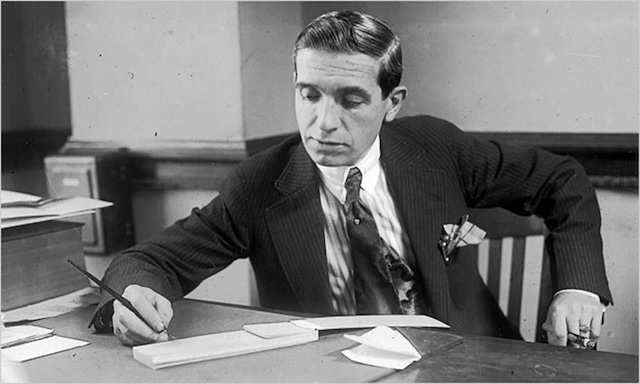

A month ago, the fake debt ceiling fight ended and Congress suspended the federal government’s borrowing limit for two years. Since the debt ceiling deal, the US Treasury has added a staggering $851 billion to the national debt. When Charles Ponzi’s investment opportunity to sell international postage stamps was exposed to be a scam in 1920, its basic premise would forever be associated with the man’s name. A

When Charles Ponzi’s investment opportunity to sell international postage stamps was exposed to be a scam in 1920, its basic premise would forever be associated with the man’s name. A