The U.S. dollar has been declining for several months, causing it to lose value and igniting fears that the country is heading for a recession.

The U.S. dollar has been declining for several months, causing it to lose value and igniting fears that the country is heading for a recession.

According to Charles Schwab, the dollar has fallen by about 8 percent to 10 percent in both real and nominal terms since late last year.

Speculation that the dollar could lose its status as the world’s primary reserve currency comes from rumors that Communist China may move to use the yuan in commodity trades with several trading partners. Brazil and Argentina are also mulling over being a common currency worldwide. Continue reading

Nearly 12 years ago I penned a similar cartoon to this one. It featured the sad demise of ‘King Dollar’. The earlier cartoon showed the defeated old King Buck surrounded by his decaying kingdom. The forces of real money, gold and silver, rode triumphantly on horses in the background.

Nearly 12 years ago I penned a similar cartoon to this one. It featured the sad demise of ‘King Dollar’. The earlier cartoon showed the defeated old King Buck surrounded by his decaying kingdom. The forces of real money, gold and silver, rode triumphantly on horses in the background.  “The reputation of economics and economists, never high, has been a victim of the crash of 2008. An even more serious criticism is that the economic policy debate that followed seems only to replay the similar debate after 1929. The issue is budgetary austerity versus fiscal stimulus, and the positions of the protagonists are entirely predictable from their previous political allegiances.

“The reputation of economics and economists, never high, has been a victim of the crash of 2008. An even more serious criticism is that the economic policy debate that followed seems only to replay the similar debate after 1929. The issue is budgetary austerity versus fiscal stimulus, and the positions of the protagonists are entirely predictable from their previous political allegiances. Did you know that central banks bought more gold last year than any year in the past 55 years—since 1967?

Did you know that central banks bought more gold last year than any year in the past 55 years—since 1967?

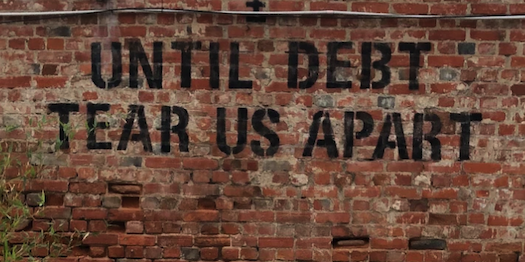

We’re not living the American dream.

We’re not living the American dream. When a few mid-sized US banks suddenly went belly-up last month, the bond market made its feelings known — and with gusto. Two-year Treasury yields slid a percentage point over three days, the most since 1982. For traders accustomed to treating such signals as sacrosanct, the message was obvious: The recession many had been (incorrectly) predicting since last summer was really, truly inevitable now.

When a few mid-sized US banks suddenly went belly-up last month, the bond market made its feelings known — and with gusto. Two-year Treasury yields slid a percentage point over three days, the most since 1982. For traders accustomed to treating such signals as sacrosanct, the message was obvious: The recession many had been (incorrectly) predicting since last summer was really, truly inevitable now.  The stress on the financial sector caused by two bank failures in the United States last month is still a threat and should be addressed by a reimagining of the regulatory process, according to JPMorgan Chase CEO Jamie Dimon.

The stress on the financial sector caused by two bank failures in the United States last month is still a threat and should be addressed by a reimagining of the regulatory process, according to JPMorgan Chase CEO Jamie Dimon. What would be your immediate concern if you lost your job? In a GOBankingRates survey polling 1,002 Americans, more than half of overall Americans said they wouldn’t be able to afford their basic bills and groceries.

What would be your immediate concern if you lost your job? In a GOBankingRates survey polling 1,002 Americans, more than half of overall Americans said they wouldn’t be able to afford their basic bills and groceries.